LONG-TERM BOND YIELDS

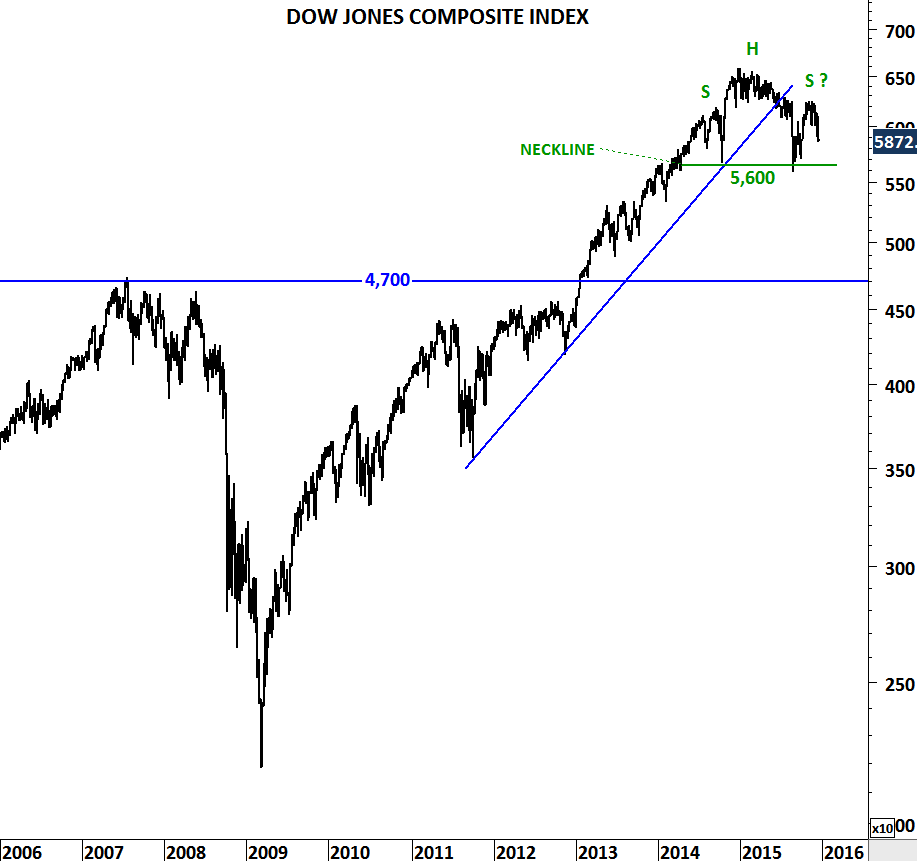

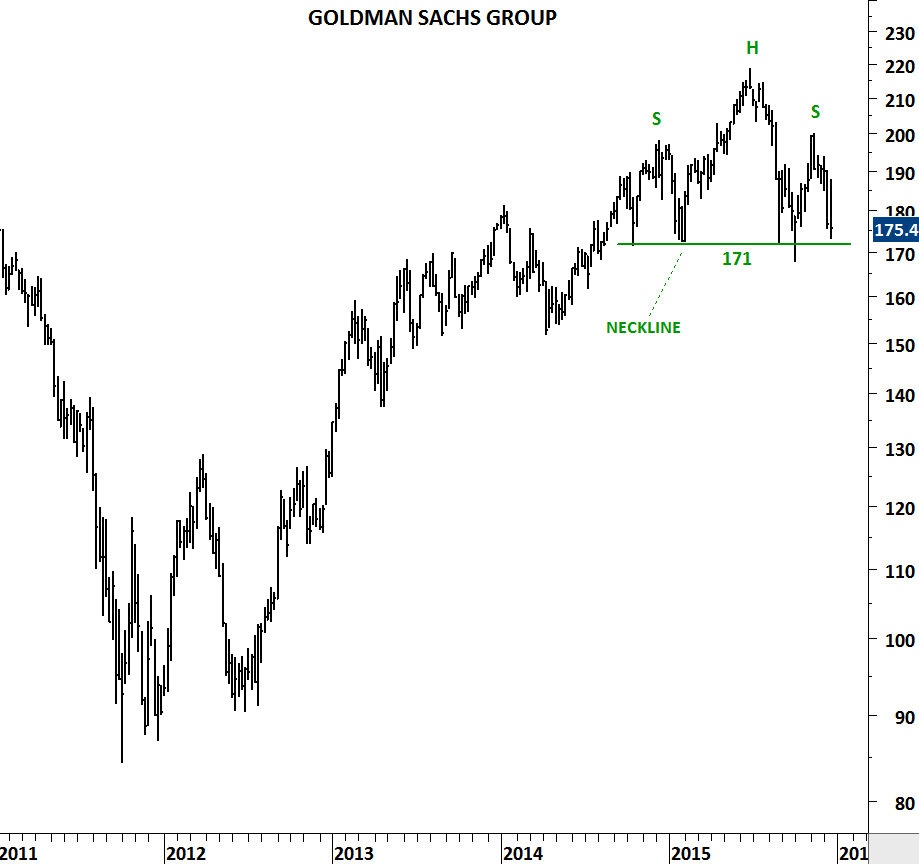

First half of 2016 can be a volatile time for developed market bonds. Yields can move higher from current levels. I’m not sure what could be the economic trigger for such price action but charts suggest possible trend periods in the coming months. Here are the charts I will be following in the first quarter of 2016.

