Tech Charts Year in Review – Year Seven, May 2024 Webinar

Tech Charts Year in Review. Aksel compares the before and after of charts shared with Members over the last year followed by a live Q&A.

Tech Charts Year in Review – Year Seven

- A study on Chart Pattern Reliability with the available sample data over the past year.

- H&S continuation has been the most reliable chart pattern over the past year. Rectangle continued to be in the top 3 reliable chart patterns.

- Detailed statistics on different types of breakouts.

- The impact of different market cycles on chart pattern opportunities.

- Live Q&A

- Do you always use Log scale? Or, in some cases, use regular? 42:40

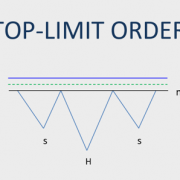

- So, if you want to be aggressive in looking for Type 1 & Type 2 breakout, you have a stop width of 3% (confirmation level minus pattern boundary), right? 43:26

- Would you recommend going long at the lower support level of a rectangular pattern (assuming we are in a bull market) to capture first the move to the resistance level and then the breakout? 44:47 (Rectangle - Trading Range-Bound Price Action & Candlestick Patterns at Support and Resistance)

- Given the large monthly pattern, how would you set trailing stops for $GOLD / $SILVER? 46:11 (ATR Trailing Stop-Loss - H&S Top)

- Is Type 3 based on closing price or intraday? 47:15

- Do you ever use price-relative charts for equities? If not, why? 48:13

- How do you manage entries during the earning season? Do you skip patterns when earnings are in the next x days? 48:47

- Can the success rate of cart pattern breakouts be improved by incorporating volume? 49:13

- When calculating ATR Trailing Stop Loss, how many periods do you use to calculate the ATR? 51:27

- Do you ever add to a trade when you realize it is Type 1? 52:39

- How much leeway can you give when drawing the horizontal boundary? You don't negate the pattern if it goes slightly over the boundary or slightly below the lower boundary. Is it subjective, or is it a specific rule? 53:12