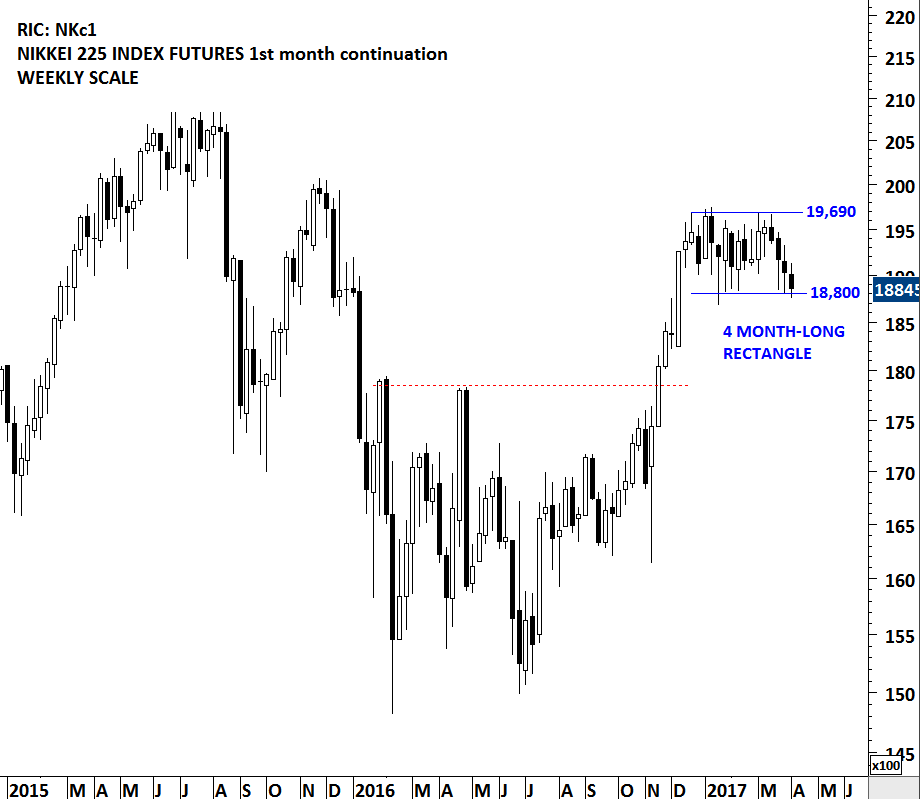

JAPAN NIKKEI 225 INDEX

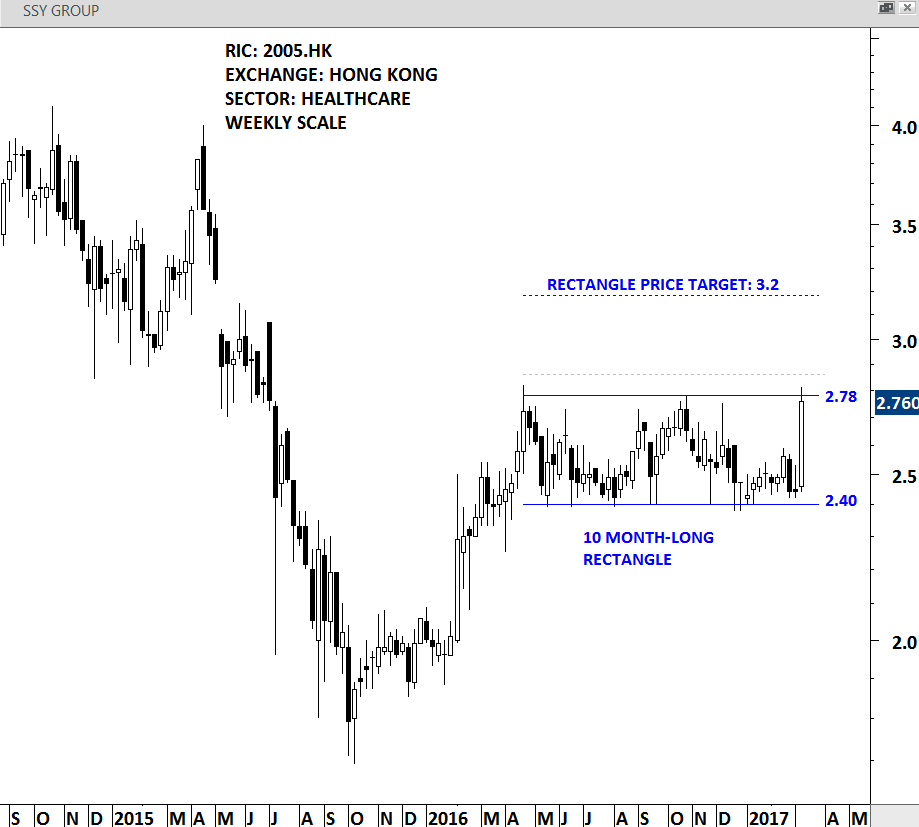

Rectangles are usually considered to be a continuation chart pattern. They form as a trading range during a pause in the trend. The pattern is identifiable by two comparable highs and two comparable lows. Rectangles are sometimes referred to as consolidation ranges or trading areas. The rectangle chart pattern is not complete until a breakout is occurred.

To qualify as a continuation chart pattern, a prior trend should exist. Rectangles can extend for a few weeks or many months. If the pattern is less than 3 weeks, it is usually considered a flag, also a continuation chart pattern. Ideally, rectangles will develop over a 3-month period. Generally, the longer the pattern, the more significant the breakout. The direction of the next significant move can only be determined after the breakout has occurred. The estimated move is found by measuring the height of the rectangle and applying it to the breakout level.

JAPAN NIKKEI 225 INDEX FUTURES 1st month continuation

Japan's NIKKEI 225 Index is possibly forming a rectangle chart pattern with the boundaries between 18,800 and 19,690. The index is now testing the lower boundary of its 4 month-long sideways consolidation. Due to the tight consolidation range, volatility on both daily and weekly scale reached an extreme low level. These type of low volatility periods are usually followed by strong price action. It is important to note that there are times when a rectangle can act as a reversal chart pattern. A breakdown below the lower boundary at 18,800 will suggest lower prices in the coming weeks. However, failure to breakdown the support at 18,800 and a possible rebound from the current levels will increase the likelihood of a rectangle as a continuation chart pattern, targeting higher levels.