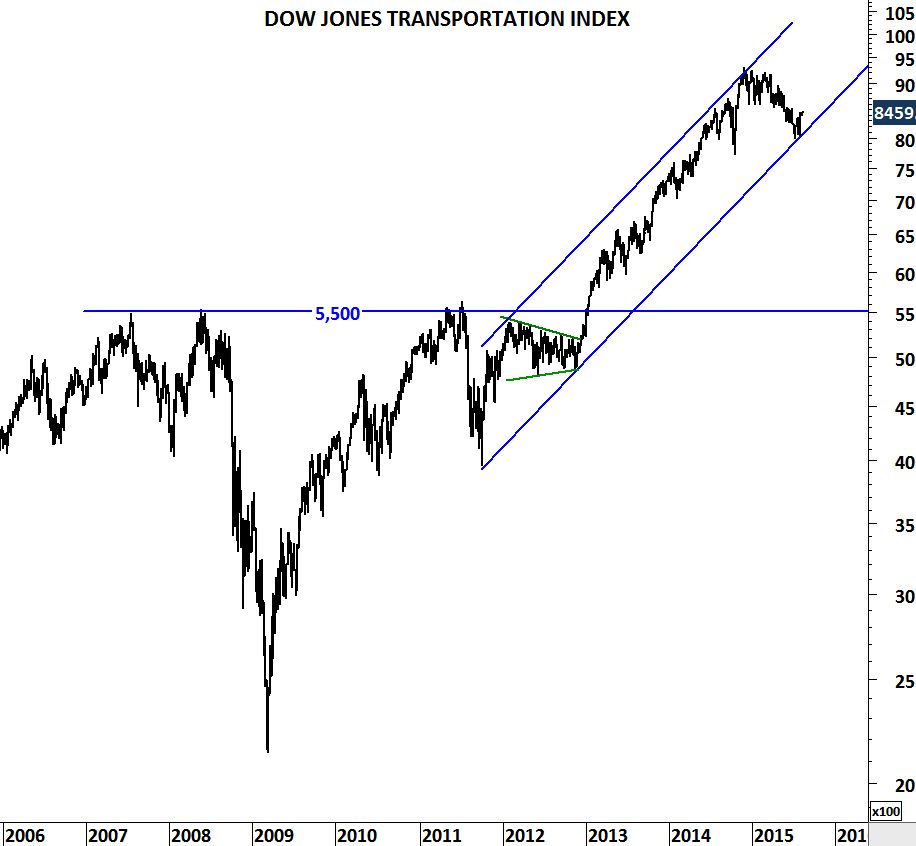

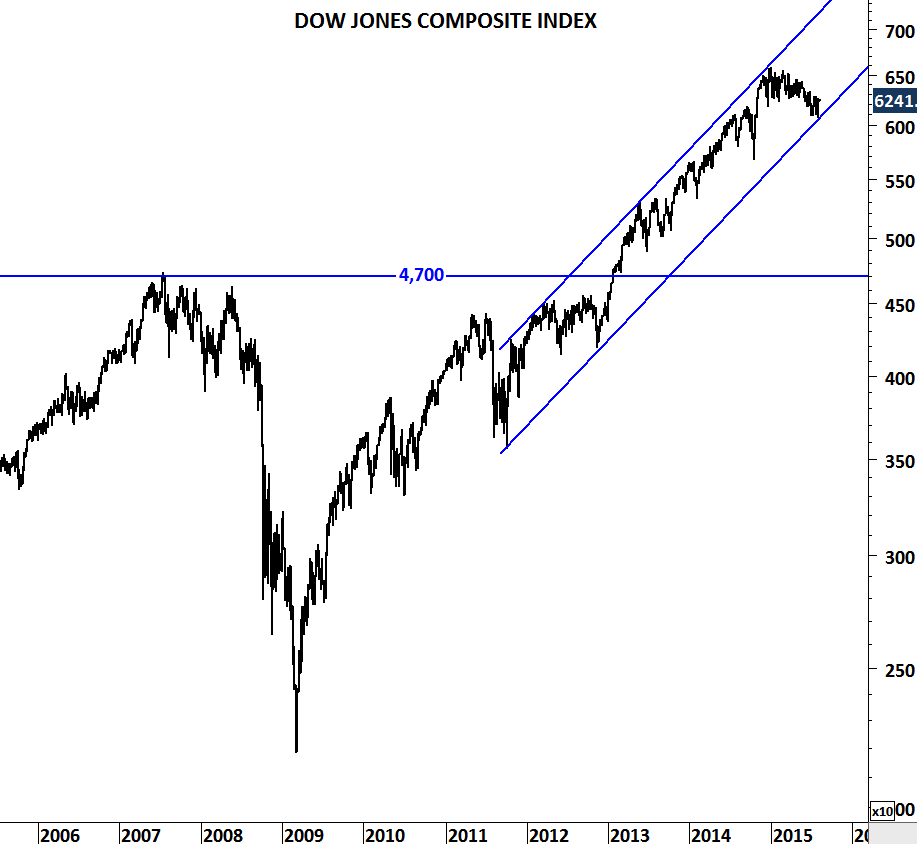

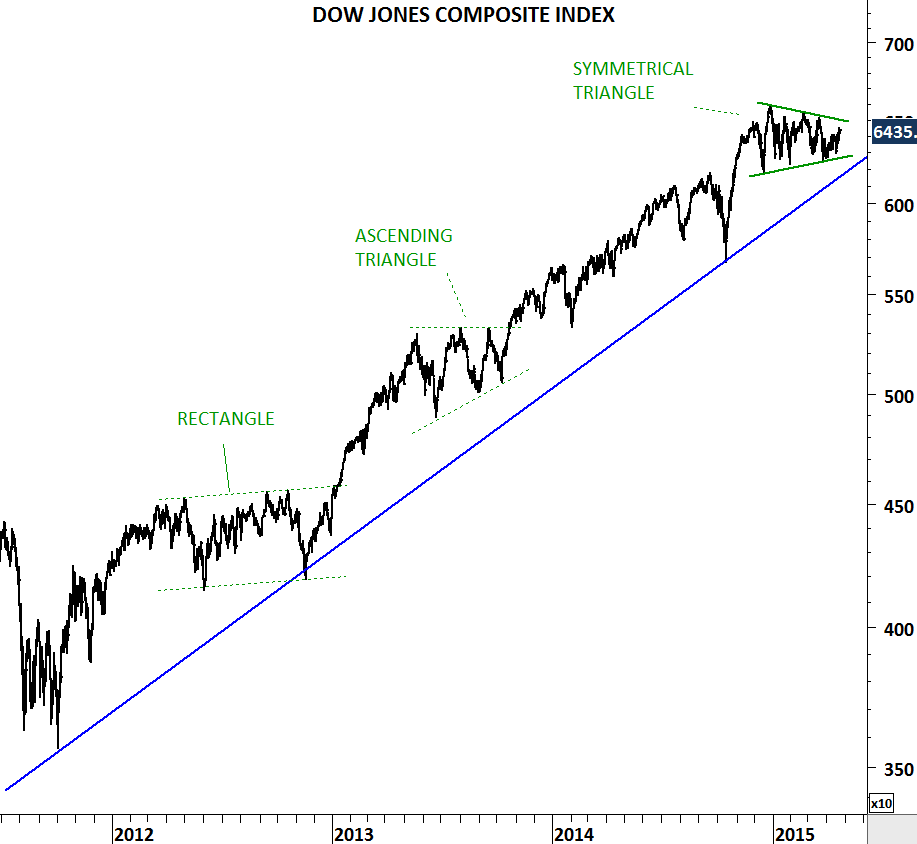

Dow Jones Composite Index measures changes within the 65 companies that make up three Dow Jones averages: the 30 stocks that form the Dow Jones Industrial Average (DJIA), the 20 stocks that make up the Dow Jones Transportation Average (DJTA) and the 15 stocks of the Dow Jones Utility Average (DJUA). The Dow Jones 65 Composite, like the three sub-indexes, is price-weighted.

