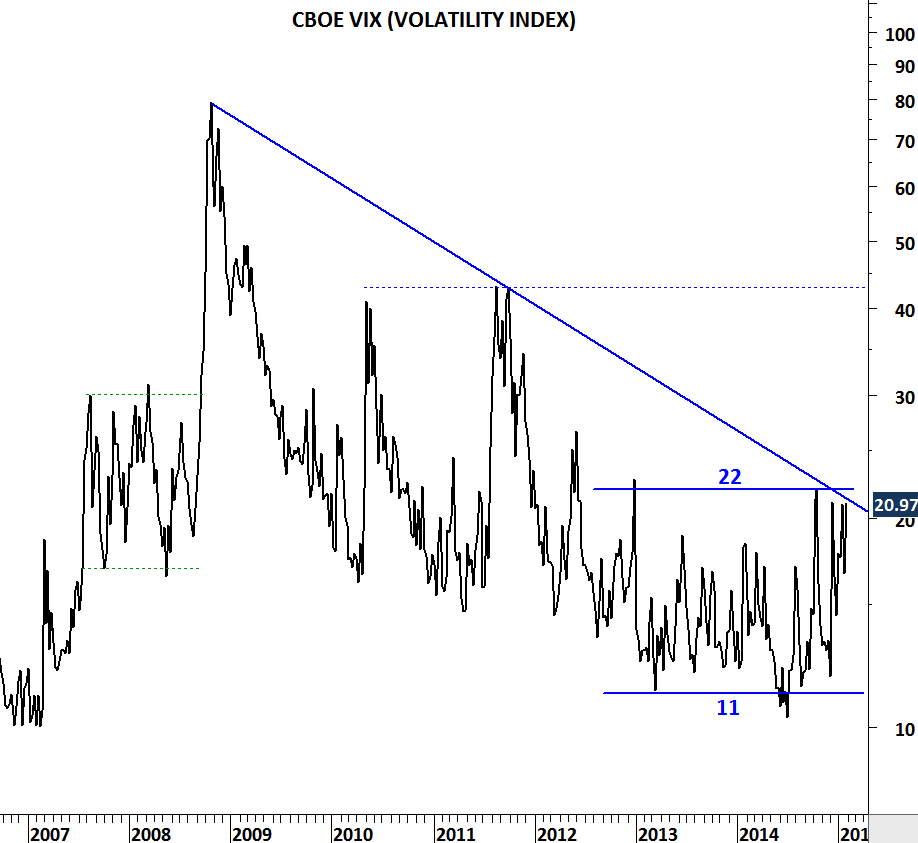

CBOE VIX (VOLATILITY INDEX)

Volatility can move higher in the following months if we see a decisive weekly close above 22 levels. In the last two years CBOE VIX consolidated in a range between 11 and 22. Six year-long downward trend line and the upper boundary of the horizontal consolidation range meet at 22 levels. A decisive break above 22 levels can result in a sharp upward move towards 40-45 area. Such price action will be bearish for global equity markets. It is important to keep a close eye on this chart development in the next few months.