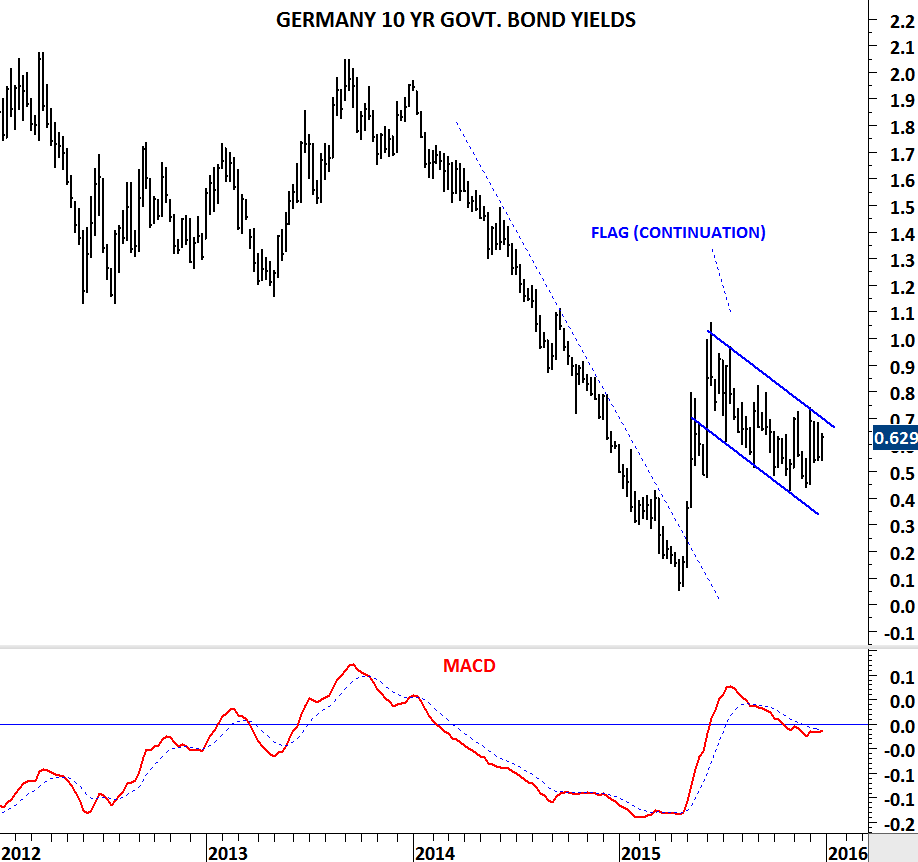

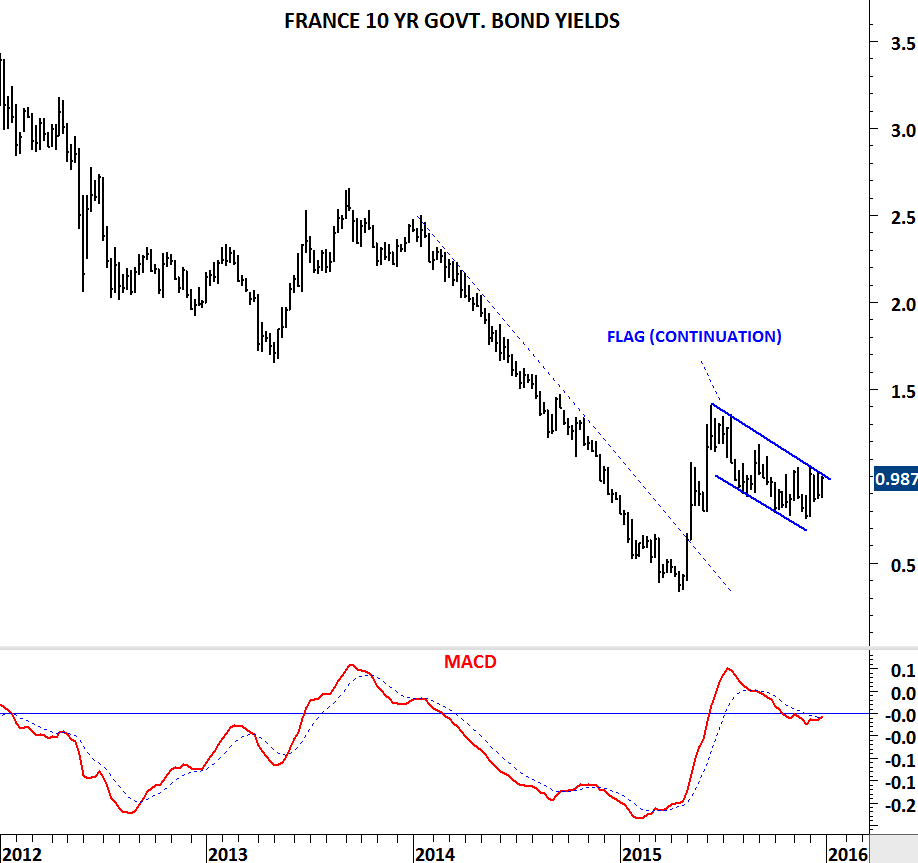

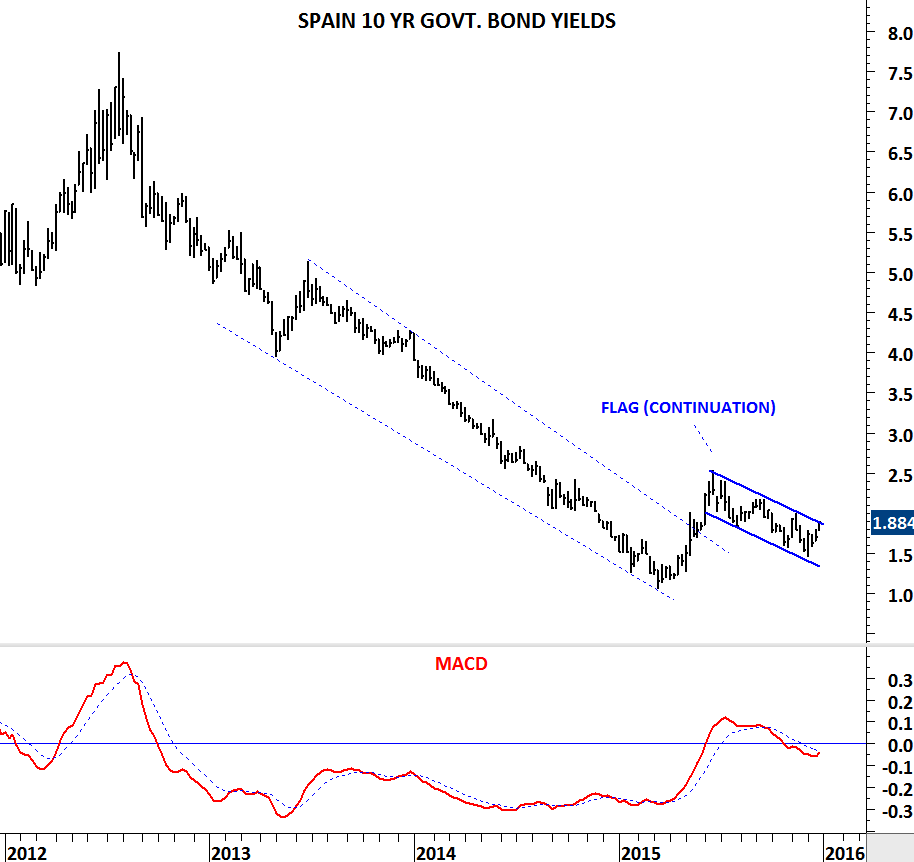

After sharp rebounds in the first half of 2015, developed market bond yields moved sideways in the remaining part of the year. Yields failed to test 2015 lows and the consolidation formed flag chart patterns. Flag formation is regarded as a continuation, usually forms halfway through out the price action. Breakout from the flag signals continuation in the direction of the breakout.

