GLOBAL EQUITY MARKETS – September 17, 2022

/0 Comments/in Premium/by Aksel KibarREVIEW

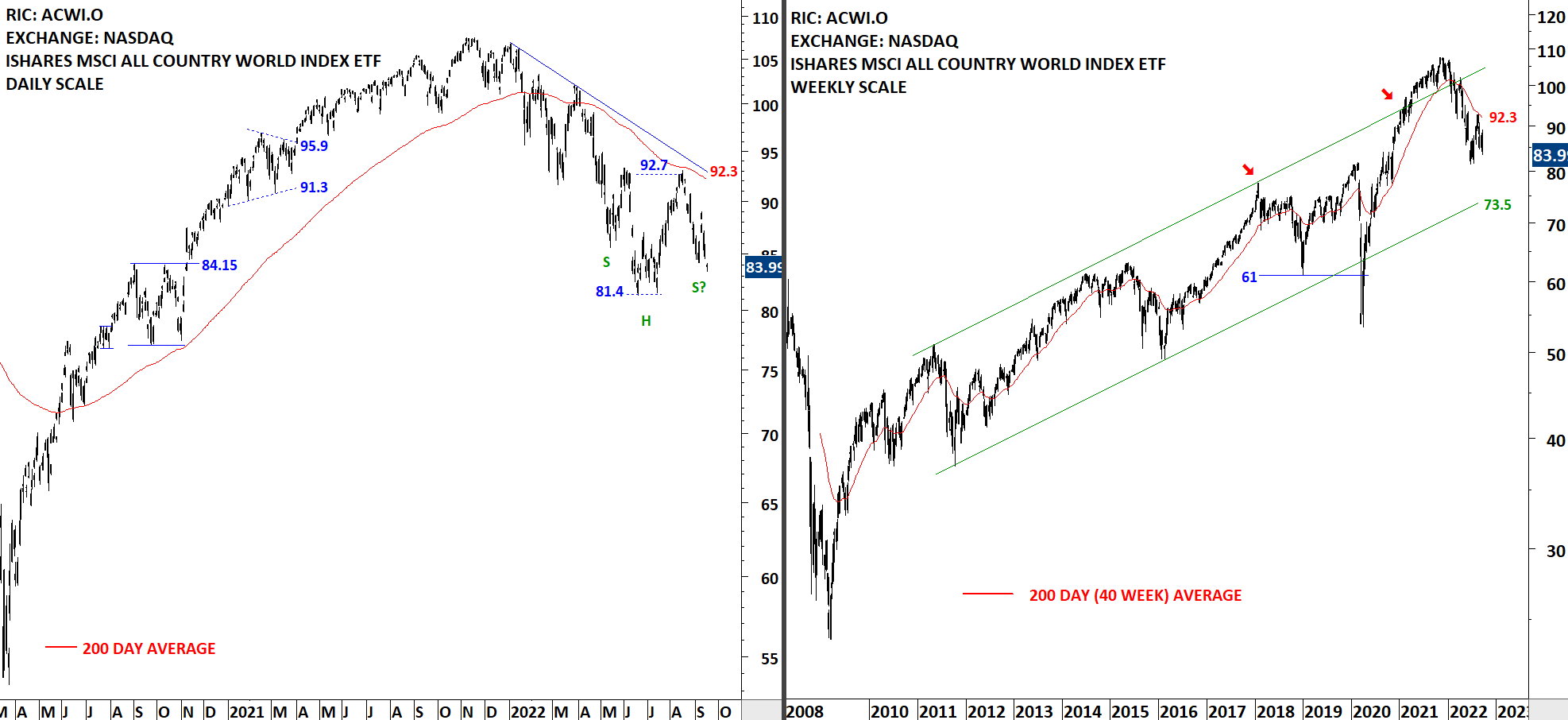

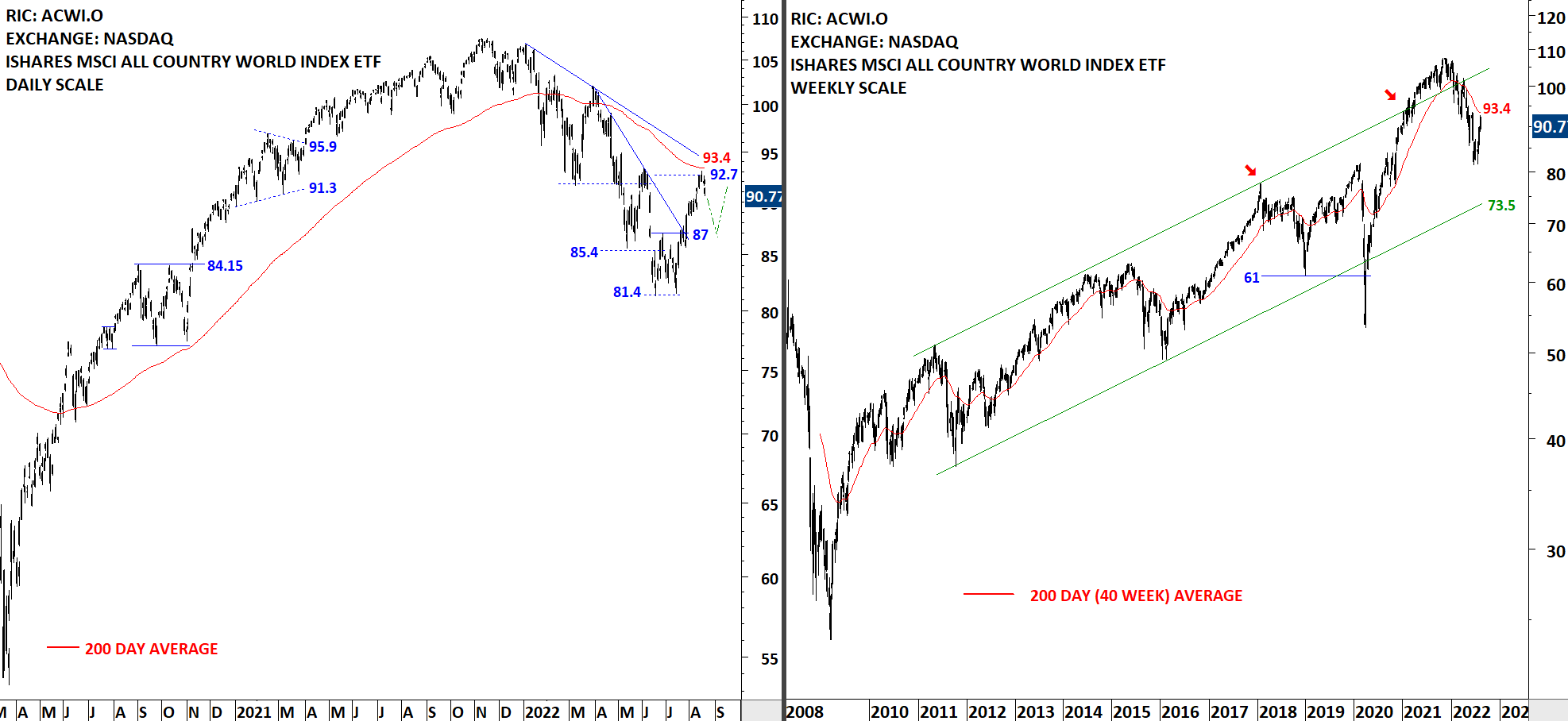

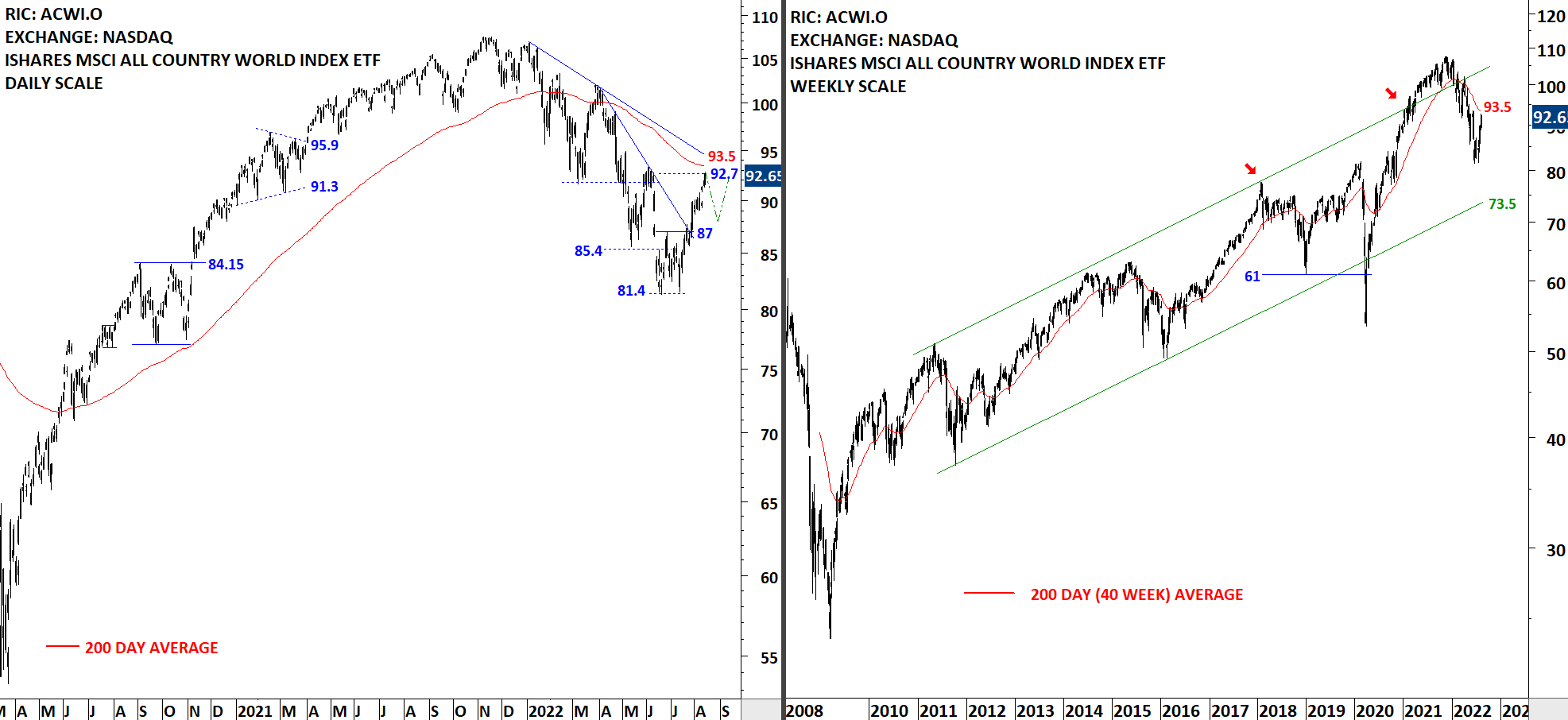

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) remains below its 200-day average which is acting as resistance at 92.3 levels. I've been discussing the possibility of a higher low and a H&S bottom reversal. With right shoulder becoming more and more extended towards the low at 81.4 levels, the probability of a H&S bottom has reduced. We have a wide trading range between 81.4 and 92.3 levels. Chart pattern is possibly morphing. Short-term support is at 81.4 levels.

