GLOBAL EQUITY MARKETS – May 28, 2022

REVIEW

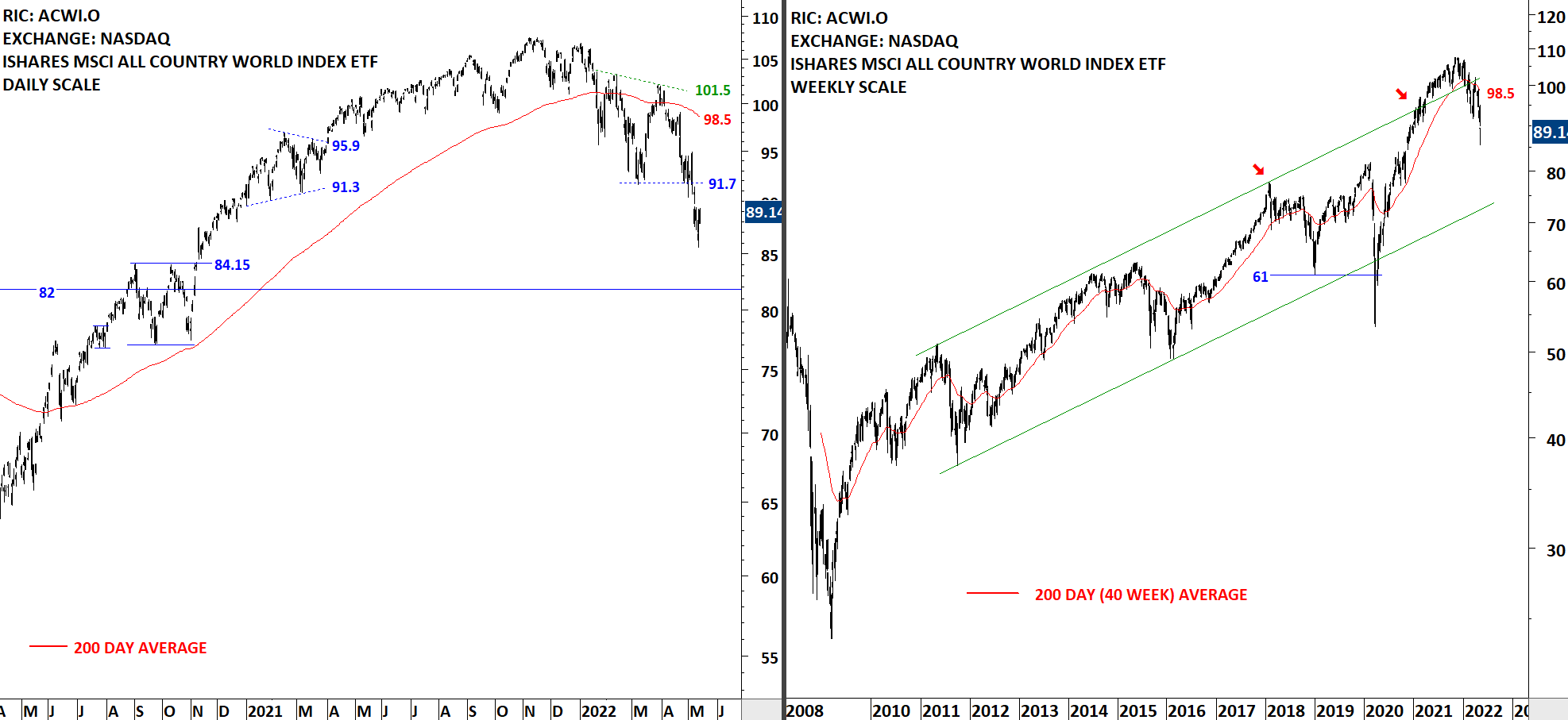

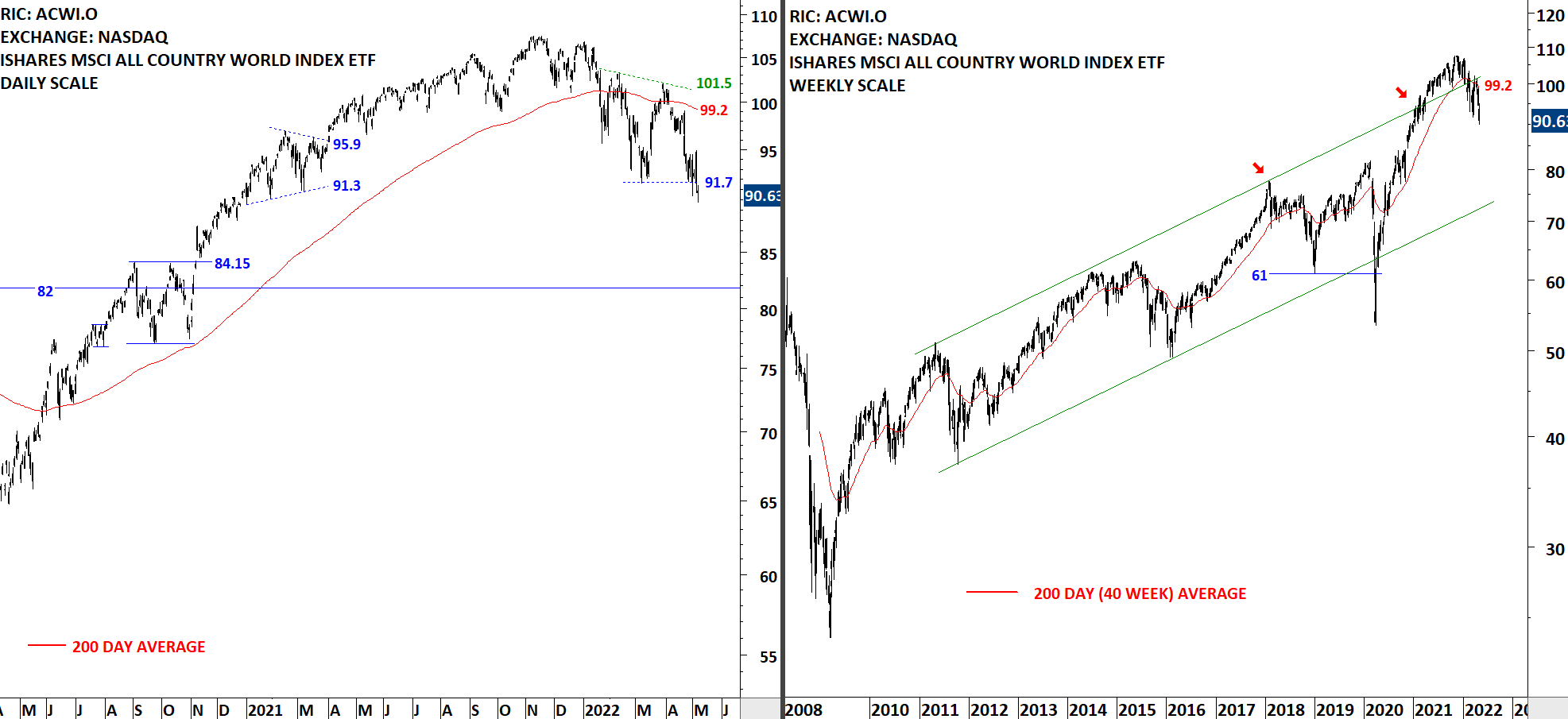

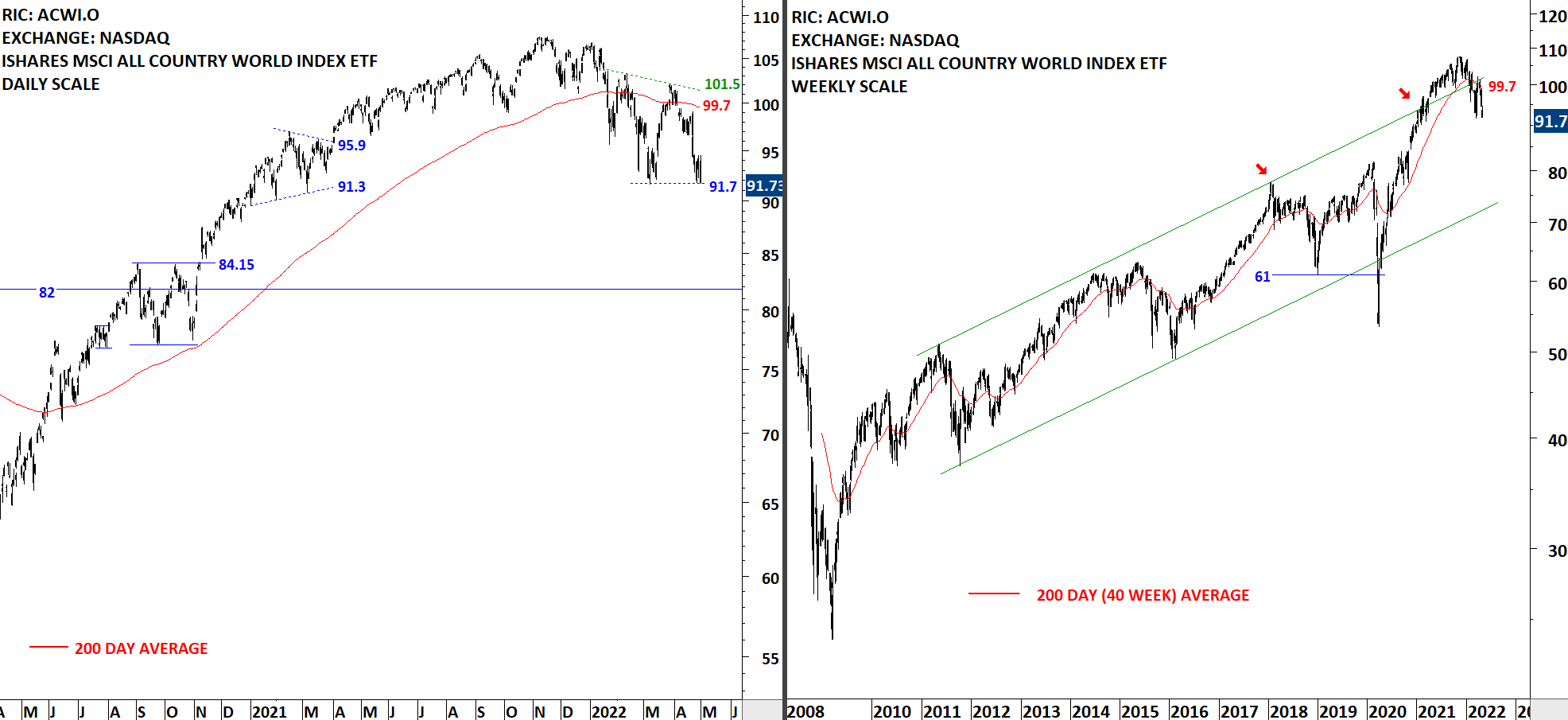

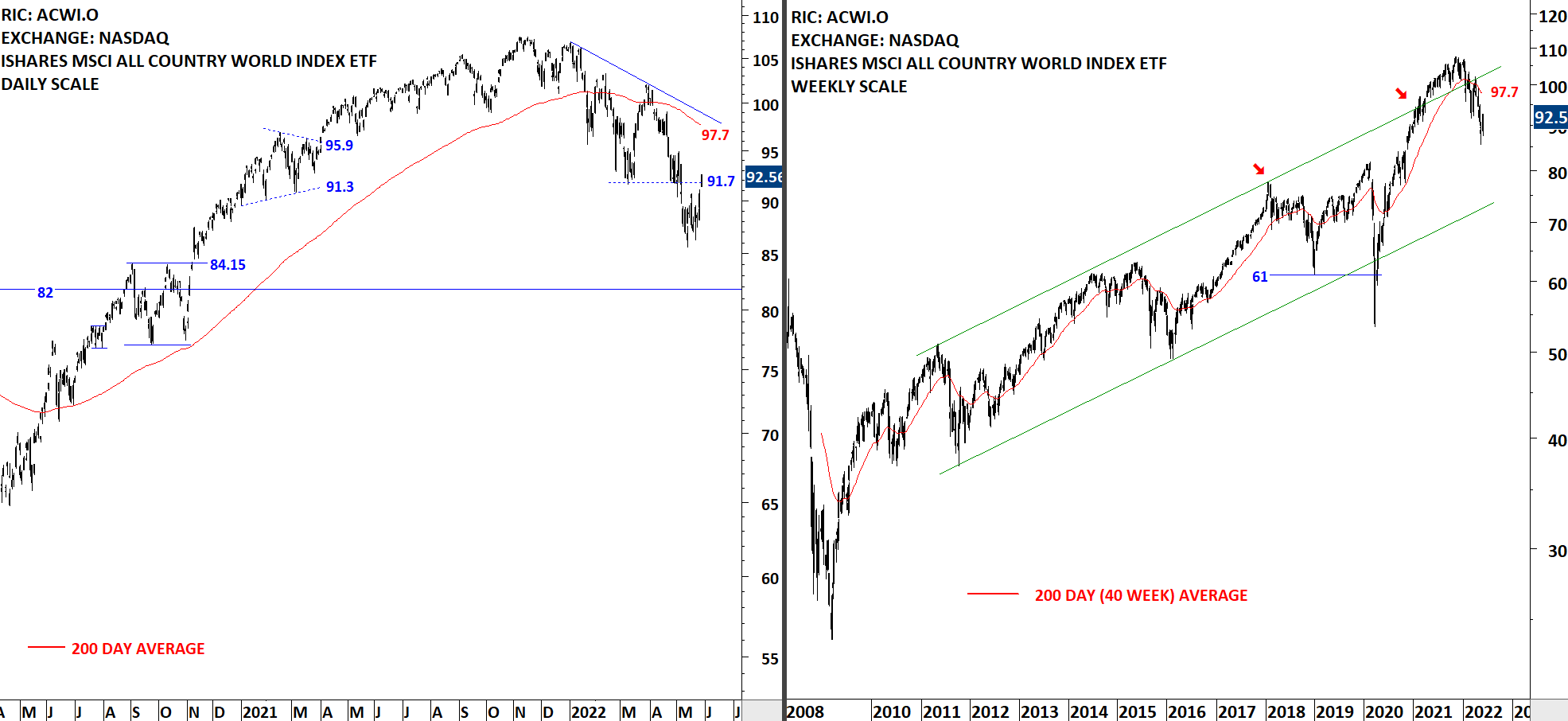

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) remains below its 200-day average. Friday's price action pushed the ETF above the minor low at 91.7 levels. The 200-day average is currently at 97.7 levels. Global equities are rebounding in a downtrend. There are strong resistances ahead. I continue to monitor the ETF for a reversal chart pattern. Upward momentum can push the ETF towards the long-term average. Too early to call for a bottom reversal at this point. I will continue to take breakout signals on individual equities that complete lengthy consolidations to new highs.

Read More

Read More