GLOBAL EQUITY MARKETS – January 6, 2018

Announcement: I will be speaking at the Dubai Traders Summit organized by MetaStock on April 26th. Over the past decade I worked for institutions in the region, managing funds & portfolios as well as analyzing Emerging and Frontier markets. At this one day event I hope to connect with Tech Charts members & followers, ex-colleagues and fellow traders to discuss some of the best classical chart patterns that helped me in making trading and investment decisions. Registration is free. You can follow this link to register >> DUBAI TRADERS SUMMIT APRIL 26th.

REVIEW

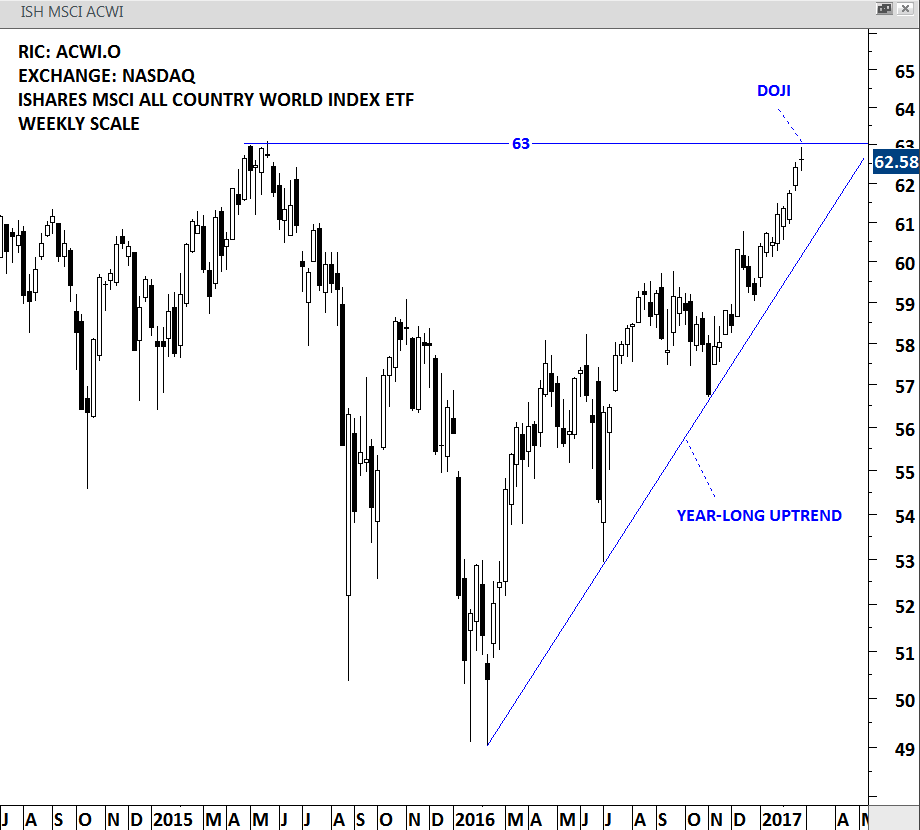

Global Equity Markets started the new year on a high note. Back to back gains pushed the iShares MSCI All Country World Index towards the upper boundary of its upward trend channel. Strong uptrend remains intact. If the year-long upward trend channel is valid, the upper boundary can act as a short-term resistance. There is no chart pattern that would suggest a trend reversal at this point.

Read More