While German 10 year government bond yields pulled back in an orderly correction, MACD found support around 0 levels. Breakout from the 6 month-long channel will be confirmed with a weekly MACD buy signal.

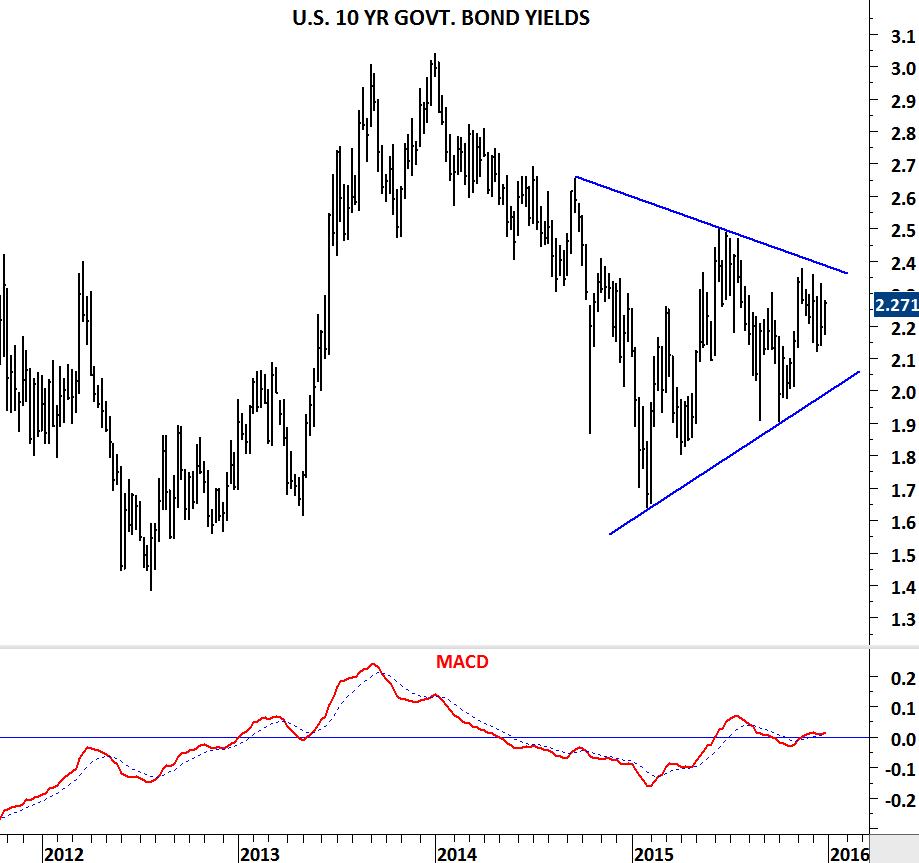

Chart pattern on the U.S. 10 year government bond yield is different from its European peers. U.S. yields have been forming a symmetrical triangle. Breakout in either direction will confirm this chart pattern. Resistance is at 2.4 and support at 2.0.

