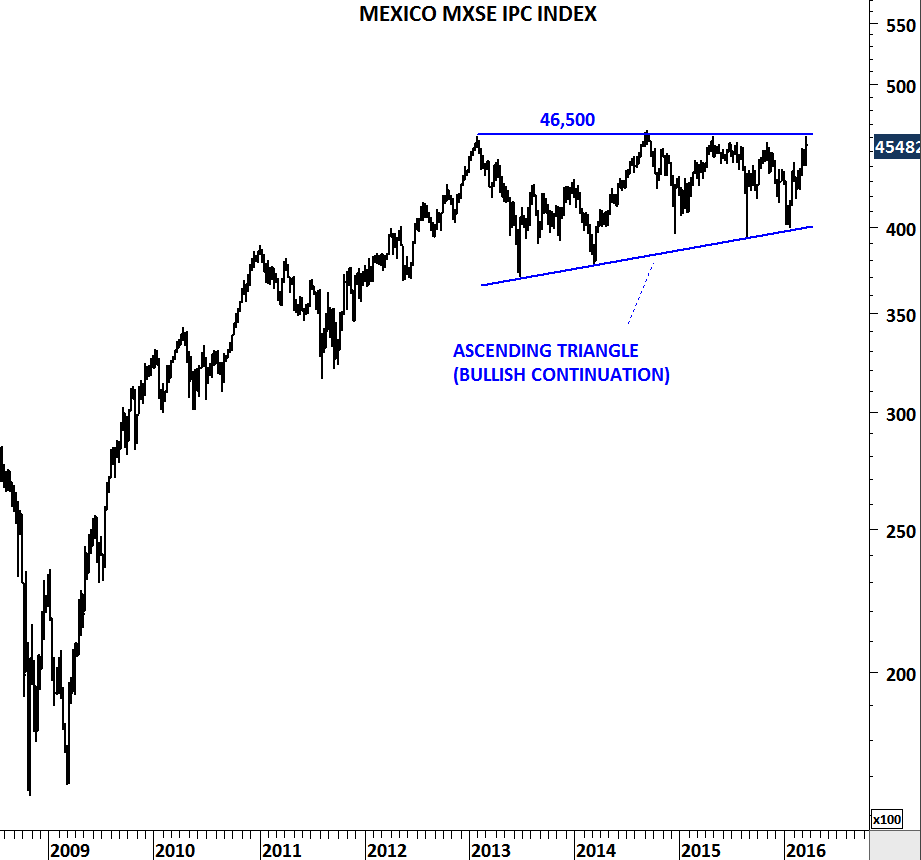

MEXICO IPC INDEX

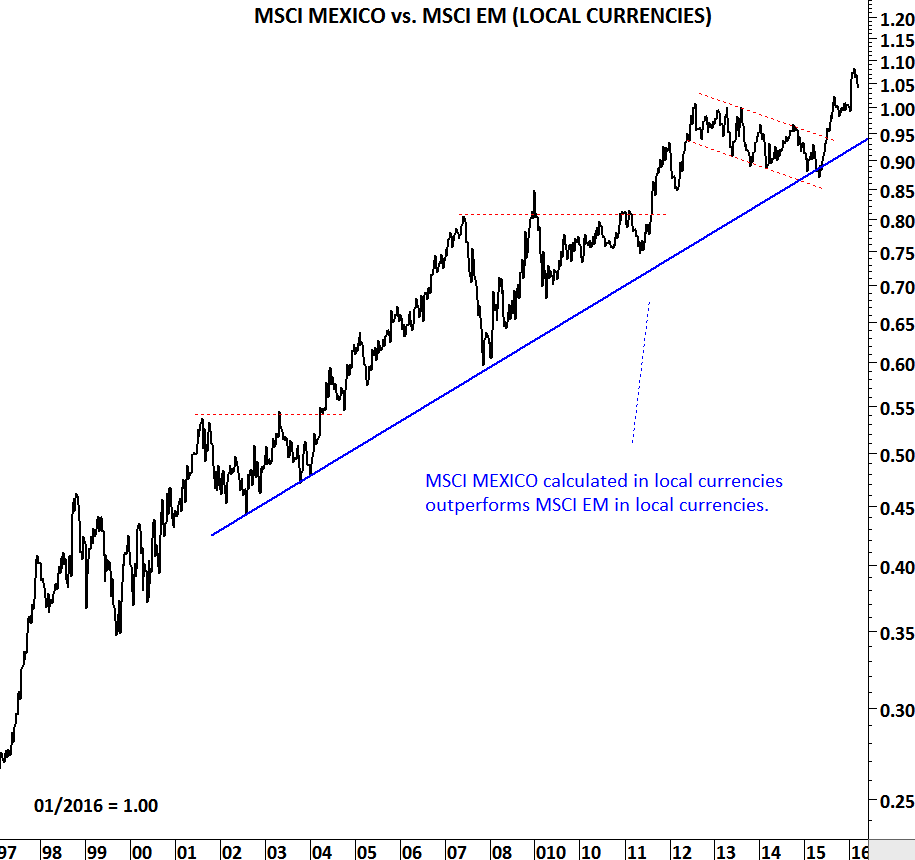

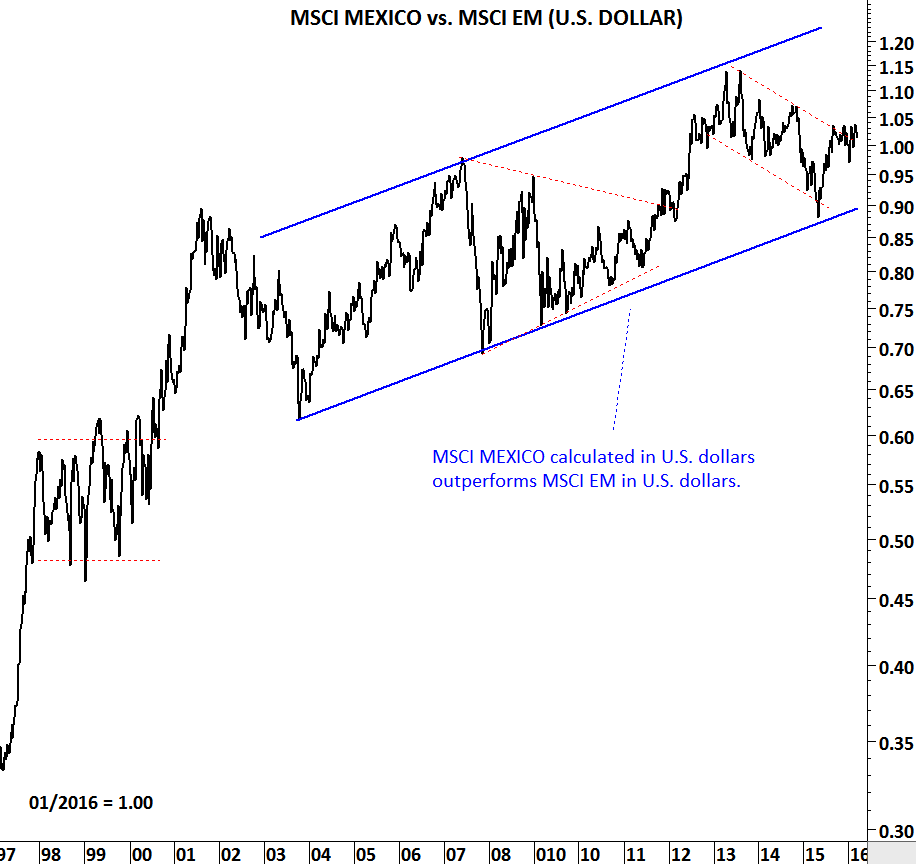

Mexico’s IPC index, denominated in local currency, is preparing for a strong breakout. During Emerging markets poor performance (2011-2016), Mexico outperformed the MSCI Emerging Markets index. Strong relative performance is also reflected on the absolute performance of the IPC index, with the national benchmark now challenging horizontal resistance for the 5th time over the past 3 years. Breakout above strong resistance can push the index to all-time high levels.

The developing chart pattern could be an ascending triangle with bullish implications. Breakout above 46,500 levels will confirm the bullish chart formation and suggest higher prices that can target 55,000 levels.

