Every week Tech Charts Global Equity Markets report features some of the well-defined, mature classical chart patterns under a lengthy watchlist and the chart pattern breakout signals that took place during that week. Global Equity Markets report covers single stocks from developed, emerging and frontier markets, ETF’s and global equity indices. The report starts with a review section that highlights the important chart developments on global equity benchmarks. This blog post features part of the review section highlighting chart pattern developments on Asian equity benchmarks.

REVIEW

Over the past few months two major breakdowns were featured on Asia equity markets. Both Korea Kospi 200 Index and Singapore Strait Times Index completed top formations and breached their long-term averages. Breakdowns also breached their multi-year upward trend line supports. Singapore Strait Times Index is now very close to its chart pattern price target at 3,100 levels. However, the index is in a steady downtrend and there is no evidence of a short-term bottom formation.

Korea Kospi 200 Index completed a year-long H&S top chart pattern after breaching the neckline at 304 levels. The index remains below its long-term average and in a steady downtrend. The year-long H&S top has an unmet price target at 273.7 levels.

China SSE 50 Index first breached its long-term average and then broke down its 4 year-long upward trend line at 2,615 levels. Last two month’s consolidation is possibly forming a symmetrical triangle that can act as a bearish continuation chart pattern. Strong resistance area remains between 2,615 and 2,625 levels. Chinese equities are in a steady downtrend.

