GLOBAL EQUITY MARKETS – July 19, 2025

REVIEW

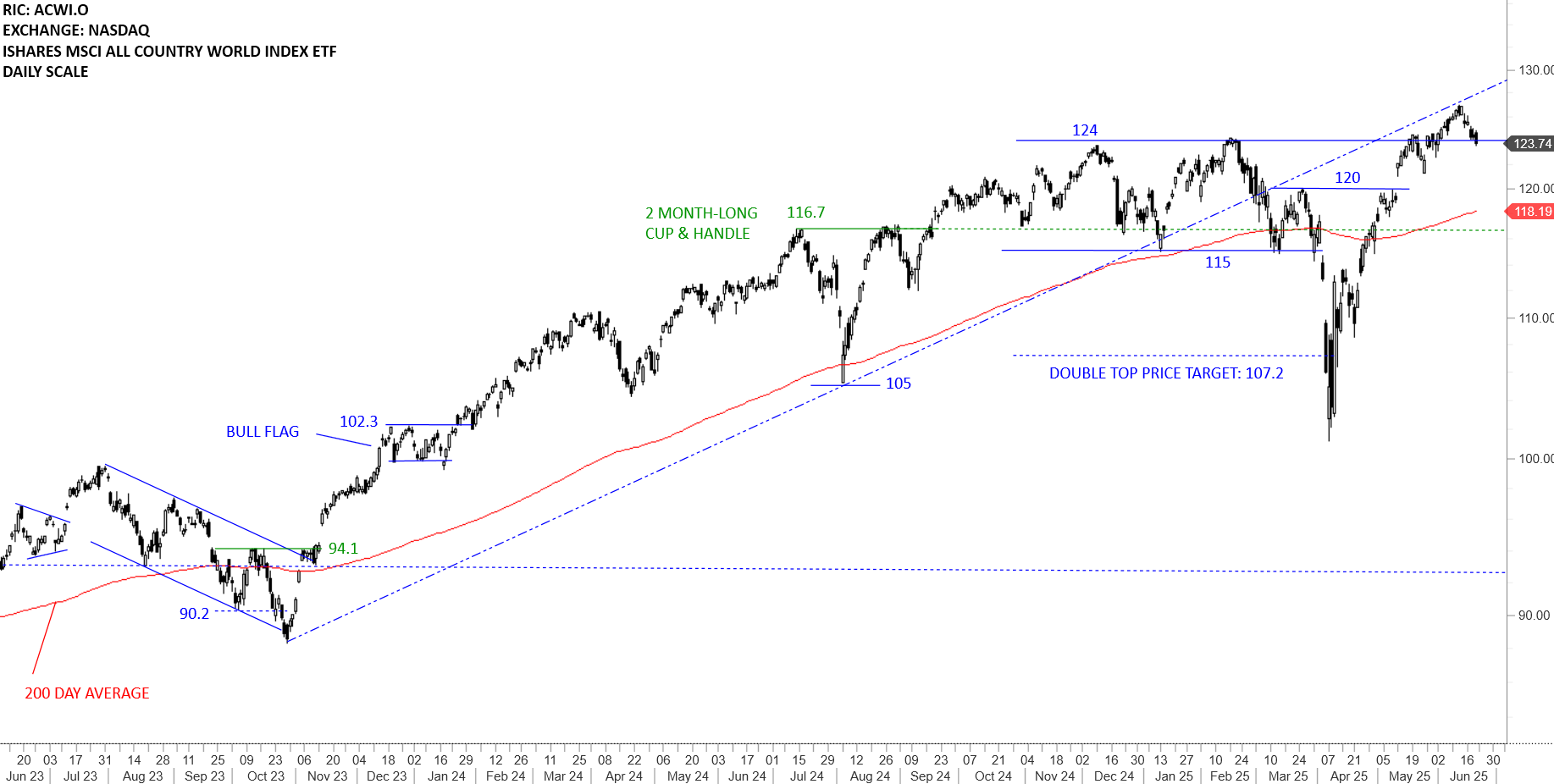

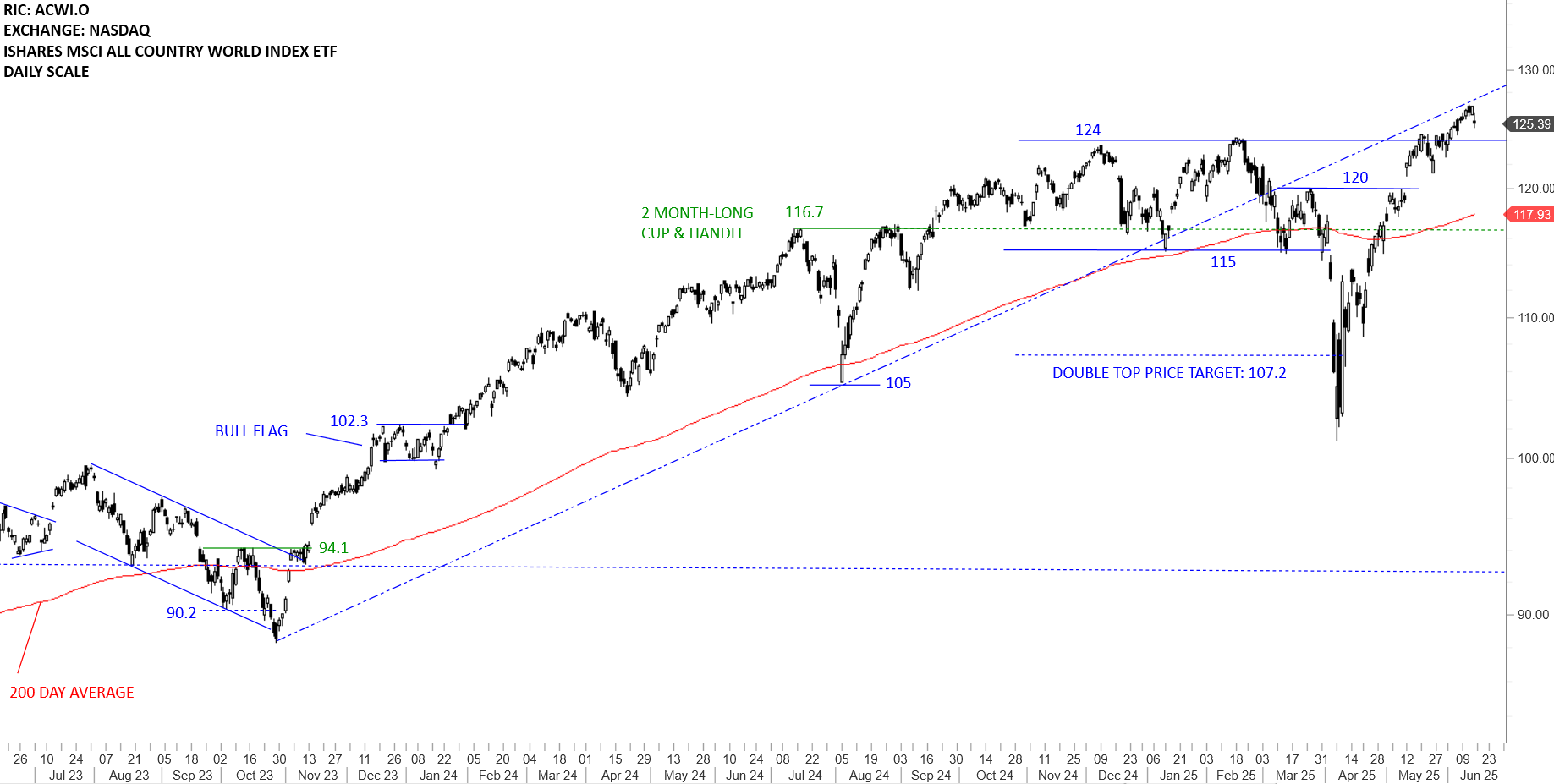

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) did a round trip after the sharp sell-off and reached its all-time highs around 123.5 levels. The fact that the ETF cleared its 200-day average and moved significantly above it can be analyzed long-term positive as pullbacks and consolidations are likely to find support above the 200-day. After clearing the horizontal resistance at 123.5 and the minor high at 127 levels, 123.5-127 area will act as support during any pullback. The ETF is possibly forming a short-term bullish flag that can act as a continuation chart pattern. Outlook is positive for Global Equities. The ETF is resuming higher.

Read More

Read More