GLOBAL EQUITY MARKETS – May 19, 2018

REVIEW

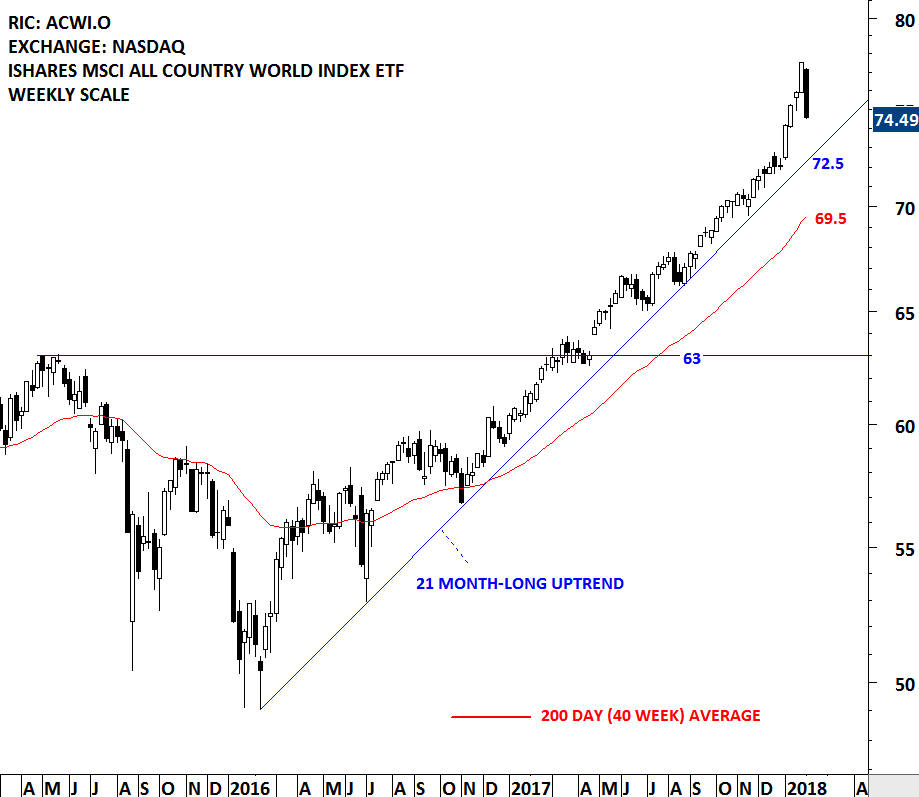

We are seeing a decoupling in terms of performance in the Global Equity Markets. Developed markets continue to remain strong whereas Emerging markets start to weaken. The charts below show both the iShares MSCI All Country World Index ETF and the iShares MSCI Emerging Markets Index ETF in a steady uptrend. However, over the past few weeks, the iShares MSCI All Country World Index ETF managed to rebound from its long-term average but the iShares MSCI Emerging Markets Index ETF struggled around the strong support area. Failure to recover from strong support area can result in a breakdown and larger scale correction for the Emerging Markets. The iShares MSCI Emerging Markets Index ETF is testing the 200-day (40 week) moving average.

Read More

Read More

I really enjoyed our conversation with Caroline Stephen, the host of Talking Trading. We discussed Technical Analysis, Classical Charting and my charting and trading experience in the Middle East & North Africa markets.

I really enjoyed our conversation with Caroline Stephen, the host of Talking Trading. We discussed Technical Analysis, Classical Charting and my charting and trading experience in the Middle East & North Africa markets.