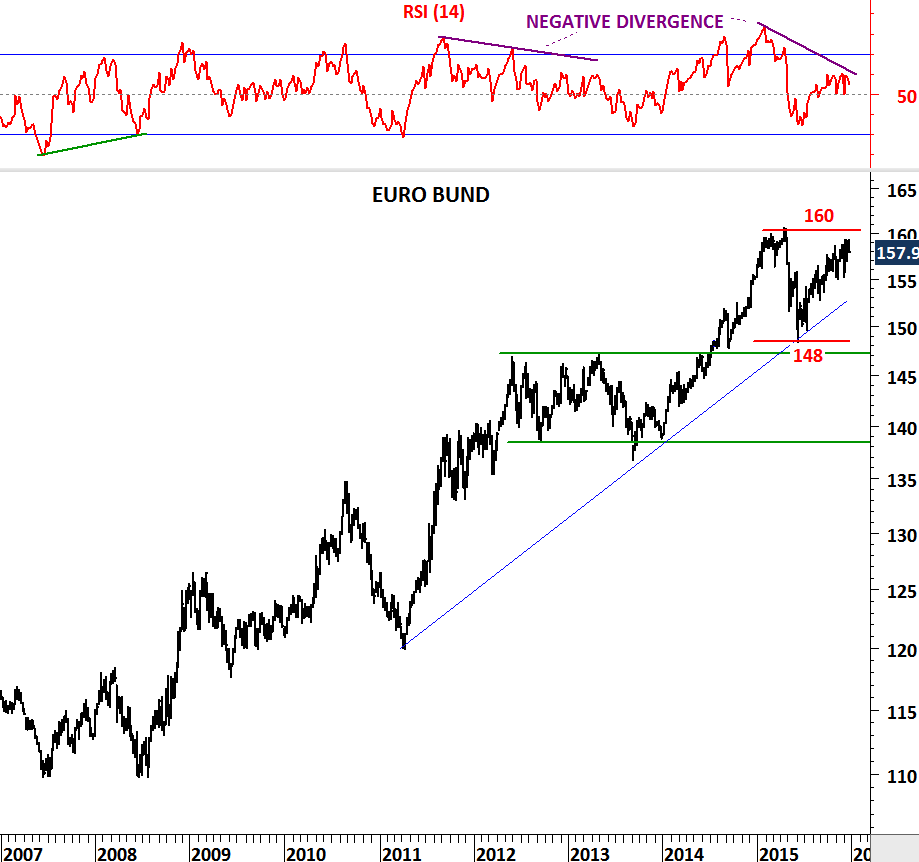

When yields go up, bonds move in the opposite direction. Euro BUND which is the 10 year German government bond, reached an important resistance area with a clear negative divergence on its momentum indicator. When analyzed with the underlying yields, we can conclude that higher interest rates can result in a pullback towards 148 levels.

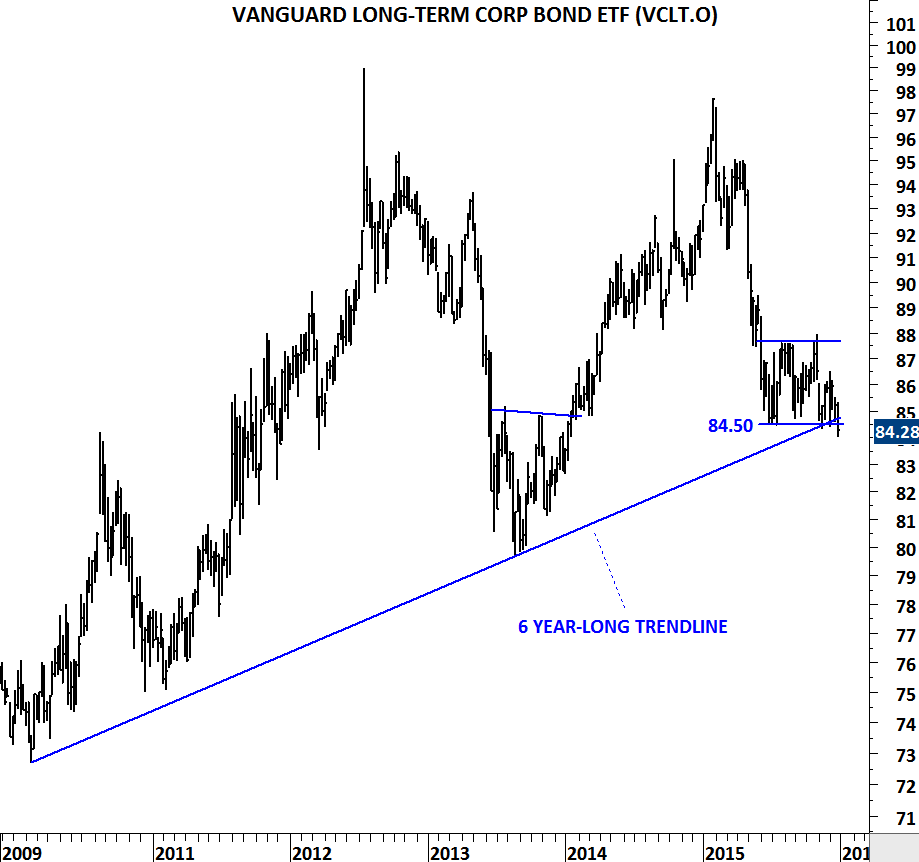

Another interesting chart that drew my attention is the long-term corporate bond ETF. The chart above shows the Nasdaq listed Vanguard Long-Term Corporate Bond ETF (VCLT.O). Price is now challenging 6 year-long trend support. A decisive breakdown on the weekly scale chart will signal higher yields and lower corporate bond prices. (For more information on the above ETF)