EMERGING MARKETS and SOUTH AFRICA

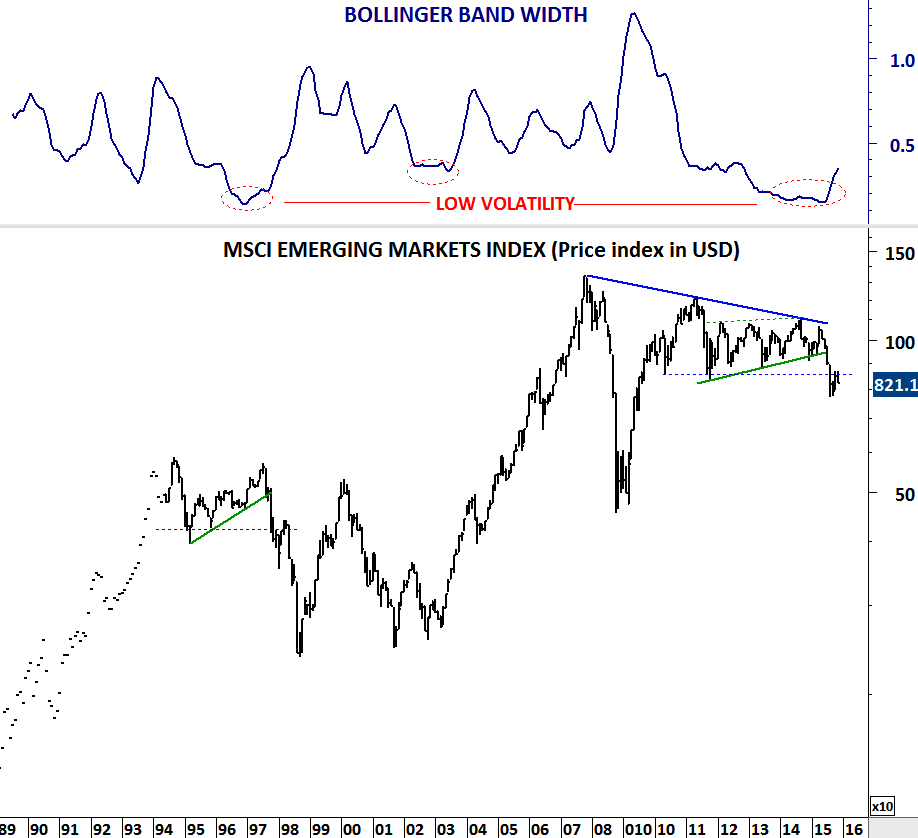

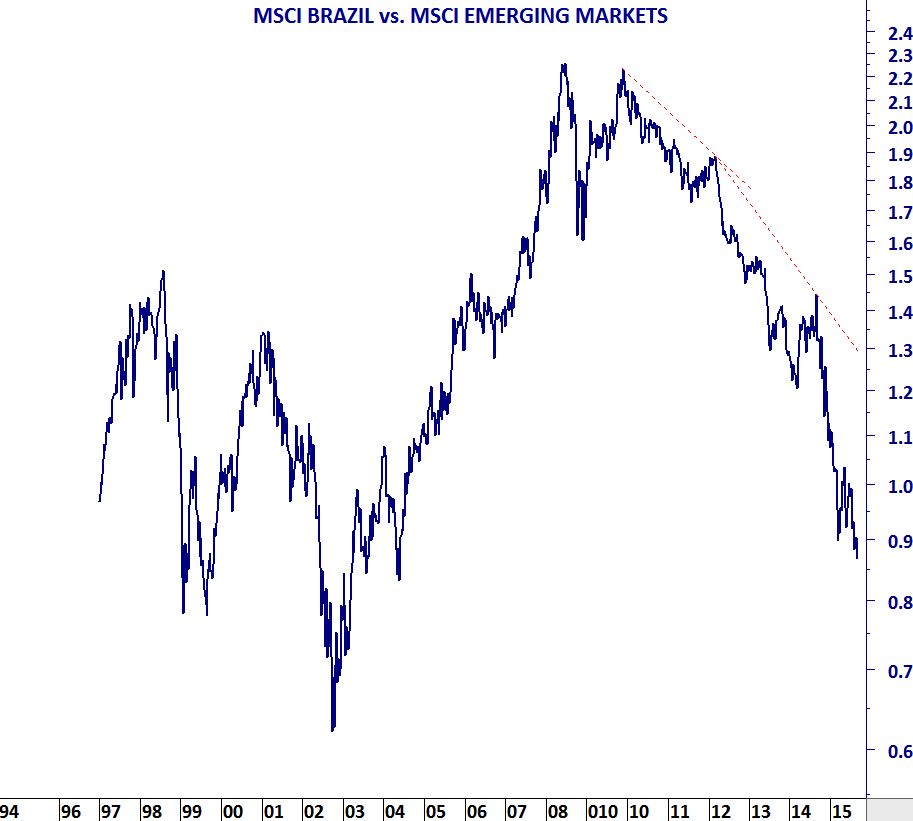

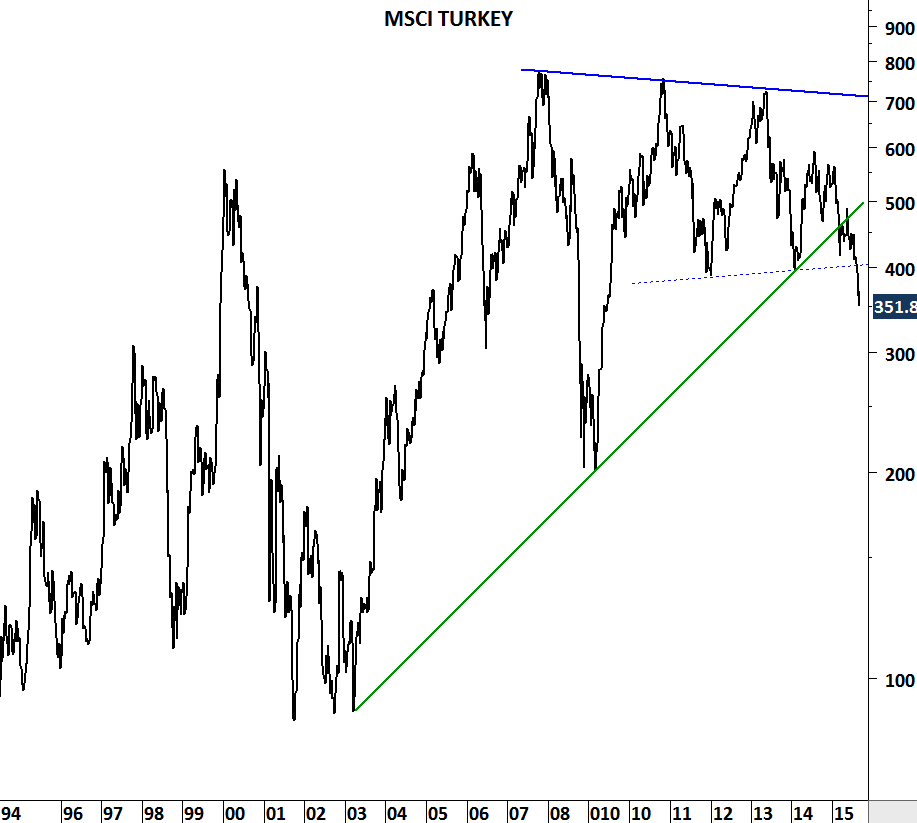

Following one month of positive price action, weakness resumed in the emerging market equities. Until previously broken support levels are breached on the upside, strength in emerging market equities will be classified as counter-trend move. In other words, MSCI Emerging Markets index should clear 860-900 area on the upside to reverse the larger-scale downtrend.

