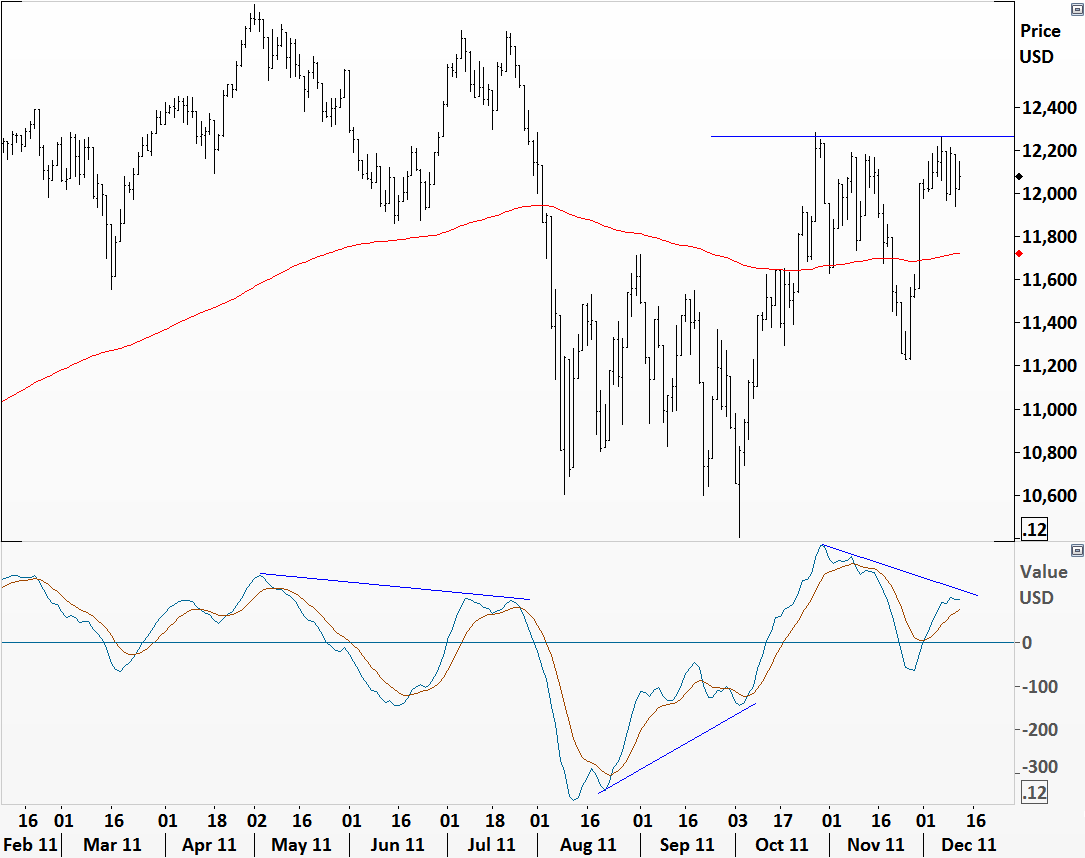

DOW JONES INDUSTRIAL AVERAGE

MACD divergences are great tools to anticipate trend reversals. They are the first warning signal to show the weakness in momentum. When combined with technical support/resistance levels their message could be extremely valuable. Dow Jones Industrial Average has been ranging between 12,800 and 10,600 levels for the past 8 months. MACD warned us before every major market reversal. In July, in October and now… Dow Jones Industrial is now testing a strong resistance at 12,300 levels with a negative divergence. We can conclude that the index will not be able to break above the strong resistance with the current momentum. A sell signal on MACD could pull the Dow Jones Industrial Average lower towards its 200 day moving average at 11,700 levels. Equities are having difficulty to move higher. This is bearish for equities…