CHINA SSE 50 INDEX & CHINA GDP

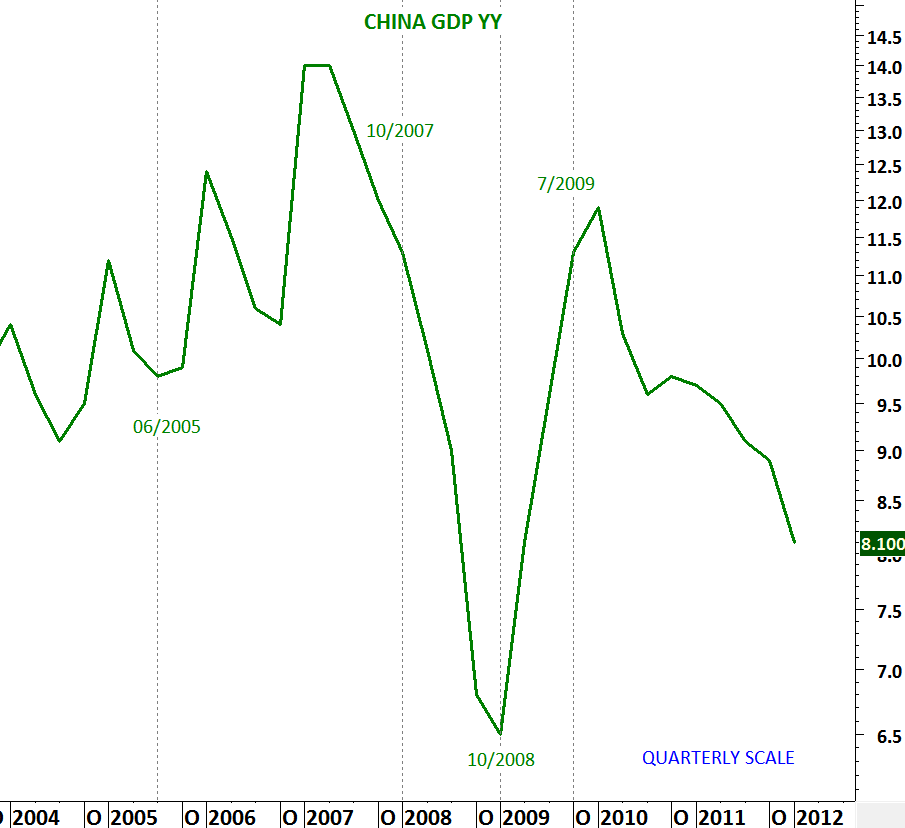

Yesterday markets were strong with the expectation of a better than expected Chinese GDP data for the Q1. Today markets were disappointed by the worse than expected data at 8.1% for the quarter. Expectation was around 8.3%-8.5% but 8.1% growth was clearly below expectations. Q4 2011 growth was at 8.9%. This is the lowest growth in almost 3 years and from the chart below you can see the downtrend over the past three years.

In this post I’m analyzing the China SSE 50 Index and the quarterly GDP growth for China. The two charts are self illustrative with their correlation and trending periods. Downtrends on the equity markets were accompanied by lower growth and vice versa. Major trend reversals (in this case price breaking above/below long-term moving average) on the equity index was a good indicator and confirmation of better/worse GDP growth.

Given that the SSE 50 Index is trending lower in a clear parallel trend channel since mid-2009, expecting a downward trend on GDP is reasonable. Though anticipating a reversal on GDP is more difficult. For this reason I will use SSE 50 Index as a leading indicator or a confirming indicator to expect higher growth in the world’s second biggest economy. Both 1 year-long moving average and the upper boundary of the downward trend channel are overlapping between 1,800 and 1,900, making this area a strong resistance. Before we see SSE 50 Index breaking above this resistance we should expect weak growth. We need to see confirmation in equity markets that usually anticipates the future of the economy.

Given that the SSE 50 Index is trending lower in a clear parallel trend channel since mid-2009, expecting a downward trend on GDP is reasonable. Though anticipating a reversal on GDP is more difficult. For this reason I will use SSE 50 Index as a leading indicator or a confirming indicator to expect higher growth in the world’s second biggest economy. Both 1 year-long moving average and the upper boundary of the downward trend channel are overlapping between 1,800 and 1,900, making this area a strong resistance. Before we see SSE 50 Index breaking above this resistance we should expect weak growth. We need to see confirmation in equity markets that usually anticipates the future of the economy.