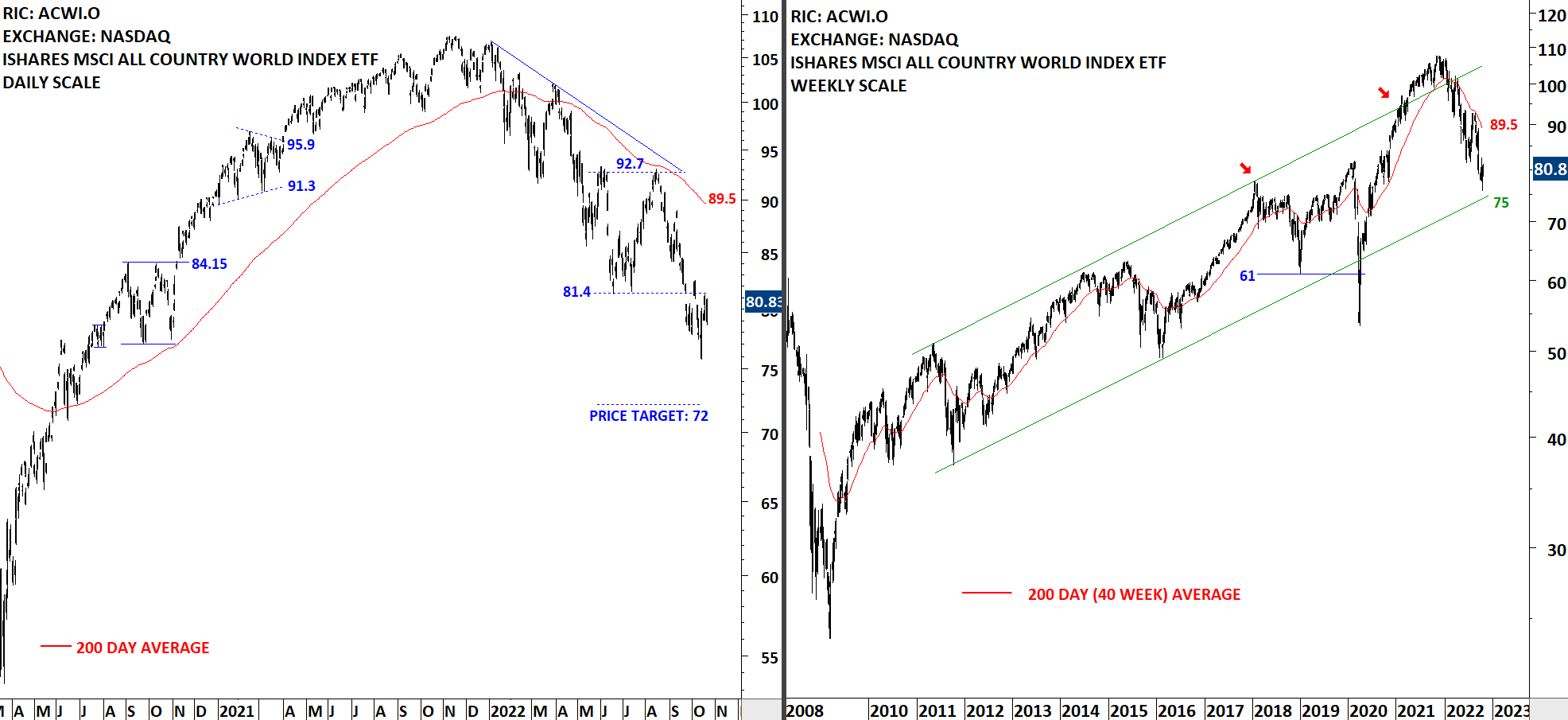

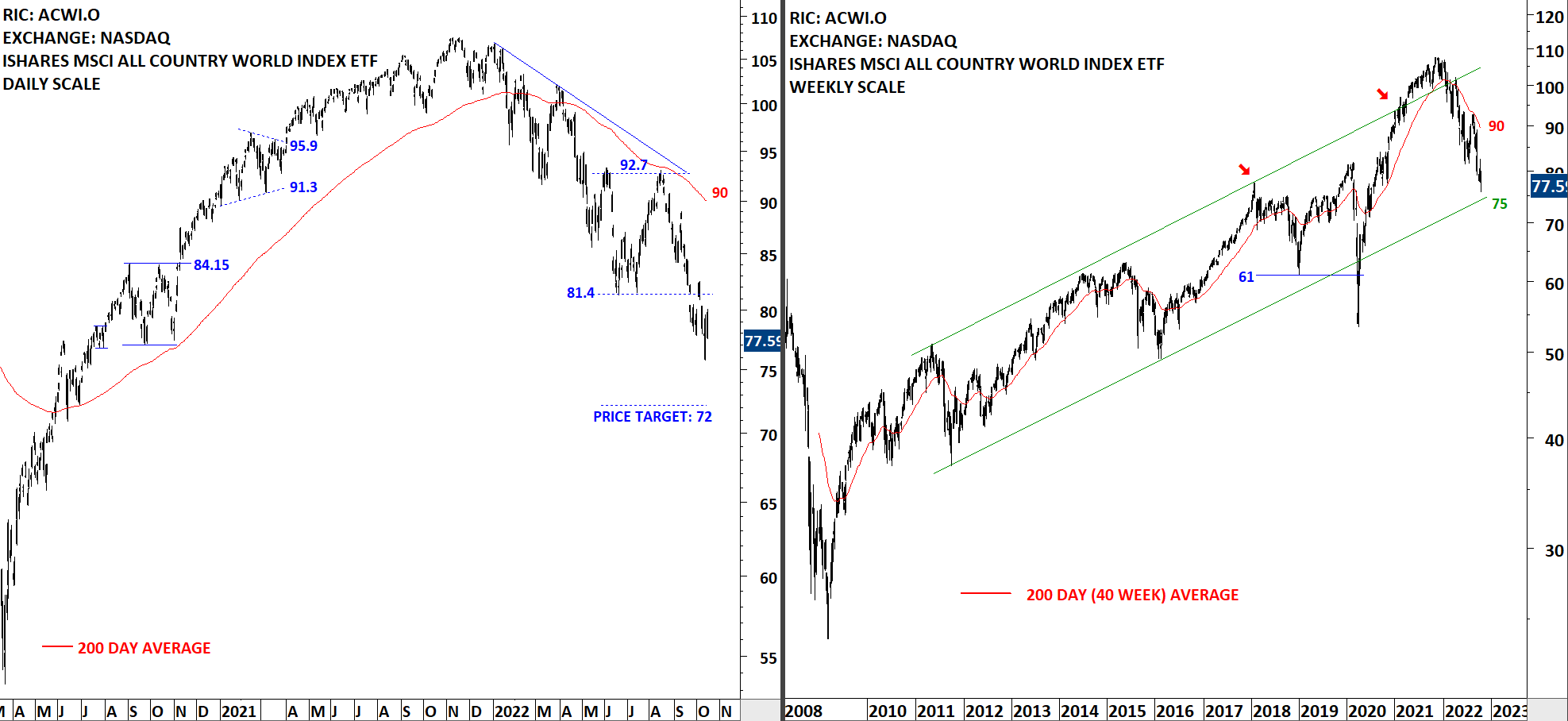

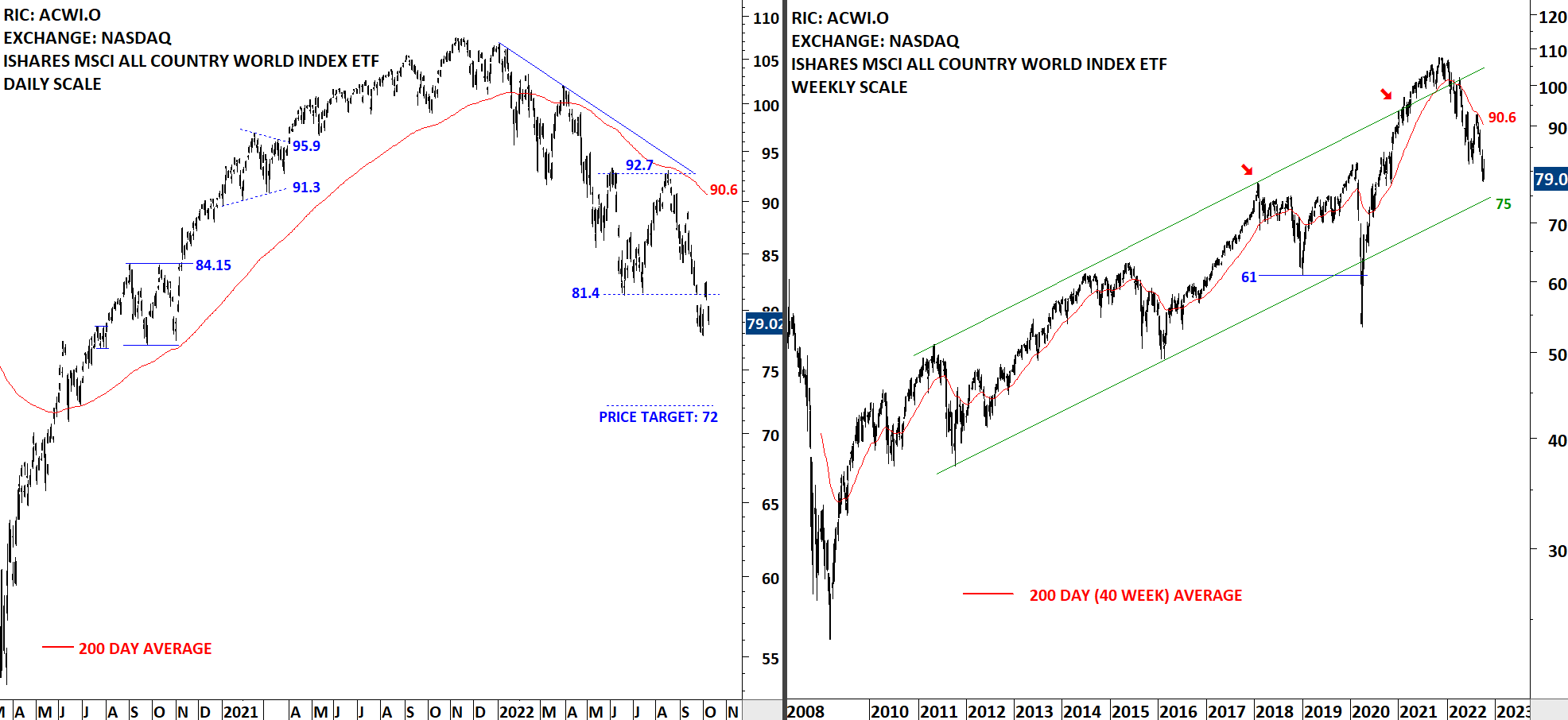

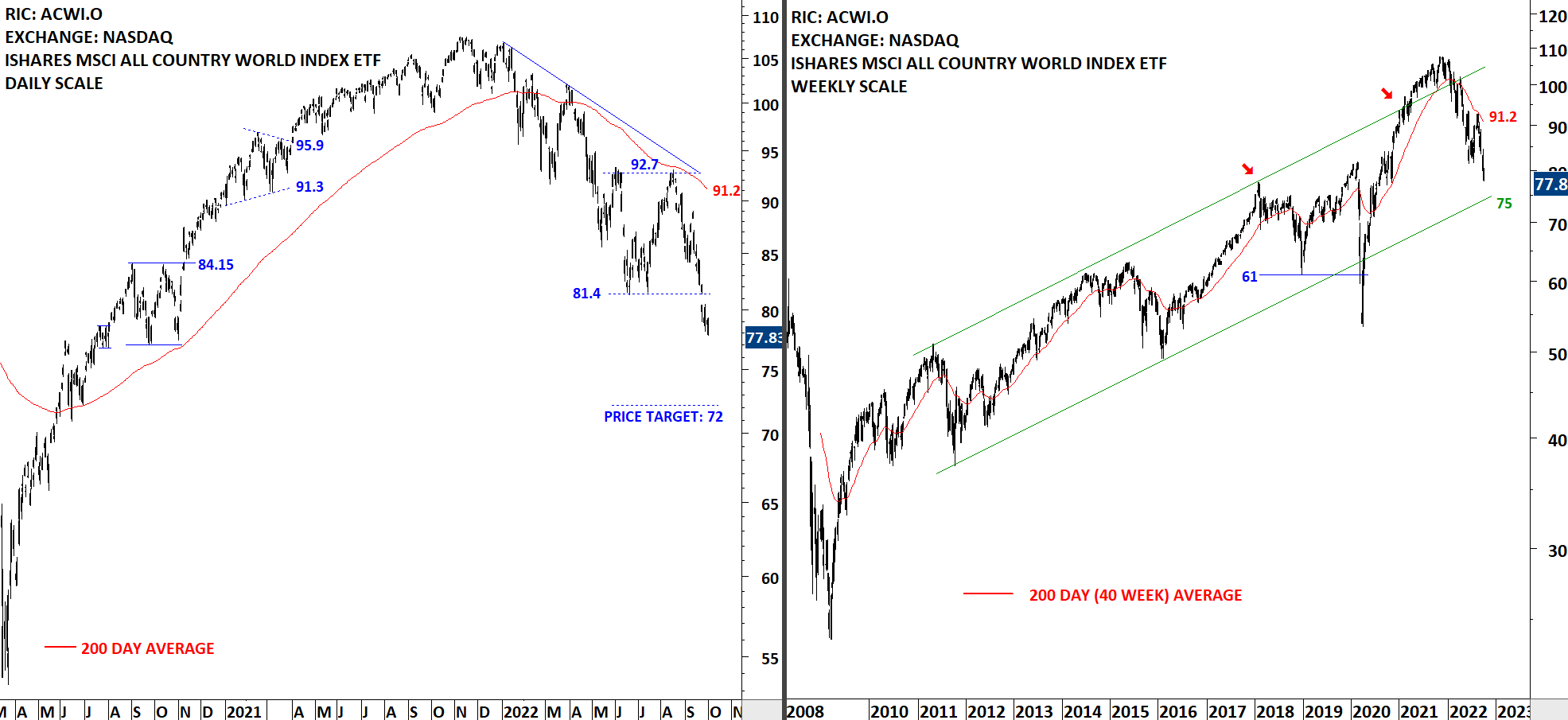

