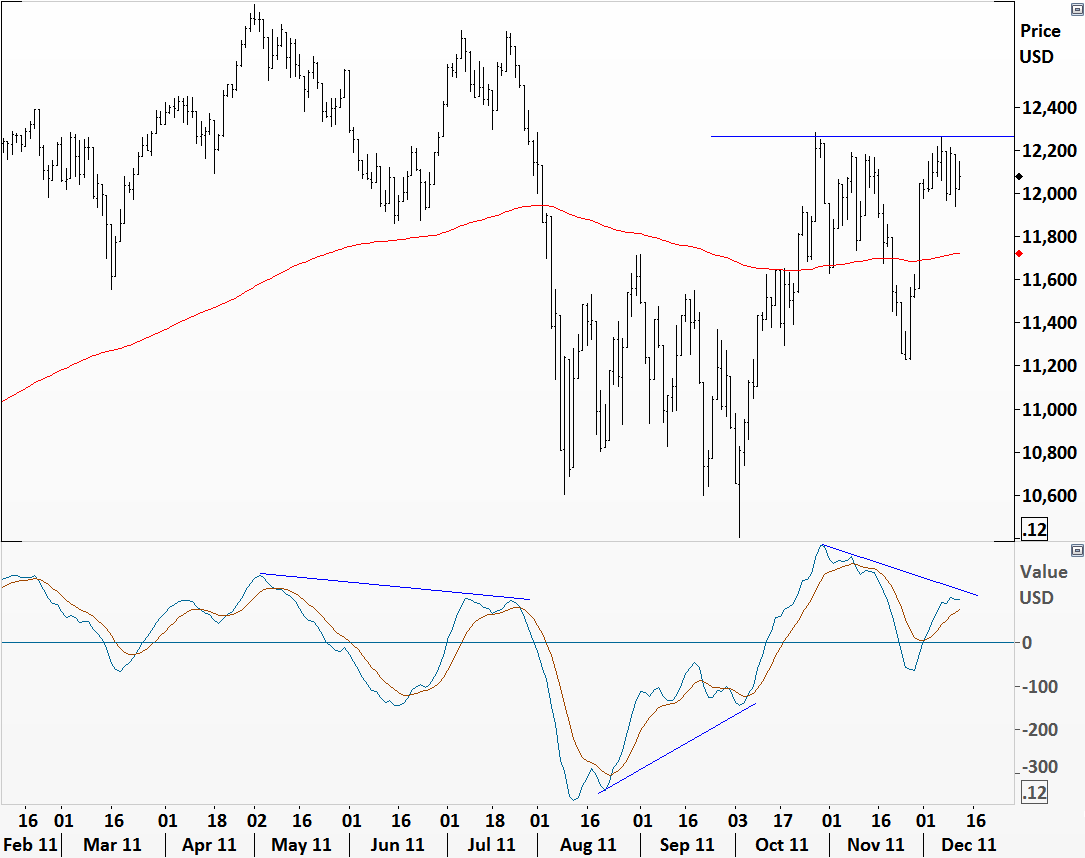

U.S. Unemployment Rate (%)

In August I analyzed the U.S. unemployment rate from a technical perspective. Technical analysts (Chartists), look at pure price information and analyze directional movement. In doing so, they use different technical indicators. Here I’m using 1&2 year moving averages to identify cross-overs. Unemployment in U.S. has peaked around 10% in October 2009 and since then it has fallen towards 8.6%. Moving average cross-over in the beginning of 2011 signaled improving job market for U.S. If we analyze past data we can see that every cross-over was followed by better employment figures for at least one year after the technical signal. Given that the cross-over signal was generated in the beginning of 2011 we can expect better figures in 2012.