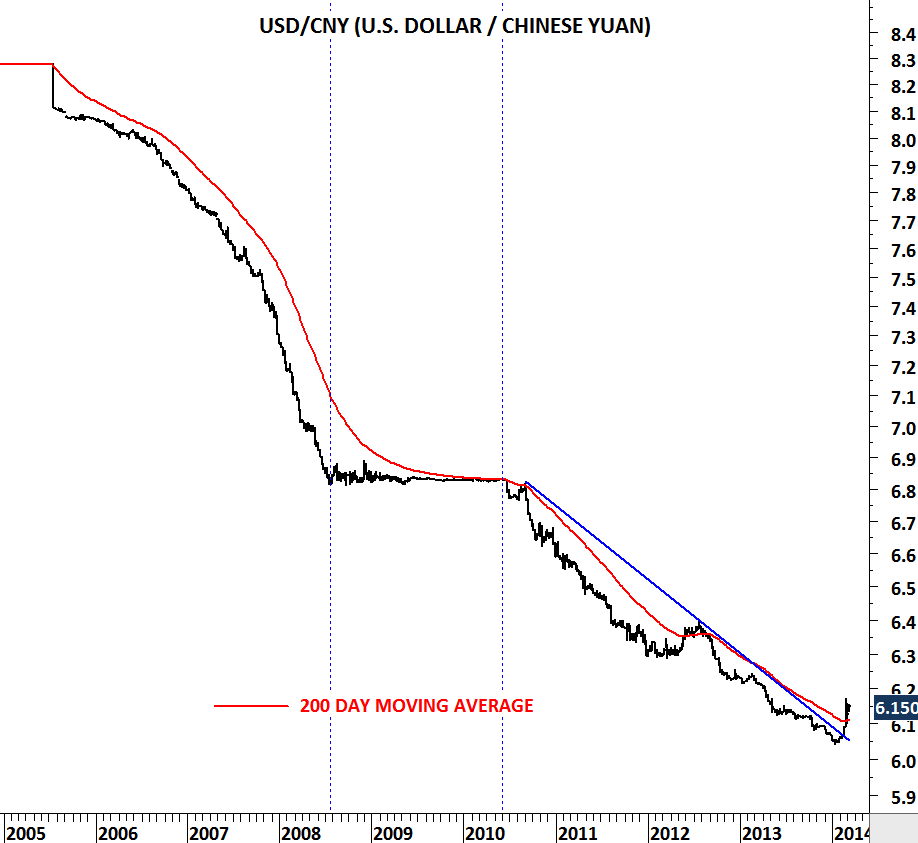

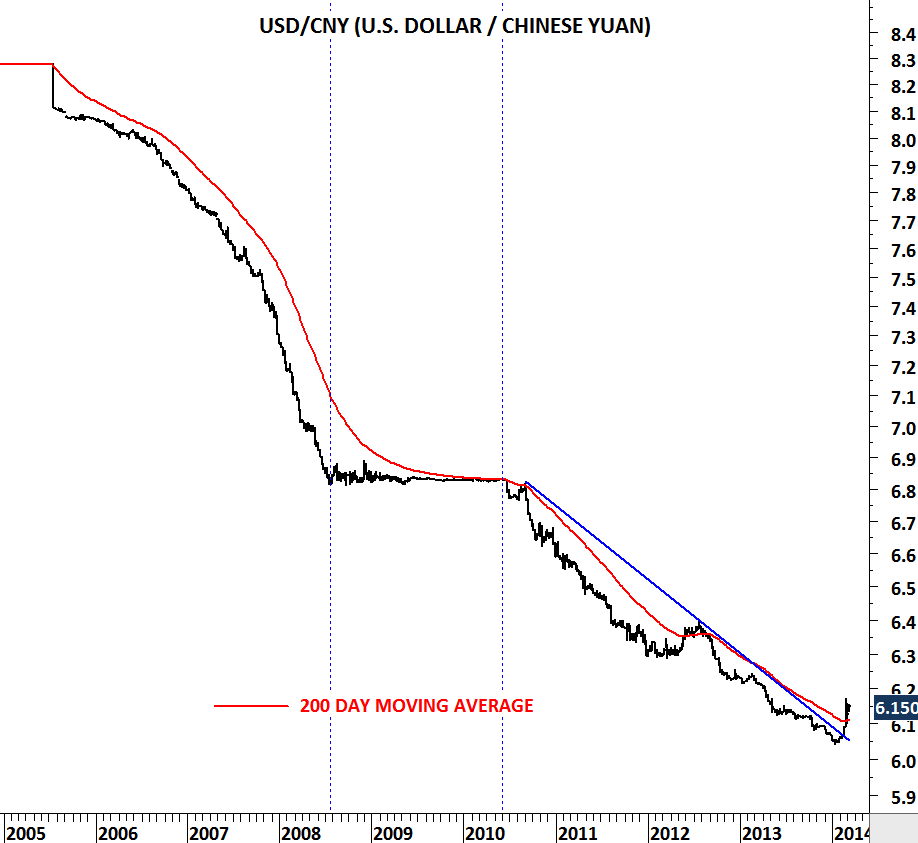

Still a highly managed currency Chinese yuan is trading above its 200 day moving average – with only one exception since 2005. China was criticized for currency manipulation during the financial crisis between 2008 and 2009. PBOC (The People’s Bank of China) was asked to strengthen the yuan and China to focus on internal demand rather than an export driven economy.

