U.S. Unemployment Rate (%) & Chicago PMI

U.S. unemployment rate jumped to 8.2% in May. U.S. Employers added 69,000 jobs, fewer than forecast. If you remember from the earlier posts I’ve analyzed the unemployment rate with technical indicators and applied moving average crossovers to see the changes in trend on this time series. Study showed improving job market followed by bullish cross-over on the 1 & 2 year moving averages. Employment figures improved for at least one year after the technical signal. 1972-1973 and 1959-1960 were two periods where unemployment declined but improvement last only one year. All other cycles last between 3 and 7 years. So it is extremely important to see the continuation of the positive trend as we have now finalized 1 year since the last cross-over. However today’s data warns us to be more cautious going forward. It is a clear indication of weak job market and if we don’t see better figures in the next few months we can experience a repeat of 1960-1962 and 1973-1976.

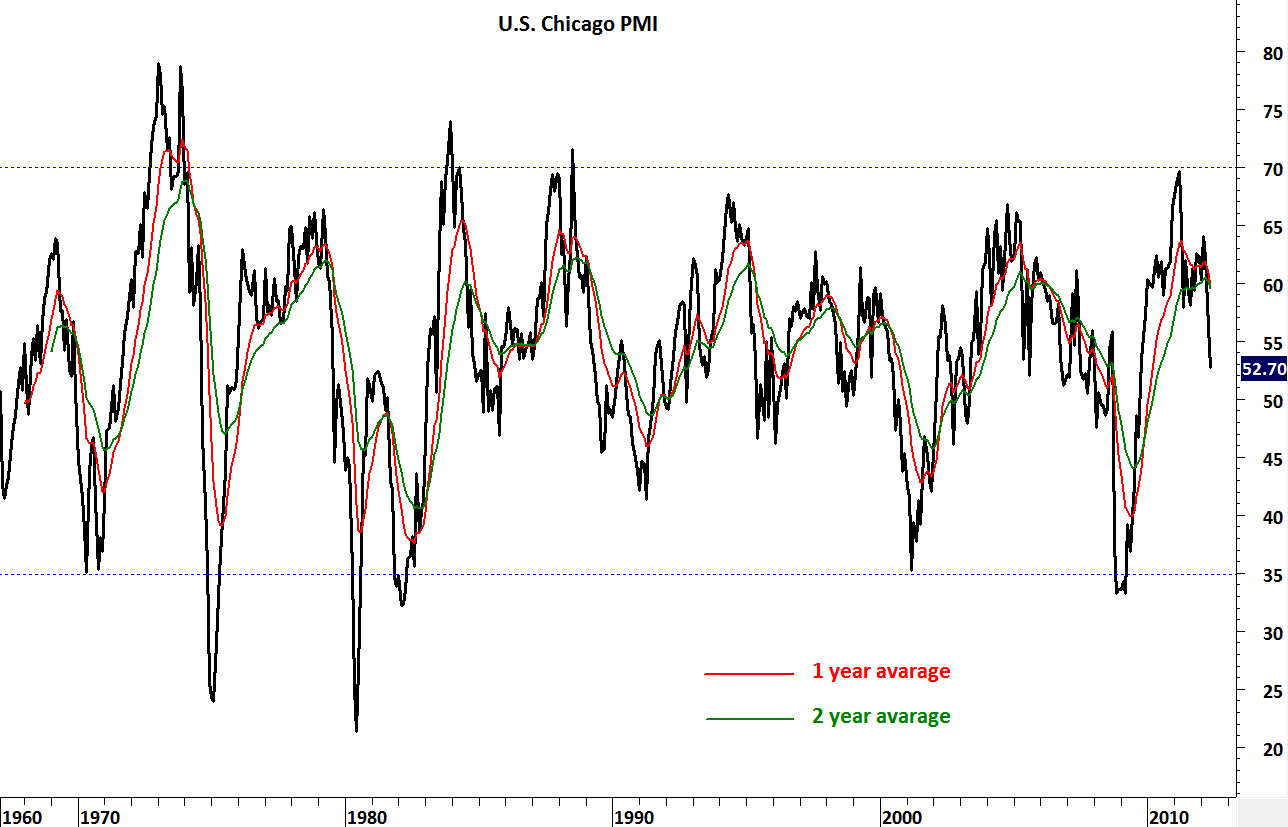

Here is another data point that looks like it has peaked. Throughout the recovery this report has been posting strong rates of growth, and the slowdown here points at the risk of monthly slowing and even contraction for an increasing number of other regional surveys. The official name of this report is ISM – Chicago although it is commonly referred to as the Chicago PMI. ISM stands for Institute for Supply Management while PMI is shorthand for purchasing managers’ index. The traditional name goes back to the years when the ISM was called the National Association of Purchasing Management. Investors should track economic data like the Chicago PMI to understand the economic backdrop for the various markets. The stock market likes to see healthy economic growth because that translates to higher corporate profits. The bond market prefers a moderate growth environment that won’t generate inflationary pressures. The Chicago PMI gives a detailed look at the Chicago region’s manufacturing and non-manufacturing sectors. Many market players don’t realize that non-manufacturing activity is covered in this index and tend to focus on the manufacturing side only. This survey is somewhat local in nature – reflecting overall economic activity in the Chicago area. But many see the Chicago PMI as being representative of the overall economy.

Markets focus on the overall index – the Business Barometer which many refer to as the Chicago PMI. The breakeven point for the index is 50. Readings above 50 indicate positive growth while numbers below 50 indicate contraction. The farther the reading is from 50, the more rapid the pace of growth or decline.