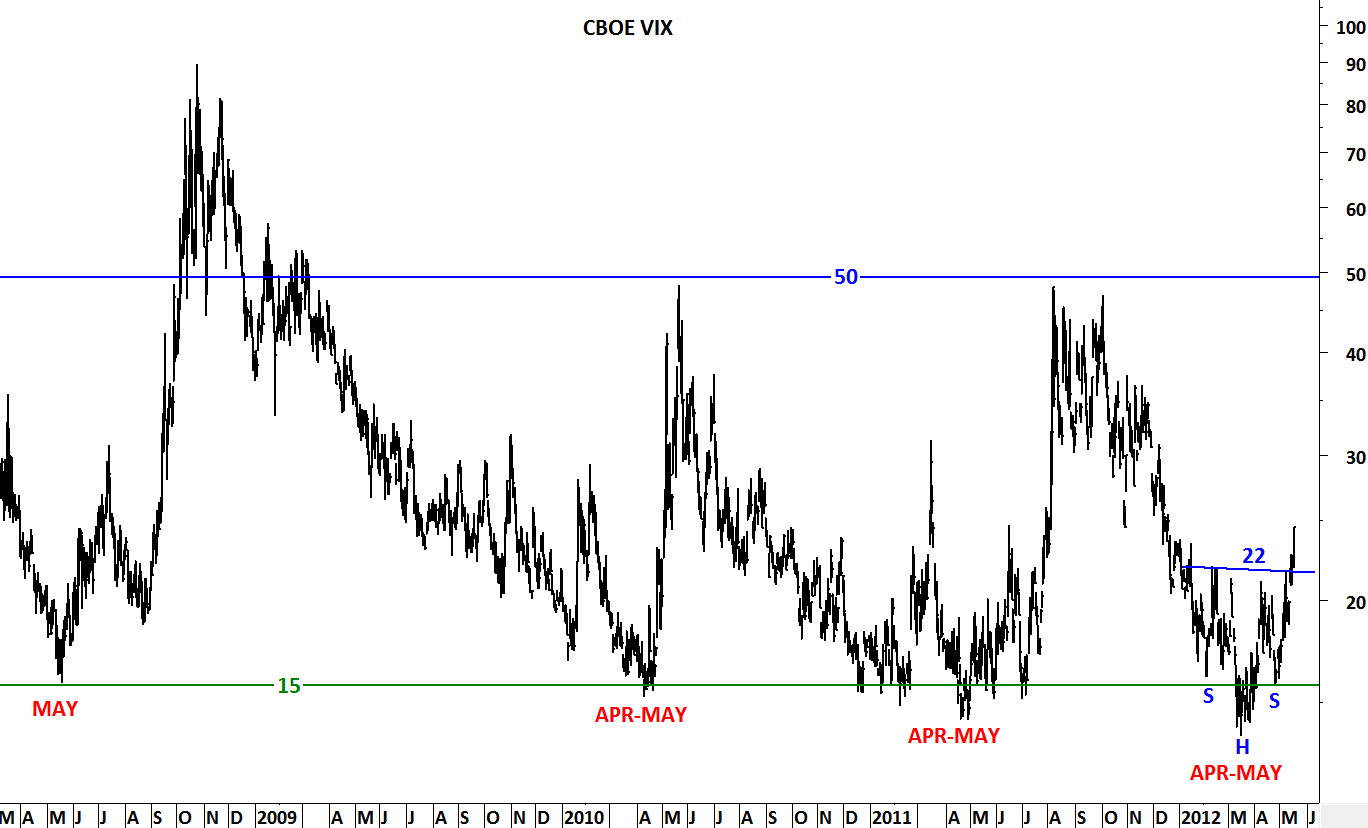

CBOE VIX (Volatility Index)

Yesterday’s trading session pushed the Volatility Index higher and CBOE VIX breached the important resistance at 22 levels. This is an important breakout as VIX is now above the inverted Head & Shoulder pattern neckline. Higher VIX signals weakness for equities in the intermediate term. Please note that inverted H&S pattern price target is 30. 22 level will now become support and also stop-loss for long VIX positions.