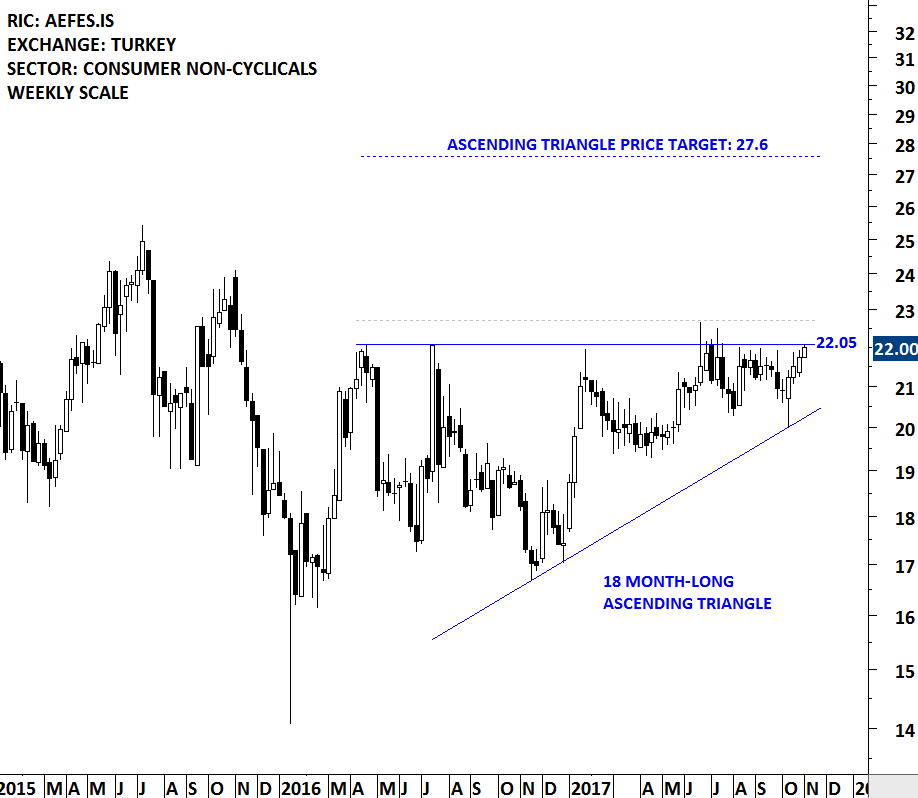

Ascending Triangle Chart Patterns – March 2018 Tech Charts Webinar

- Ascending triangle is a reliable bullish chart pattern that can act as a bottom reversal and continuation

- Breakouts from chart patterns with horizontal boundaries are more reliable when compared with breakouts from diagonal boundaries

- Important technical points when identifying ascending triangle chart patterns

- Importance of several tests of chart pattern boundary before a breakout takes place

- The broader context of price action and where the ascending triangle chart pattern forms

- Ascending triangle as a launching pattern

- Ascending triangle forming as a bottom reversal will take longer to develop

- Review of ascending triangle chart pattern breakouts between May 2017 and February 2017

- Defining chart pattern negation level and a logical point to label chart pattern negation on ascending triangle

- Recent chart pattern breakouts

- Developing ascending triangle chart patterns; a review of watchlist candidates

- Q&A

- Which broker do you recommend, where I can trade these stocks? I’m having a hard time finding one. 48:05

- If I’m new to classical charting, what should I do to learn how to identify each pattern? 49:45

- Any comment you care to make on the state of global markets? Europe and Japan look on edge… 51:44

- Do you actually search through hundreds of charts each week or do you use a software that alerts you to a breakout taking place across various markets? 53:14

- Science vs Art question - on the SBLK chart can you discuss your reasons for drawing the horizontal line where you did? 58:13

- Do you sell all your positions at profit target, if not how do you scale out? 1:00:33

- Do you look at currency and commodity patterns?1:01:23

- Do you look also for short sale candidates? 1:02:30

- Is there any point to consider when applying classical chart patterns on forex charts instead of stock? 1:04:50

- Do you have an estimate of timing - when the target should be met breaking out of these ascending triangle? 1:05:45