New housing construction rose in August, boosted by the strongest pace of single-family home starts in more than two years that shows an improving U.S. real estate market – says the news headlines… Beginning construction climbed 2.3 percent to a 750,000 annual rate, less than forecast and restrained by a drop in the building of apartments, from a revised 733,000 annual pace in July, Commerce Department figures showed today. The average rate on a 30-year fixed mortgage held at 3.55 percent in the week ended Sept. 13, near the 3.49 percent on July 26 that was the lowest in data dating to 1971, according to McLean, Virginia-based Freddie Mac.

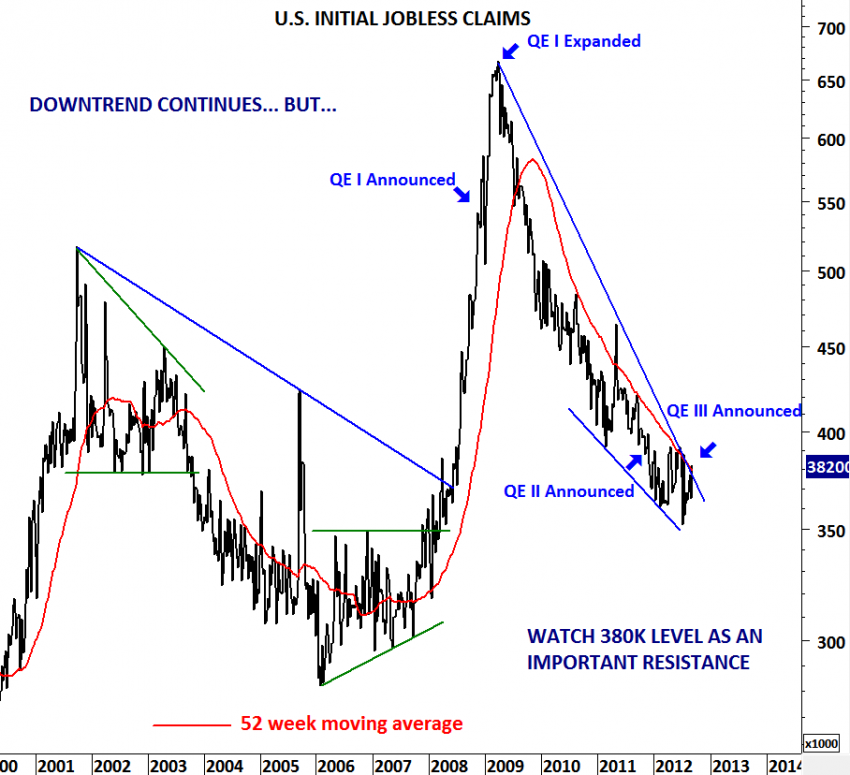

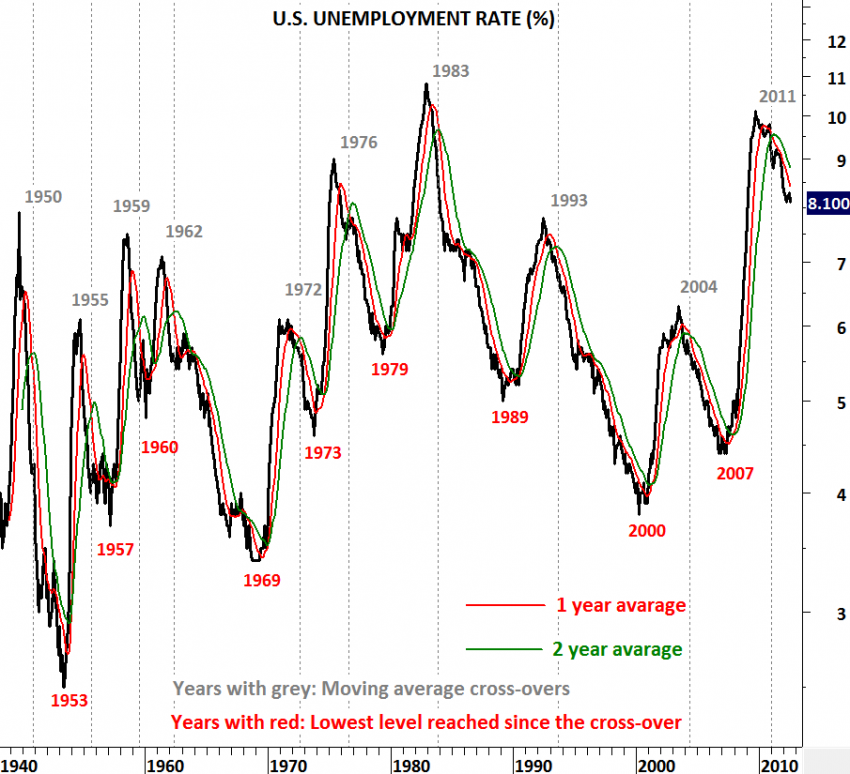

I’ve frequently updated the U.S. housing starts data with a historical perspective. Today I’m adding the latest data and reviewing this important chart once again. Given the amount of liquidity out there (QE1, QE2, QE3 and QE Unlimited…) and the lowest level of mortgage rates and the relatively low level of median home prices don’t you think the recovery so far looks anemic? In 1966, 1975, 1982 and 1991 each rebound has taken a “V” shape reversal and resulted in a strong recovery. It has been 3 years since the bottom and the U.S. housing starts are still below the 850K threshold. Yes, housing starts data shows improvement and there has been a 2.3% increase MoM, though let’s not forget that the July figure was revised down! My conclusion is that; I still see the housing market fragile. Until we get the U.S. housing starts data above 850K levels (historical support), I will NOT be bullish on the U.S. housing market.