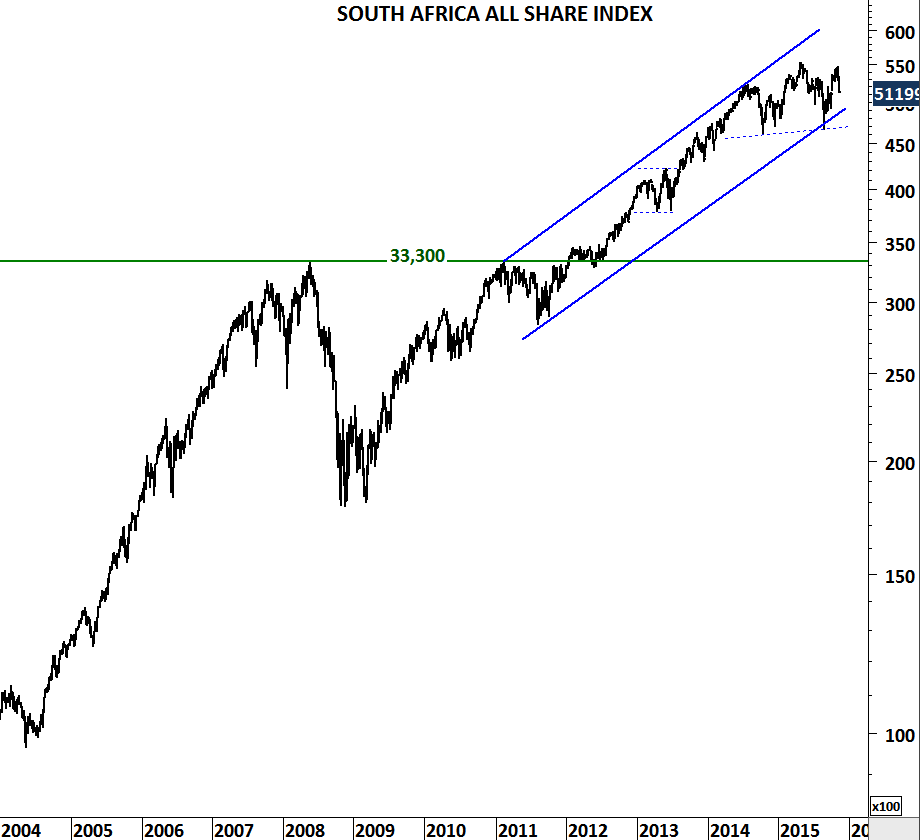

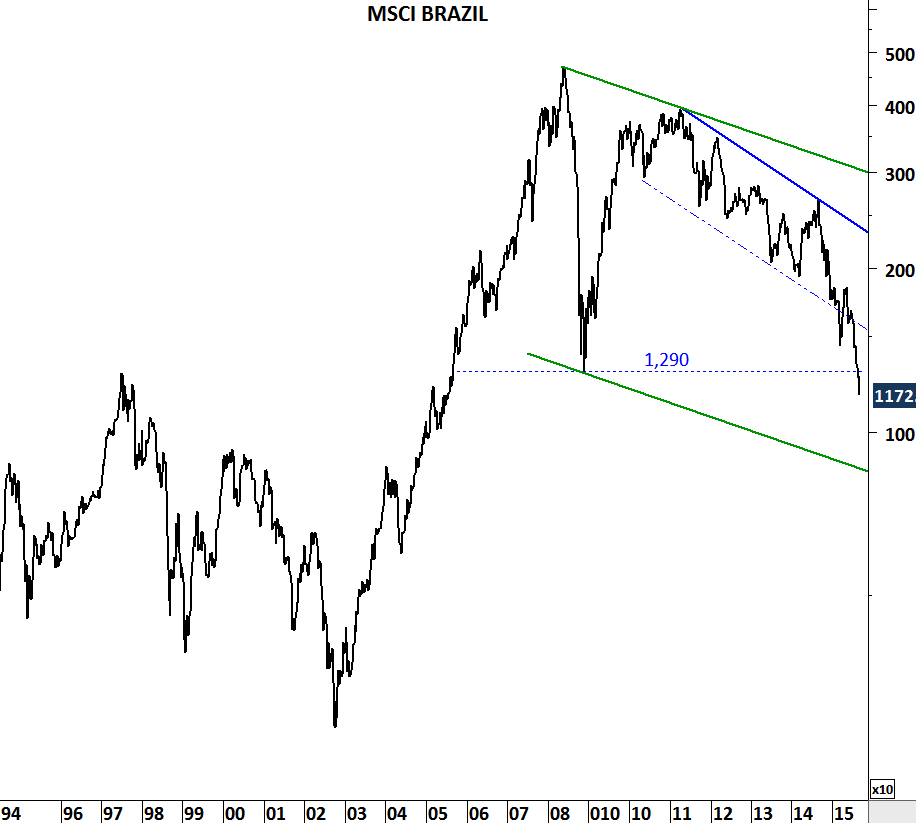

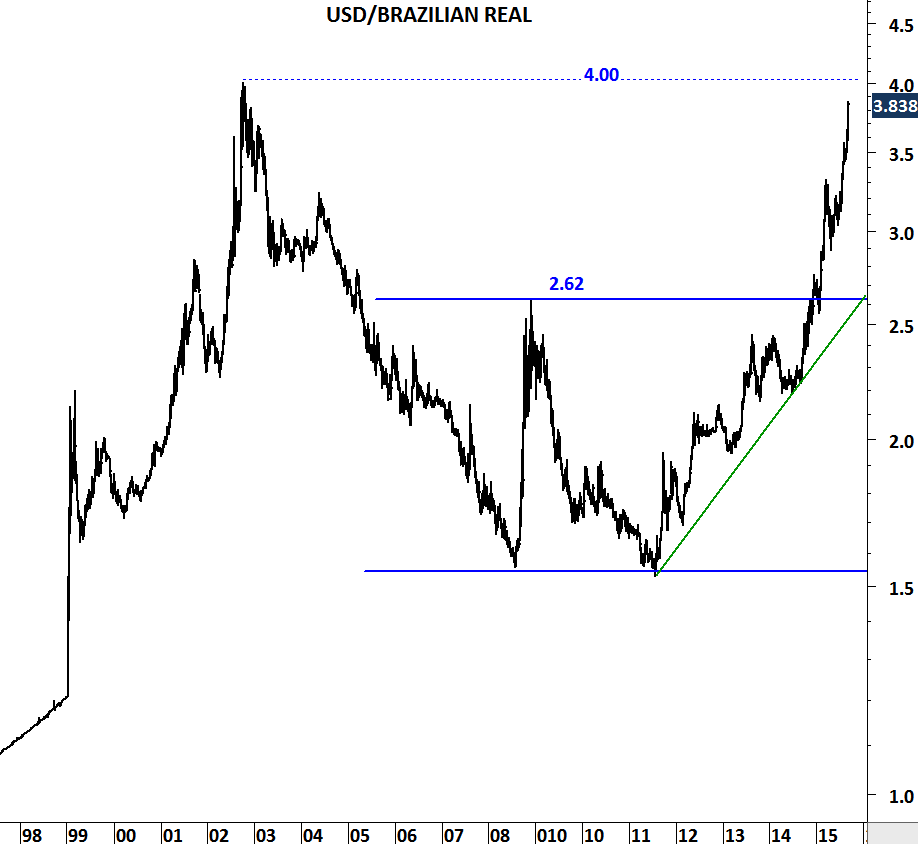

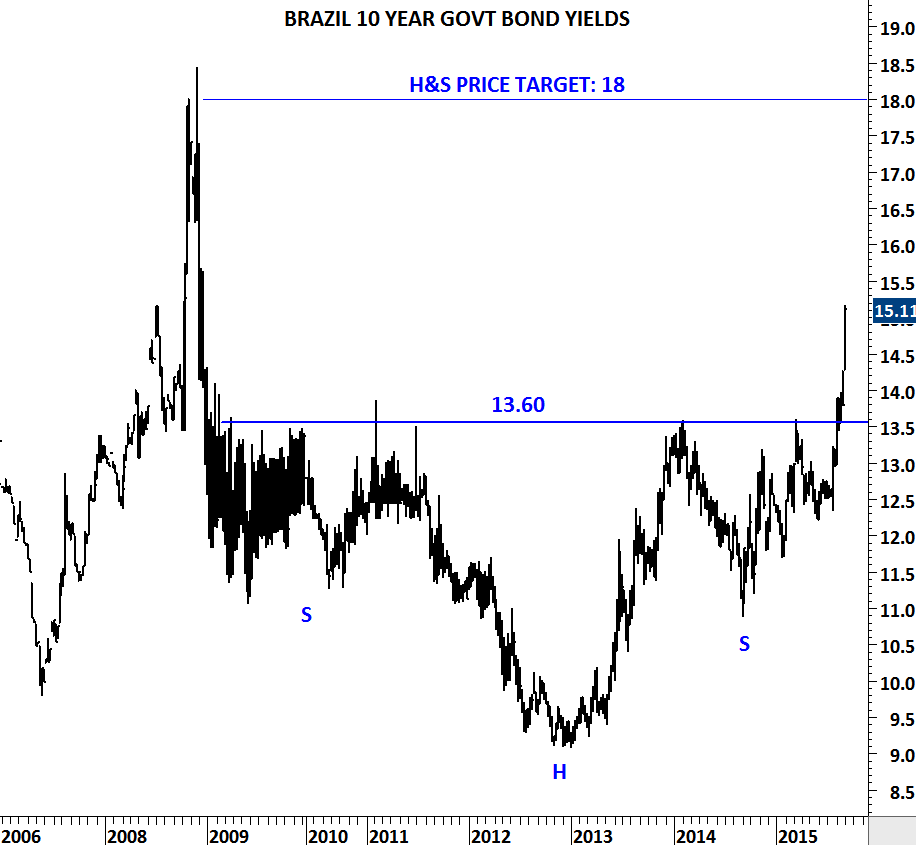

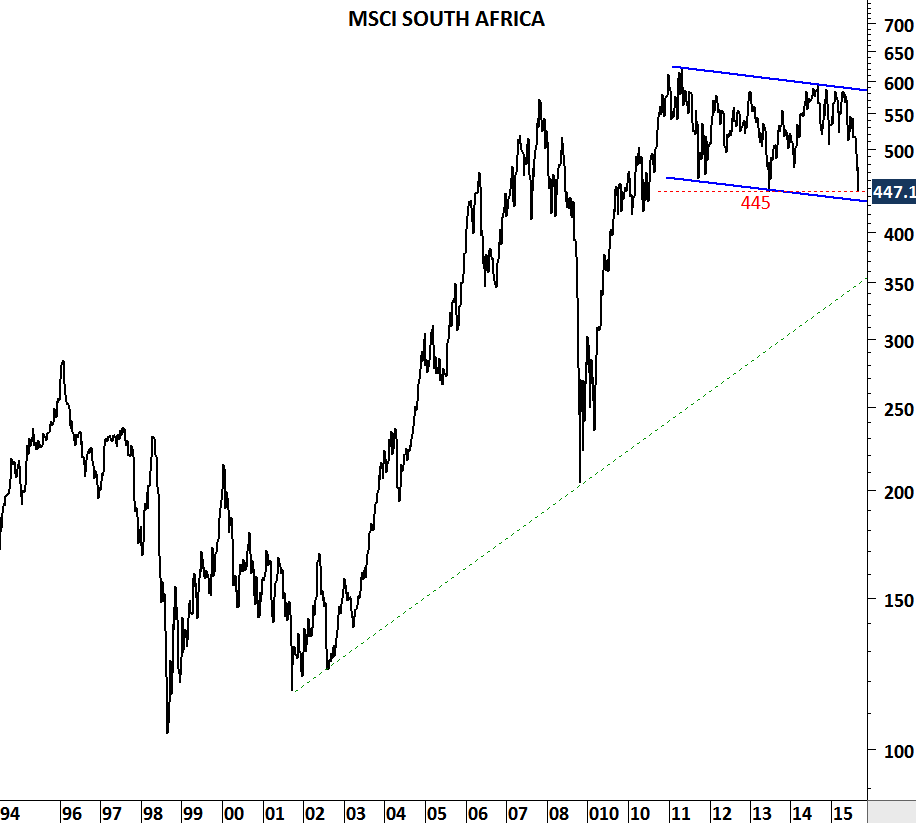

