U.S. DOLLAR INDEX

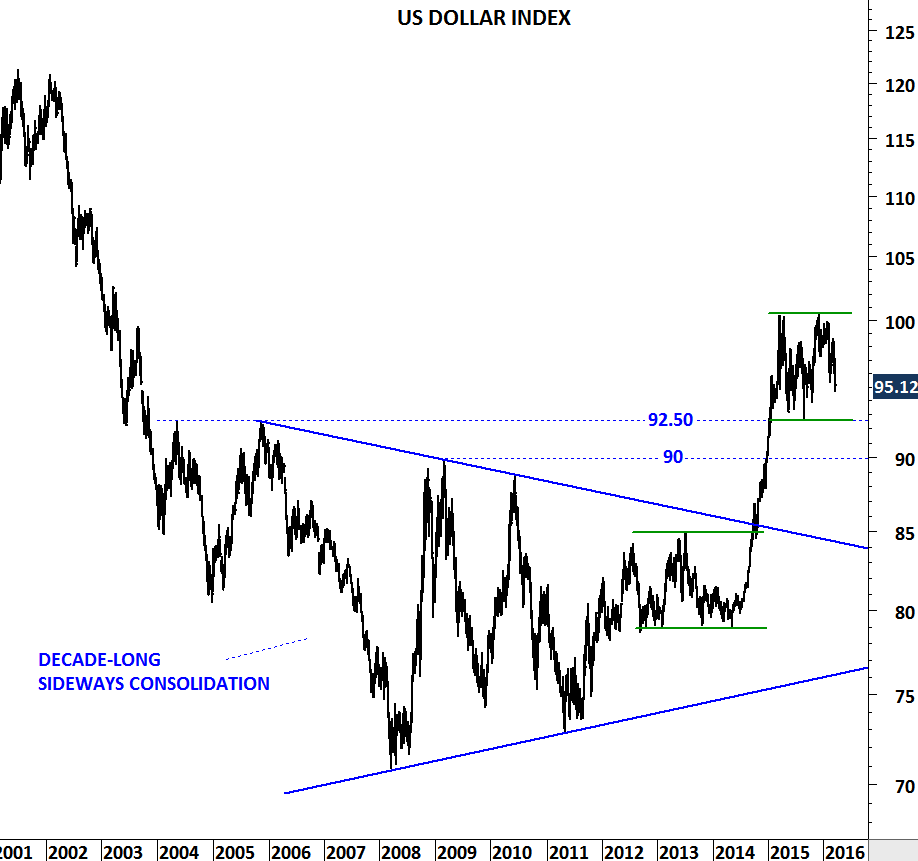

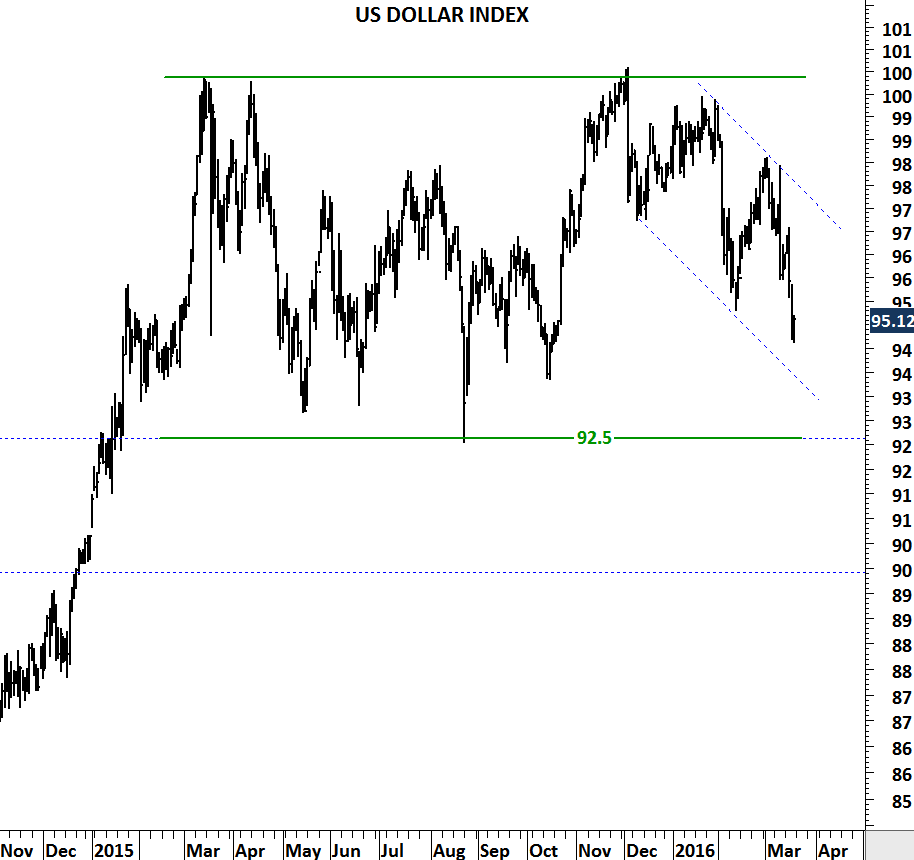

Over the past week, FED’s dovish comments resulted in U.S. dollar weakness. However U.S. dollar index started weakening in the beginning of December 2015 irrespective of FED action. Wide price fluctuation between 92 and 100 levels is likely to be a sideways consolidation.

After its strong rally from 80 levels, U.S. dollar index is taking a breather. At this stage, it is early to call for a change in trend or claim that the U.S. dollar bull market is over. U.S. dollar index should find support around 92 levels. Only after a decisive breakdown below 92 levels we can expect large-scale correction for the U.S. dollar. Until that happens I view the medium/long-term outlook on the U.S. dollar as bullish.