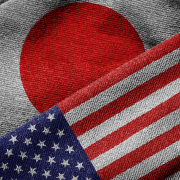

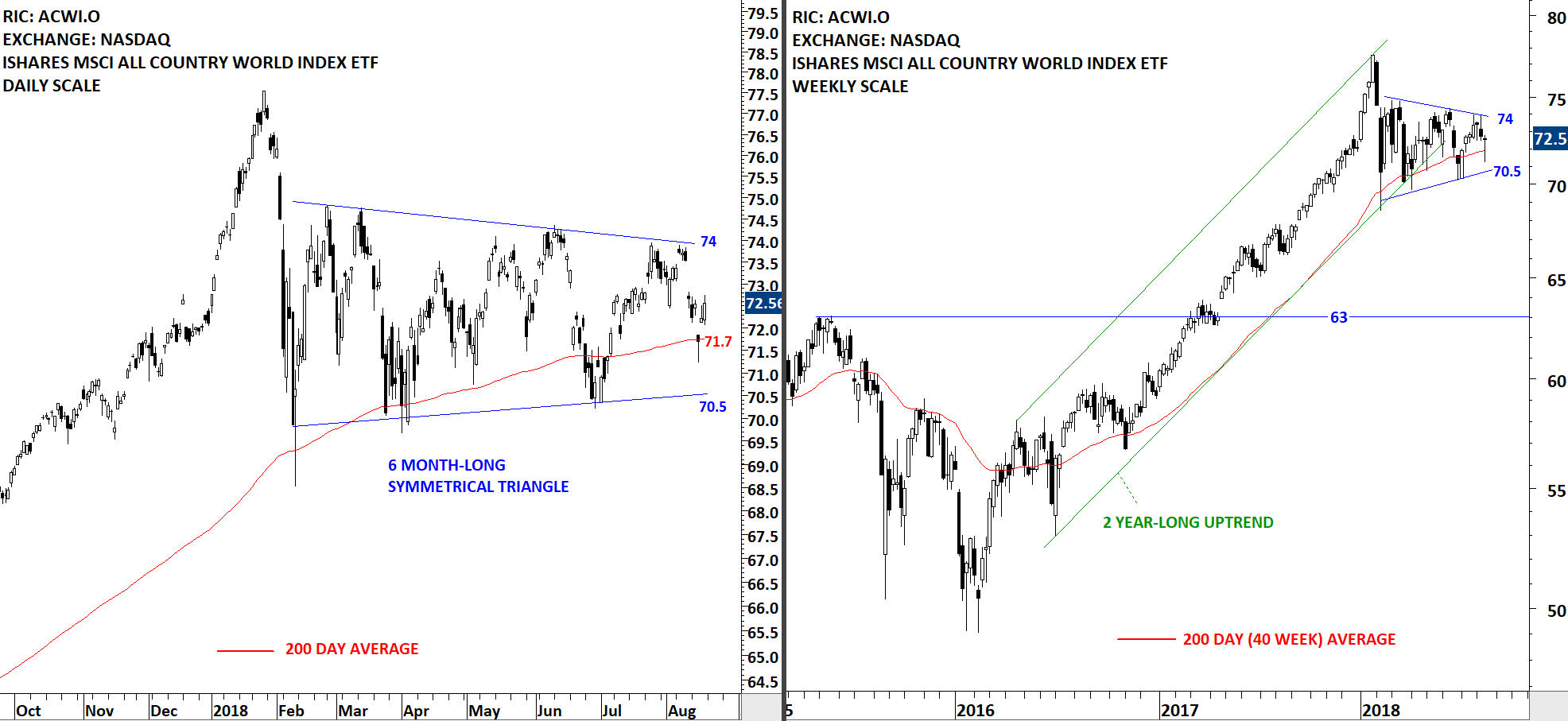

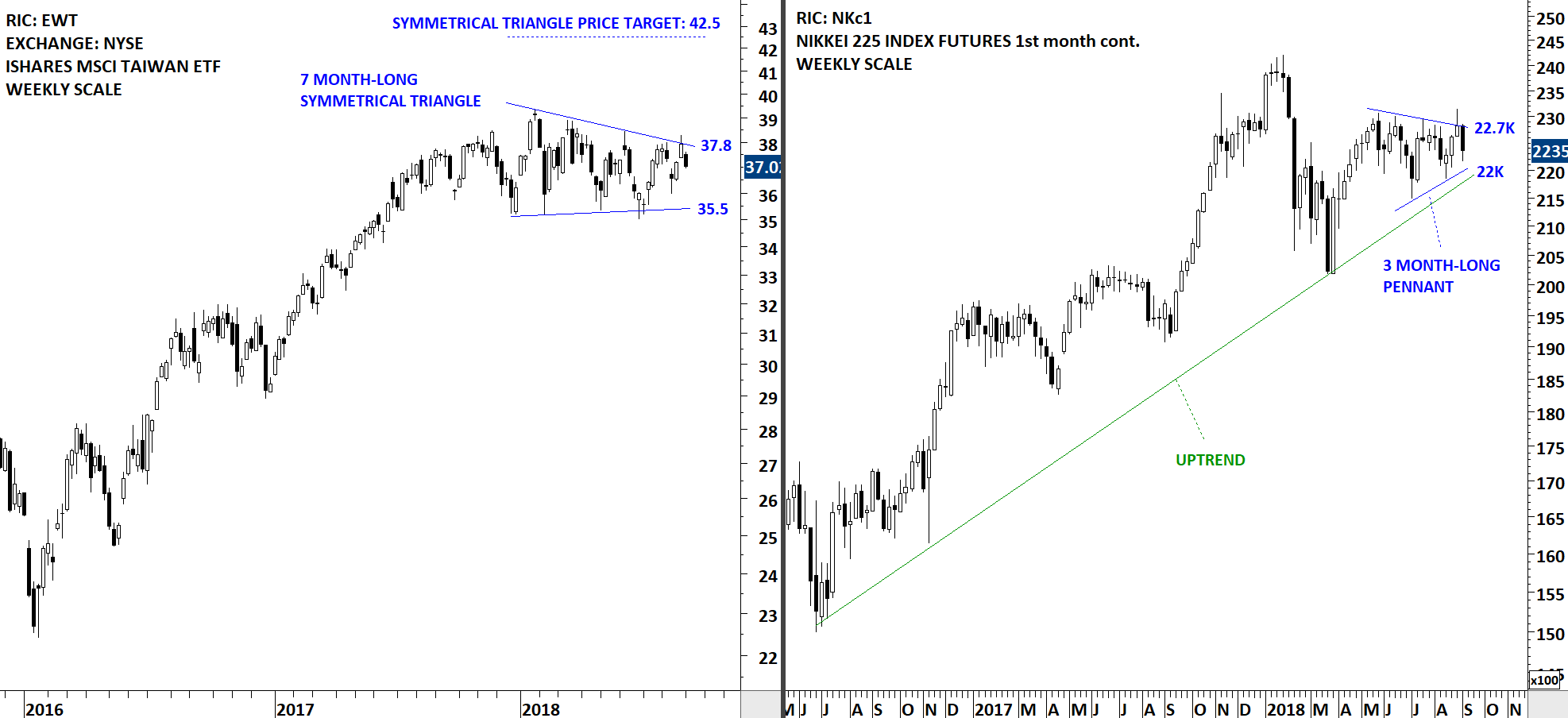

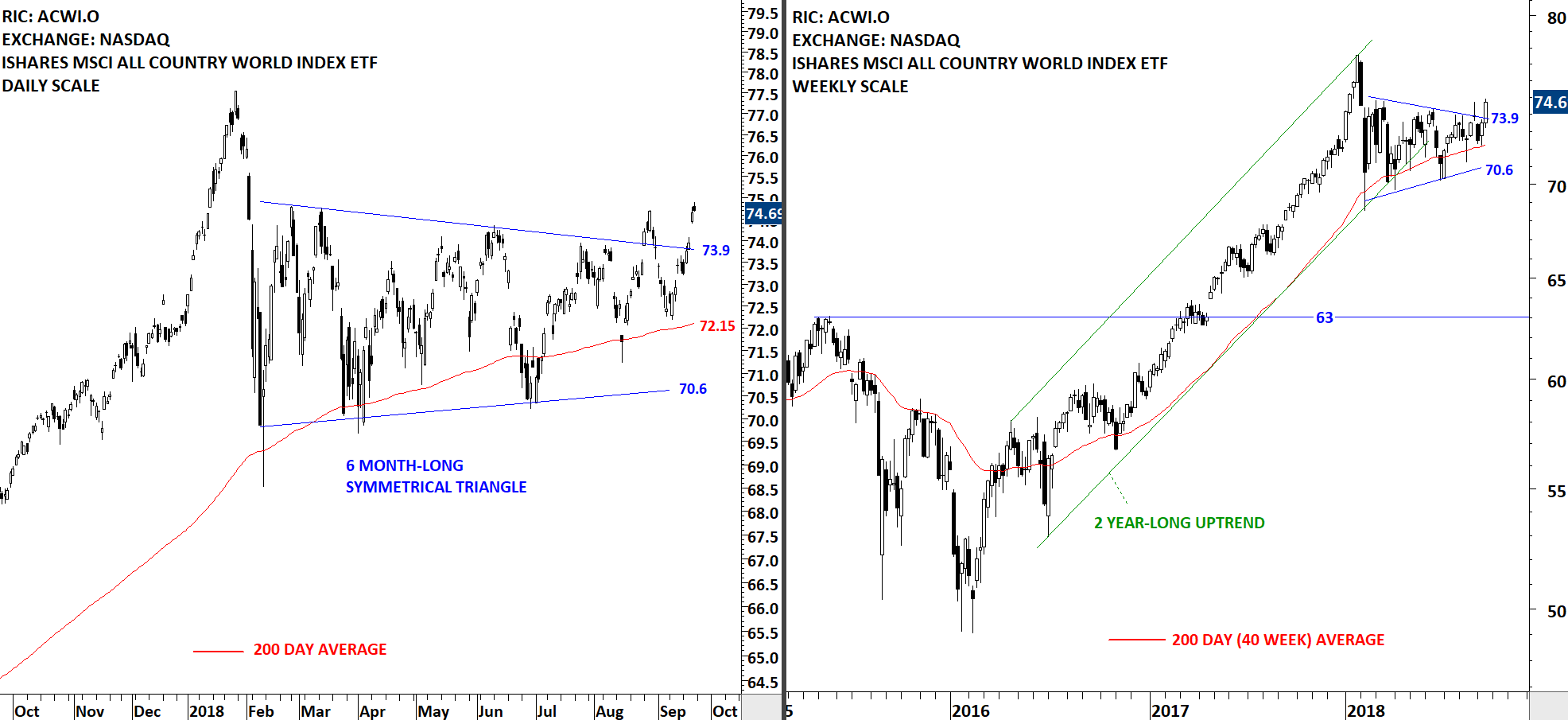

Two Asian equity benchmarks are holding well despite the weakness in regional equities. Japan’s Nikkei 225 Index and Taiwan ETF (EWT) listed on the New York Stock Exchange, are going through tight consolidations. Charts below feature the 1st month continuation futures price chart for Nikkei 225 Index and the iShares MSCI Taiwan ETF (EWT). Breakout higher from these tight consolidations can be positive for both Japan and Taiwan equities.

Tech Charts Membership

By becoming a Premium Member, you’ll be able to improve your knowledge of the principles of classical charting.

With this knowledge, you can merge them with your investing system. In fact, some investors use my analyses to modify their existing style to invest more efficiently and successfully.

Get Access Now

As a Premium Member of Aksel Kibar’s Tech Charts,

You will receive:

-

Global Equities Report. Delivered weekly.

-

Classical charting principles. Learn patterns and setups.

-

Actionable information. Worldwide indices and stocks of interest.

-

Risk management advice. The important trading points of each chart.

-

Information on breakout opportunities. Identify the ones you want to take action on.

-

Video tutorials. How patterns form and why they succeed or fail.

-

Watch list alerts. As they become available so you can act quickly.

-

Breakout alerts. Usually once a week.

-

Access to everything (now and as it becomes available)

o Reports

o Videos and video series

-

Multi-part webinar course. You learn the 8 most common charting principles.

-

Webinars. Actionable and timely advice on breaking out chart patterns.

For your convenience your membership auto renews each year.

Get Access Now

Read More

Read More