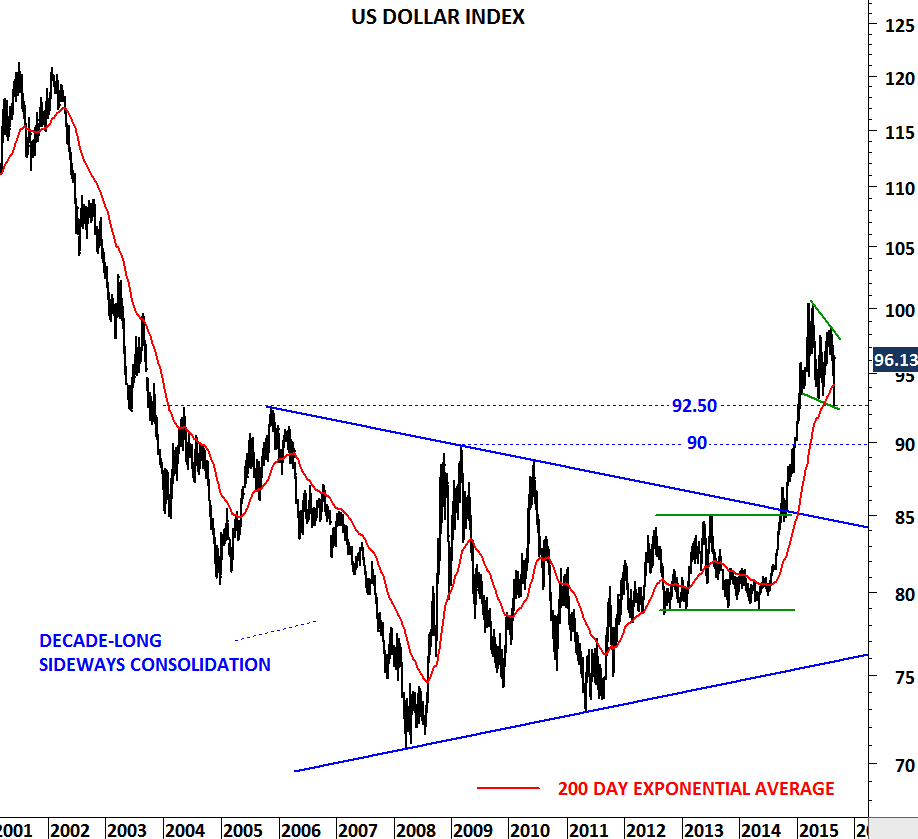

U.S. DOLLAR INDEX

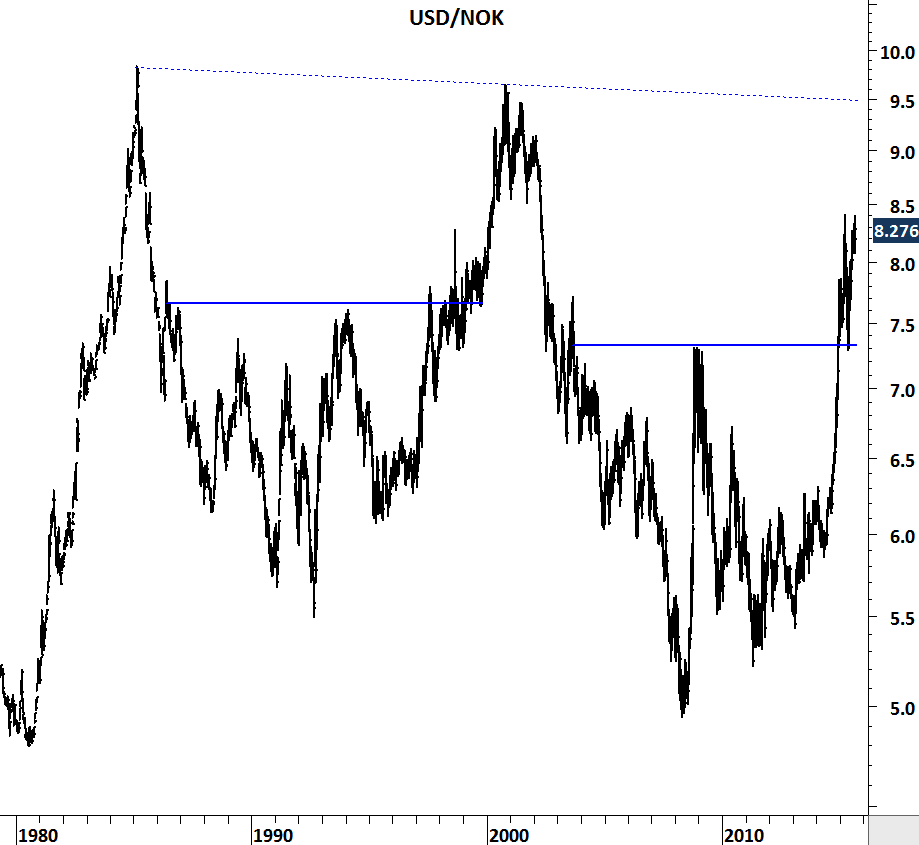

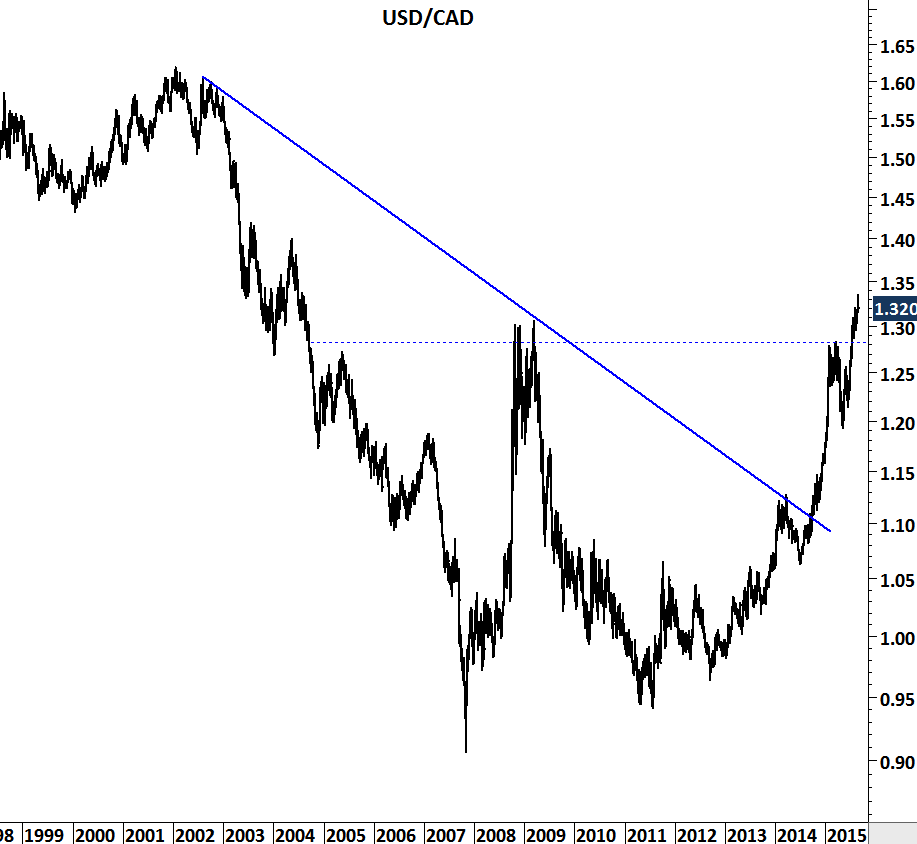

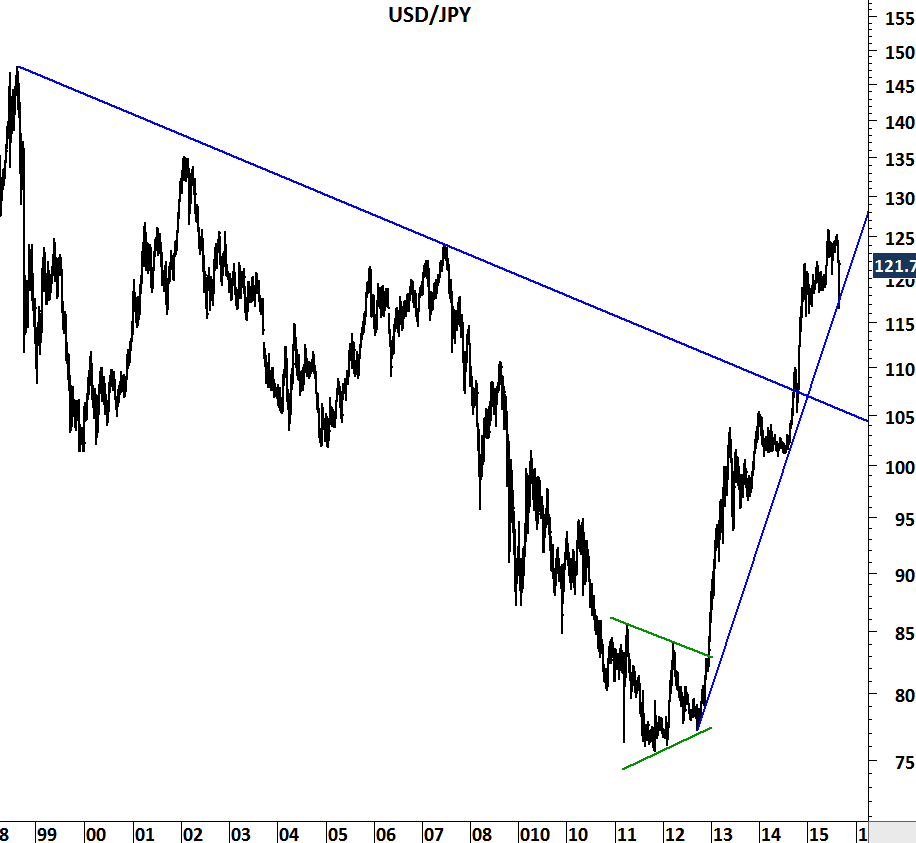

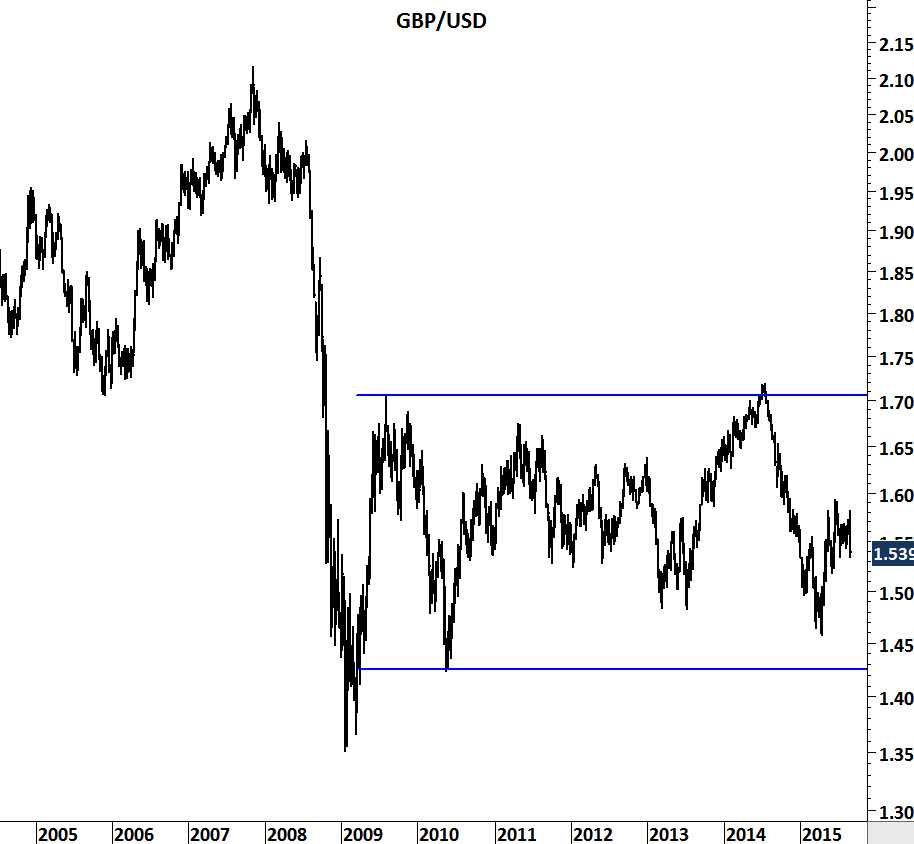