Read More

Read MoreCRYPTOCURRENCIES – September 11, 2022

/0 Comments/in Premium/by Aksel KibarI'm seeing better defined setups in altcoins than BTC and ETH in the cryptocurrencies. Those altcoins can offer breakouts/breakdowns that can offer trend periods in the coming weeks. In this report we review those setups and the levels for breakouts. Read More

GLOBAL EQUITY MARKETS – September 10, 2022

/3 Comments/in Premium/by Aksel KibarREVIEW

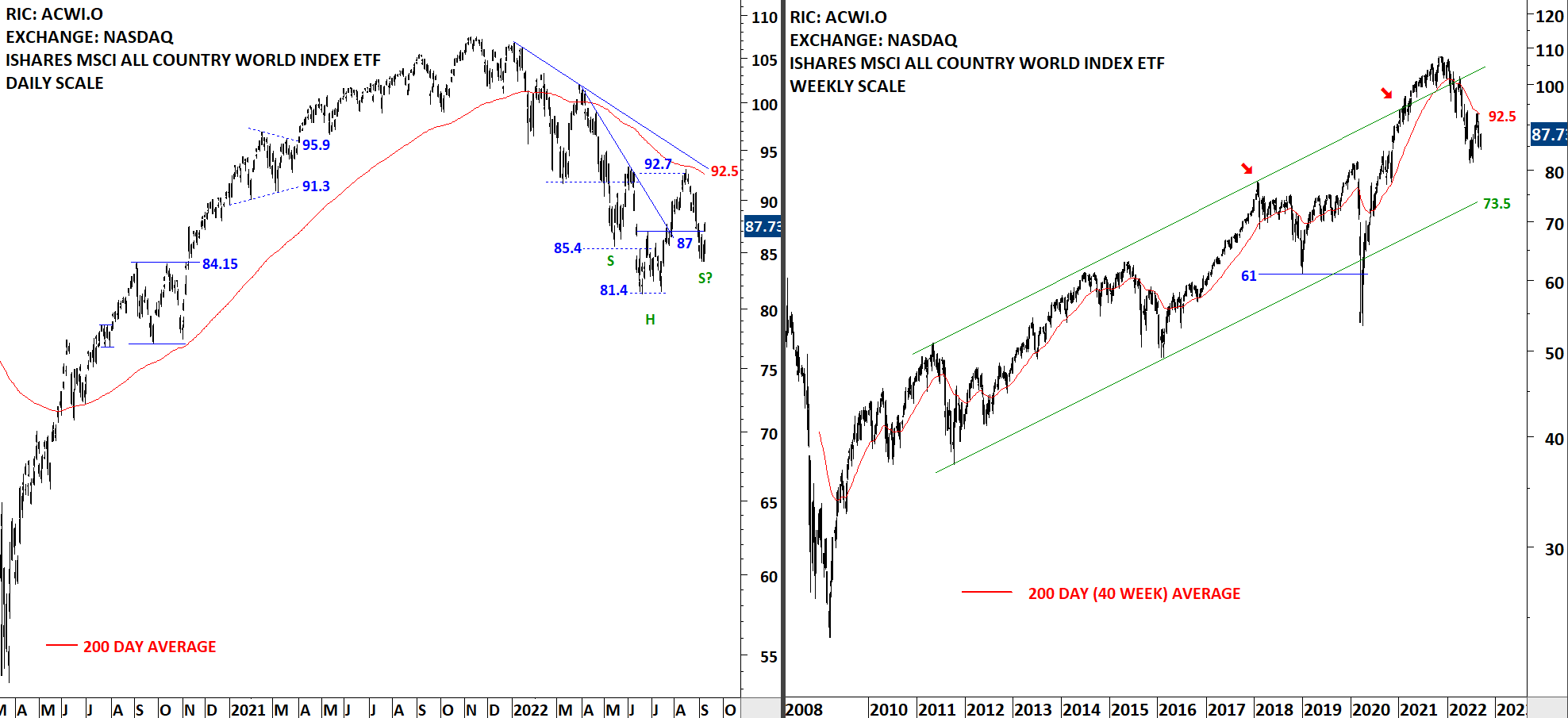

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) remains below its 200-day average which is acting as resistance at 92.5 levels. I've been discussing the possibility of a higher low and a H&S bottom reversal. For that pattern to become better defined, the right shoulder low must be already in and price needs to rally towards the neckline around 92.7 levels. Failure to do so in the following days can resume the downtrend below the long-term average. We have a wide trading range between 81.4 and 92.5 levels.