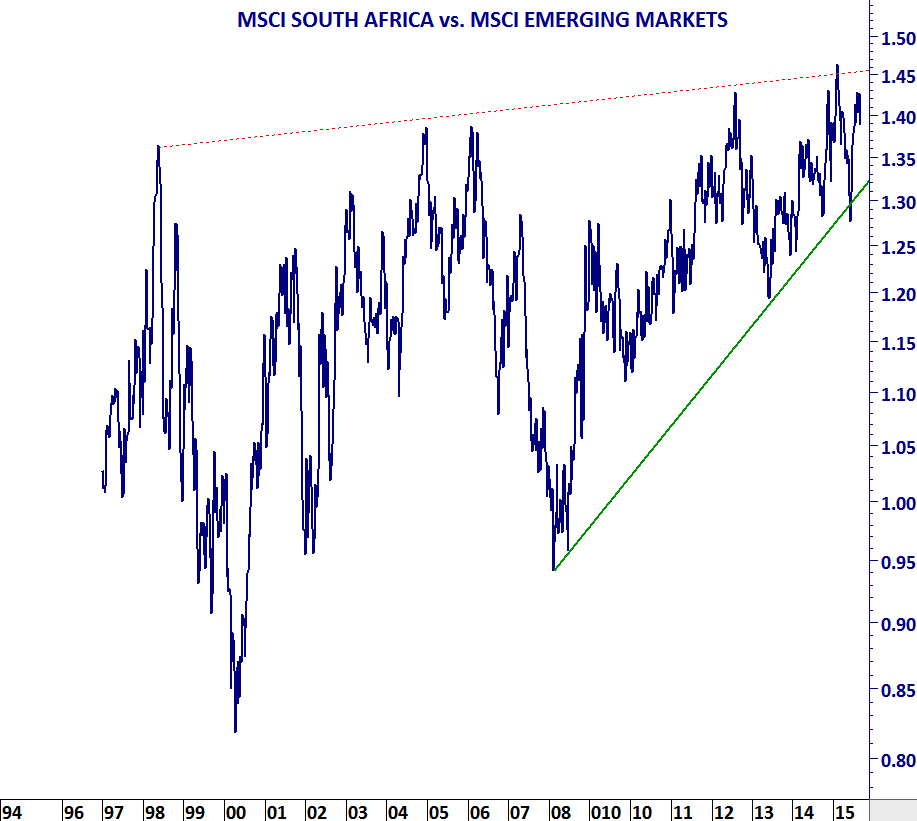

Since the beginning of 2011, emerging market equity weakness has been mainly due to sharp depreciation in the local currencies. Some of the emerging market equity indices reached all-time high levels while the U.S. dollar denominated MSCI Emerging Markets index recorded lower lows. One good example is the South Africa All Share Index (with local currency). Since the beginning of 2011, South Africa All Share index resumed its multi-year uptrend, reaching all-time high levels while the MSCI South Africa index (price index in U.S. dollar) trended lower.