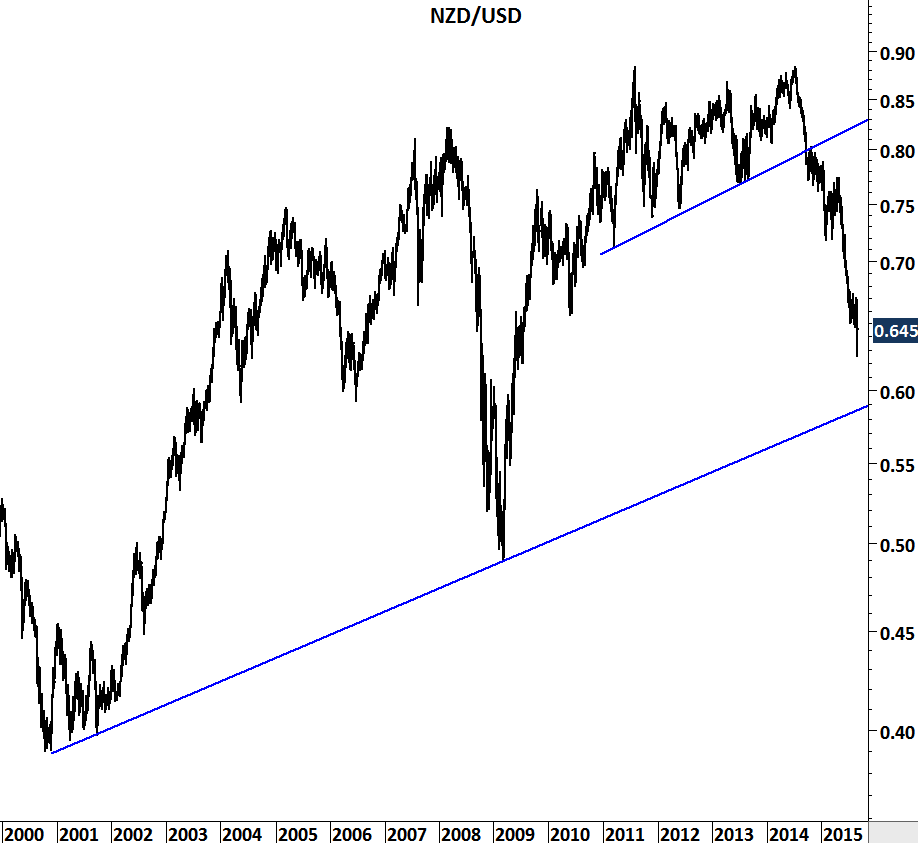

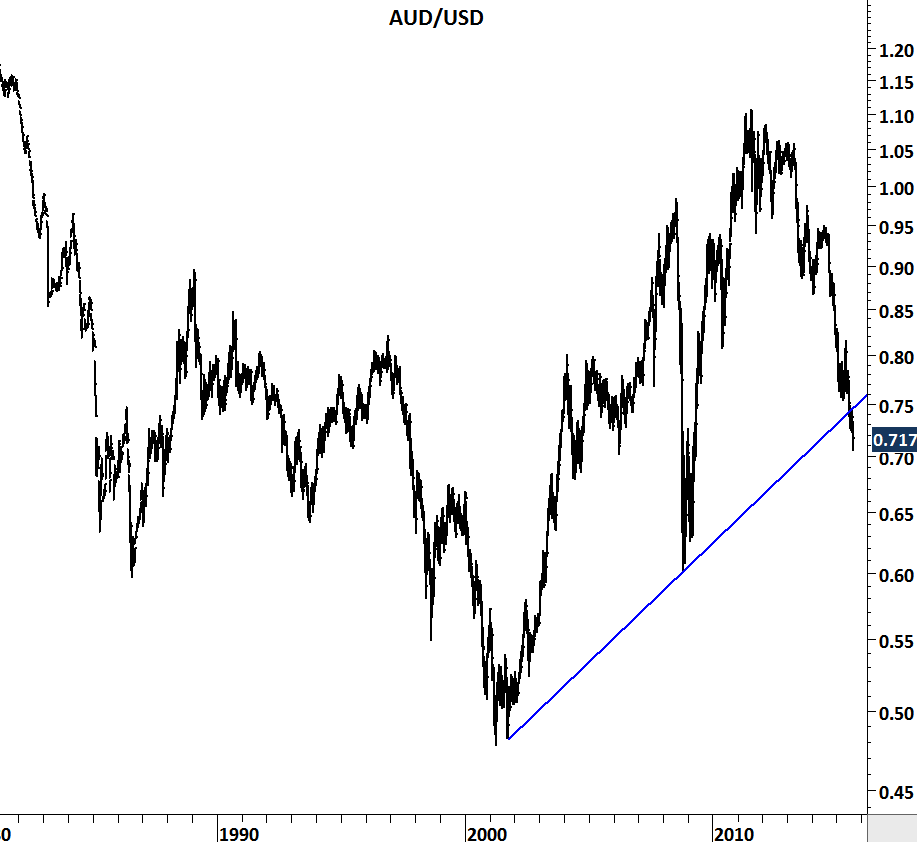

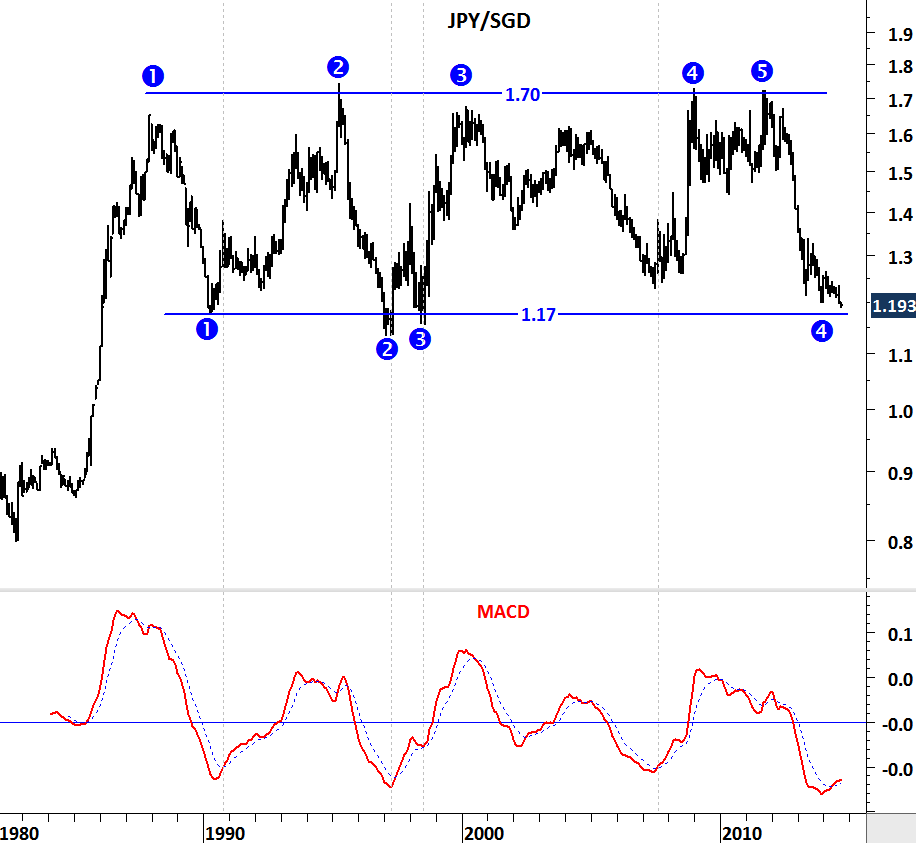

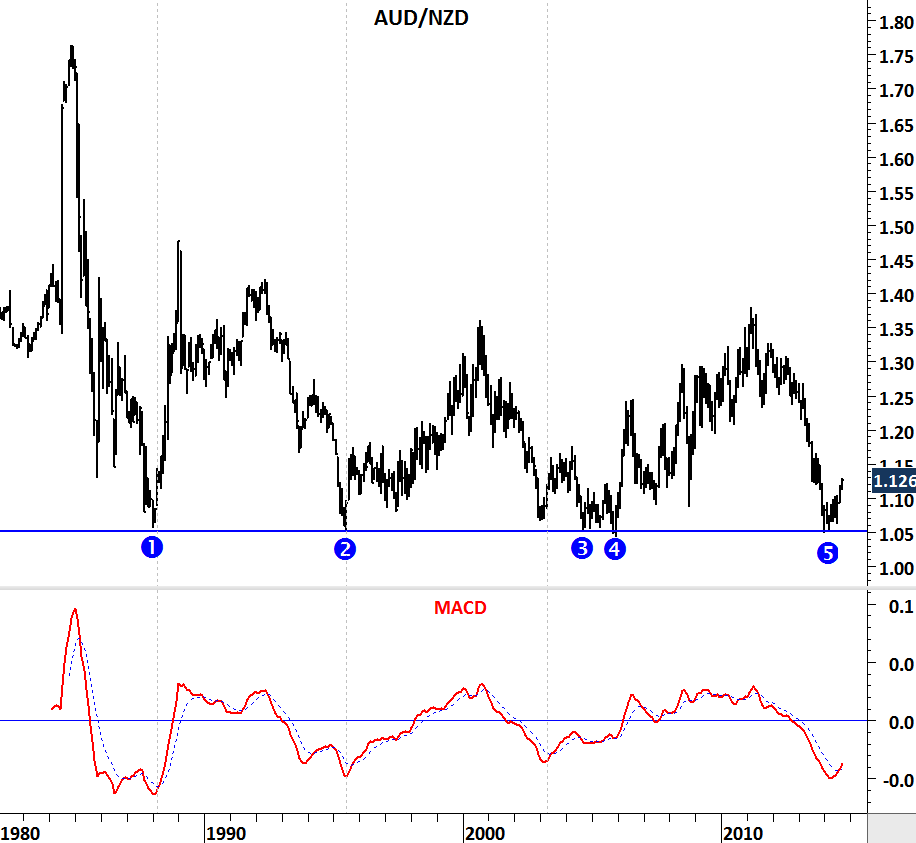

U.S. dollar strength is here to stay. Greenback had a strong recovery last week. Strong dollar will continue to put pressure on commodities, commodity currencies and also emerging markets. In other words, weak emerging markets, commodities and strong U.S. Dollar trend is likely to continue in the following months.

After its breakout from a decade-long consolidation in the last quarter of 2014, U.S. Dollar index rallied from 85 to 100 levels. Since March 2015, price has been pulling back to the strong support at 92 levels. Last week, the dollar index tested the strong support and rebounded sharply. Latest consolidation is more like a counter trend move in the context of a short/medium-term correction. Uptrend in the U.S. Dollar remains intact and once the choppy sideways consolidation is over we can expect the continuation of the uptrend.

