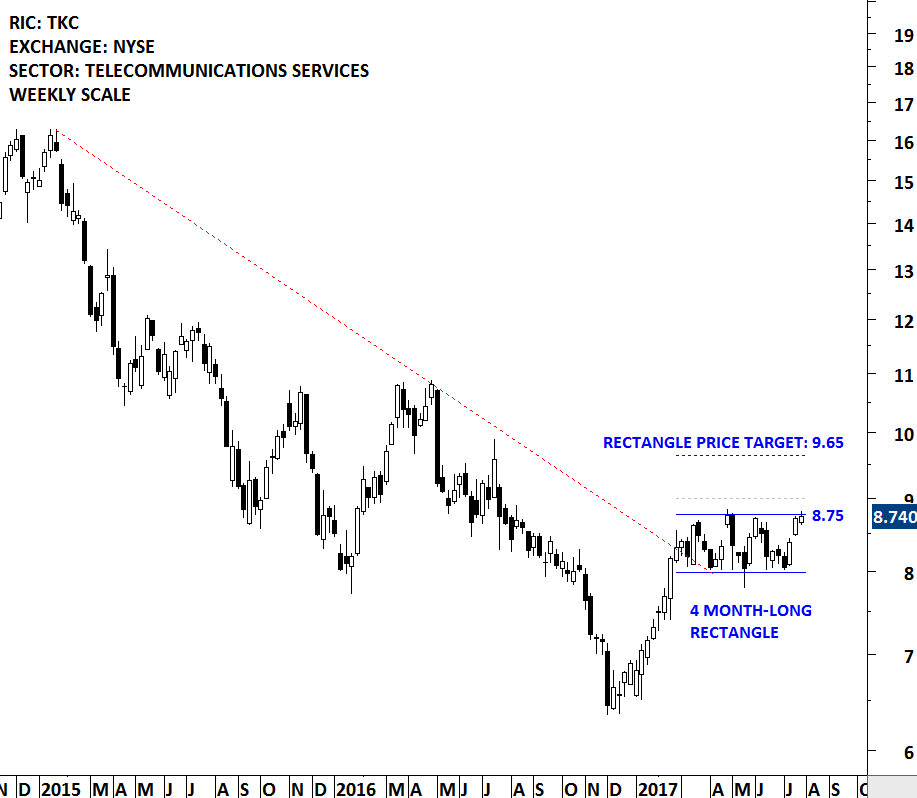

TURKCELL (TKC) – TURKEY

Every week Tech Charts Global Equity Markets report features some of the well-defined, mature classical chart patterns under a lengthy watchlist and the chart pattern breakout signals that took place during that week. Global Equity Markets report covers single stocks from developed and emerging markets, ETF’s and global equity indices. The main focus of the weekly report is to bring member’s attention some of the best examples of classical charting. Chart patterns that are likely to resolve in a directional move. This blog post highlights one of several great chart setups from the latest Global Equity Markets report. Below you will also find a sample educational video on rectangle chart pattern as well as past examples of Tech Charts Breakout Alerts on Rectangles.

TURKCELL ILETISIM HIZMETLERI (TKC)

Turkcell Iletisim Hizmetleri AS is engaged in establishing and operating a Global System for Mobile Communications (GSM) network in Turkey and regional states. The stock is listed on the New York Stock Exchange via depository receipts. Price chart formed a 4 month-long rectangle with the horizontal boundary standing as resistance at 8.75 levels. A daily close above 9 levels will confirm the breakout from the bullish continuation chart pattern with a possible price target of 9.65 levels. Rectangle can act as a bullish continuation chart pattern.