GLOBAL EQUITY MARKETS – May 21, 2022

REVIEW

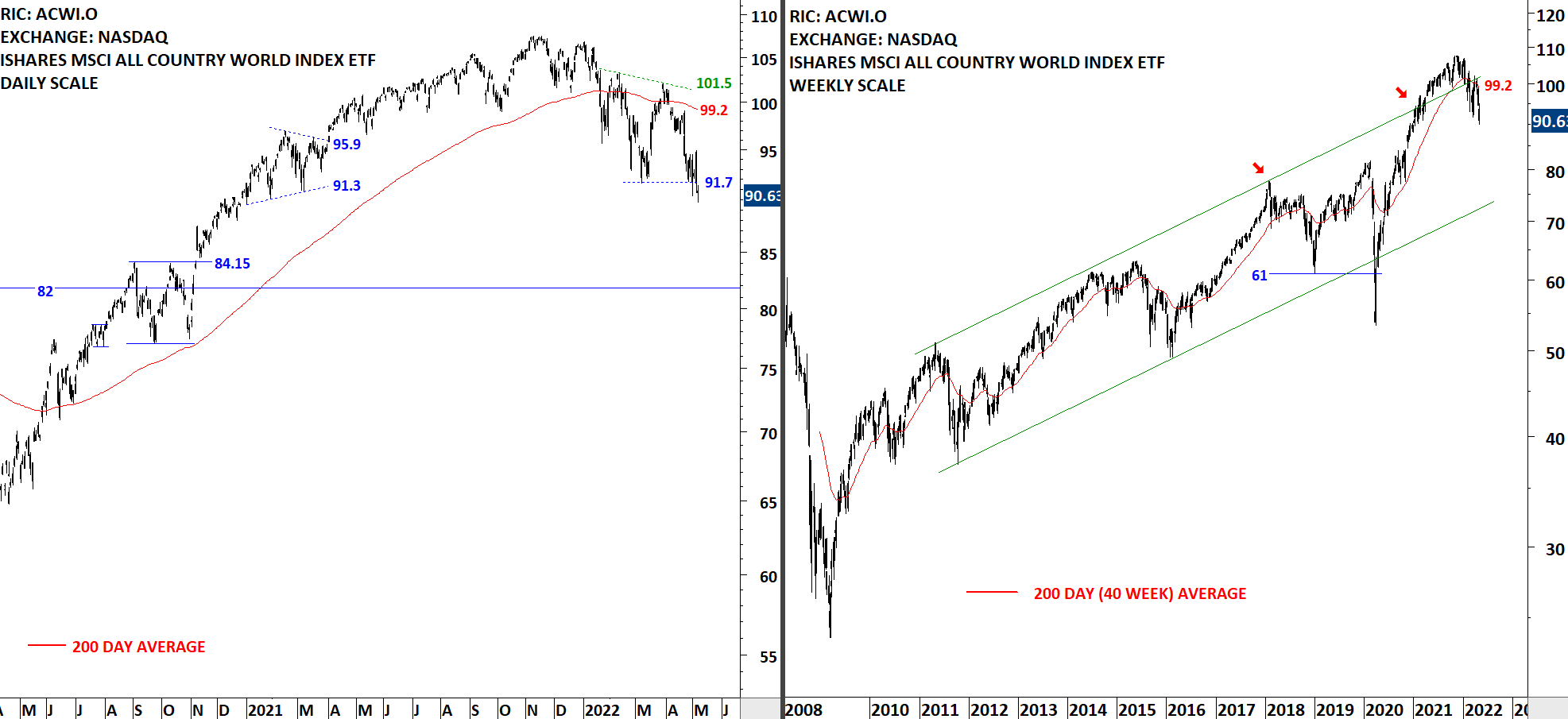

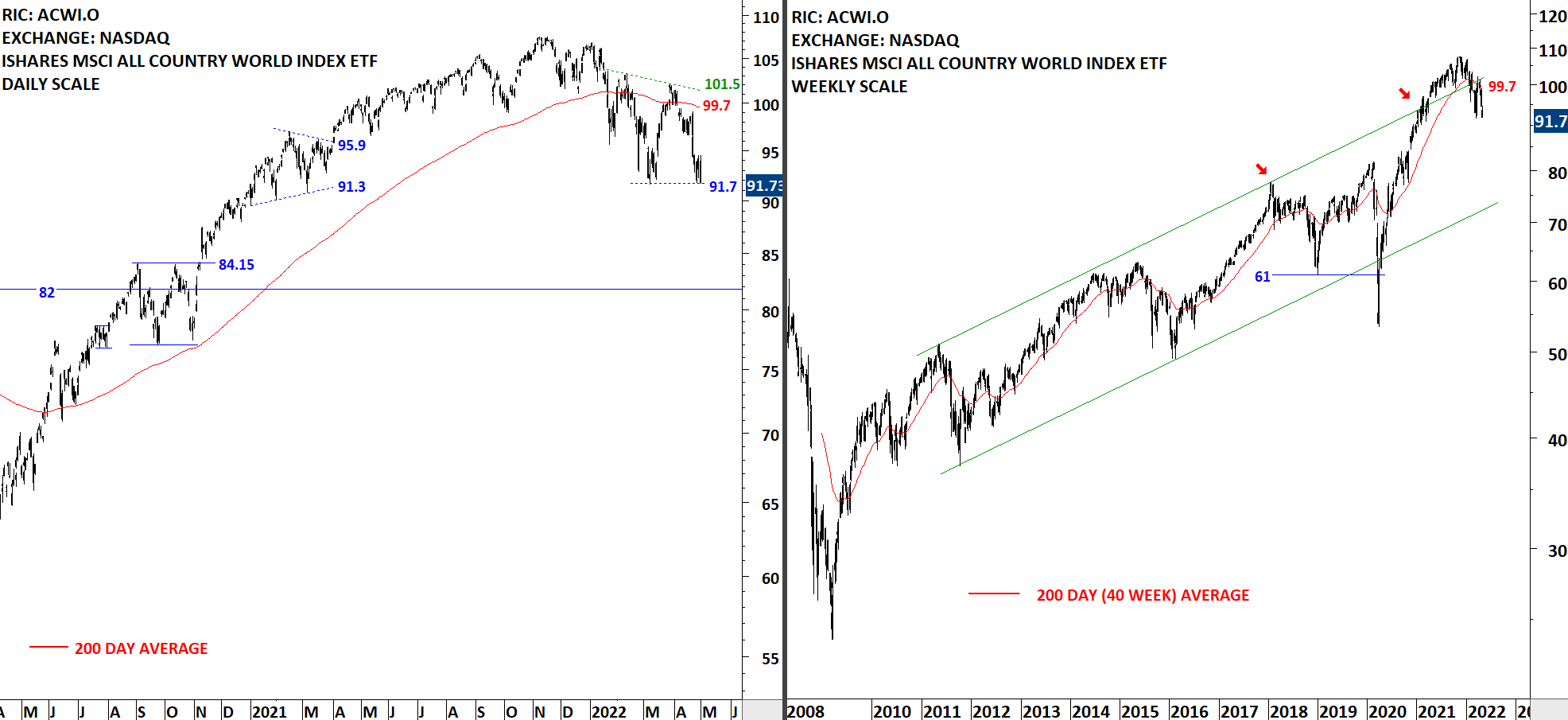

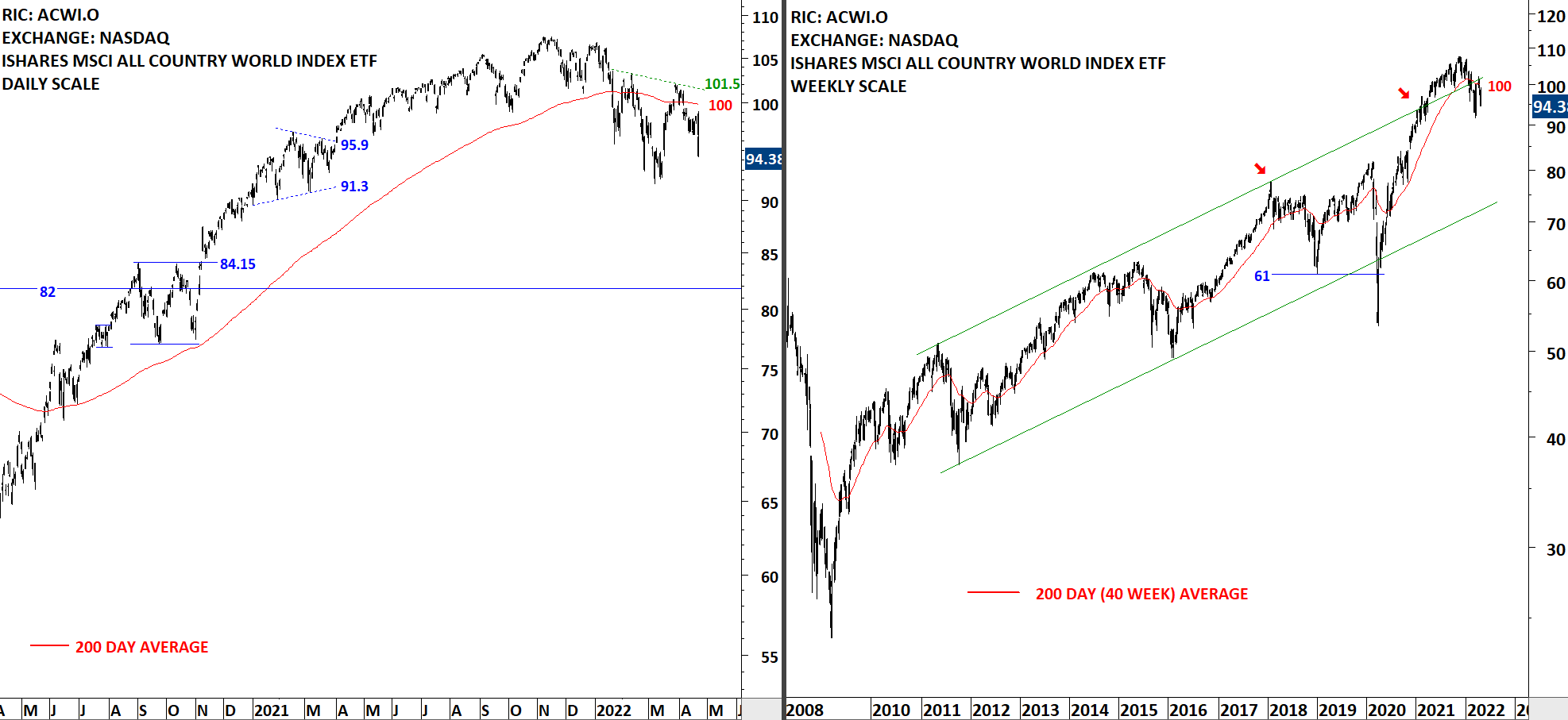

