GLOBAL EQUITY MARKETS – June 22, 2019

REVIEW

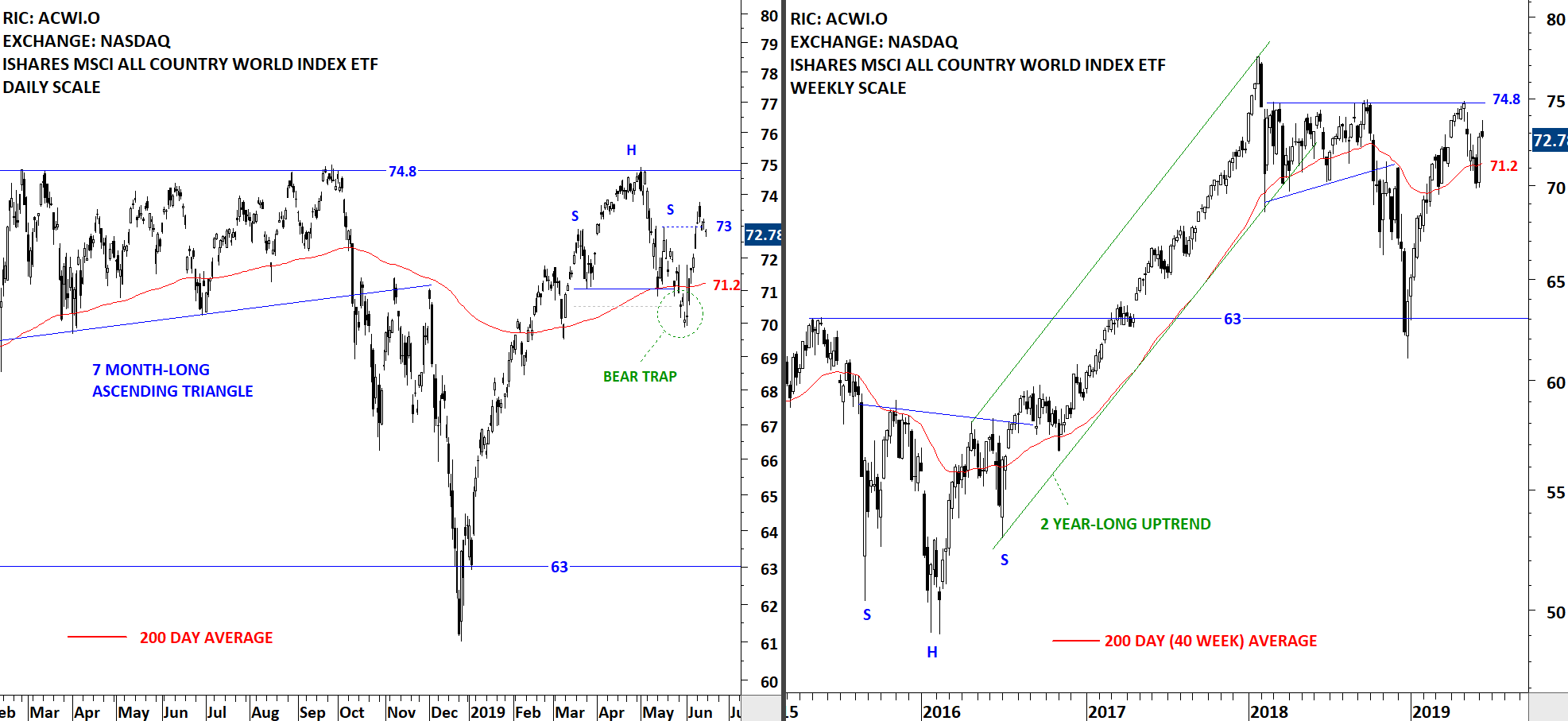

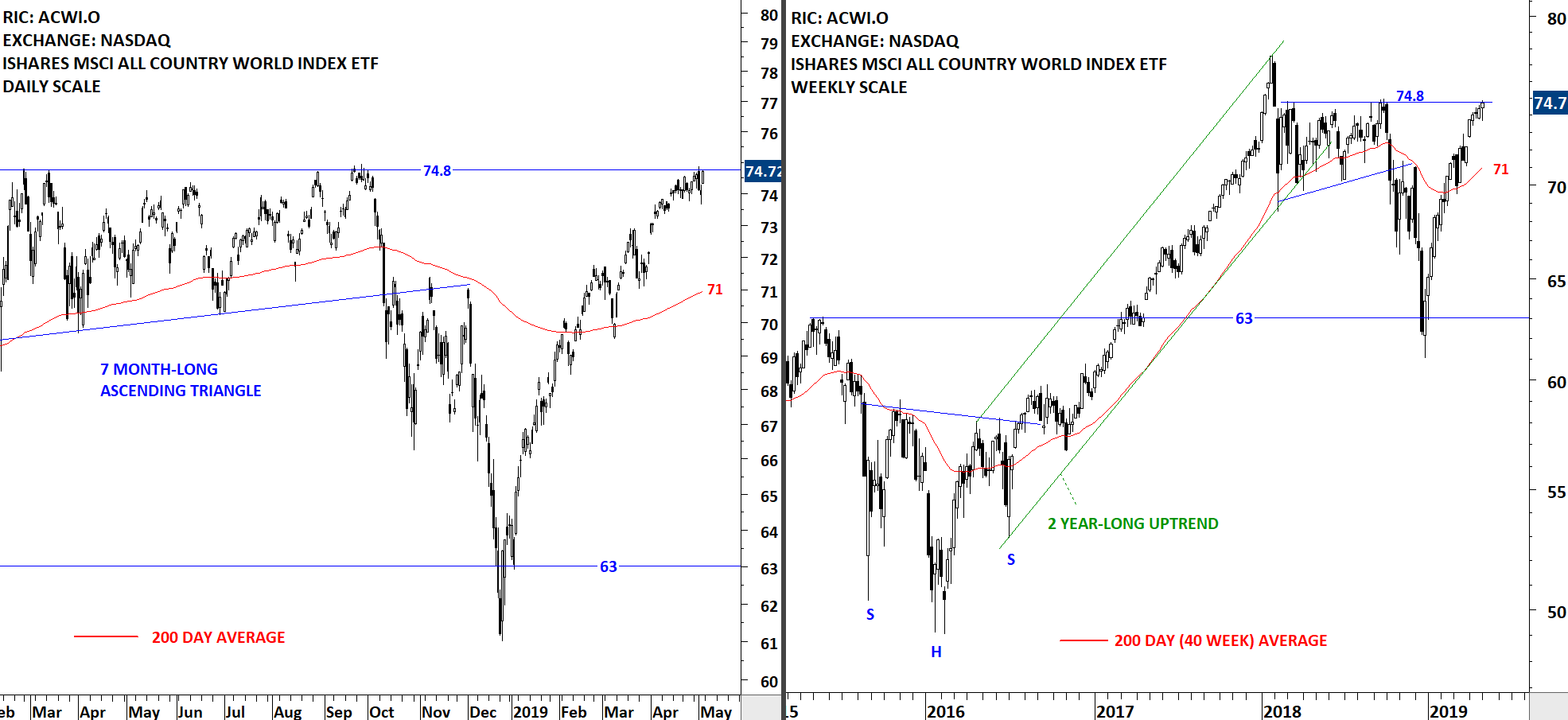

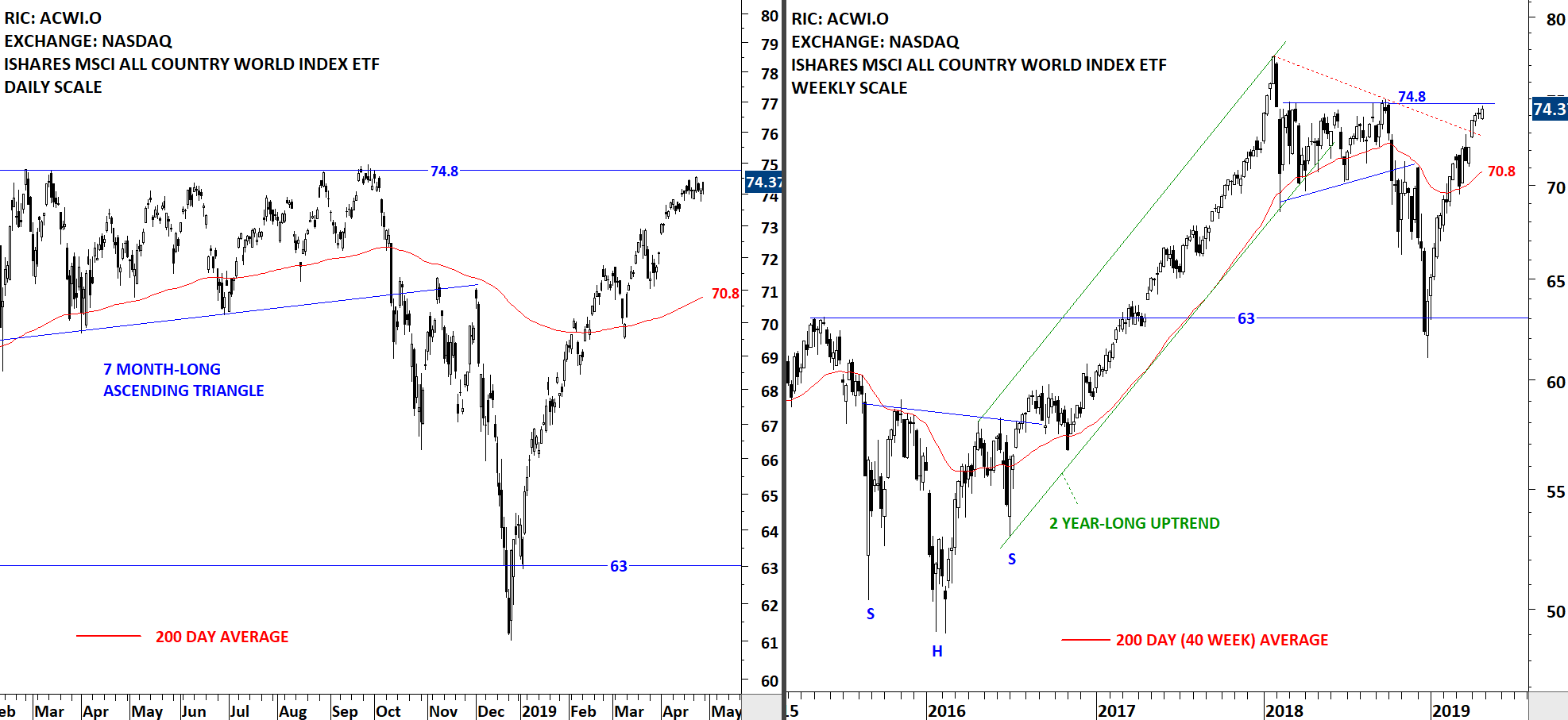