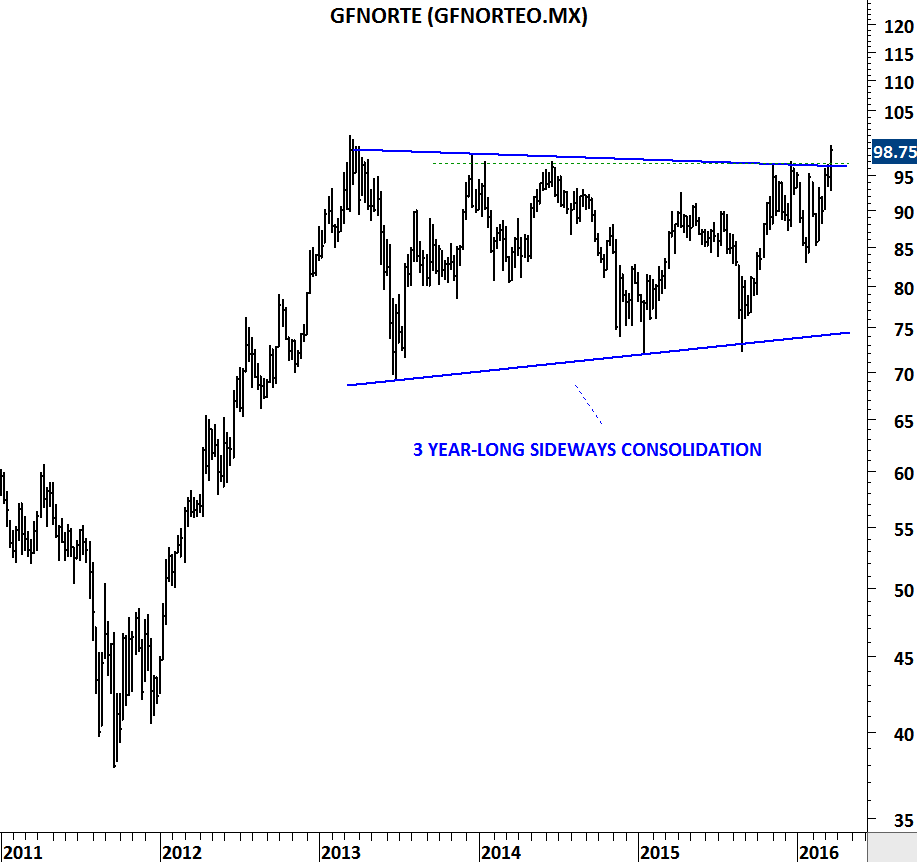

While the MEXICO IPC INDEX is forming a bullish ascending triangle poised for a breakout to higher levels, here are some of the constituents that have similar bullish chart set ups.

GFNORTE formed a 3 year-long sideways consolidation. Stock is now challenging historical high levels. Breakout above 100 levels will be very positive.

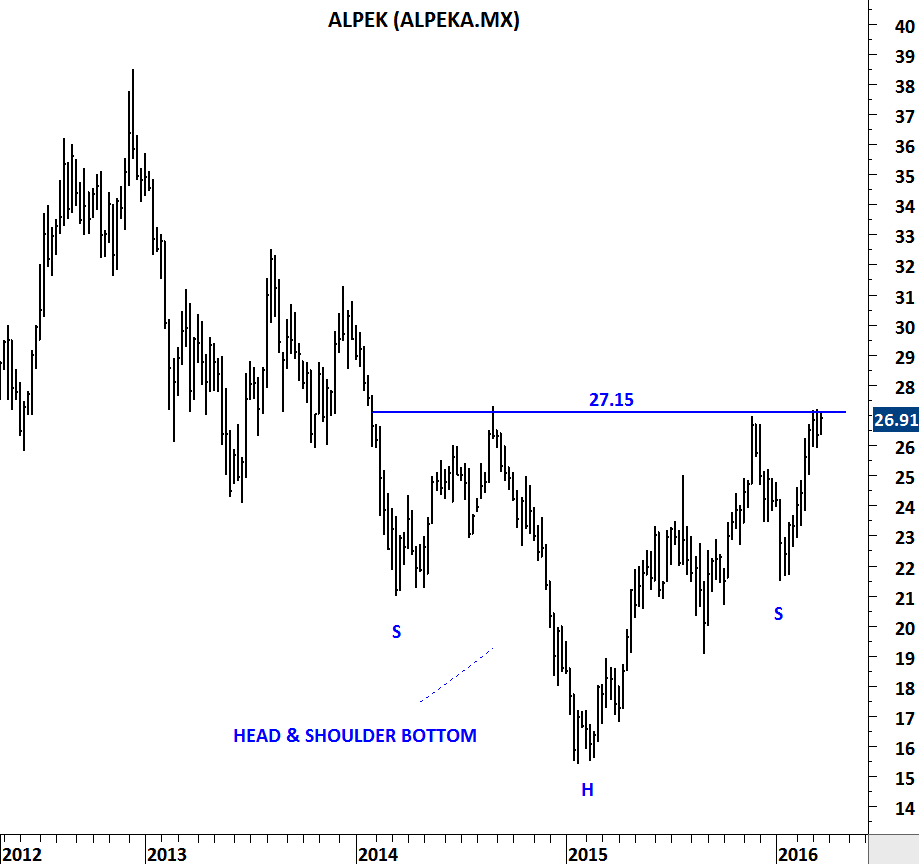

2 year-long H&S bottom on ALPEK has strong resistance at 27.15 levels. A decisive weekly break above the neckline at 27.15 will result in higher prices.