GLOBAL EQUITY MARKETS – August 8, 2020

REVIEW

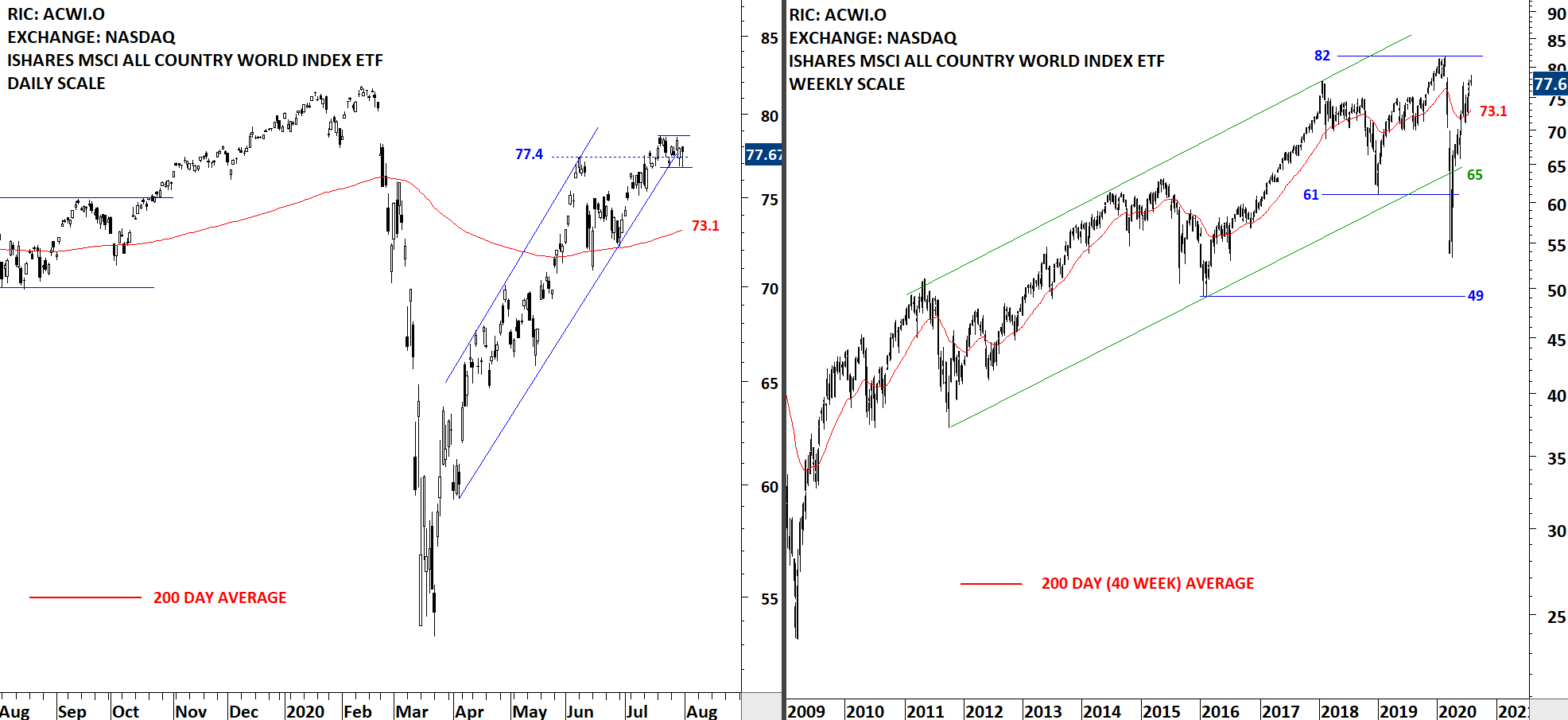

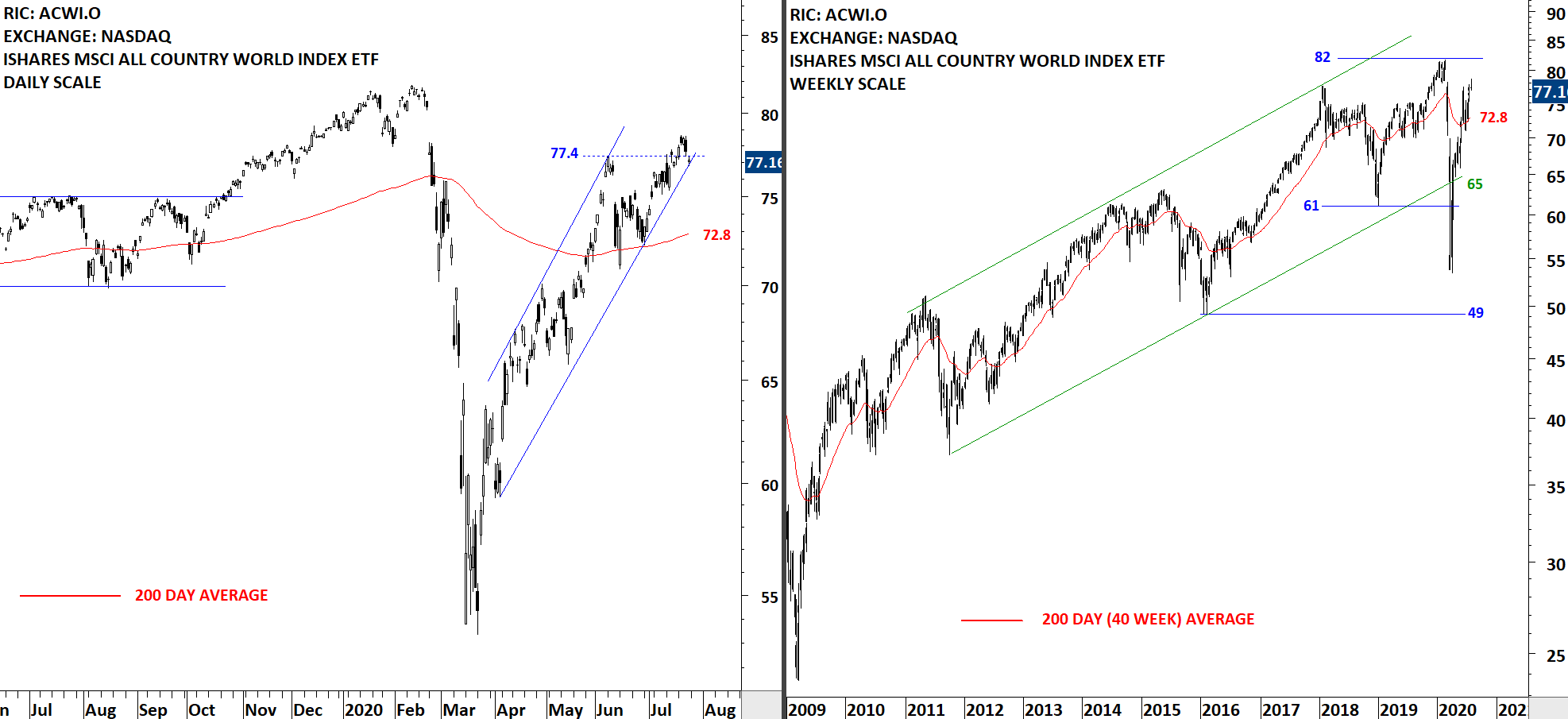

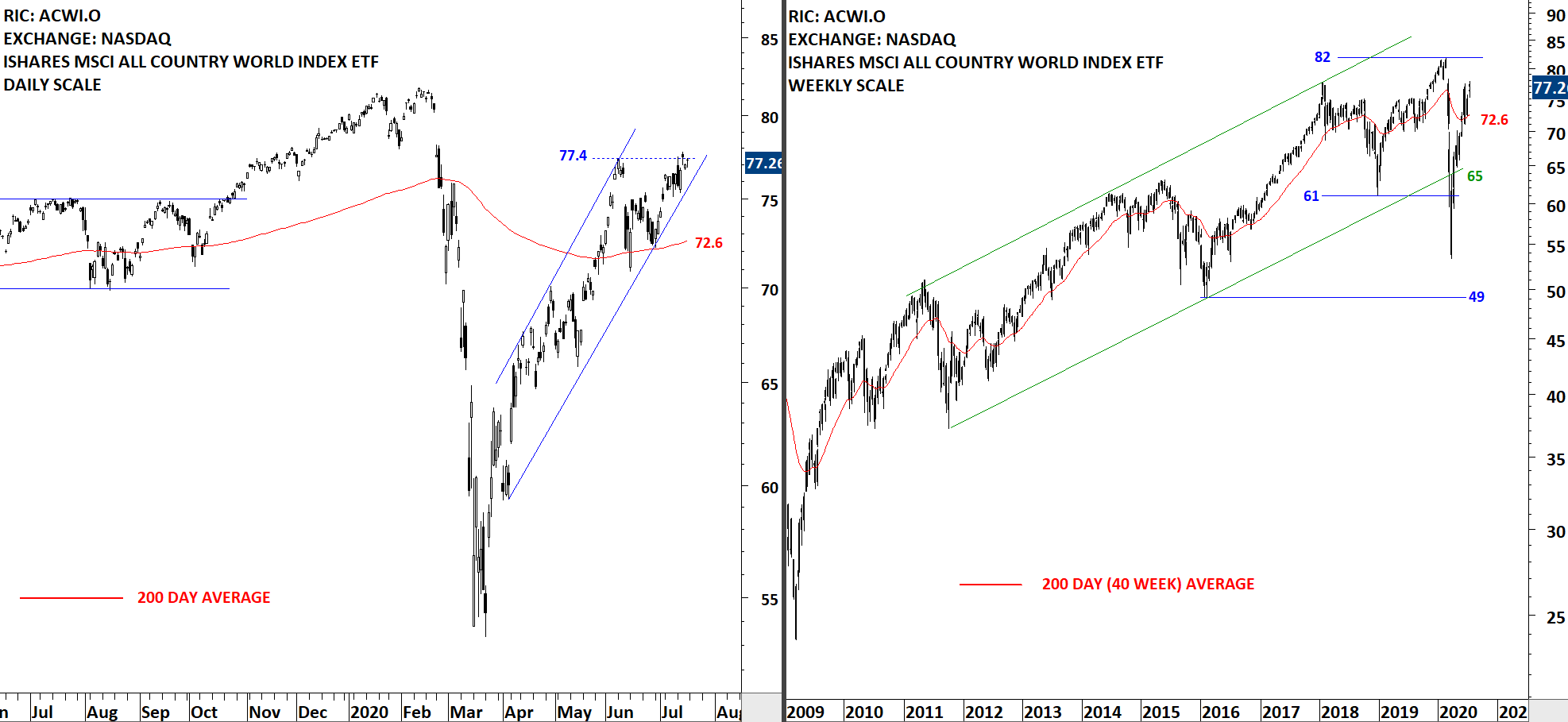