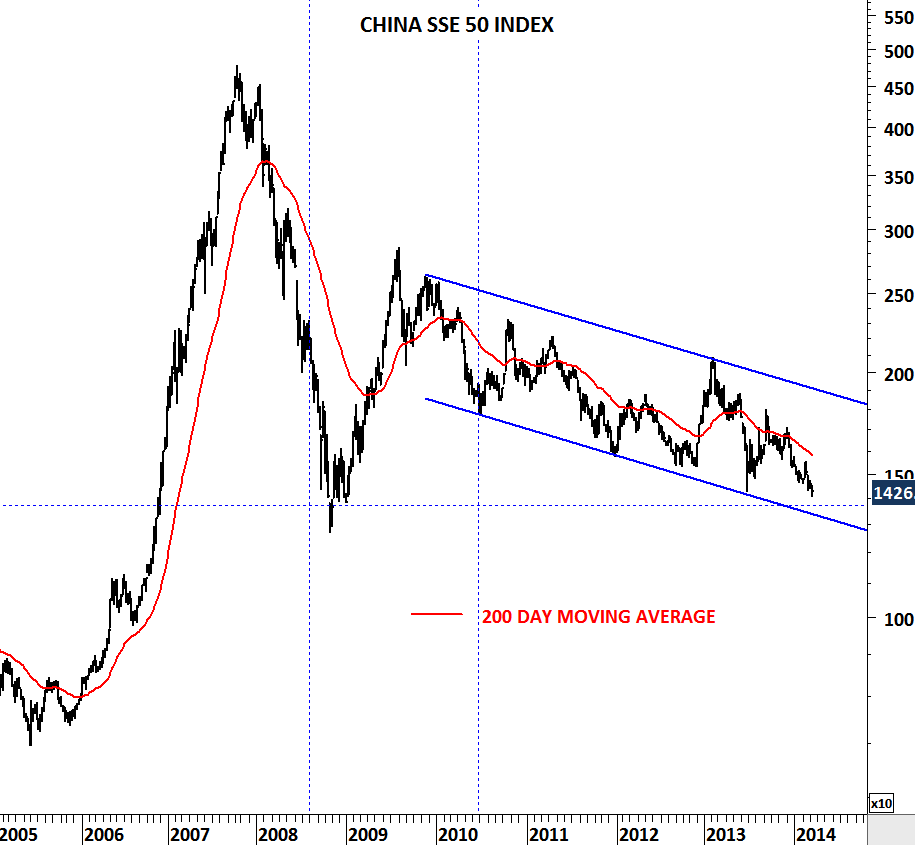

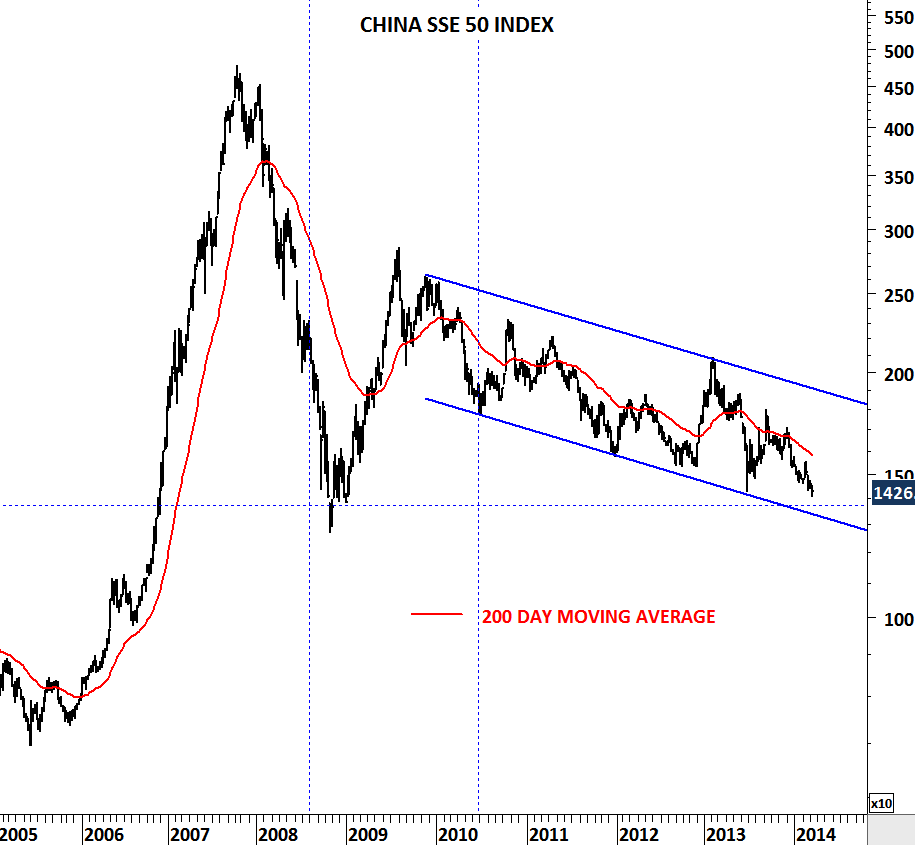

In the second half of 2010, USD/CNY started moving lower resulting in weak U.S. dollar against the Chinese yuan. Over the past 4 years China lagged the global recovery. China SSE 50 index is now testing 2009 low levels. However, since the beginning of 2014, USD/CNY started moving in the opposite direction of the major downtrend. Similar price action occurred in the second half of 2012 but it was short-lived. Cross rate failed to hold above the long-term average.

Technical outlook could be different now. 6.1 levels will be an important threshold in the following months. Given that SSE 50 index is now very close to a major support both Chinese equities and the currency should be watched closely. If USD/CNY holds above the 200-day moving average, this will signal a major shift in the long-term trend.