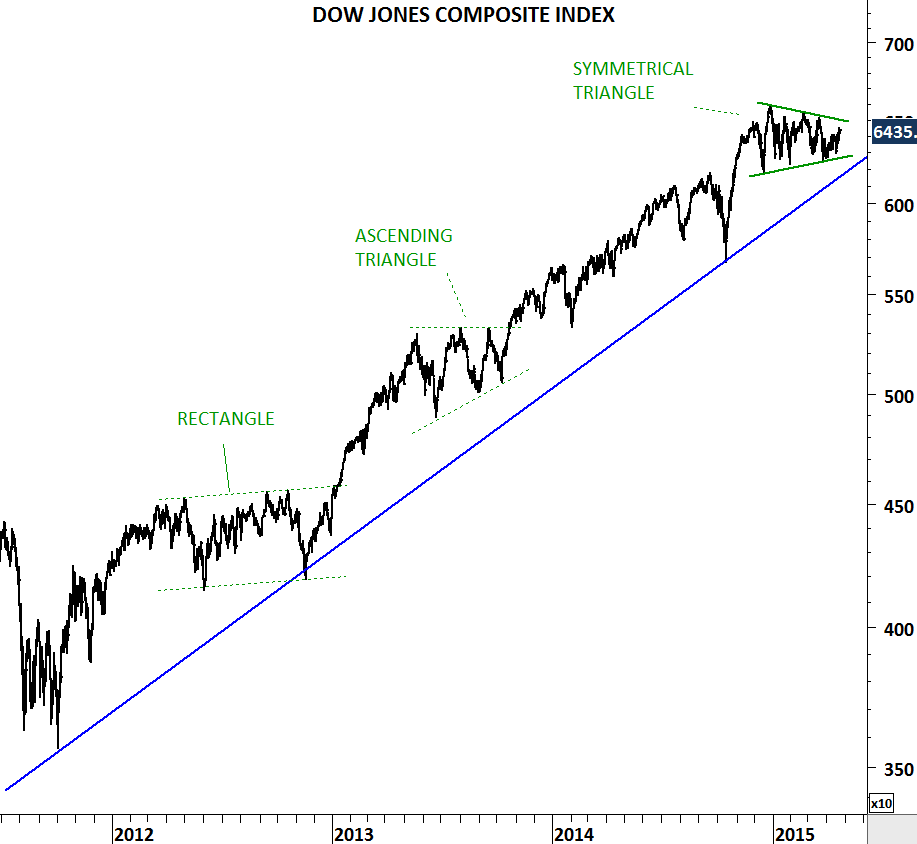

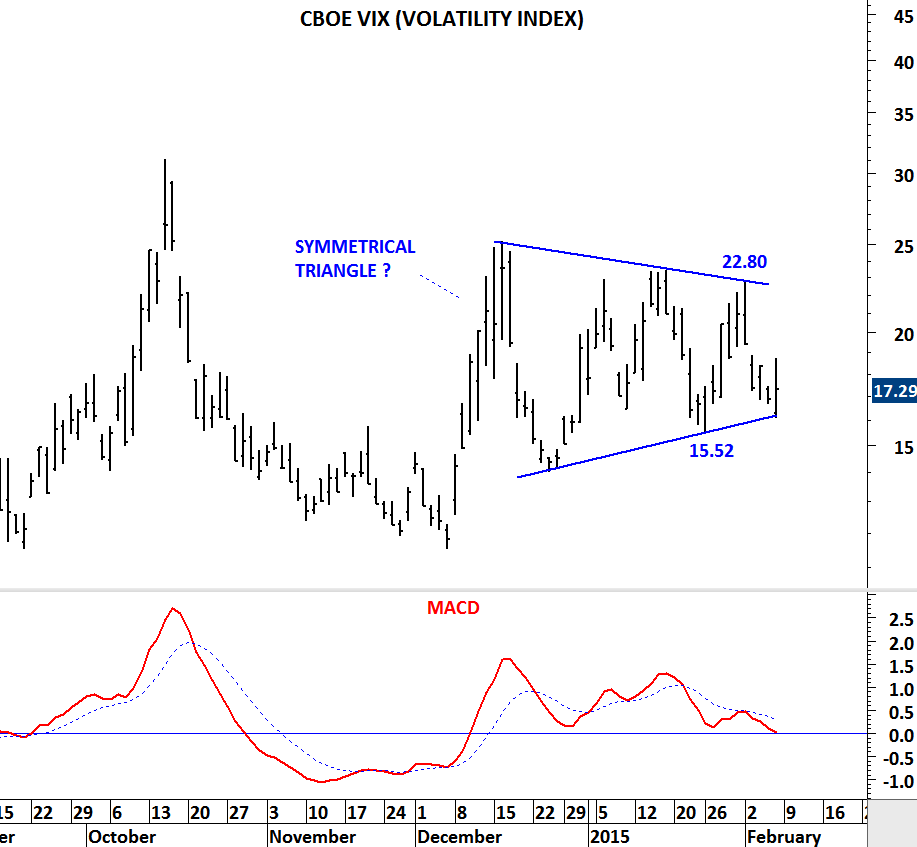

While there are broader measures of stock market performance for U.S. equities, this is another index that I follow as it offers some clearly identifiable chart patterns. Since the beginning of 2015, Dow Jones Composite Index has been forming a symmetrical triangle, usually regarded as a continuation chart pattern in a strong uptrend. Earlier in 2012 and 2013, Dow Jones Composite index formed other types of continuation chart patterns (rectangle & ascending triangle) and each were followed by breakouts and resumption of the uptrend.

Breakout from the year-long sideways consolidation pattern (symmetrical triangle) can result in another period of strength in U.S. equities. Strong support for the index remains between 6,100 and 6,300. Breakout above 6,500-6,600 area will complete the consolidation.