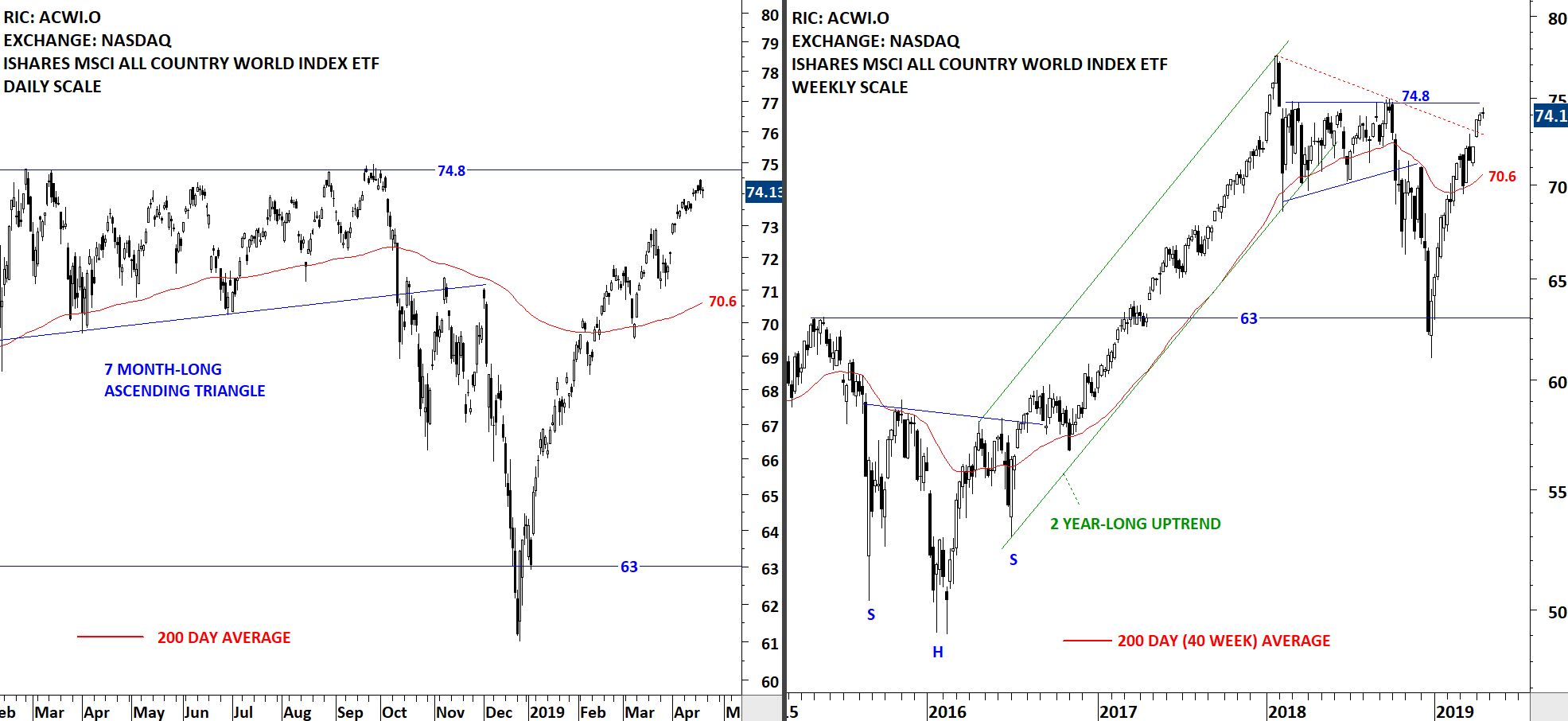

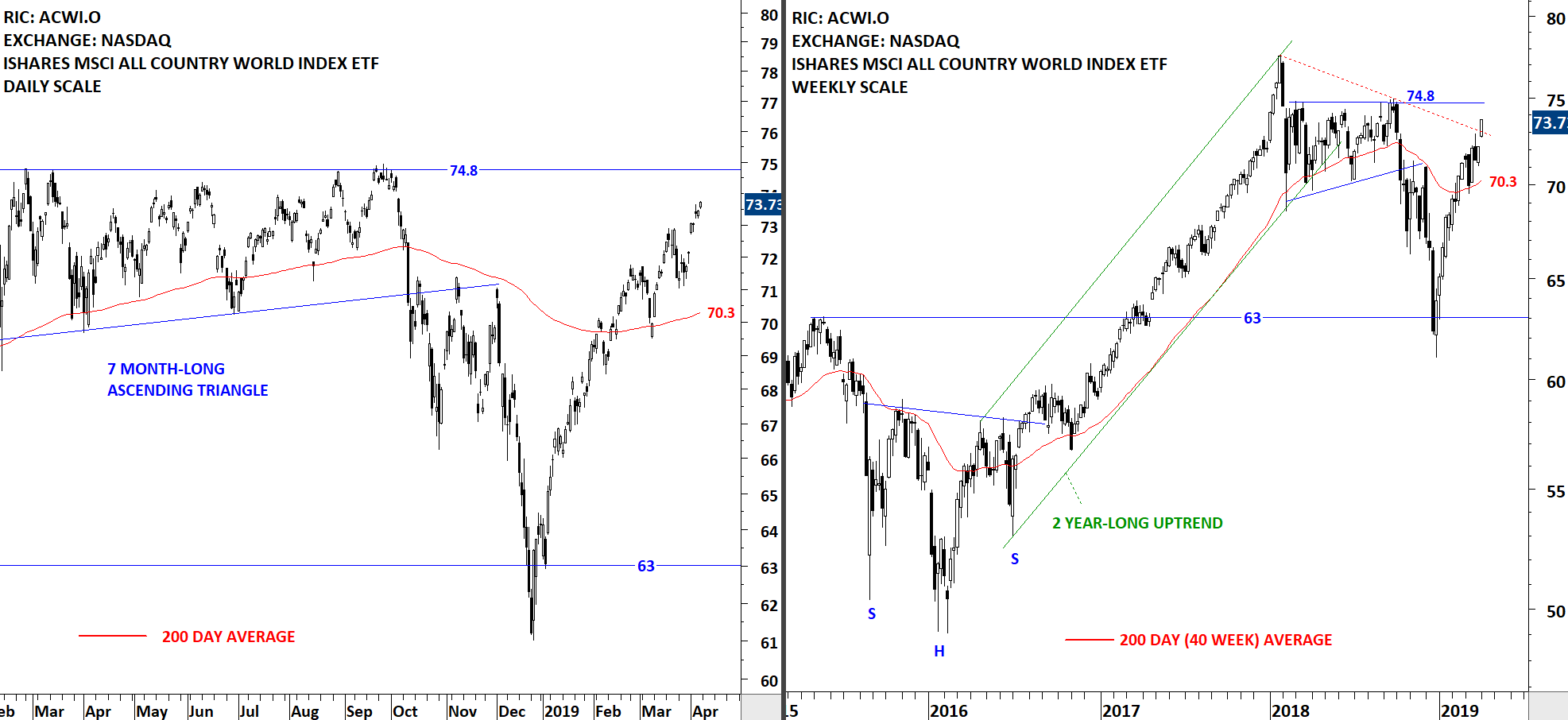

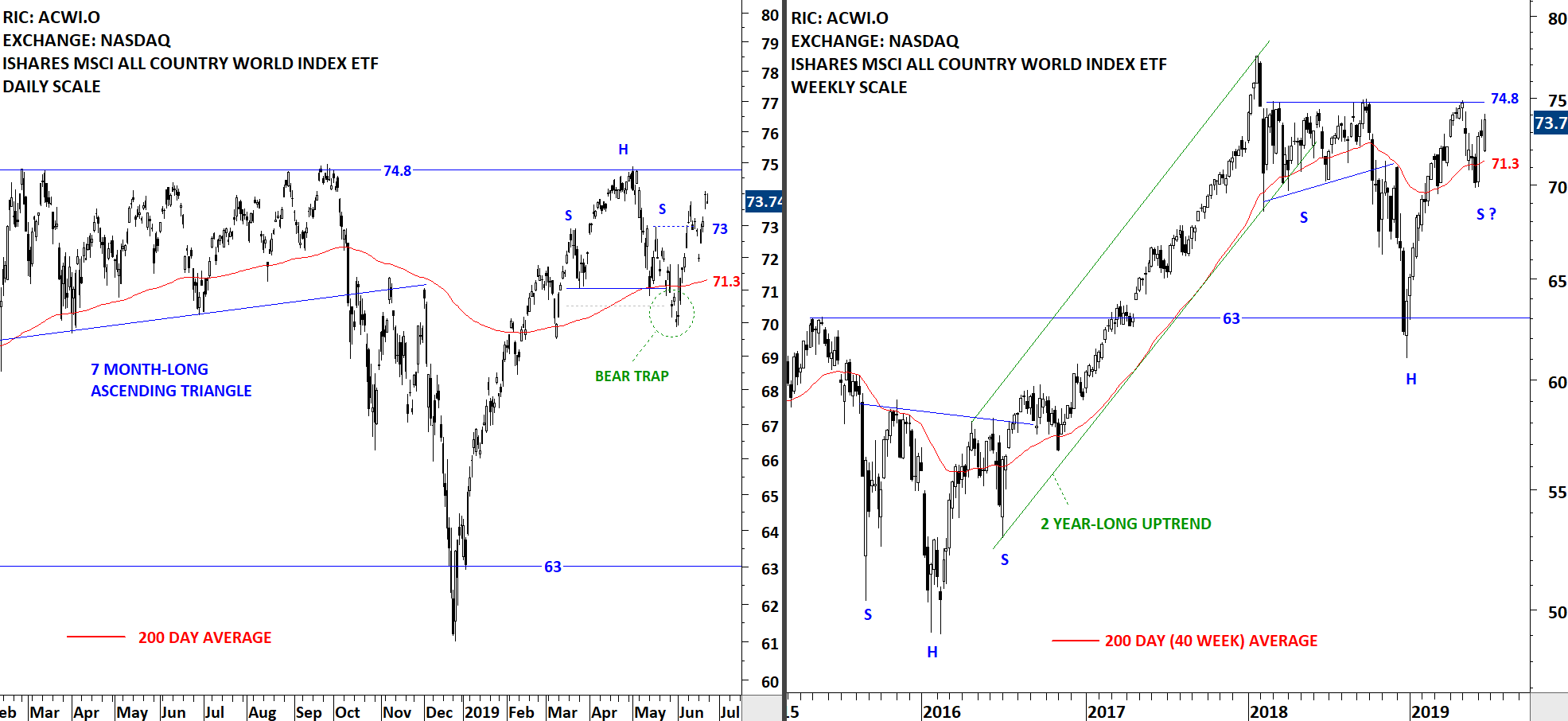

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) remains above its 200-day average. Strong resistance stands at 74.8 levels and the 200-day moving average as support at 71.3 levels. The weekly scale price chart can form a possible H&S continuation. So far the right shoulder formed symmetry in price but not in time. In other words the time it took for the left shoulder has been longer than the right shoulder. Perfect symmetry is rare. Breakout above 74.8 levels will be positive for Global equities.

Read More

Read More