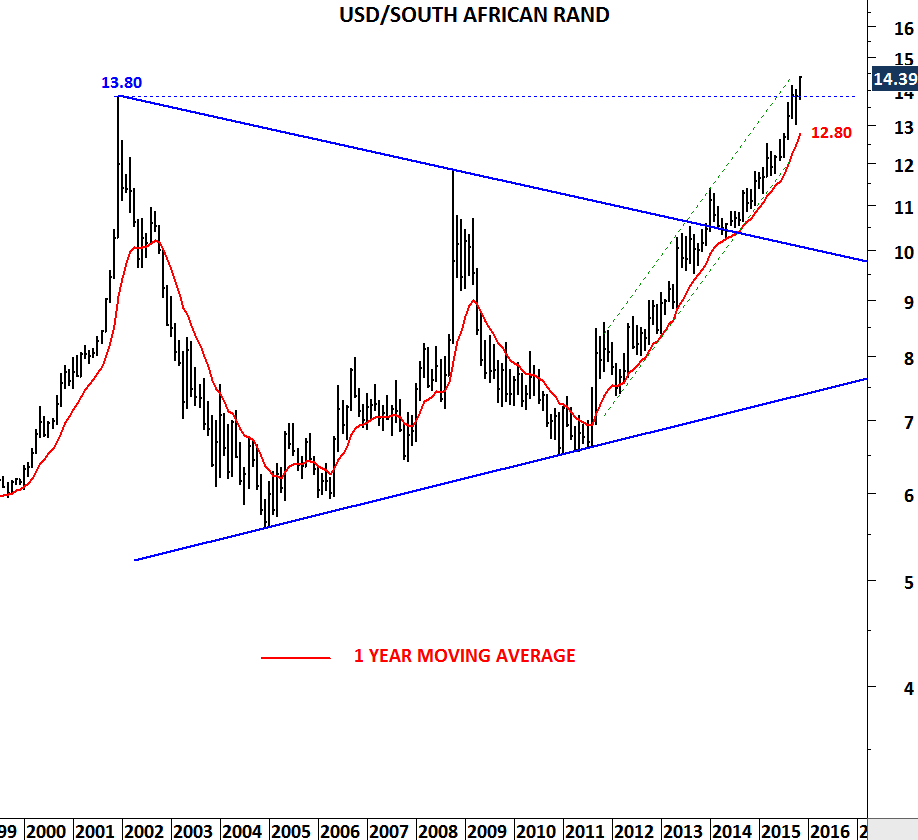

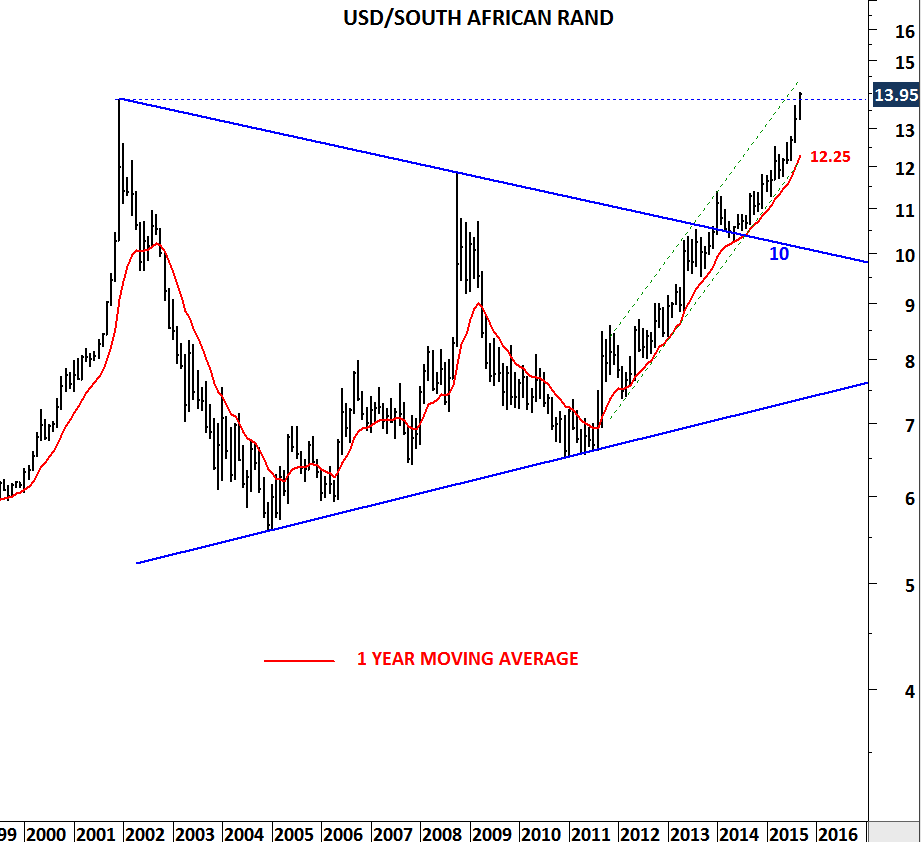

Weakness in emerging market currencies are likely to continue. USD/ZAR is breaking out to all-time high levels. Supported by the FED rate hike we might see acceleration in those currency trends.

Any thoughts on how U.S. dollar denominated equity indices such as MSCI South Africa will perform if we see South Africa All Share index testing lower levels with U.S. dollar strength?