CRYPTOCURRENCIES – June 26, 2022

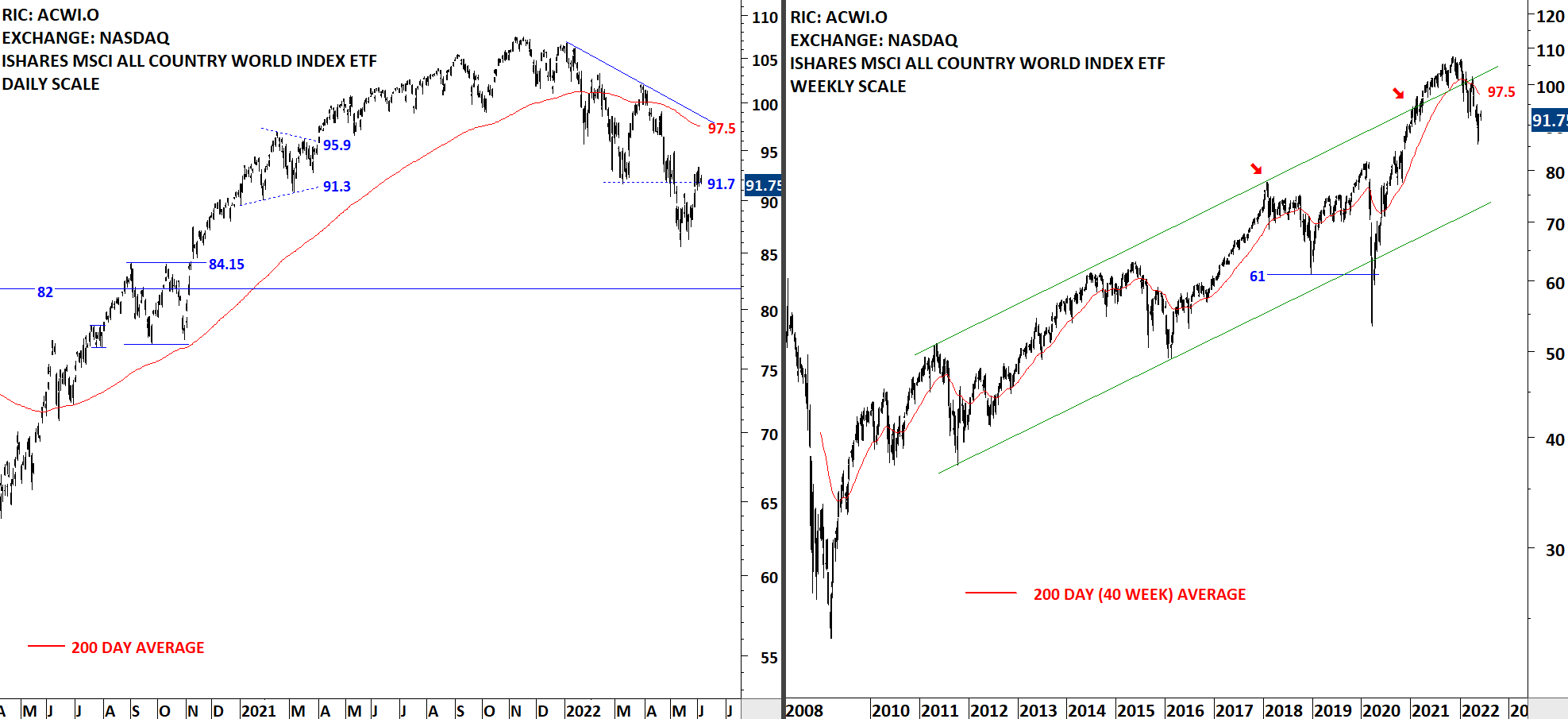

Did we see the bottom in cryptocurrencies or is it just another bear market rebound that will be followed by another leg down? Several pairs experienced rebounds from their minor lows. In this update I'm featuring those that are forming rectangles or possible double bottom reversals. Please bear in mind that prices are clearly below their year-long averages and the trends are down. So any reversal pattern below the long-term averages will likely be choppy and might not produce a strong directional movement.