GLOBAL EQUITY MARKETS – November 24, 2018

REVIEW

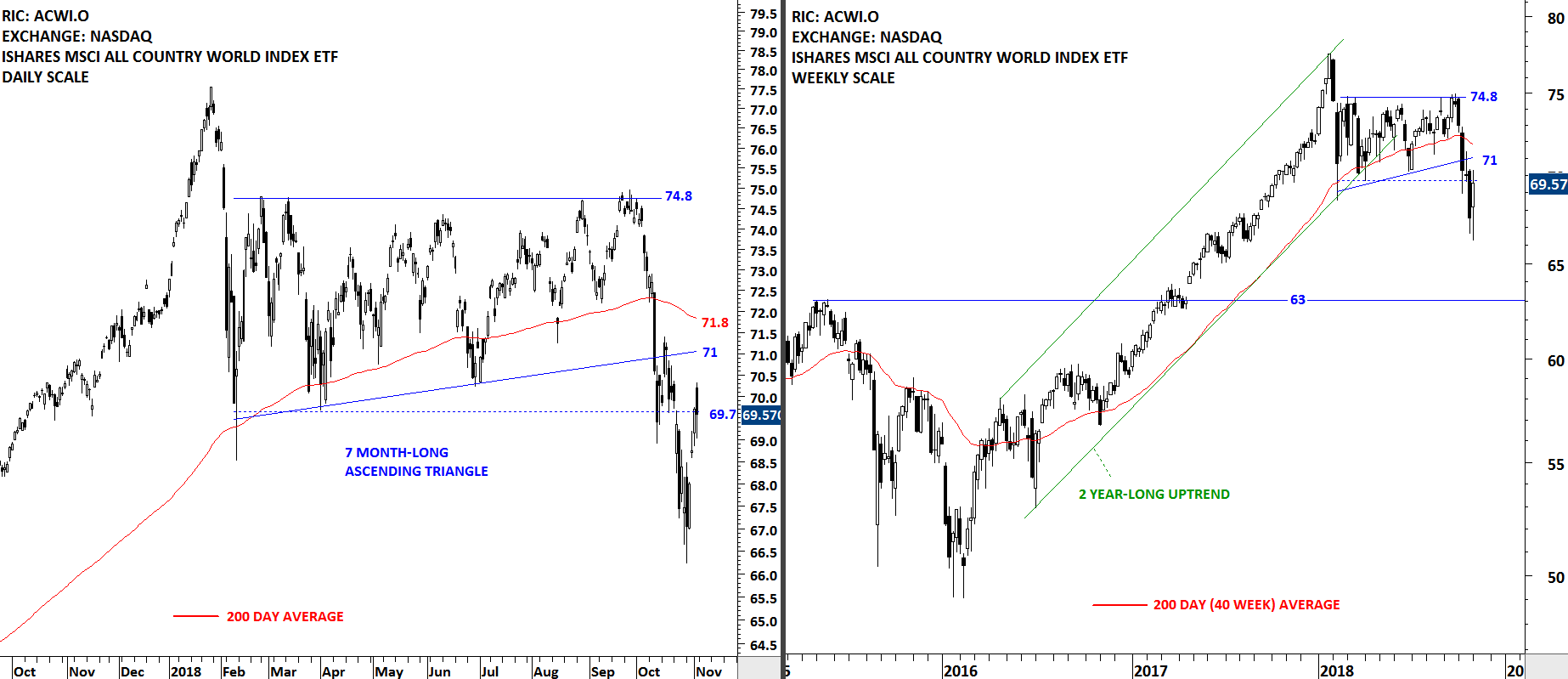

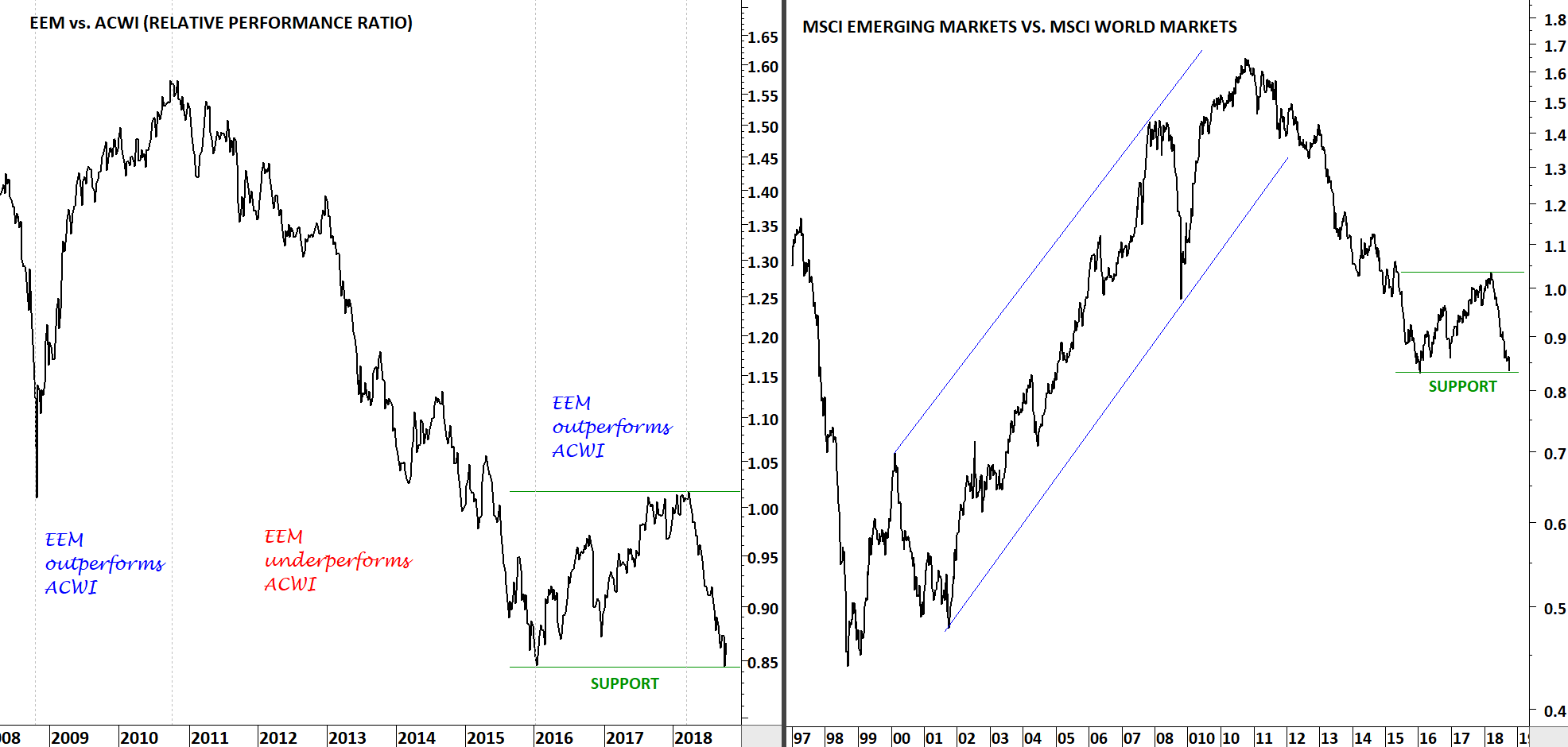

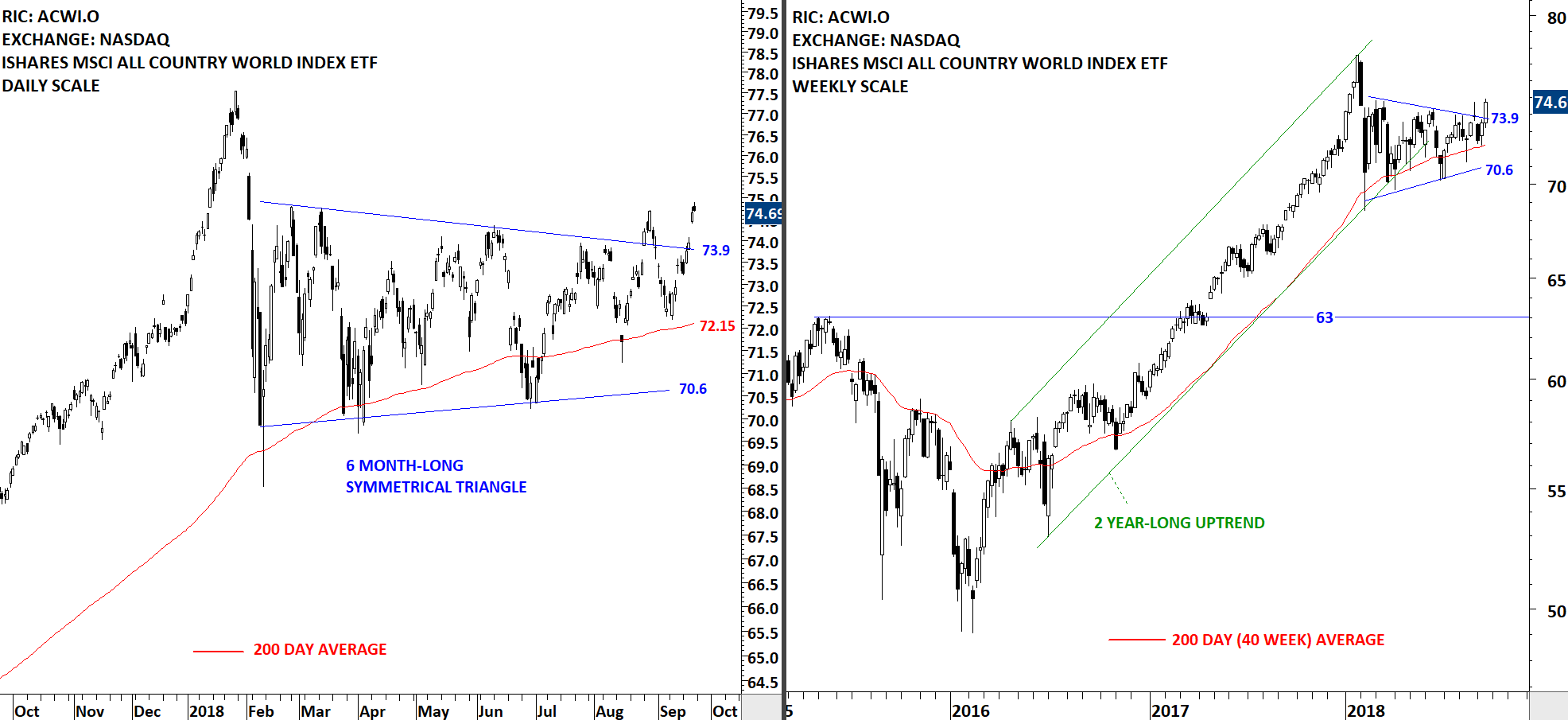

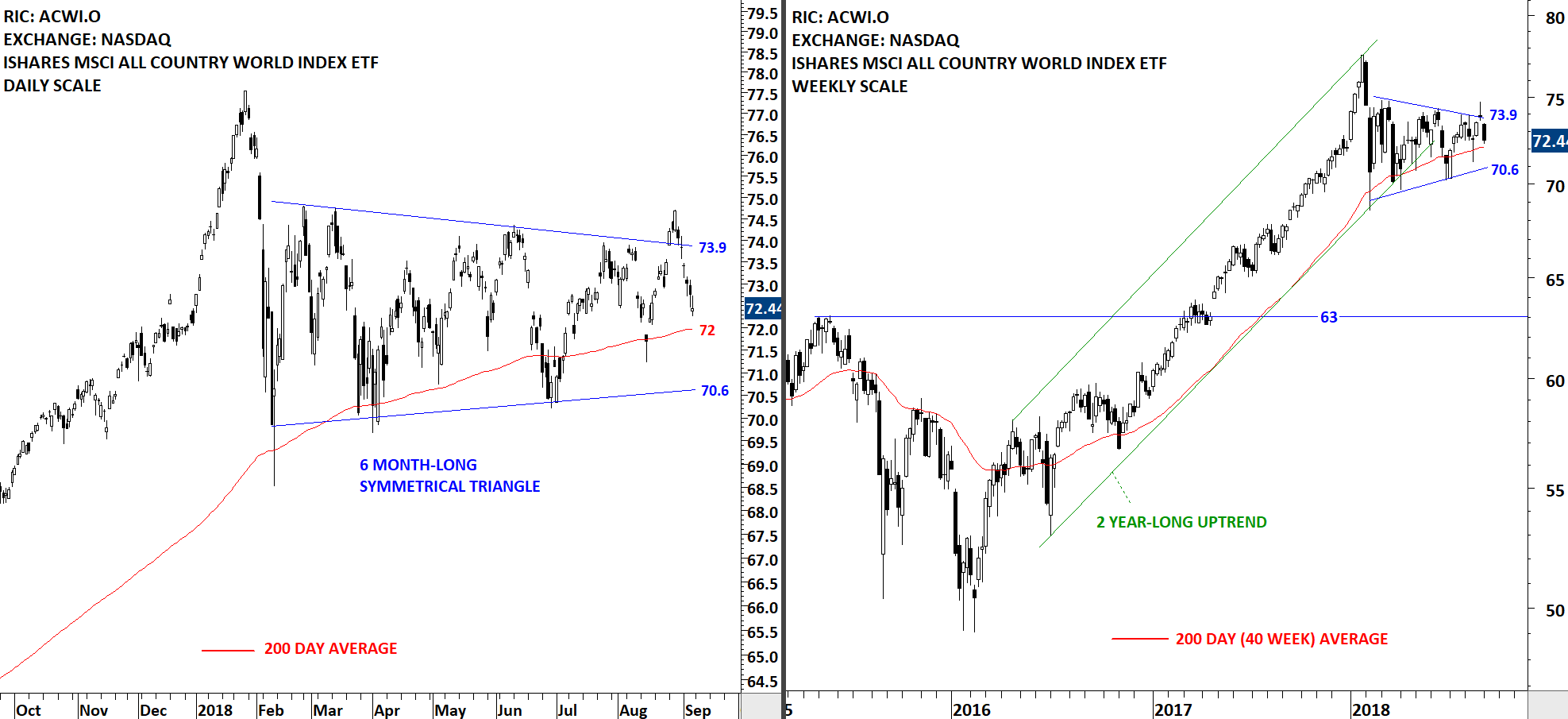

