A review of the most reliable chart patterns Tech Charts Global Equity Markets report featured over the past two years – September 2019 Tech Charts Webinar

A review of the most reliable chart patterns Tech Charts Global Equity Markets report featured over the past two years – September 2019 Tech Charts Webinar

Webinar Outline

- We will review some of those chart pattern breakouts that were featured in the Global Equity Markets report

- We will review some of the conditions that are required for successful completion of different chart patterns

- We will look at some of the developing bullish continuation chart patterns

- We will continue to highlight Tech Charts members favorite chart pattern setups in different equity markets

- We will have a member Q&A at the end of the webinar

Live questions from Members

- On triangle breakouts, how important do you feel it is to clear the last pivot point (as opposed to buying the breakout immediately) before entering a trade? 1:07:49

- Could you please comment the HUI or GDX graph? 1:08:30

- You have been using SSE50 to analyze China. May I suggest including or start using A50? The reason is apparently the futures contracts trading on SGX. Or, is there a leveraged way to trade SSE50 other than CFD? 1:09:15

- Slide 2 – Is the moving average simple, exponential, or something else? 1:09:52

- Can you start posting the slides with the member webinar on the member site? It would be very helpful. 1:10:52

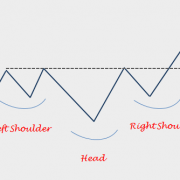

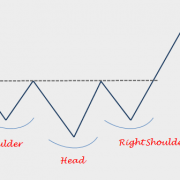

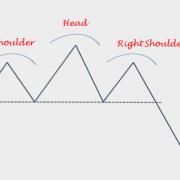

- H&S bottom reversal: it looks like from the examples that the downtrend line would be breached, retested and form the right shoulder and then breakout. The question, would it be advisable to take position after right shoulder(retest of the down trend line)? 1:11:09

- When a H&S has a neckline that is slanted left or right, to which point do you trade? 1:12:08

- Why three times 10-period ATR? Is it from experience, is this the best setting for Aksel’s time frame? 1:13:02

- Broadening triangle – It’s probably not worth taking a position but when a flat top broadening triangle forms in the downtrend, is there a bias? Example Canada government bond 2-year rate. Flat top broadening triangle formed from March, in the middle of the downtrend. 1:14:30

- How do you answer something like this: “I never thought buying breakouts was a good way to trade. Takes so many buyer s to get a stock through resistance. You don’t wanna be buying AFTER that…Pullbacks after the breakout or ahead of a breakout only for me.” 1:15:32

- When a premature breakout happens, and the stop is hit, if the breakout happens again, would you take the signal again? If yes, do you change the position size if the risk is lower this time (pivot closer to breakout level)? 1:16:47

- Have you calculated which patterns tend to assume which roles: continuation vs. reversal? 1:17:37

- Is there any suggestion, other than using the correlation table, which breakout signals to select from because you highlight many and they all look pretty good. 1:18:32

- What does on a daily closing basis mean – example when saying, “That the 3%-breakout-confirmation has to happen on a daily closing basis?” 1:19:14

Recorded live 9.15.2019