CBOE VIX (Volatility Index)

VIX is the ticker symbol for the Chicago Board Options Exchange Market Volatility Index, a popular measure of the implied volatility of S&P 500 index options. Often referred to as the fear index or the fear gauge, it represents one measure of the market’s expectation of stock market volatility over the next 30 day period.

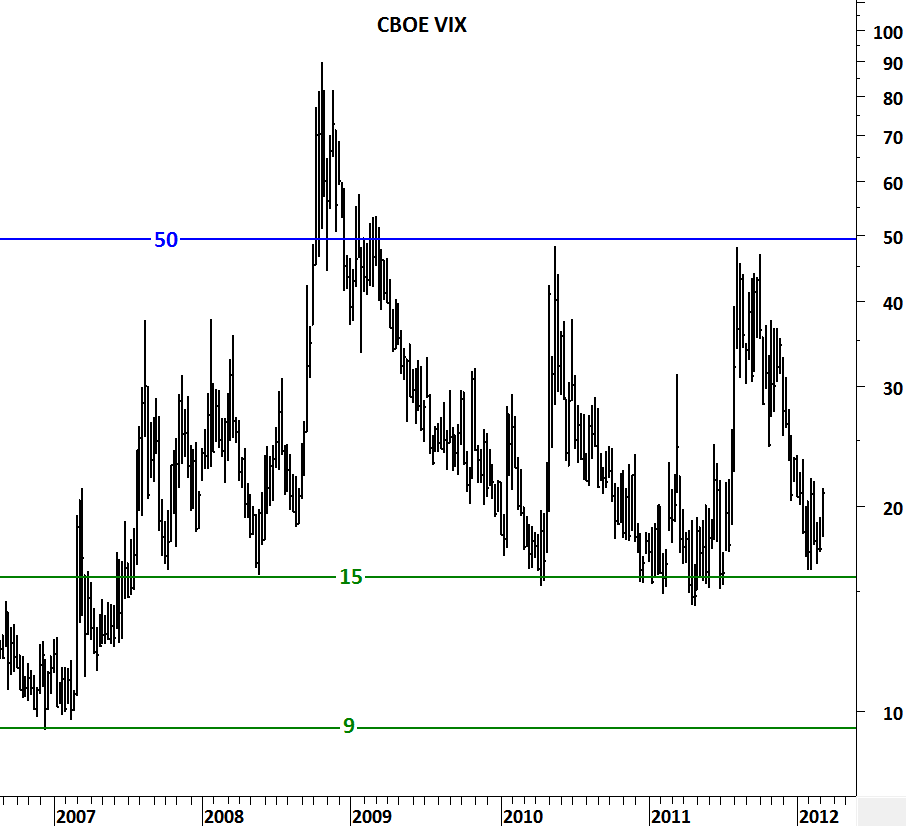

Since August-October 2011 period global equity markets have been in an uptrend. During the same period CBOE VIX has fallen from 50 levels to 15 levels. Historically 50 has been the boundary for negative sentiment and 15 has been for positive sentiment. Though in the past CBOE VIX reached 9 levels (extreme optimism) on the downside and 89 levels (extreme pessimism) on the upside, on average it consolidated between 15 and 50. 6 month strong equity market performance helped sentiment to improve and pushed the VIX lower towards the boundary of positive sentiment.

There is now higher probability of CBOE VIX to rebound from 15 levels in the following months as a result of short/intermediate term equity market correction. It is important to watch the levels on the VIX as we are now rebounding from a major support area.