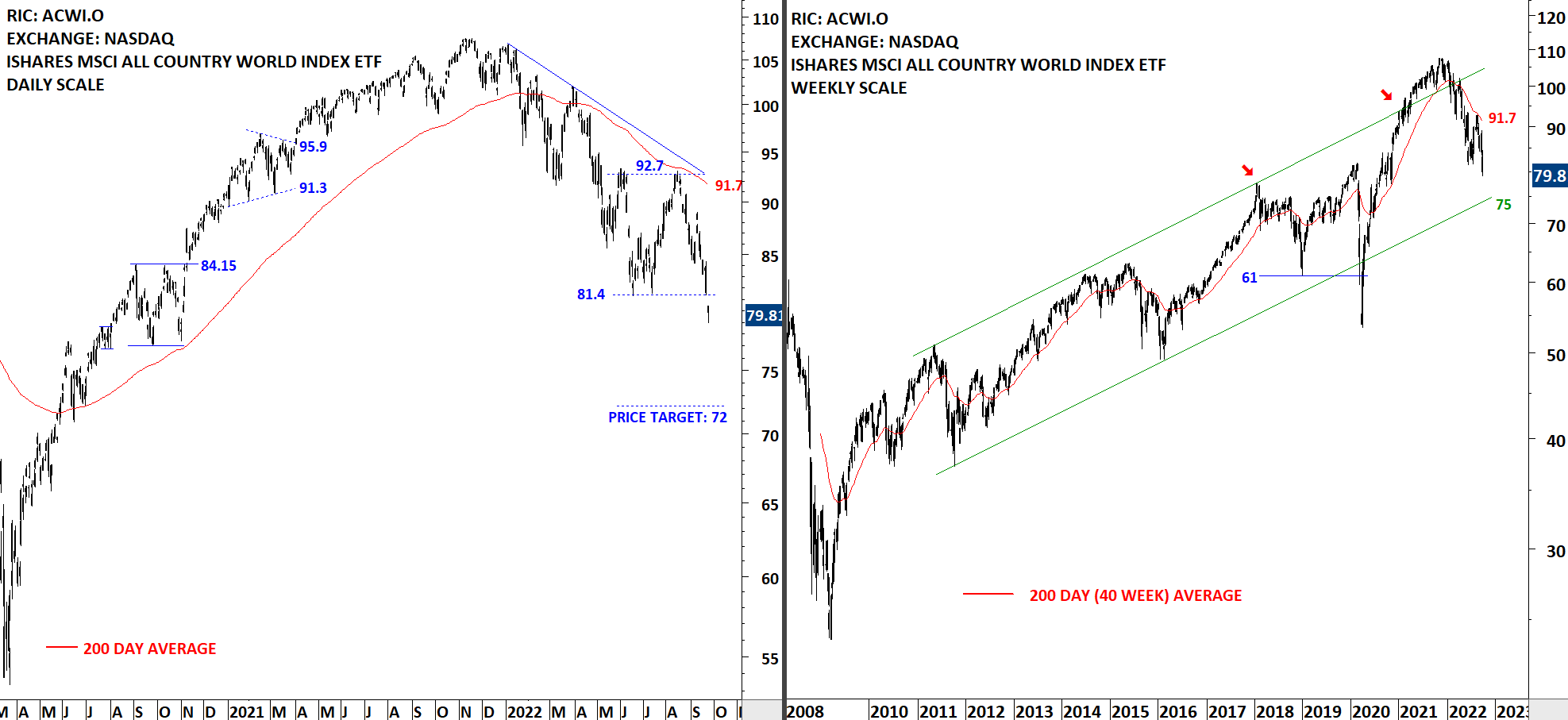

GLOBAL EQUITY MARKETS – October 29, 2022

REVIEW

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) remains below its 200-day average which is acting as resistance at 89.1 levels. The ETF recovered above 81.4 levels. Downtrend is intact. This week's price action possibly completed a short-term reversal chart pattern. Daily charts below analyze the possible short-term reversal.

Read More

Read More