GLOBAL EQUITY MARKETS – March 12, 2017

This week there has been 7 additions to the #TECHCHARTSWATCHLIST. Most of the chart patterns are bullish as major global equity indices continue to remain in a uptrend.

#TECHCHARTSWATCHLIST

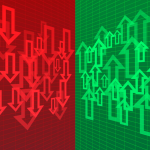

SSY GROUP LTD (2005.HK)

SSY Group Limited is an investment holding company principally engaged in the research, development, manufacture and sale of pharmaceutical products. The stock is listed on the Hong Kong Stock Exchange. Price chart of SSY GROUP formed a 10 month-long rectangle with the strong horizontal resistance standing at 2.78 levels. Rectangle is a continuation chart pattern. A daily close above 2.86 will confirm the breakout from the bullish chart pattern. Possible price target for the rectangle stands at 3.2 levels.

SSY GROUP – WEEKLY SCALE

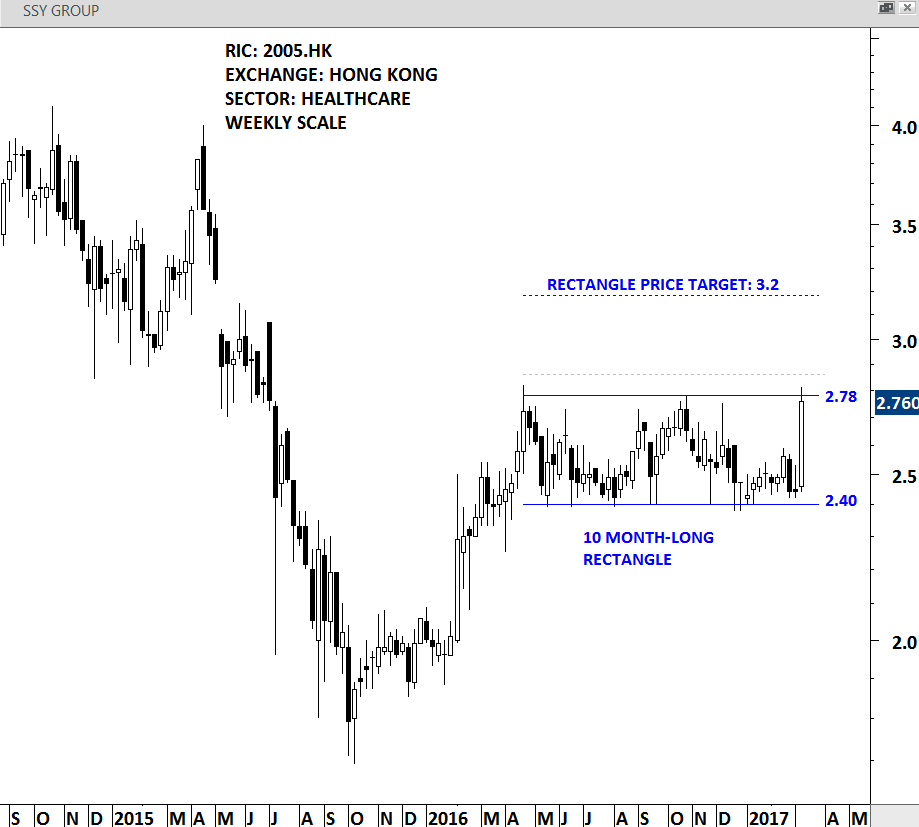

SAMSONITE INTERNATIONAL (1910.HK)

Samsonite International S.A. is principally engaged in the design, manufacture, sourcing and distribution of luggage, business and computer bags, outdoor and casual bags, travel accessories and slim protective cases for personal electronic devices. The stock is listed on the Hong Kong Stock Exchange. Price chart of Samsonite formed a 10 month-long symmetrical triangle. Symmetrical triangles can be continuation as well as reversal chart pattern. The boundaries of the contracting consolidation range is between 21.80 and 25 levels. A daily close above 25.75 will confirm this as a continuation chart pattern with a possible price target of 32 levels.

SAMSONITE INTERNATIONAL – WEEKLY SCALE

MICROPORT SCIENTIFIC CORP (0853.HK)

MicroPort Scientific Corporation is a Hong Kong-based investment holding company principally engaged in the manufacture and sales of medical products. The stock is listed on the Hong Kong Stock Exchange. Price chart formed a 4 month-long symmetrical triangle. A daily close above 6.18 will confirm the chart pattern as a continuation with a possible price target of 6.65. The boundaries of the consolidation are between 5.57 and 5.95.

