Announcement:

Dear Tech Charts members,

We have included a new feature to Tech Charts website. At the bottom of each report we have incorporated comment platform DISQUS. Previous comment platform was not allowing members to post charts and have discussions. With this improvement, I hope to have detailed discussions with our members and possibly post breakout alerts related to each week's report. I also hope that Tech Charts members will be able to interact with each other through the DISQUS platform (at the bottom of each weekly report) to share their knowledge on different instruments available to take advantage of breakout opportunities. I hope we will all benefit from this new feature.

REVIEW

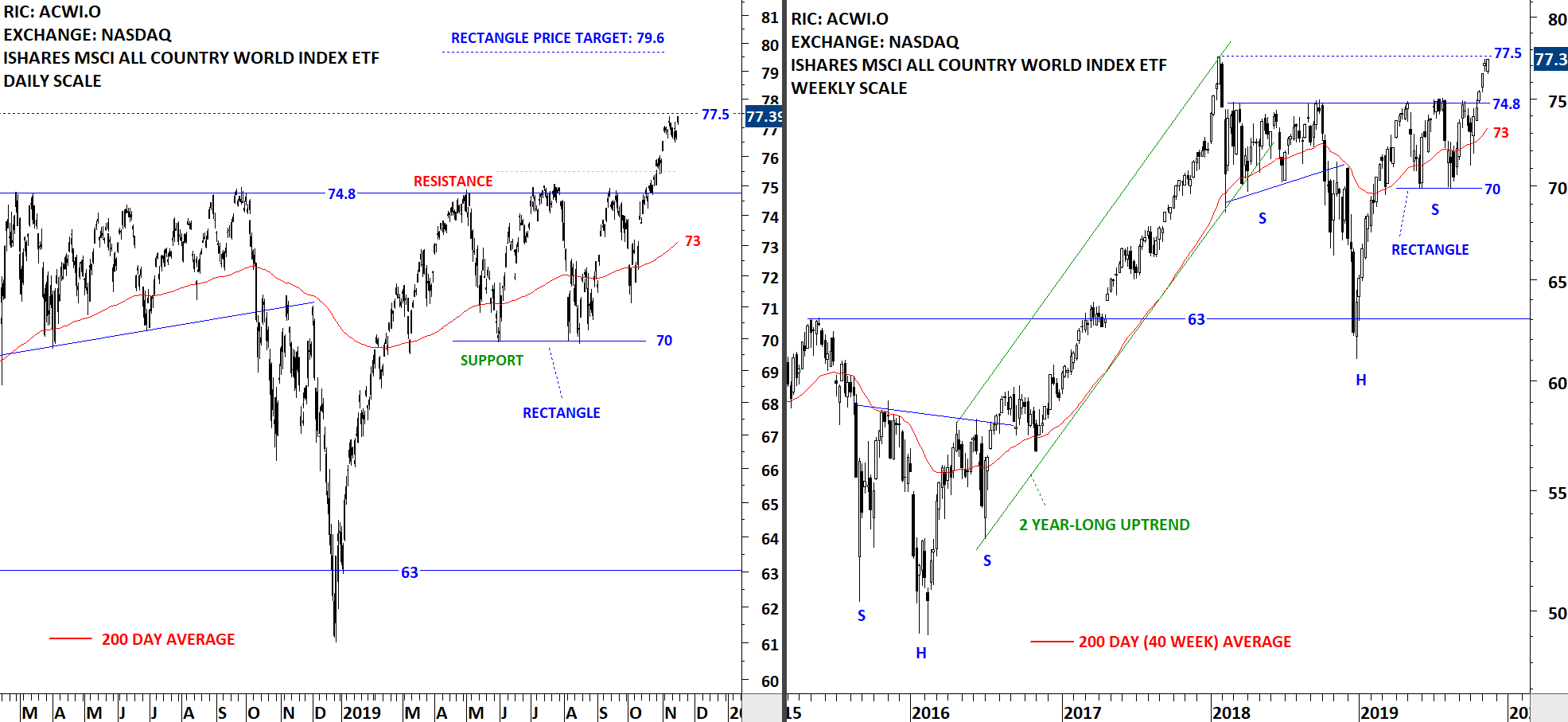

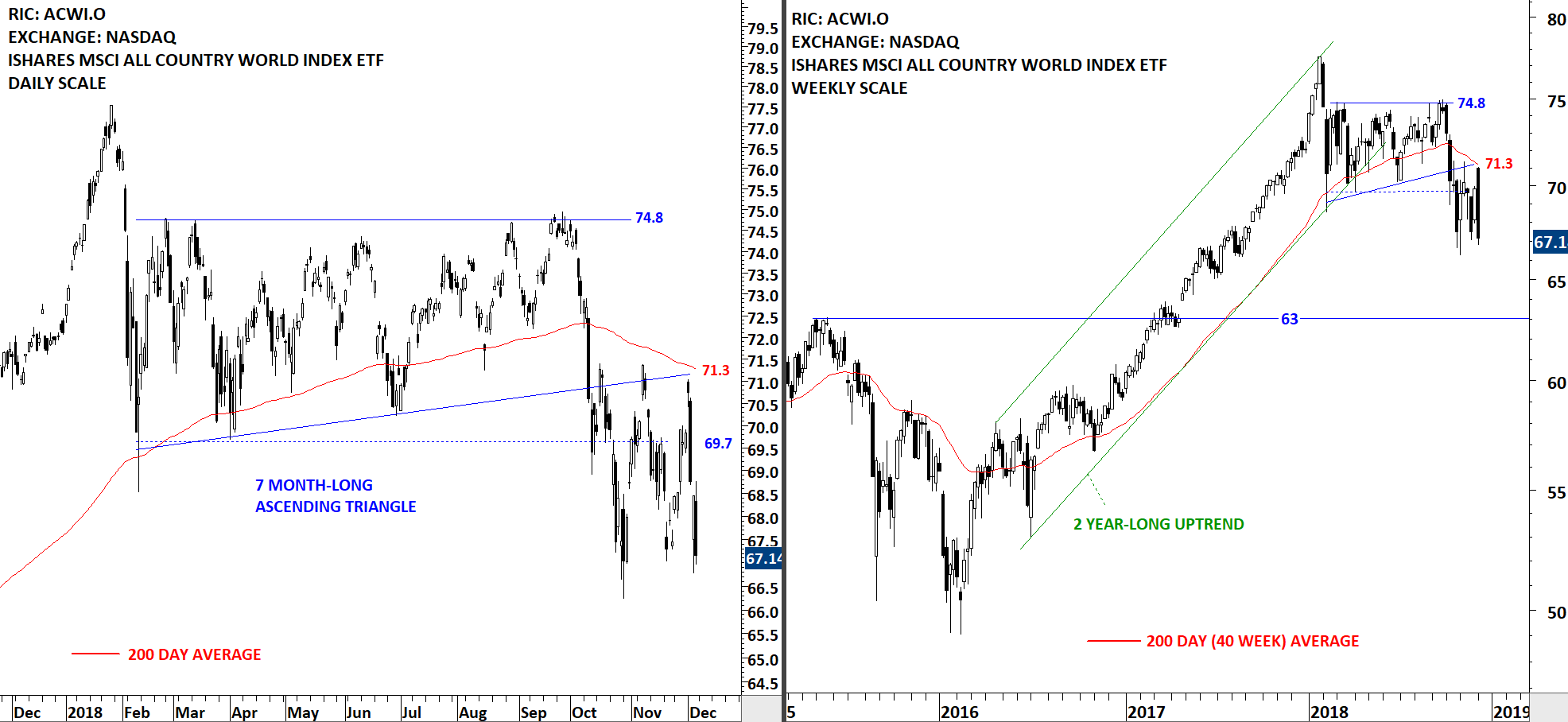

