BRENT CRUDE OIL

Oil prepares for a massive breakout in the following weeks/months. Magnitude of the price change is likely to make the oil “the hot topic” in the financial media. Why am I saying this?

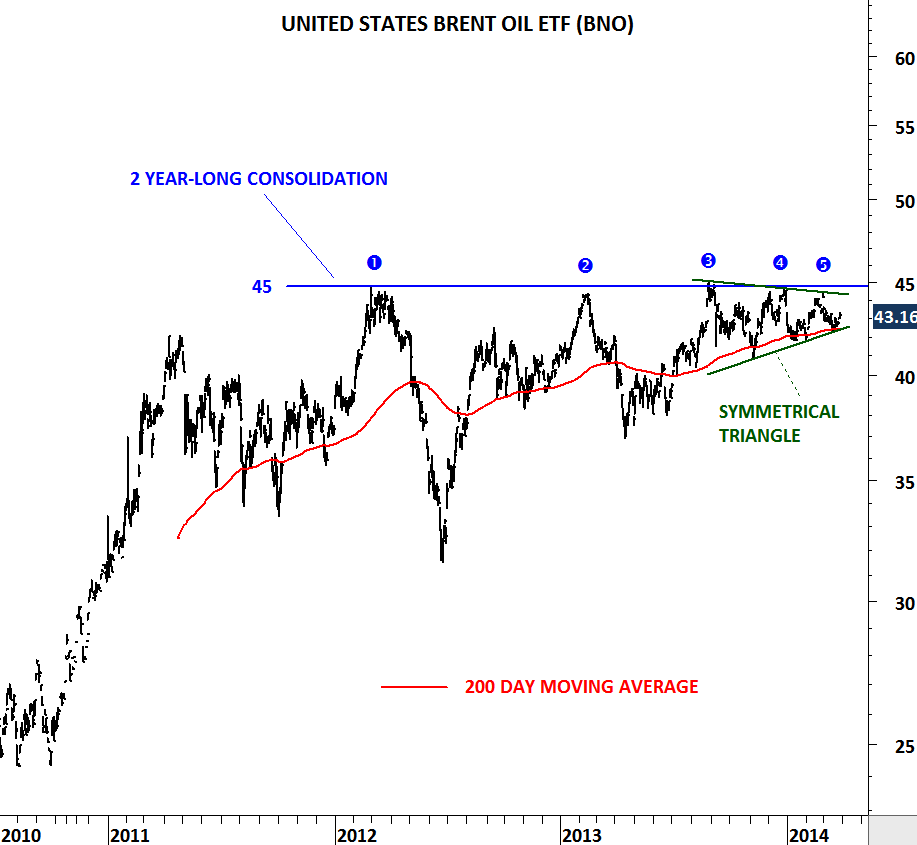

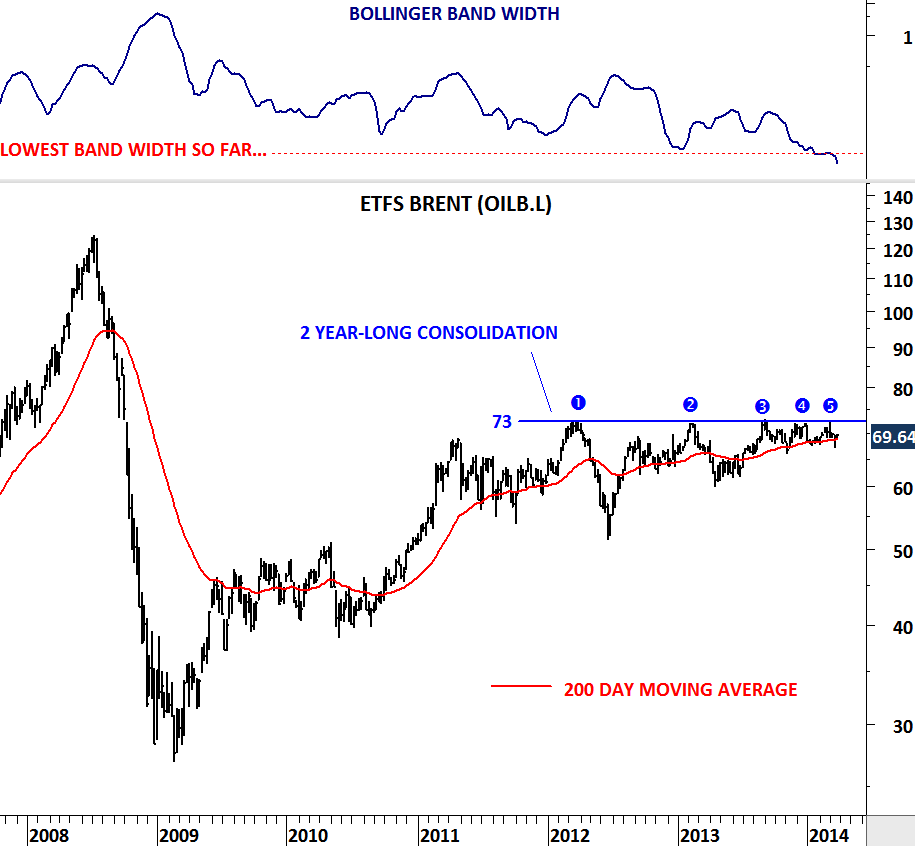

1) Breakouts from low volatility periods are usually very powerful and are followed by strong directional moves. United States Brent Oil ETF (BNO) and ETFS Oil Securities (OILB.L) both meet this criteria.

2) The longer price tests a trend resistance the more valid that level becomes. 45 levels on the BNO and 73 levels on the ETFS Brent are strong horizontal resistances. They are valid trend lines.

While it is still early to call for a direction, I would suggest everyone should place these two charts at the top of their watch list. A strong directional move is overdue.