CBOE VIX (Volatility Index)

VIX is the ticker symbol for the Chicago Board Options Exchange Market Volatility Index, a popular measure of the implied volatility of S&P 500 index options. Often referred to as the fear index or the fear gauge, it represents one measure of the market’s expectation of stock market volatility over the next 30 day period.

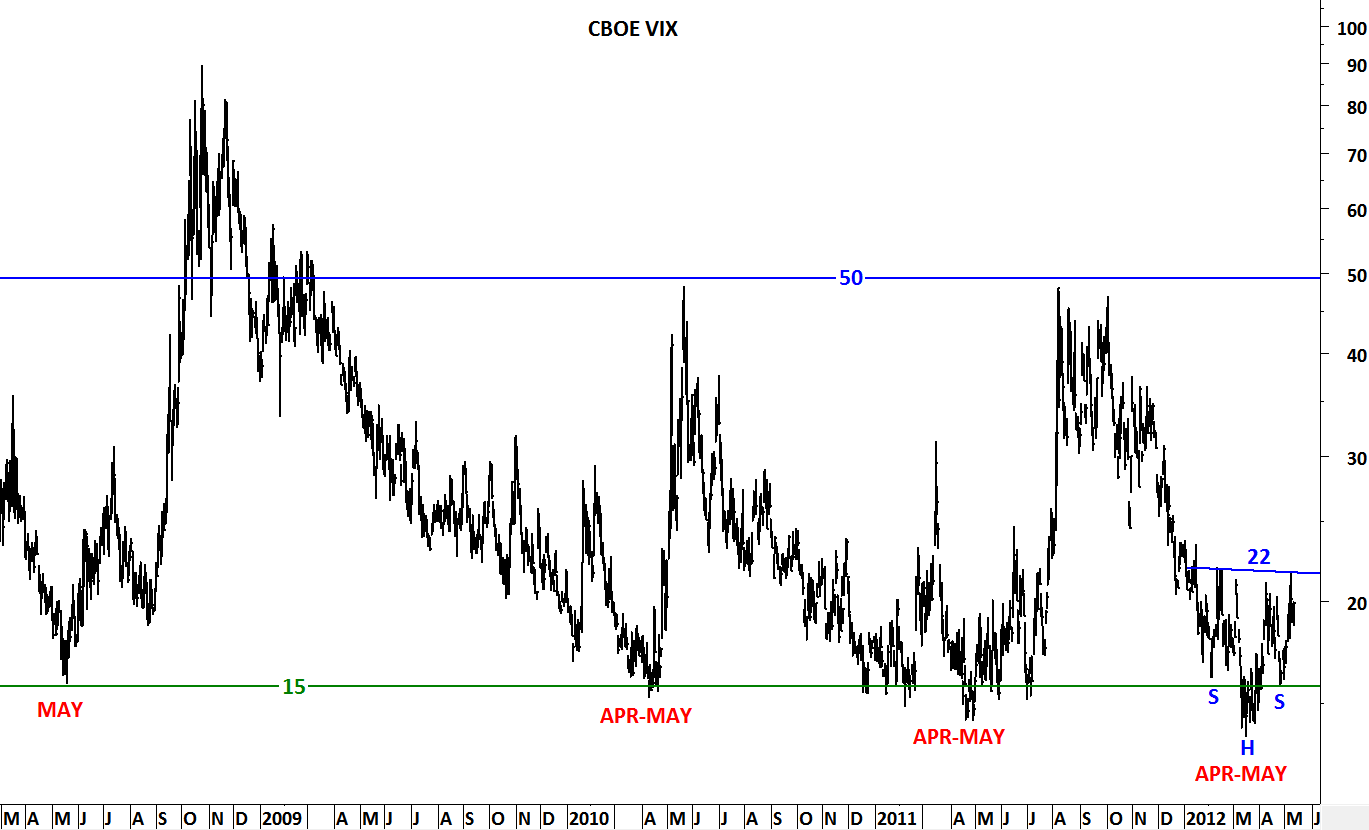

In the beginning of March I analyzed the CBOE VIX right after the volatility rebounded from 15 levels to 19 levels. Followed by a short period of equity market correction, optimism improved during March and the volatility index eased towards 14.6 levels. However, optimism in global equity markets didn’t last long and since the beginning of April VIX reversed from 15 levels and reached 22 levels. Three month-long sideways consolidation between 14 and 22 could be an inverted Head & Shoulder reversal chart pattern. This bullish reversal pattern suggests higher levels for the CBOE VIX in the coming weeks if the index breaks above 22 levels, the resistance of the technical chart formation . Please note that extreme pessimism in equity markets mirrored the re-test of 50 levels on the VIX.

A decisive break above 22 levels can be followed by a surge in CBOE VIX towards 50 levels once again. In the past four years April-May period proved to be negative for equities.