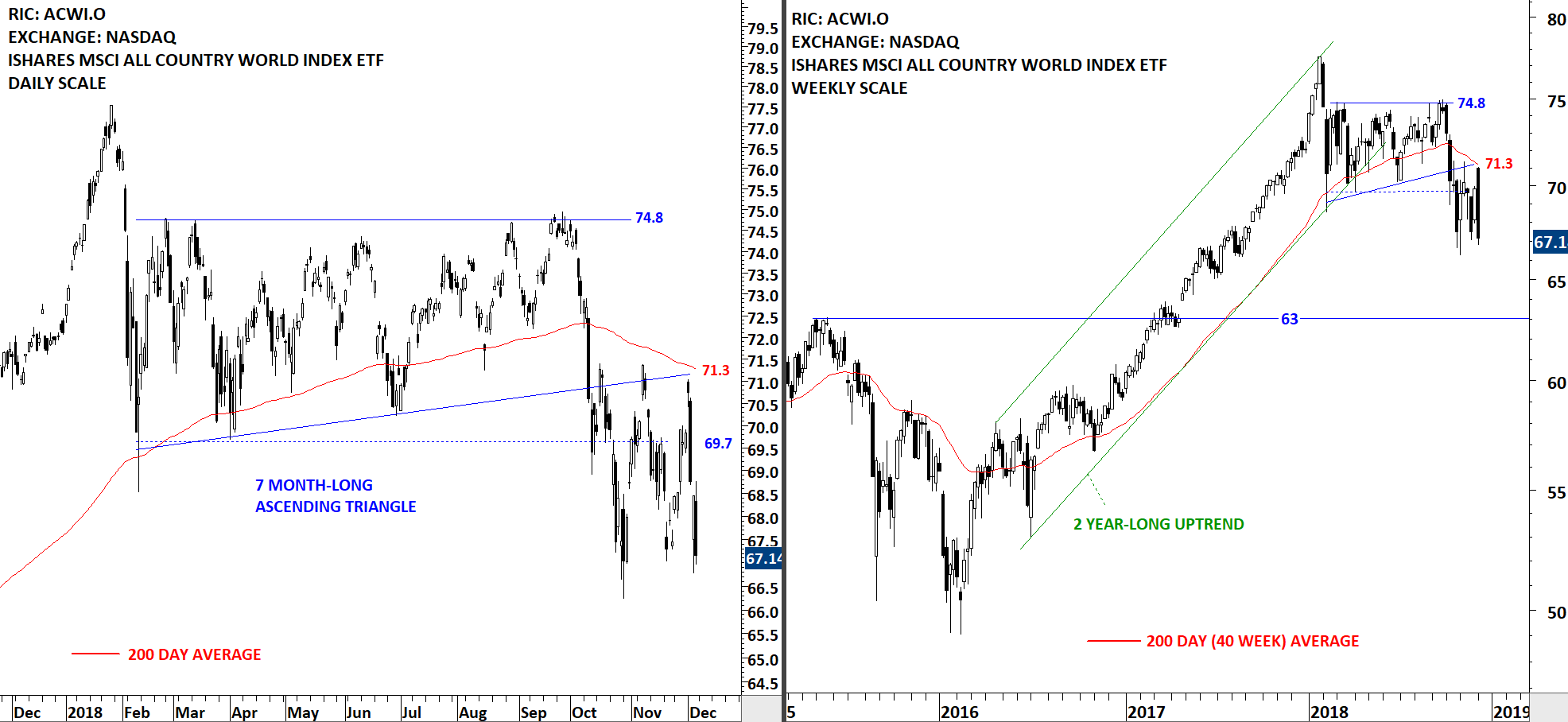

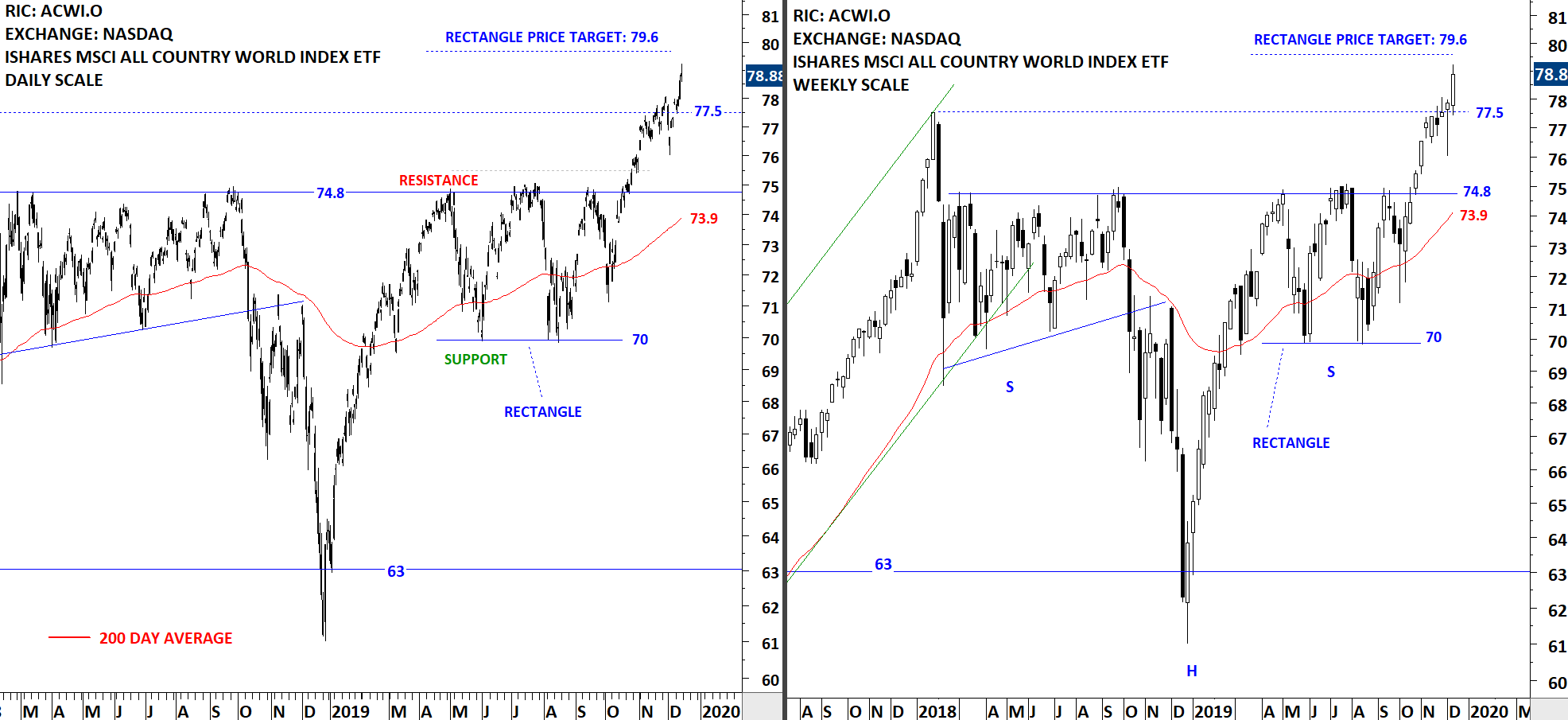

Global equity markets performance as measured by the iShares MSCI All Country World Index ETF (ACWI.O) reversed from its long-term moving average resistance at 71.3 levels. In the beginning of October the index broke down its 7 month-long consolidation and the 200-day moving average. Since then the ETF has challenged the strong resistance area between 71 and 71.5 levels but failed to breach higher. This week's sell-off pulled the ACWI ETF towards the minor support at 66.5 levels. Failure to hold above the short-term support can send the index to the next level at 63 levels. The iShares MSCI All Country World Index ETF is trading below its long-term average and is in a downtrend.

Read More Read More

Read More