U.S. BANKING STOCKS

Up trends are still intact on the financial stocks in the U.S. A quick look at U.S. banking stocks can help us put things into perspective on the medium/long-term charts. This update reviews 6 different U.S. commercial banks. As you go through the charts of these commerical banking stocks you will find similar technical outlook as outlined below.

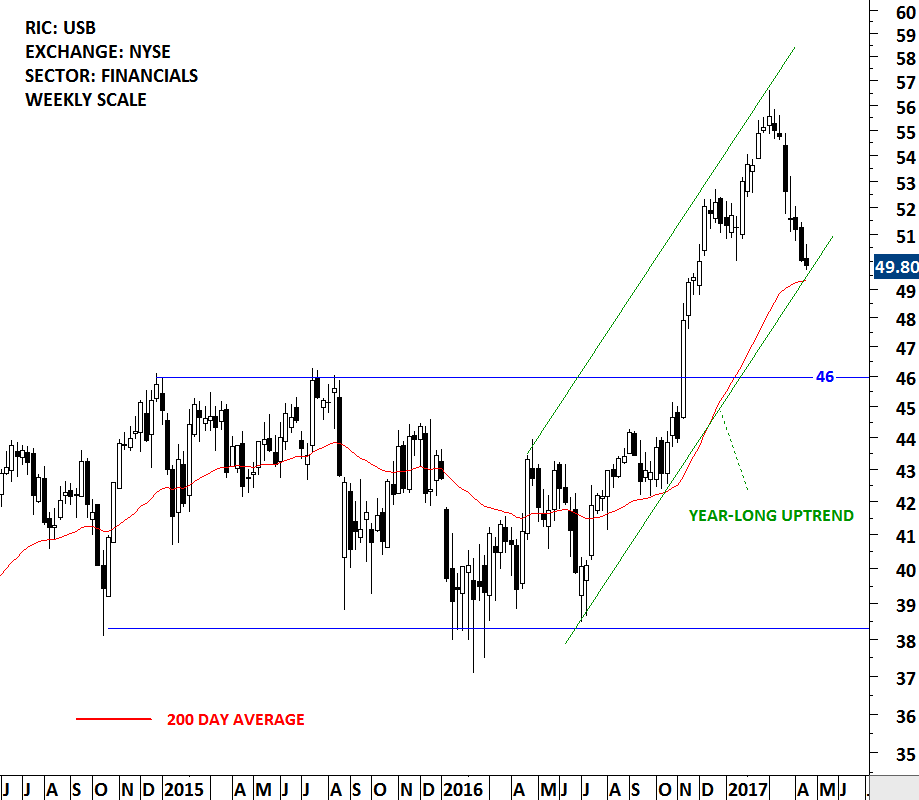

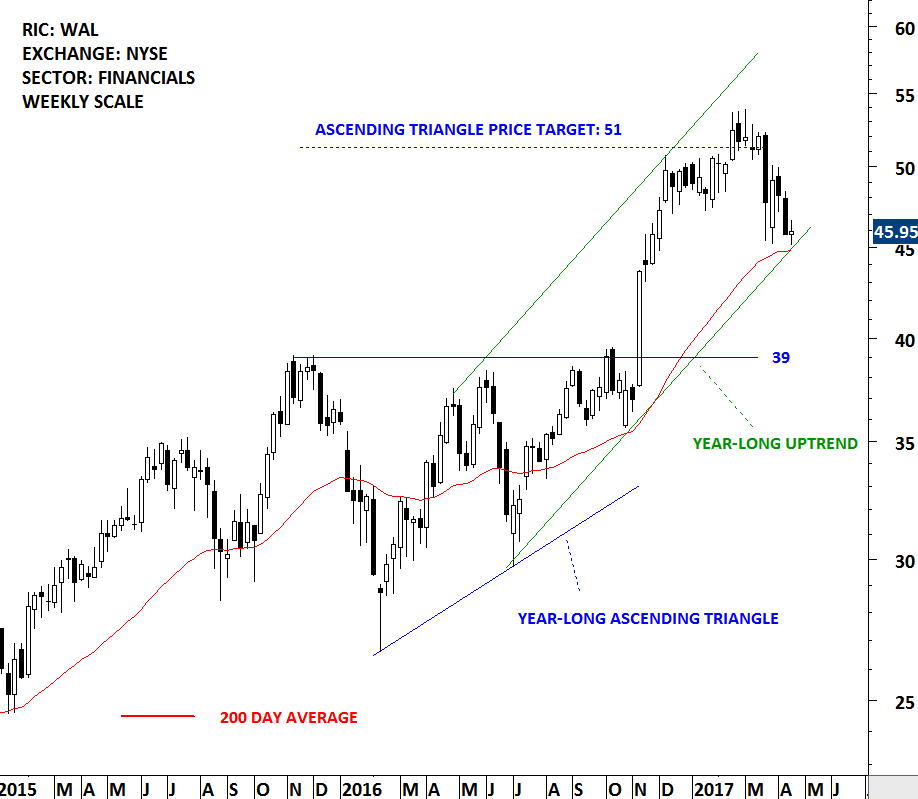

- In November 2016, following the U.S. election, all of these names had strong breakouts from lengthy consolidation periods.

- Most of the names have reached their chart pattern price targets.

- Since the beginning of 2016, all of the charts analyzed have formed consistent up trends as identified by parallel trend channels.

- Over the past 3 months, all of the names have pulled back to their 200-day averages.

Lower boundaries of parallel trend channels and long-term moving averages are usually strong technical support levels. Until the year-long up trends are broken down and 200-day moving averages are breached on the downside, we should expect the up trends to resume on these U.S. commercial banks.

U.S. BANCORP (USB)

BANK OF NEW YORK MELLON CORP (BK)

SUN TRUST BANKS INC (STI)

WESTERN ALLIANCE BANCORP (WAL)

BANCORPSOUTH INC (BXS)

GLACIER BANCORP INC (GBCI.O)