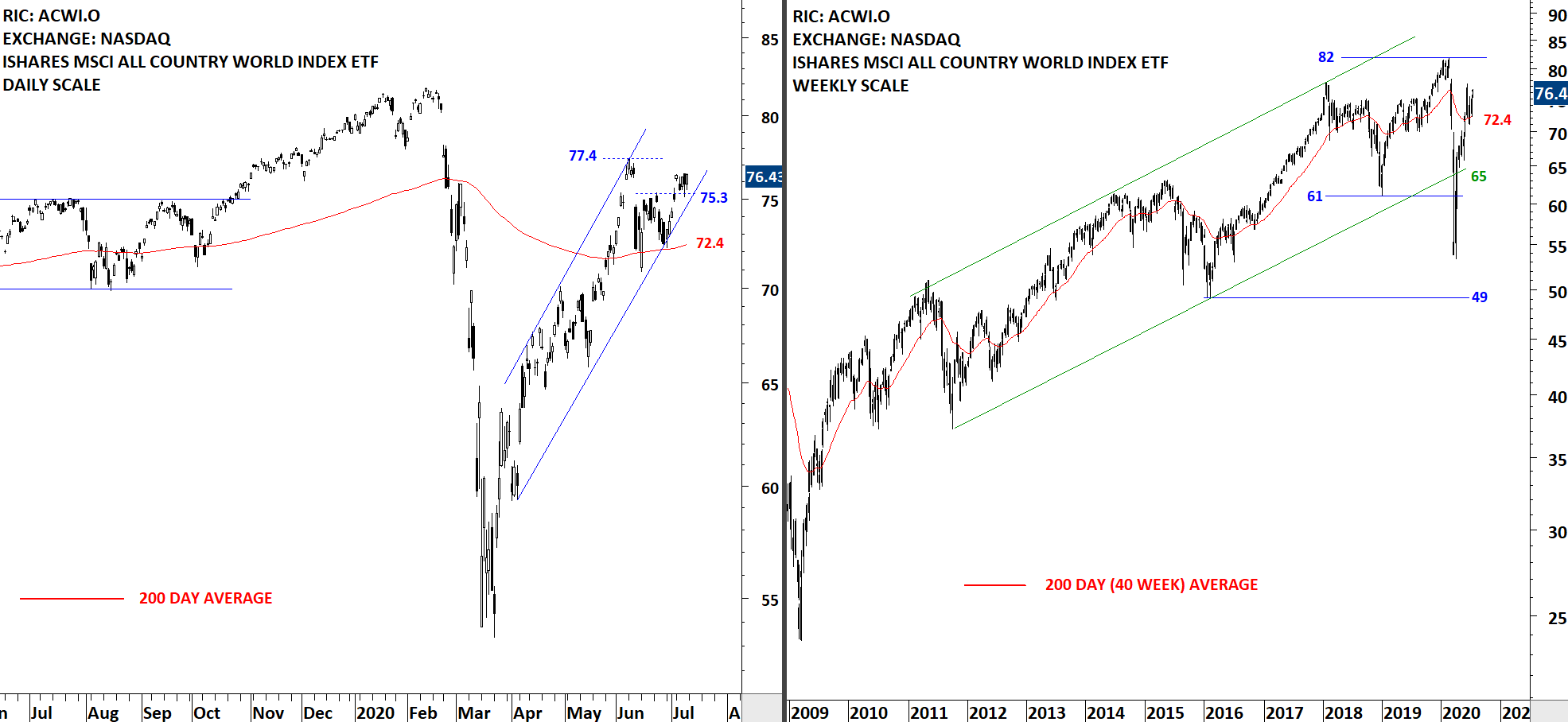

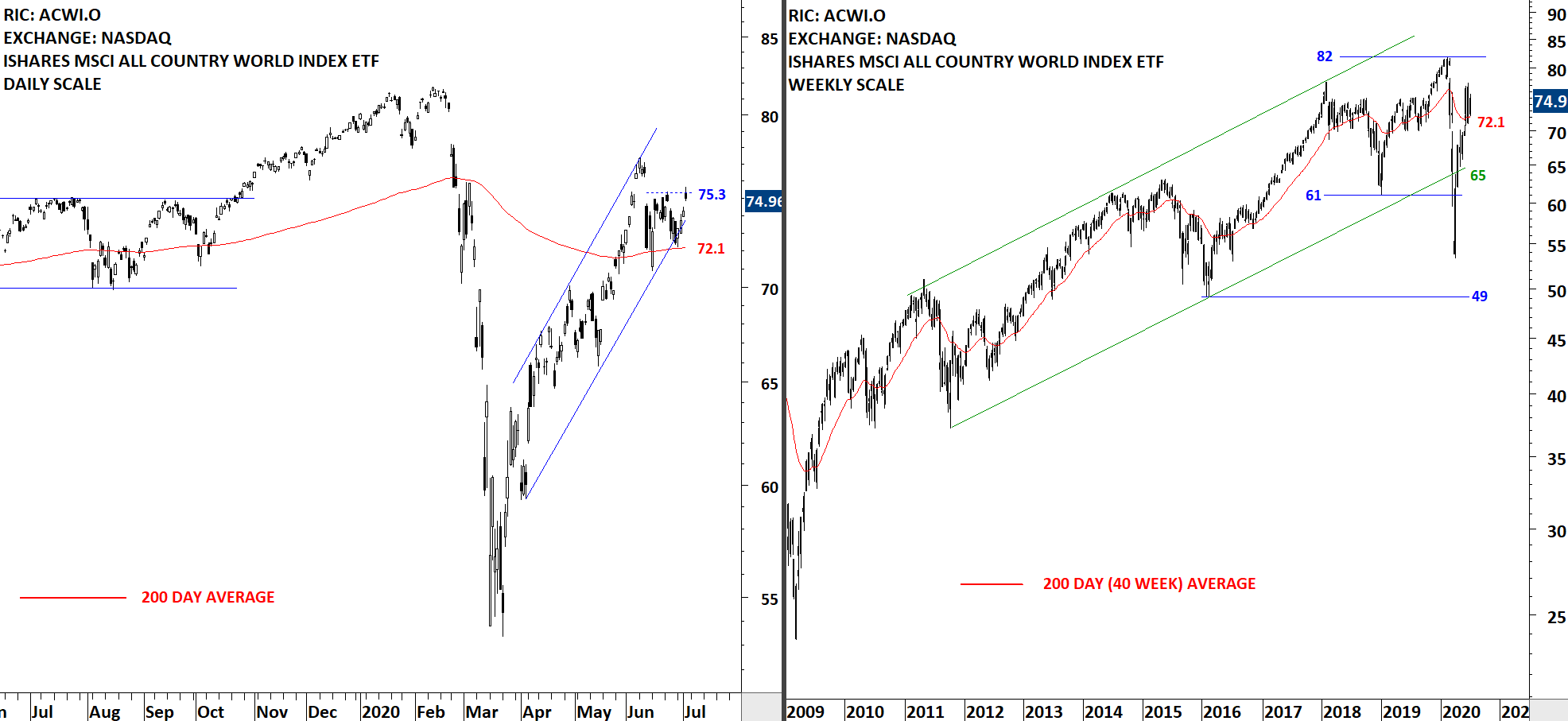

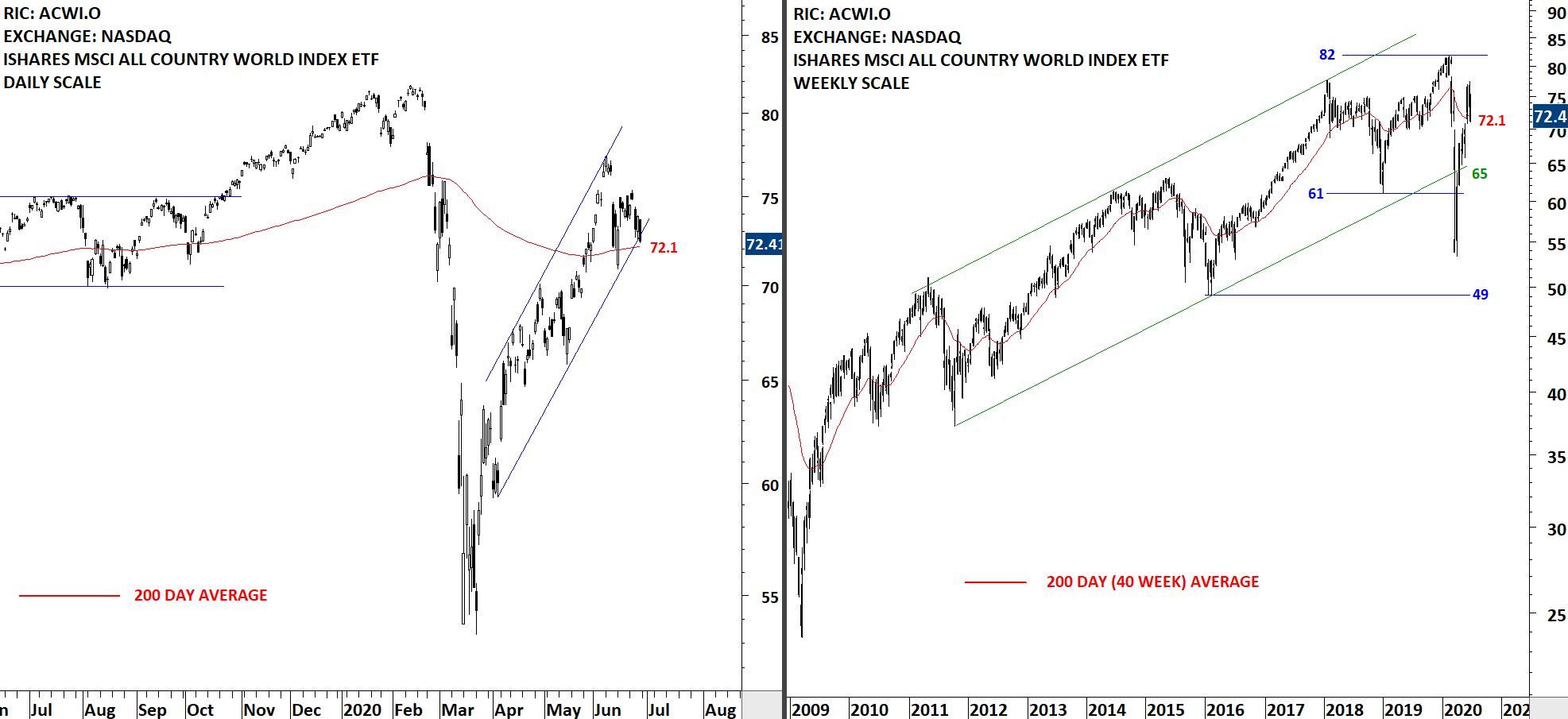

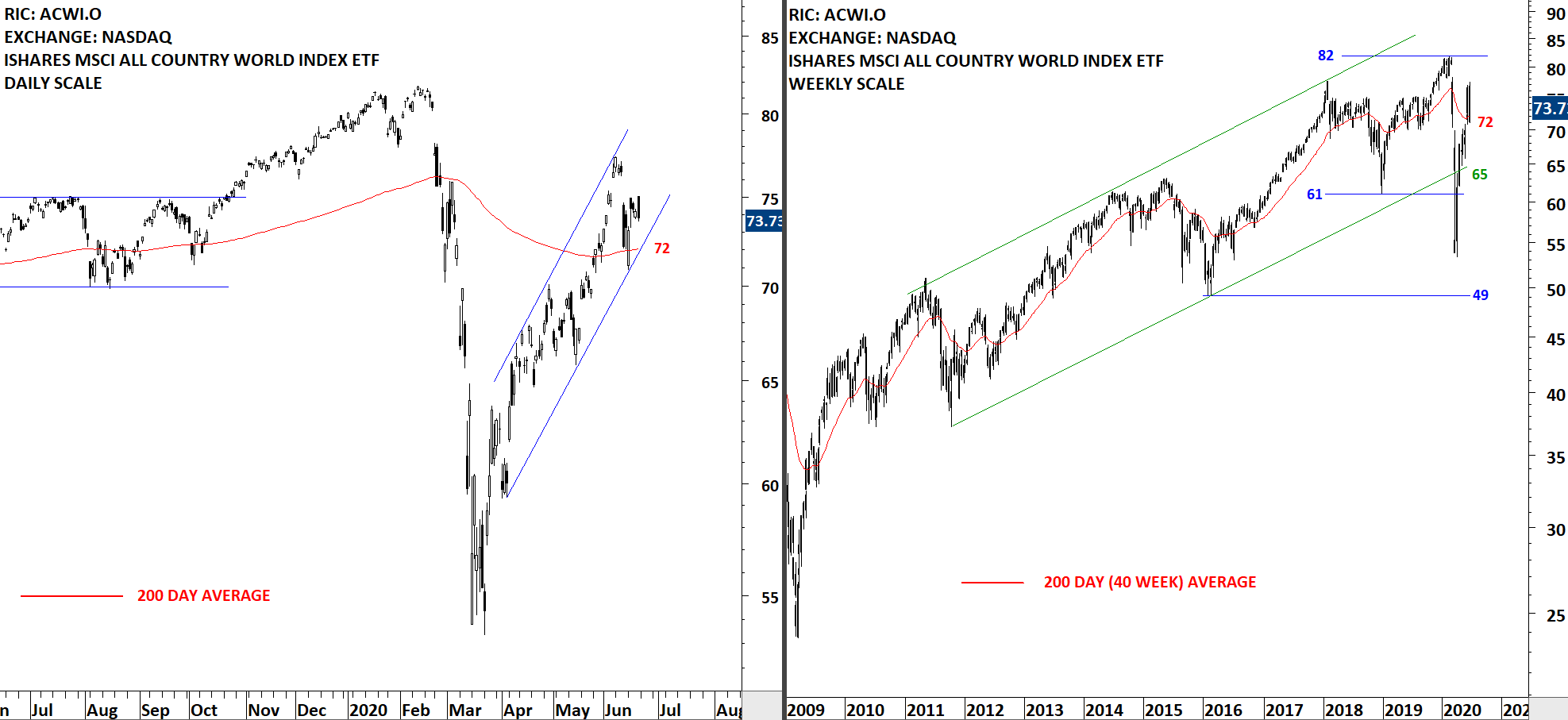