Read More

Read MoreGLOBAL EQUITY MARKETS – September 3, 2022

/5 Comments/in Premium/by Aksel KibarREVIEW

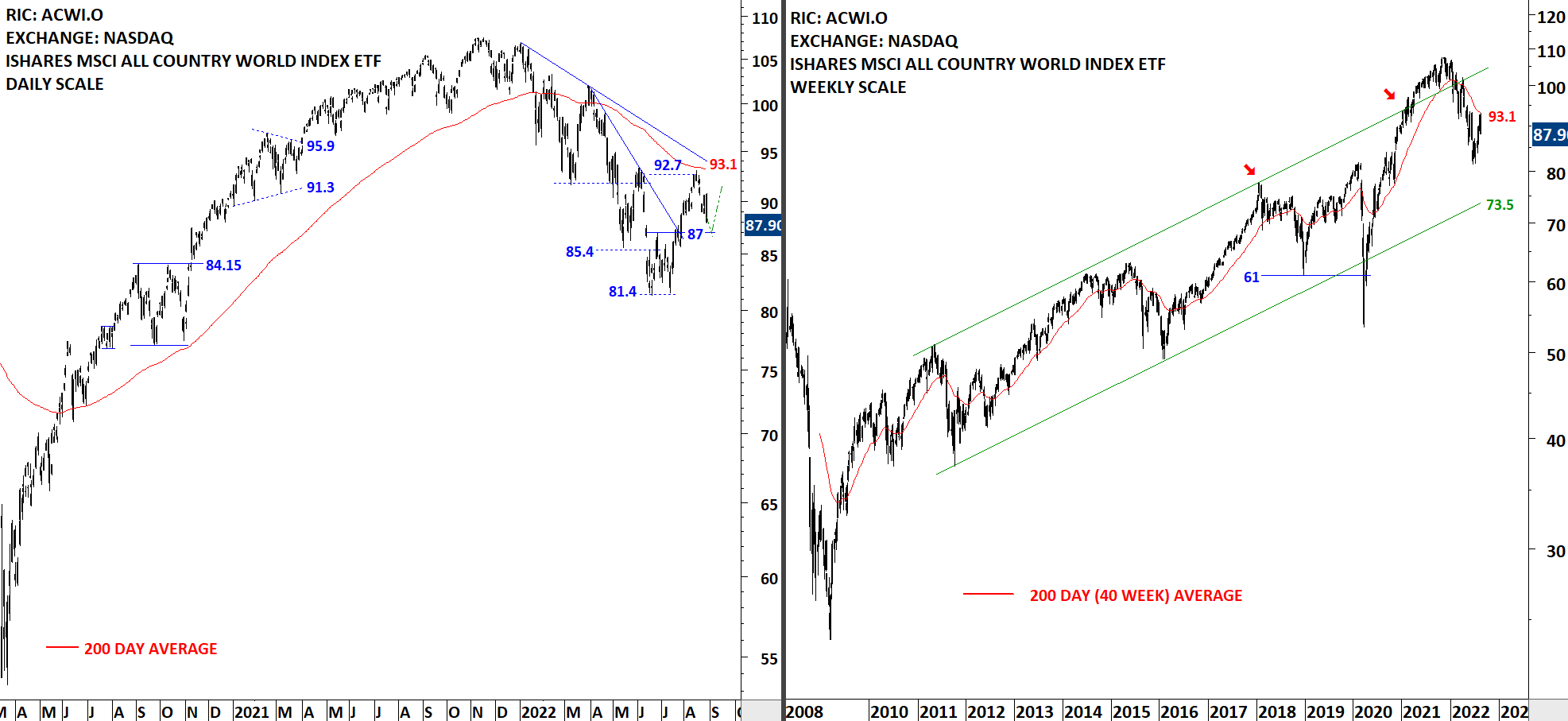

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) remains below its 200-day average. Breakout above 87 levels completed a short-term double bottom and the ETF reached the price target of 92.7 levels. The 200-day average acted as resistance at 93.1 levels. The ETF failed to hold above the neckline at 87 levels. There is still the possibility of a H&S bottom reversal, though not with the symmetry between shoulders. Given the weakness below 87 levels, I view the H&S bottom as a lower probability. Price can test the previous low around 81.4 levels. Downtrend is intact below the 200-day average.

Read More

Read MoreCRYPTOCURRENCIES – August 31, 2022

/3 Comments/in Premium/by Aksel KibarSeveral pairs remain range-bound while BTCUSD continues to trend lower after the breakdown of the possible bear flag. In this update we review some of the well-defined horizontal consolidations. Read More

GLOBAL EQUITY MARKETS – August 27, 2022

/9 Comments/in Premium/by Aksel KibarREVIEW

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) remains below its 200-day average. Breakout above 87 levels completed a short-term double bottom with the price target of 92.7 levels. The 200-day average acted as resistance at 93.1 levels. A text-book H&S bottom reversal can develop if the index completes its pull back around 87 levels to form the possible right shoulder. Such price action will form symmetry between left and right shoulders in both time and price scale. I'm now monitoring how the ETF will perform around 87 levels; the neckline of the previous double bottom.

Read More

Read MoreCRYPTOCURRENCIES – August 21, 2022

/2 Comments/in Premium/by Aksel KibarMixed performance for cryptocurrencies. Sharp reversal on BTCUSD reminds us the bearish outlook once again. Some of the altcoins managed to offer short-term uptrends while others continued to remain rangebound.

