Lately I’ve been focusing more frequently on the currency markets and especially on crossrates against the U.S. dollar. Several developed and emerging market currencies are forming major reversal patterns (inverted Head & Shoulder) that is bullish for the dollar in the short/medium-term.

http://techcharts.wordpress.com/2012/01/22/u-s-dollar-index-eurusd/ (January)

http://techcharts.wordpress.com/2012/02/11/u-s-dollar-index-eurusd-2/ (February)

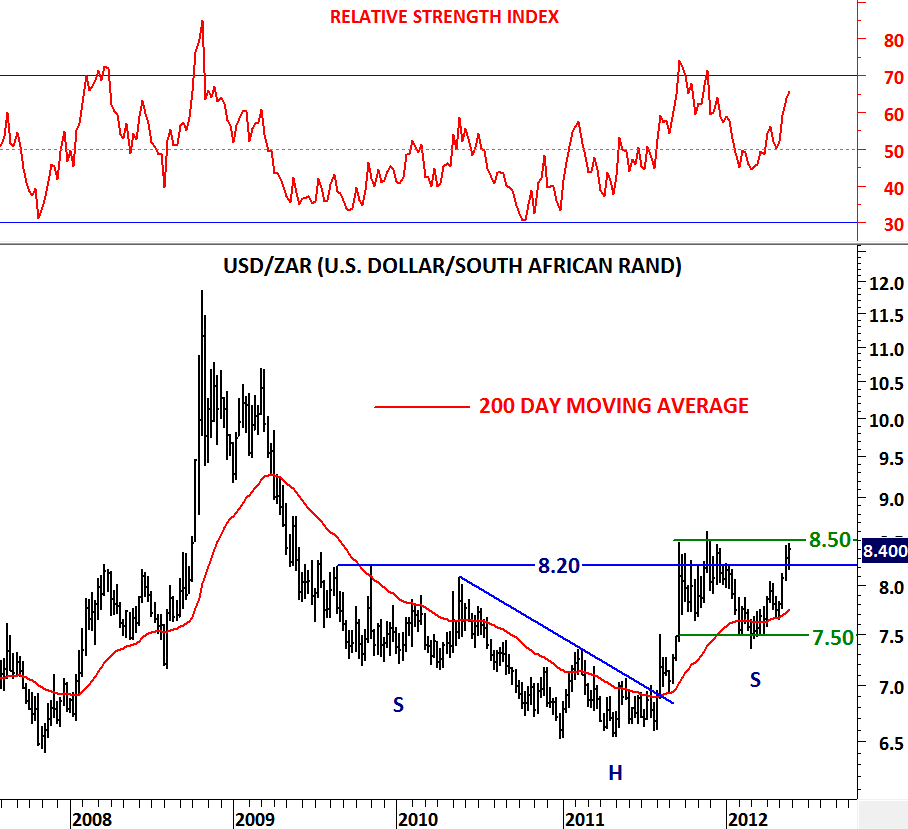

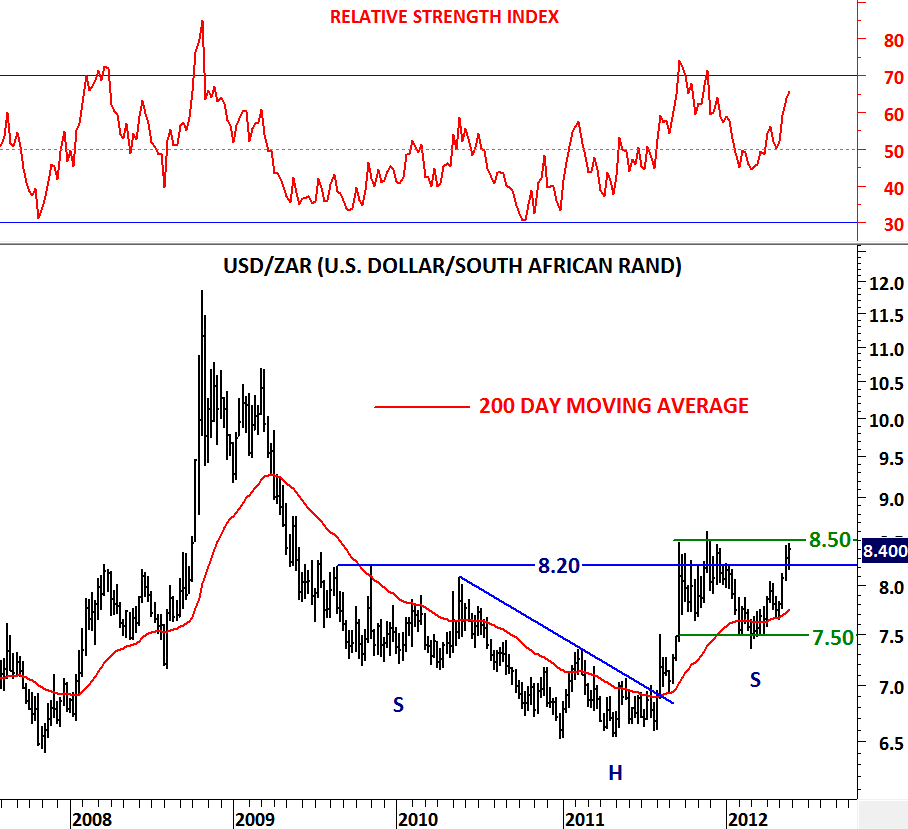

Inverted H&S pattern is a widely followed technical chart formation and has a very low failure rate. As a major reversal pattern, Head & Shoulder bottom (inverted Head & Shoulder) forms after a downtrend and its completion marks a change in trend. Head & Shoulder bottom pattern is not complete, and the downtrend is not reversed until neckline resistance is broken. With friday’s close, U.S. dollar index breached its neckline between 81.70 and 82 levels. This should be regarded as a positive technical action for the dollar and would require to search for more evidence that signals dollar strength in the short/medium-term. Below are some of the charts that have similar inverted H&S patterns, either in the phase of completion or already completed. These charts also support the case for dollar strength in the following weeks/months.

USD/BRL broke above its neckline at 1.92 as we have discussed in an earlier update. USD/IDR, USD/SEK are two other crossrates that have breached above their strong resistances. USD/CAD and USD/ZAR are still completing their base patterns. I’m not sure if we are going to see another QE that might put pressure on the dollar but so far, analyzed charts above are signaling an increasing demand for the dollar.