GLOBAL EQUITY MARKETS – December 9, 2017

REVIEW

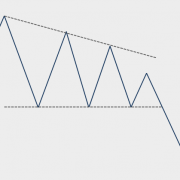

After breaking out to all-time highs in the beginning of 2017, UK FTSE 100 Index is still looking for direction as the last several-months price action formed a possible bullish continuation chart pattern. 7 month-long sideways consolidation can be identified as a possible ascending triangle with the lower boundary acting as support at 7,300 and the upper boundary as resistance at 7,600 levels. The upward sloping lower boundary and the horizontal upper boundary gives the chart pattern its bullish bias, suggesting buyers are able to bid the price higher at every pullback. Latest correction not only found support at the lower boundary of the possible ascending triangle but also at the long-term 200 day (40 week) moving average. If the support at 7,300 level holds, we can expect a rebound towards 7,600 levels.

Read More