S&P 500 INDEX and CBOE VIX

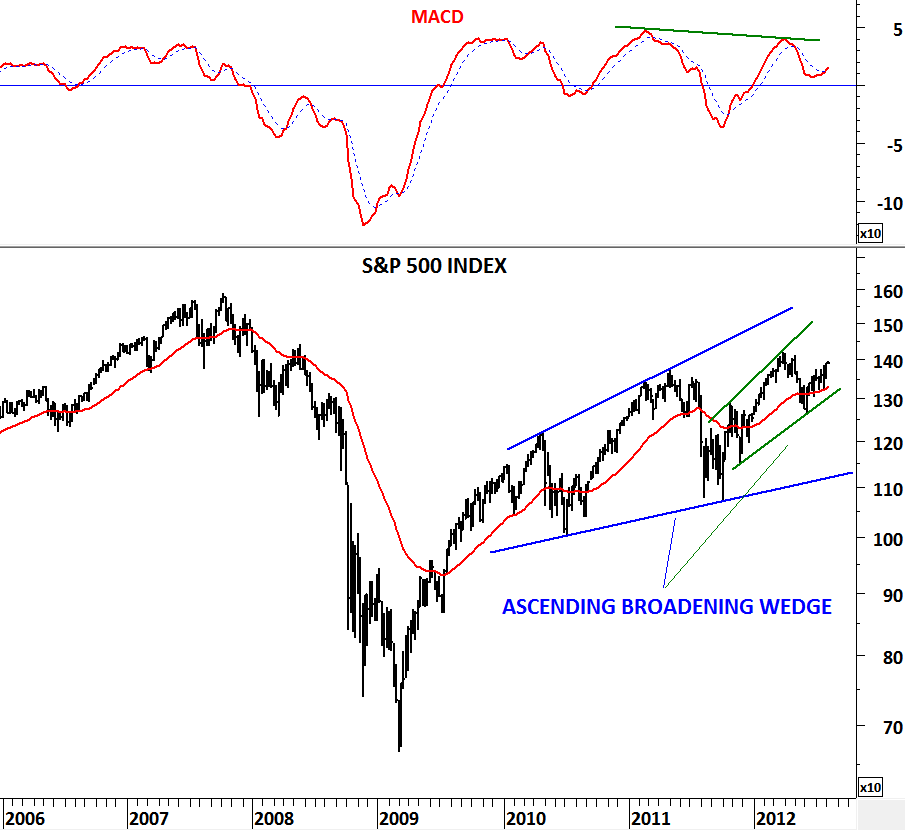

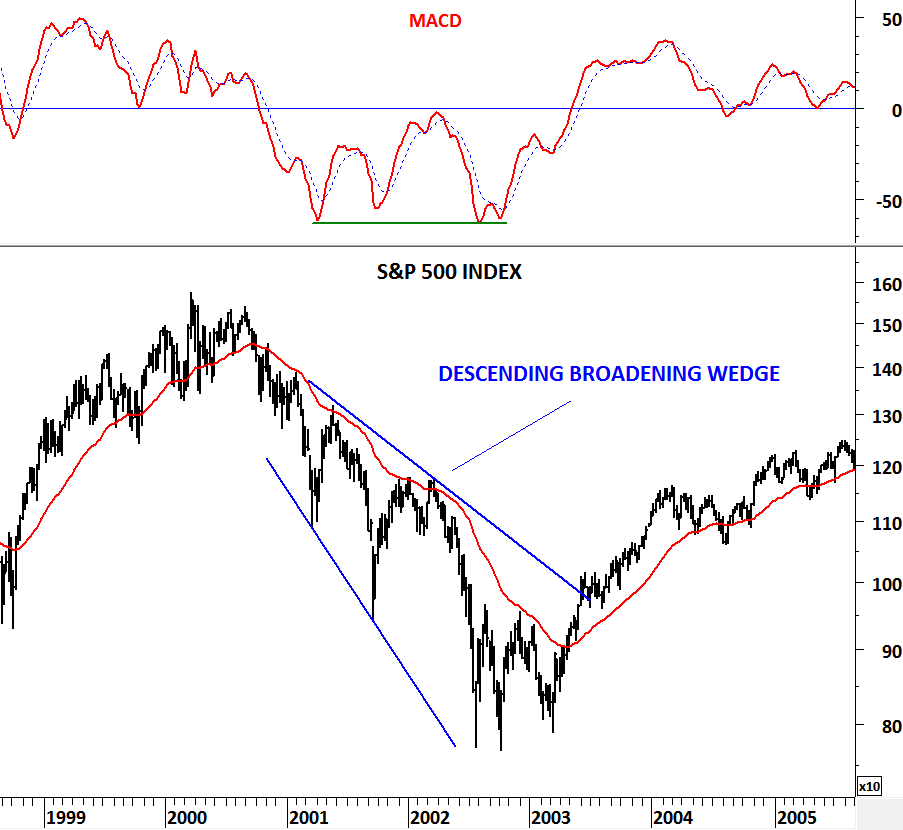

Thomas Bulkowski (author of encyclopedia of Chart Patterns) defines an ascending broadening wedge as a reversal chart pattern. An ascending broadening wedge has two upward sloping trend lines; the top one has a slightly steeper slope than the bottom one. Together, the two trend lines spread out over time but both slope upward. Once prices pierce the bottom trend line, they drop rapidly. The two trend lines are not parallel. If they were parallel you would have a trend channel. In a uptrend we see ascending broadening wedge formations and in a downtrend descending broadening wedges. They are both reversal chart patterns.

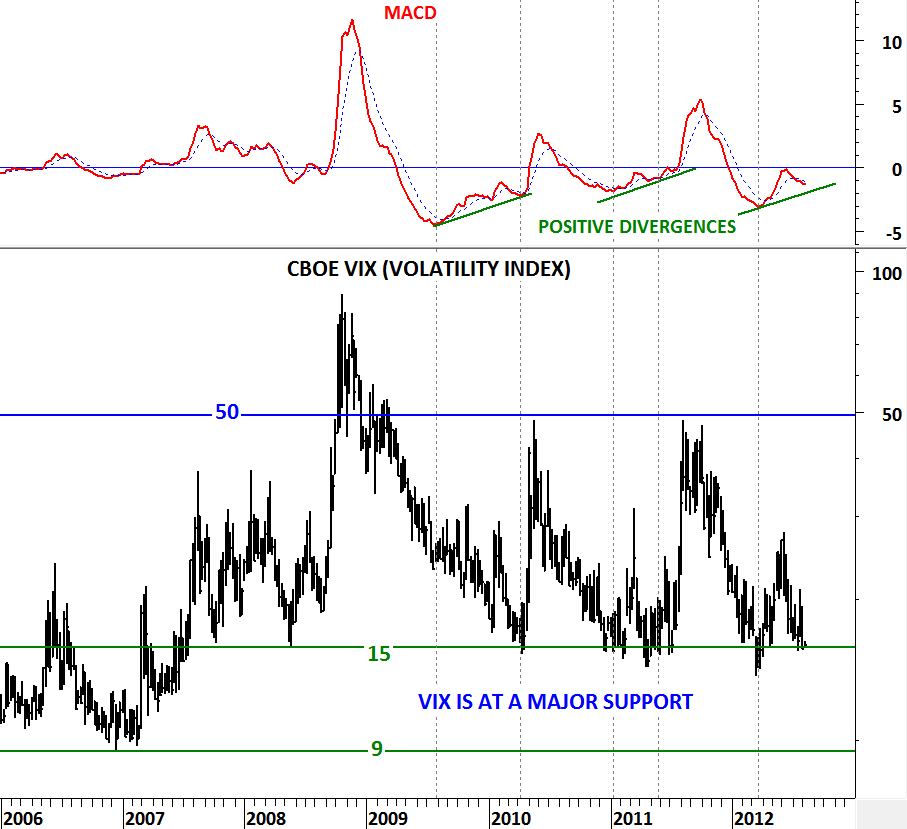

In this update I’m looking as S&P 500 Index and the Volatility Index. VIX reached a major support at 15 levels. Next support is at 9 levels but only after it breaks below 15 levels. VIX reached 9 levels in 2007 and in 1994. Other than that its boundaries have been 15 and 50 levels. In the previous two tests of the 15 levels, MACD generated positive divergences and the VIX formed an intermediate term low. It is now the 3rd time the VIX is testing 15 levels (a major support) with a positive divergence on MACD.

S&P 500 Index has been moving higher since the beginning of 2009. The uptrend has been choppy, with each medium term up leg overlapping the others price range. Choppy uptrend formed an ascending broadening wedge; usually regarded as a reversal chart pattern. Both the S&P 500 index and the VIX warns us of a possible change in trend. As a comparison I analyzed a descending broadening wedge that formed on the S&P 500 Index between 2000 and 2003. This was also a reversal chart pattern which was followed by a multi-year uptrend.