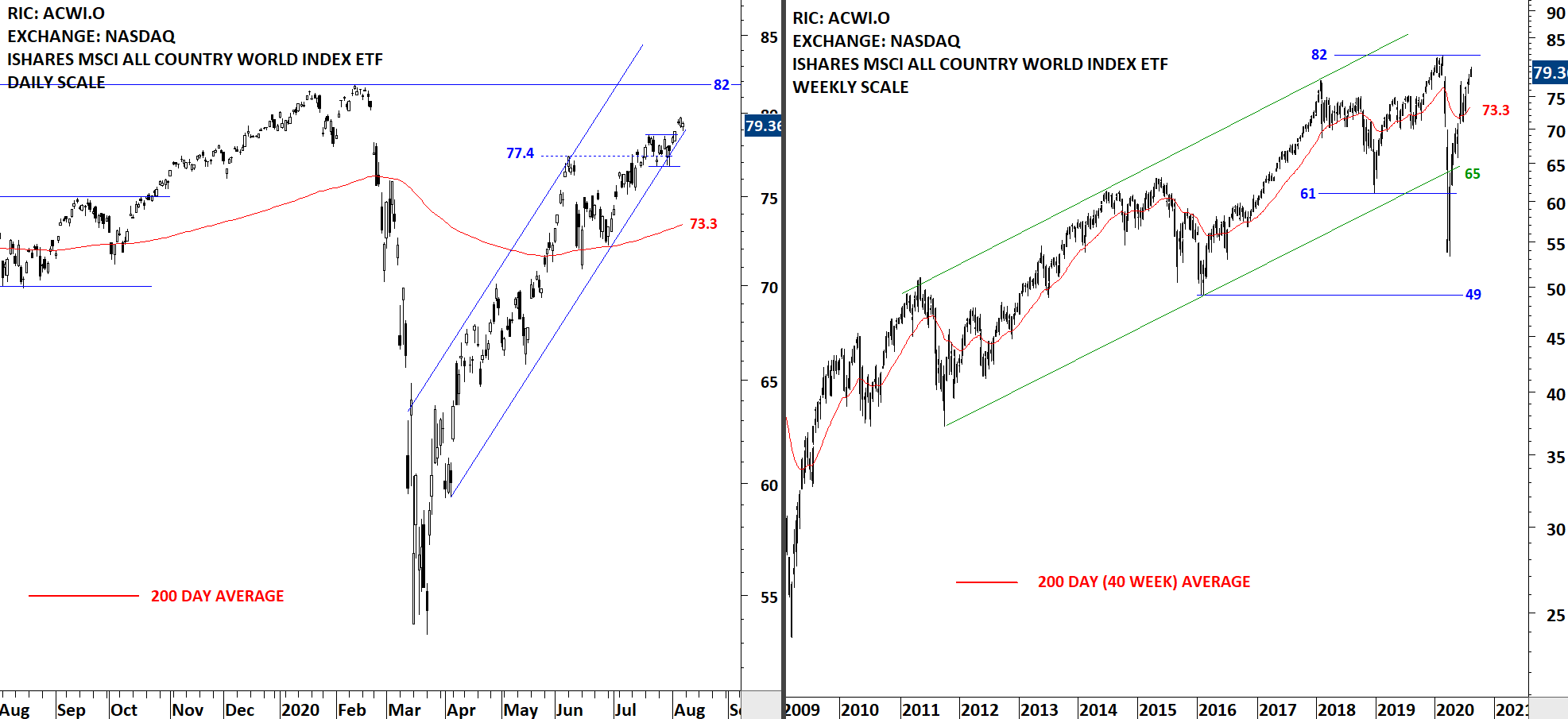

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) cleared its short-term consolidation on the upside. Last three month's price action can be identified as a rising channel. Price is trying to remain inside the trend channel and so far the price remained above the 200-day average. Uptrend is intact. The 200-day moving average is forming support at 73.3 levels. Breakdown below the lower boundary of possible trend channel can result in a pullback towards the 200-day average at 73.3 levels. Volatility is low and we can expect another trend period soon. If it is a correction with the breakdown of the trend channel, it should develop fast, towards 73.3 levels. Pre-pandemic high stands at 82 levels, which is the next important resistance.

Read More

Read More