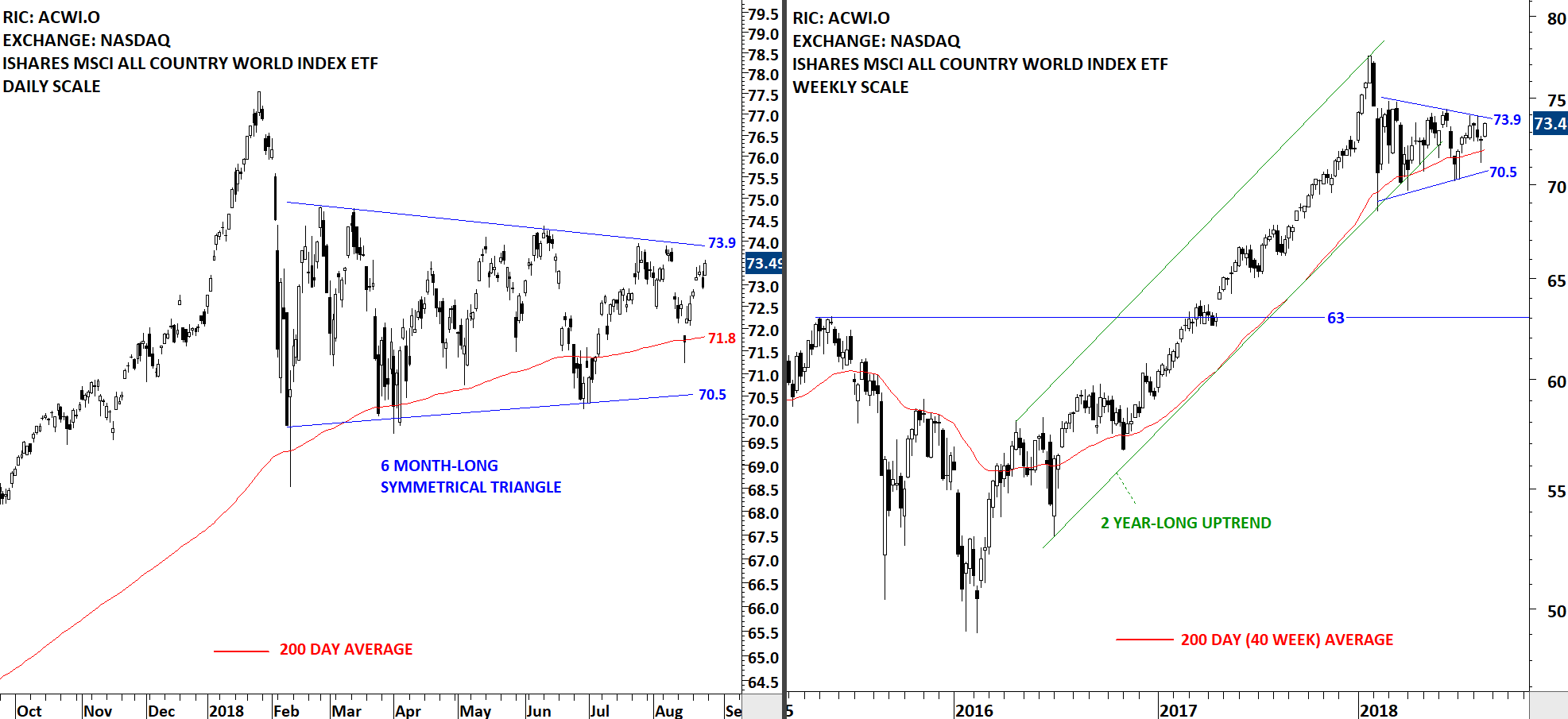

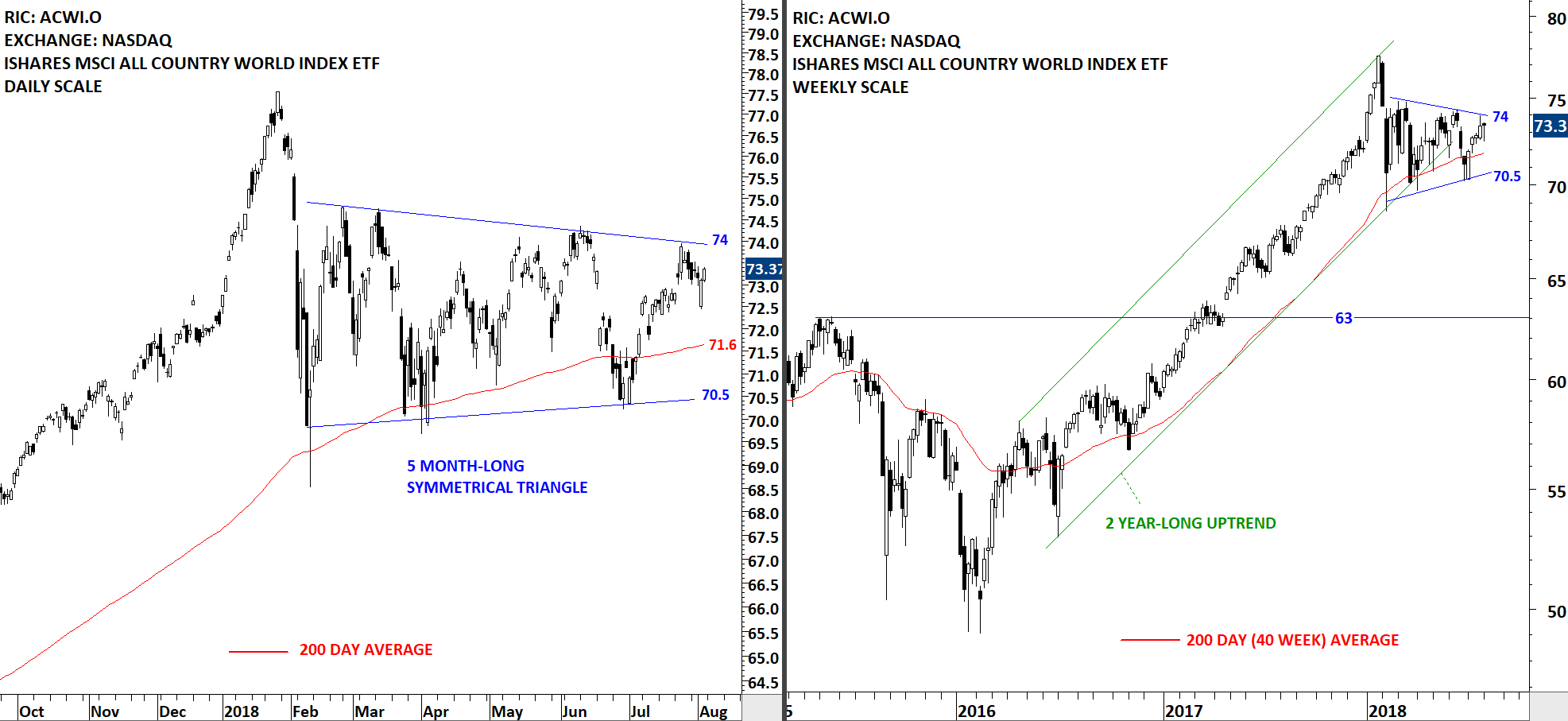

The longer the price remains below the long-term averages the more established that downtrend will become. The benchmark for the Global Equity Markets performance, iShares MSCI All Country World Index ETF (ACWI.O) broke down the lower boundary of its multi-month long consolidation and its long-term average around same time. Sharp sell-off was followed by a pullback to the chart pattern boundary. This week's price action resumed the downtrend. The minor low around October lows (66) will act as short-term support. Breakdown below the October lows can send the ACWI ETF towards the next support level at 63 levels. Strong resistance area remains between 71 and 71.5 levels. Until we see a recovery above the resistance area (71-71.5), we will expect the weakness to resume in the Global Equity Markets.

Read More

Read More