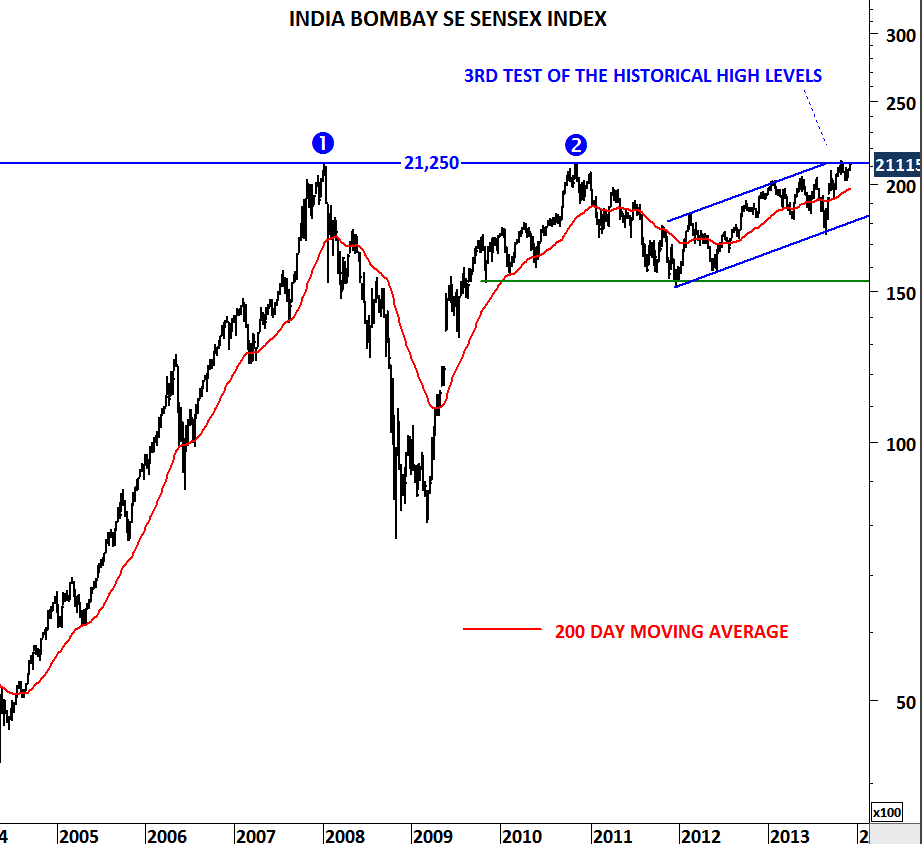

INDIA BOMBAY SE SENSEX INDEX

Strength in India’s BSE Sensex Index is no surprise as the benchmark has been testing historical high levels. In September I shared an analysis showing similarities between India and South Africa equity index chart patterns. I think consecutive tests of the historical high levels on the BSE Sensex Index will lead to a breakout and higher levels in the following months. There are usually “double tops” in technical analysis but rarely we see “triple tops”. 3rd test of the historical high level at 21,200 could be a preparation for a decisive breakout. Let’s wait for confirmation. A breakout above 21,200 with a strong weekly bar will be very bullish for this market.