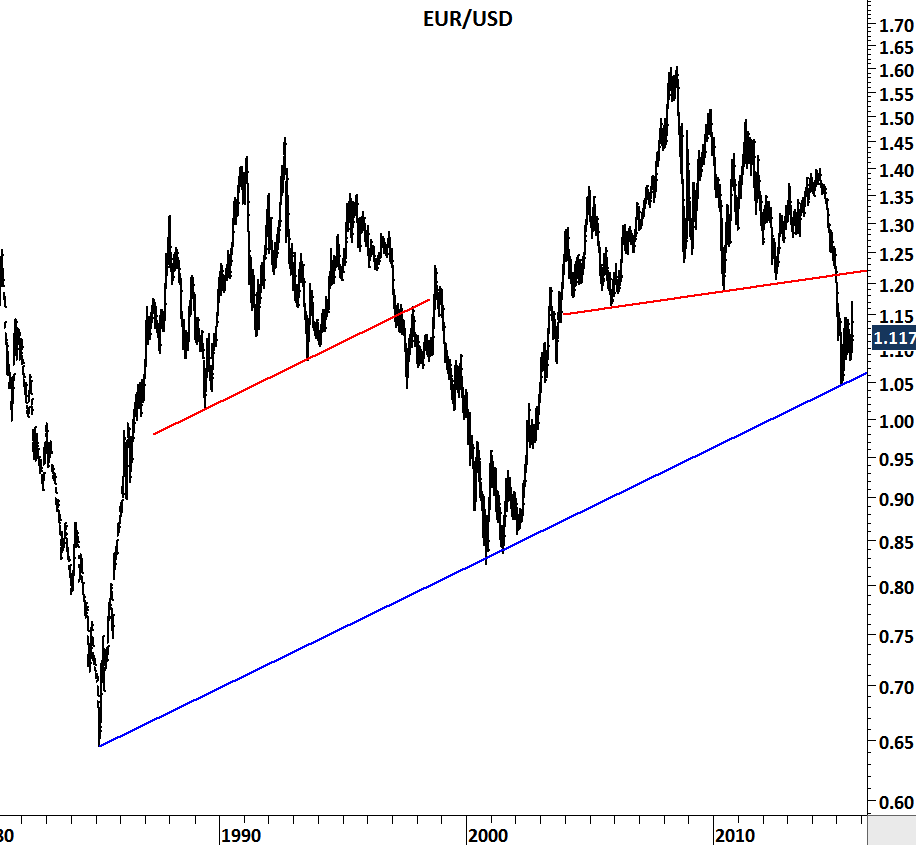

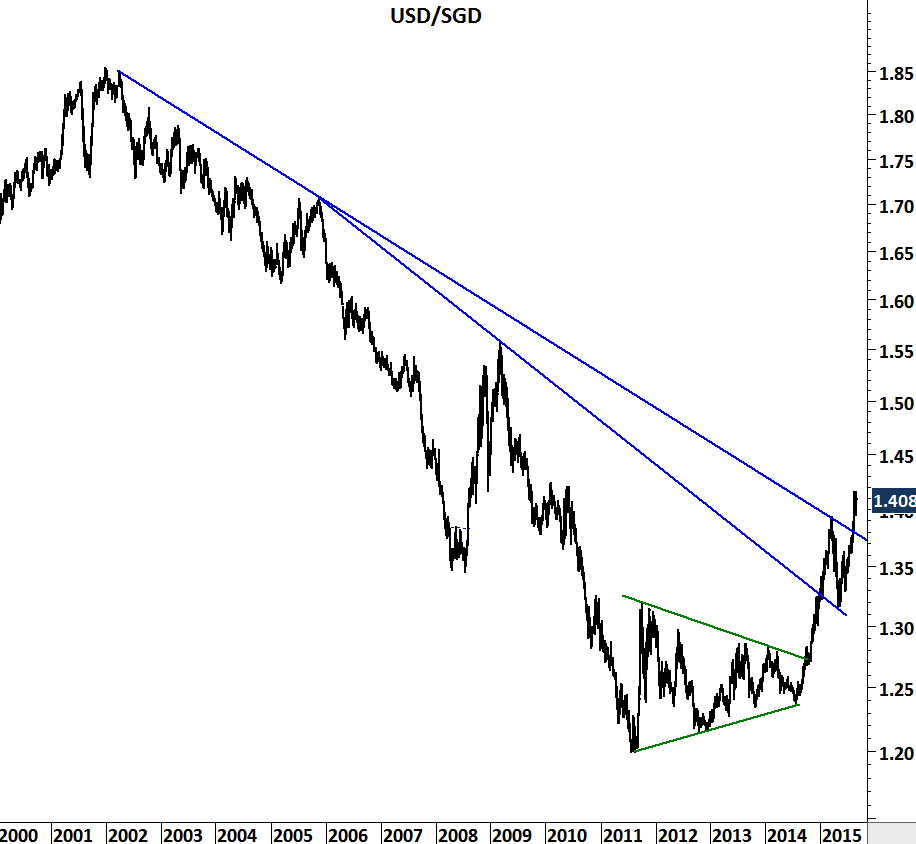

