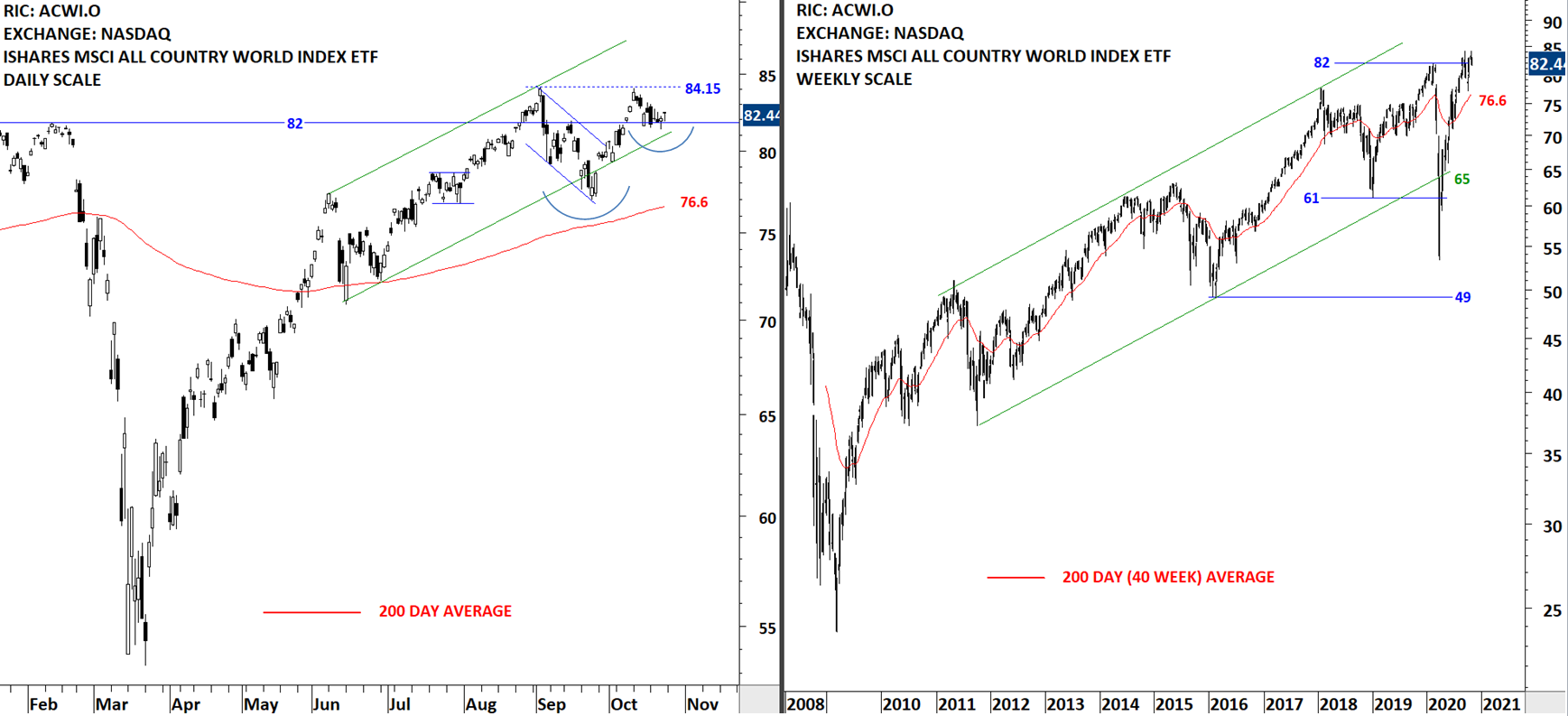

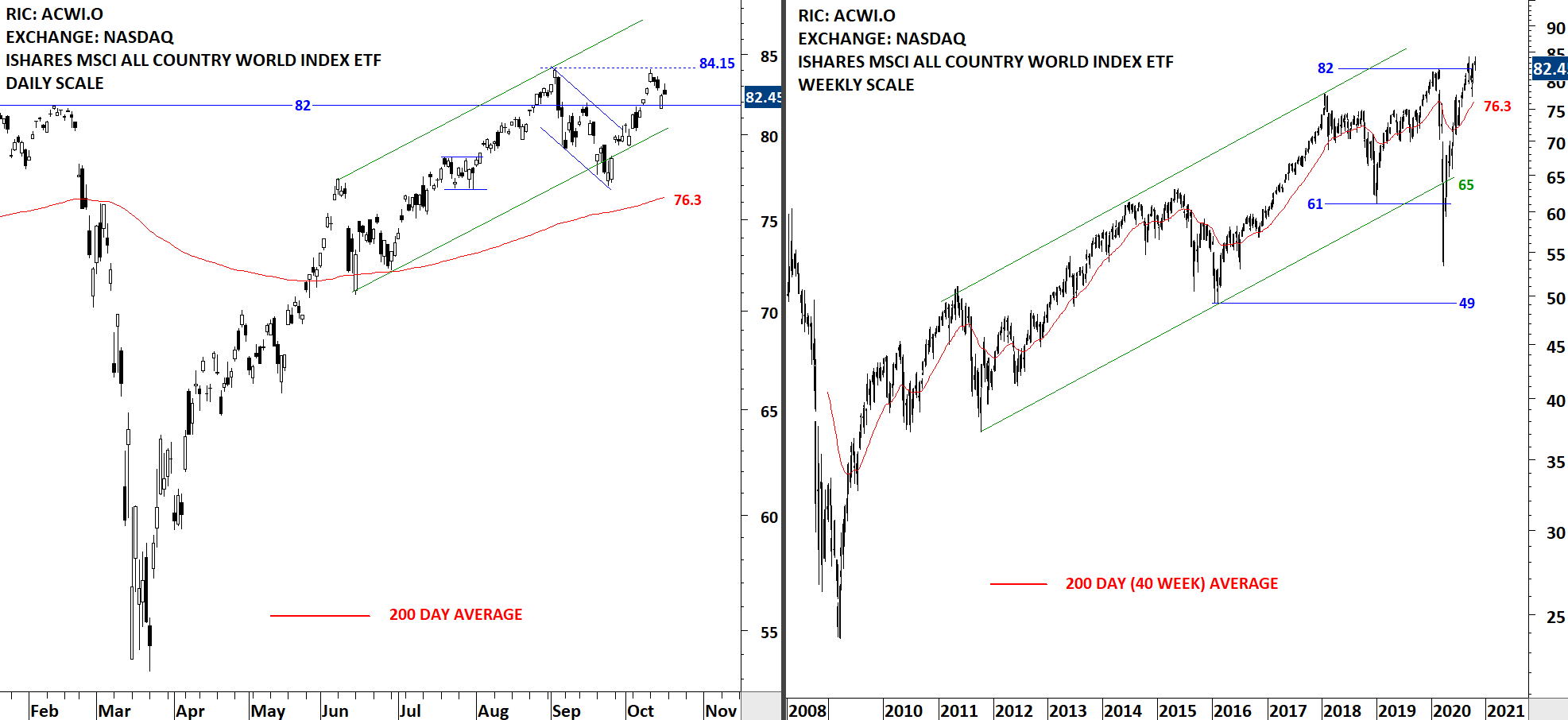

GLOBAL EQUITY MARKETS – October 31, 2020

REVIEW

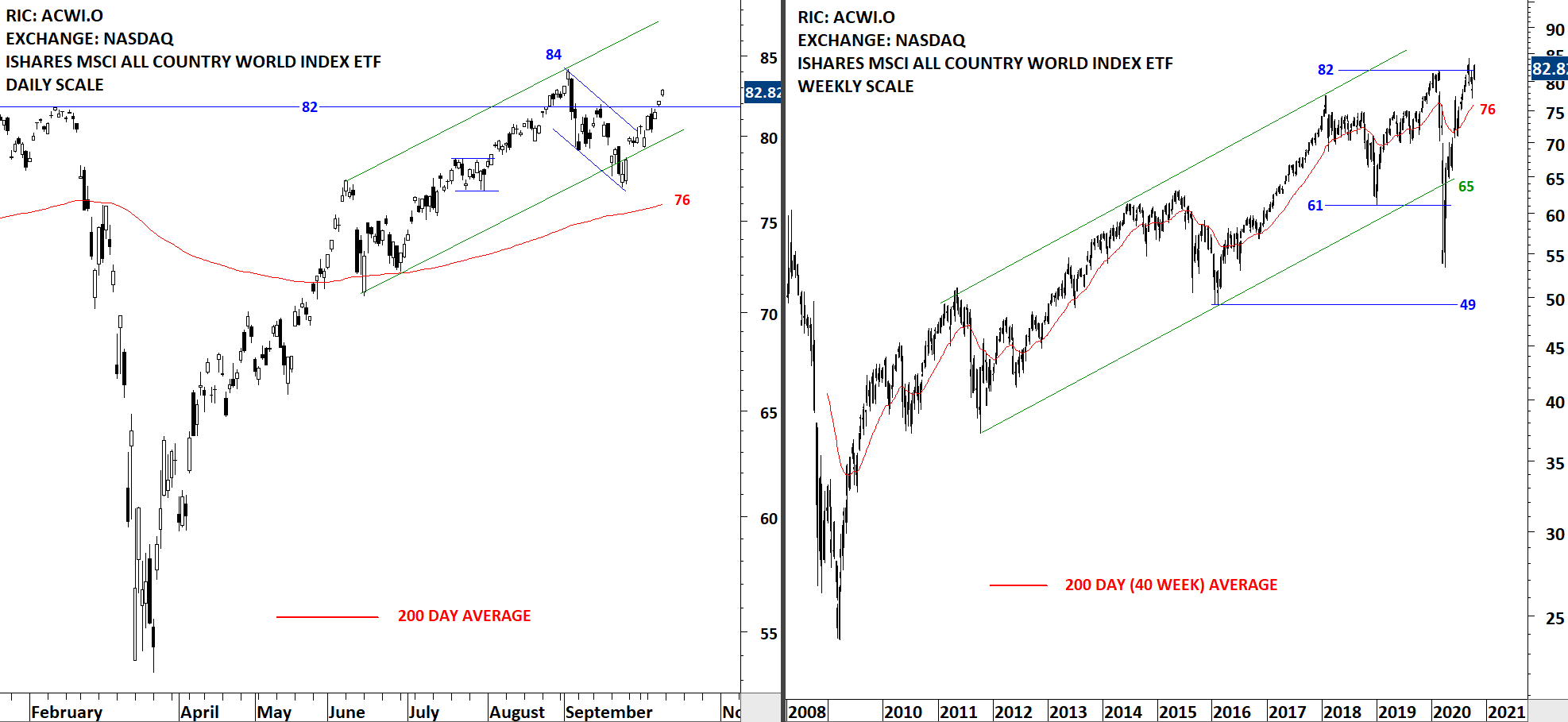

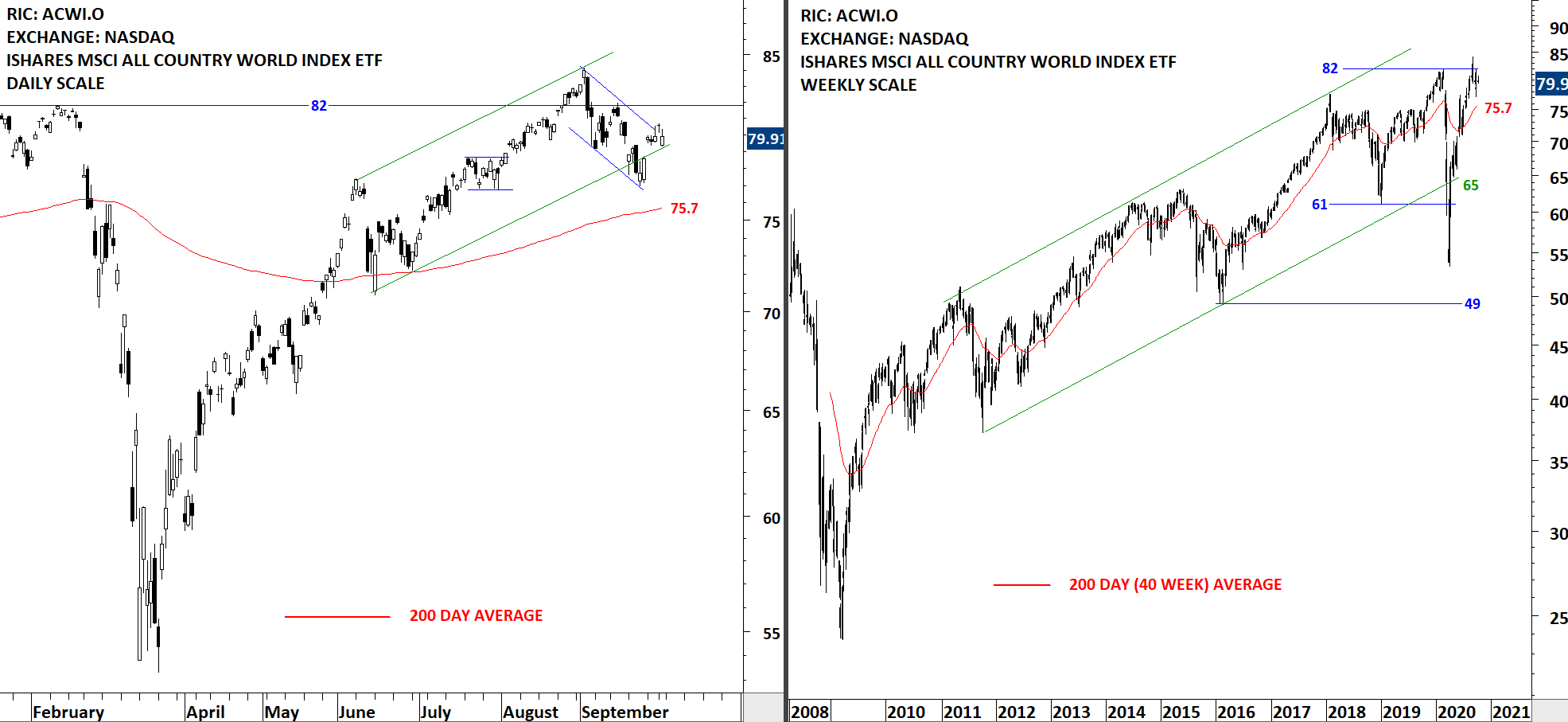

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) resumed its correction after finding resistance at 84.15 levels, the minor high. The uptrend on Global equities is intact and ACWI ETF continues to trend higher above its 200-day average which is acting as support at 76.7 levels. Global equities are searching for direction in the short-term. Price is at an important inflection point. Last 2 month's consolidation between 84.15 and 76.7 levels can act as Read More