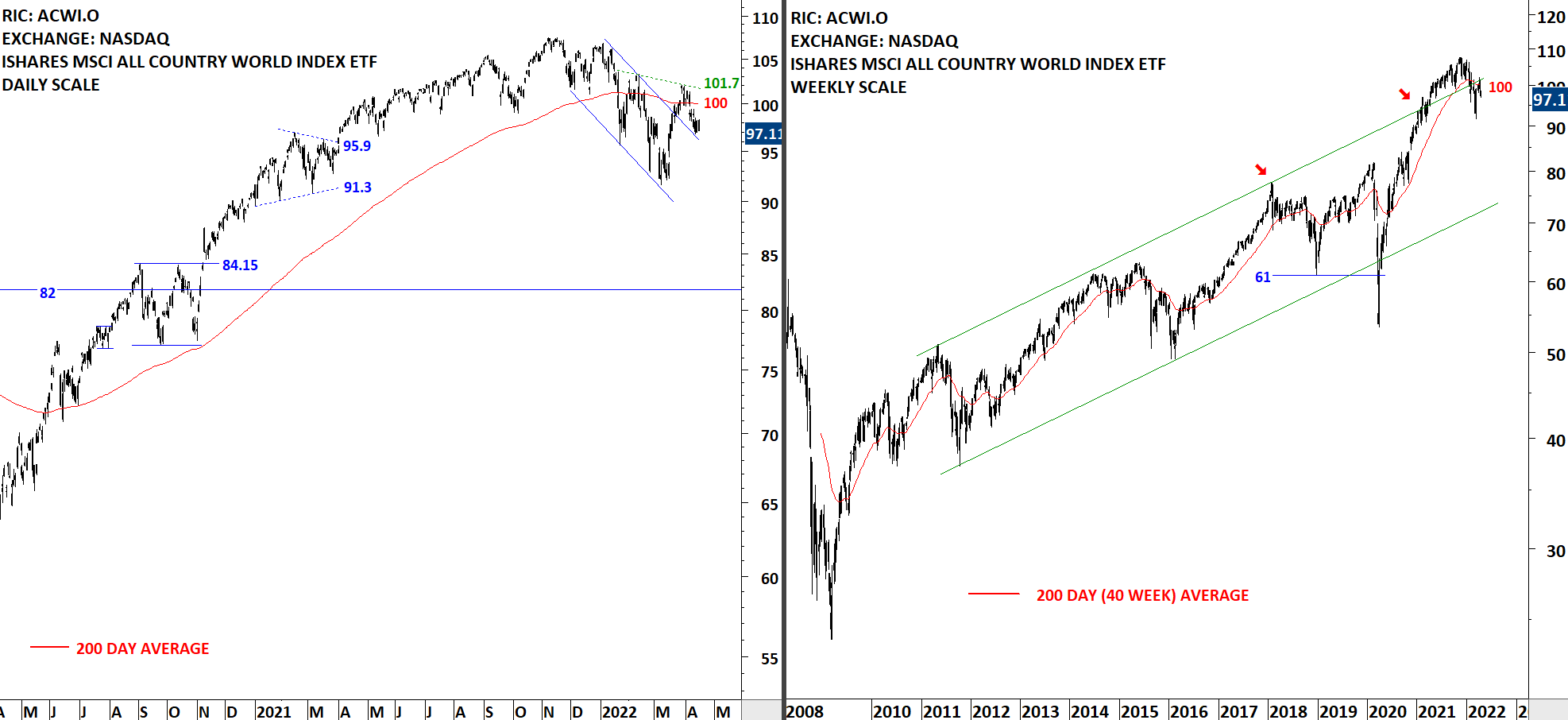

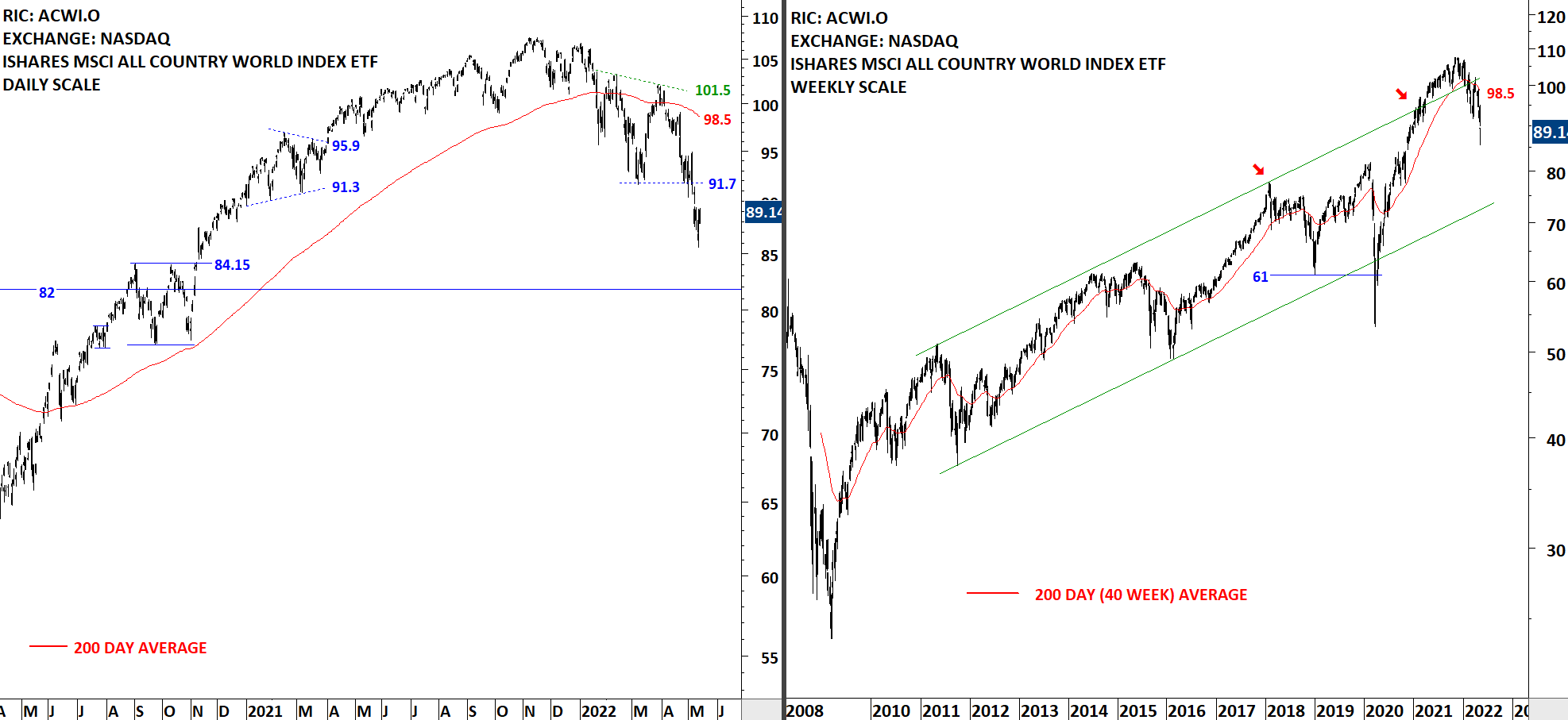

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) remains below its 200-day average and the minor low at 91.7 levels. The 200-day average is currently at 98.5 levels. Breakdown below the minor low resumed the downtrend. 91.7 levels becomes the resistance. There is no clear bottom reversal chart pattern on daily and weekly scale price charts. During any rebound, 91.7 levels will act as resistance.

Read More

Read More