GLOBAL EQUITY MARKETS – June 17, 2017

Announcements:

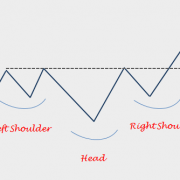

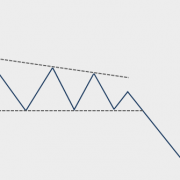

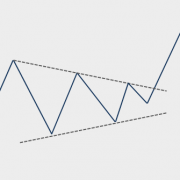

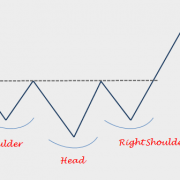

1) New educational videos explaining the most analyzed 8 classical chart patterns are uploaded under the Educational Videos page. More videos are being prepared, featuring different outcomes for these chart patterns.

2) A new page featuring all the breakout alerts will be made available (next few days) for members. It will be a helpful tool for following up on the latest chart patterns, sort latest breakout alerts by date and search by ticker.

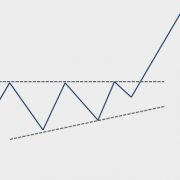

3) Due to high volume of requests from Tech Charts members, starting from this update I will add reference levels that would possibly negate a chart pattern. Other important labeling will be included on the charts. Below info graphic can be useful to explain the new additions on the charts.