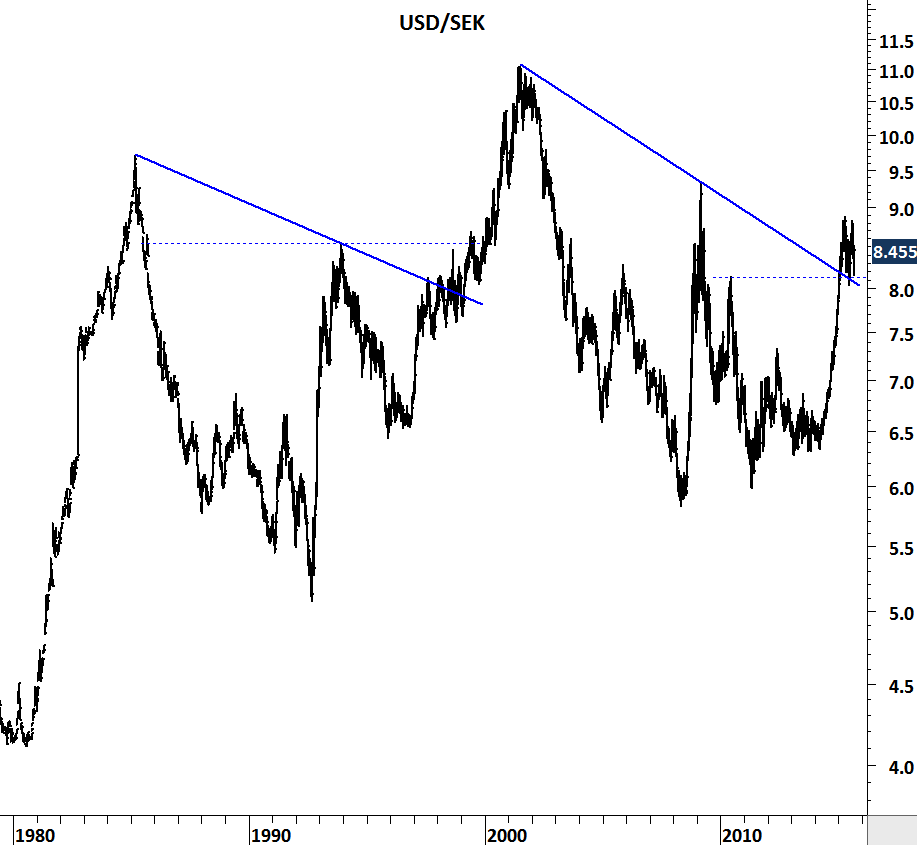

MAJOR U.S. DOLLAR CROSS RATES