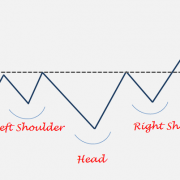

FLAG AS A MEASURING PATTERN

The flag forms on a mast, a nearly vertical price movement, either up or down. The length of the mast (in points) from the preceding congestion to the point where the Flag begins to form, will be found to indicate in by far the great majority of the cases the extent of the rapid price movement which proceeds from the last reversal point in the Flag. The price projection by using this half mast technique will give us the possible price target but does not call for a reversal of trend when the price objective is met.

Read More