RELO GROUP (8876.T)

Relo Group, Inc., formerly Relo Holdings, Inc., is a Japan-based company principally engaged in the provision of enterprises welfare outsourcing services. The stock is listed on the Tokyo Stock Exchange. Price chart of Relo Group formed an 8 month-long symmetrical triangle with the upper boundary standing at 17,550 levels. This week’s price action was strong and the stock finished the week at the upper boundary of the possible continuation chart pattern. A daily close above 18,100 levels will confirm the breakout with a possible price target of 22,500.

PARK24 CO (4666.T)

PARK24 Co., Ltd. is primarily engaged in parking business. The Parking Lot segment provides hourly and monthly parking service, though sublease contract, in which it leases idle land from land owners, and though management contract with owners of the parking facilities. It also conducts management and operation of incidental facilities of parking lots. The stock is listed on the Tokyo Stock Exchange. Price chart formed a bearish descending triangle. The horizontal boundary at 2,950 levels is acting as support. A daily close below 2,860 levels will confirm the breakdown with a possible chart pattern price target of 2,350 levels.

NIPPON CONCRETE INDUSTRIES (5269.T)

NIPPON CONCRETE INDUSTRIES CO., LTD. is a Japan-based company mainly engaged in the manufacture and sale of poles, piles and civil engineering products, the purchase of raw materials, as well as the transportation of products and the provision of contracted construction works. The stock is listed on the Tokyo Stock Exchange. Price chart of Nippon Concrete Industries formed a 6 month-long rectangle continuation chart pattern. The weekly close was above the upper boundary of the rectangle chart pattern. Edwards and Magee in their book Technical Analysis of Stock Trends suggest that a stock should breakout by a minimum 3% margin above the resistance for a clear chart pattern breakout signal. According to this guideline, a daily close above 400 levels will confirm the breakout from the 6 month-long rectangle. Possible chart pattern price target stands at 467 levels.

BIOGEN INC (BIIB.O)

Biogen Inc. is a biopharmaceutical company. The stock is listed on the Nasdaq Stock Exchange. Price chart of Biogen is forming a 6 month-long symmetrical triangle with the boundaries between 255 and 298 levels. A daily close above 307 levels will confirm the symmetrical triangle as a continuation chart pattern with a possible price target of 357.

There were 4 new chart pattern breakout signals under #TECHCHARTSALERT.

#TECHCHARTSALERT

BBVA (BBVA.MC)

Banco Bilbao Vizcaya Argentaria, S.A. is a diversified international financial company engaged in retail banking, asset management, private banking and wholesale banking. The stock is listed on the Madrid Stock Exchange. Price chart formed a 14 month-long H&S bottom with the right shoulder in the form of a bullish ascending triangle. This week’s price action broke out of both bullish chart patterns. A daily close above 6.80 confirmed the breakout with a possible H&S bottom price target of 8.6 levels.

PARGESA HOLDING (PARG.S)

Pargesa Holding SA is a Switzerland-based investment holding company engaged in various industry and services sectors, through its holdings in a number of operating companies. The stock is listed on the Swiss Stock Exchange. Price chart of Pargesa Holding formed a 10 month-long ascending triangle with the horizontal boundary standing at 68 levels. This week’s price action was strong with a close at the highest level. A new chart pattern breakout signal is triggered this week with a close above 69.35 levels. Ascending triangle price target stands at 76 levels.

SOFINA SA (SOF.BR)

SOFINA is a Belgium-based holding company that invests, directly and indirectly, in companies from various sectors. Price chart formed a 6 month-long rectangle with the resistance standing at 128.75 levels. A new chart pattern breakout signal is triggered with a daily close above 131 levels. This week’s strong price action completed the 6 month-long continuation chart pattern with a possible price target of 145 levels.

LPP SA (LPPP.WA)

LPP SA is a Poland-based company engaged in the apparel and accessories industry. The stock is listed on the Warsaw Stock Exchange. Price chart formed a year-long H&S bottom with a downward sloping neckline. The right shoulder took the form of a 4 month-long rectangle. A new chart pattern breakout signal is triggered with a daily close above 6,230 levels. This week’s price action broke out of both bullish chart patterns, the H&S bottom and the rectangle. H&S bottom chart pattern price target stands at 8,000 levels.