GLOBAL EQUITY MARKETS – August 20, 2022

/0 Comments/in Premium/by Aksel KibarREVIEW

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) remains below its 200-day average. Breakout above 87 levels completed a short-term double bottom with the price target of 92.7 levels. The 200-day average is acting as resistance at 93.4 levels. Price target for the short-term double bottom was met. A text-book H&S bottom reversal can develop if the index pulls back towards 87 levels to form the possible right shoulder. For now I monitor the price action around the 200-day average.

Read More

Read MoreGLOBAL EQUITY MARKETS – August 13, 2022

/1 Comment/in Premium/by Aksel KibarREVIEW

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) remains below its 200-day average. Breakout above 87 levels completed a short-term double bottom with the price target of 92.7 levels. The 200-day average is acting as resistance at 93.5 levels. Price target for the short-term double bottom was met during the week. A text-book H&S bottom reversal can develop if the index pauses around the 200-day average and pulls back to form the possible right shoulder. For now I monitor the price action around the 200-day average.

Read More

Read MoreIn Association with:

Latest Posts

GLOBAL EQUITY MARKETS – January 10, 2026January 10, 2026 - 10:14 am

GLOBAL EQUITY MARKETS – January 10, 2026January 10, 2026 - 10:14 am INTERIM UPDATE – January 8, 2026January 8, 2026 - 10:04 pm

INTERIM UPDATE – January 8, 2026January 8, 2026 - 10:04 pm CRYPTOCURRENCIES – January 5, 2026January 5, 2026 - 2:55 pm

CRYPTOCURRENCIES – January 5, 2026January 5, 2026 - 2:55 pm GLOBAL EQUITY MARKETS – January 3, 2026January 3, 2026 - 11:45 am

GLOBAL EQUITY MARKETS – January 3, 2026January 3, 2026 - 11:45 am

Search

As Seen On: