Chart Pattern Statistics, H&S continuation and H&S failures – December 2020 Tech Charts Webinar

Chart Pattern Statistics, H&S continuation and H&S failures - December 2020 Tech Charts Webinar

We are continuing our Member webinar series with several important and frequently asked topics. Given that the topics are different concepts in technical analysis/classical charting and trading, each section will have a +/- 10 min presentation followed by Q&A on that section.

Webinar Outline- Review of chart pattern statistics and discussion on chart pattern reliability / Q&A

- Current market conditions and review of major benchmarks/important chart pattern developments / Q&A

- A frequently asked chart pattern, H&S continuation and review of H&S failures and how to trade them / Q&A

- A typical day for me, the daily routine, selection of markets, review and research tips / Q&A

- Additional Q&A

- No Questions

- I wanted to know more about log scale and how to set targets using it. For instance, I have seen some chartist giving two targets for H&S, one for each scale. 28:44

- Where do you usually set your "stop loss" in the H&S bottom/continuation? Is it the negation level, or do you use other criteria? 30:35

- Do you use the 200 SMA or Exponential & why? Any other moving average you use? 32:11

- Could you provide another example or two for setting the H&S target? Do we measure from the neckline to the bottom of the lowest candle body in the head, or to a wick? 33:31

- Do you always get out of 100% of your trade when it gets to its objective? Or do you switch to a trailing stop? 33:47

- On the last chart, it didn't look the H&S pattern had been completed by breaching the neckline, so why is it a H&S failure? (Possibly page 17 or 18.) 49:09

- How did you calculate the H&S failure price target on page 19? 50:21

- In the H&S bottom with NON-Horizontal neckline (neckline with slope), how do you measure the price target? 51:03

- If you wait for the closing price for the breakout signal, how do you decide the trigger price? 51:38

- Are you discounting the validity of vertical necklines against the horizontal ones? 52:35

- How do you handle spindles? By using Stop Close Only orders? 53:28

- If a stocks breaks down and then reverses and goes above the right shoulder, is that a H&S failure? 54:26

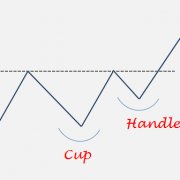

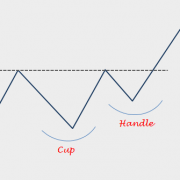

- In this BTC Monthly chart, in the log scale, do you see "Cup & Handle" with a neckline at $13,880? 1:05:00

- How do you look at Netflix now? 1:06:16

- How did you set the target about the sym triangle in slide 30? from the first point? 1:06:53

- Do you ever take any help from any indicator while identifying the chart patterns? 1:07:32

- Please check GH & KO in you have time 1:08:35

- With weekly patterns the chart validation points usually have much wider risk; what % of NAV risk for each position do you use for weekly and what for daily patterns breakouts? 1:08:44

- In the US Marker review, for example, I am assuming you are not going chart by chart and have a certain criteria "as starting point" to pick your charts. Do you mind sharing your criteria (if any)? 1:16:24

- Vacation? 1:17:49

- Can you explain a bit more about how you use volatility to identify possible patterns? I'm not sure how you review so many stocks! 1:18:05

- Do you scan charts by industry? 1:20:14

- Do you enter orders during 1 hour before the close? 1:20:41

- Would you elaborate a bit further about cases that you can open a position intraday, and do you keep stops during weekends? 1:21:20

- The filter I find useful is the MA 18 weekly rather EMA 200 . What do you think about it? 1:23:45

- Could you suggest about position size strategy? 1:24:27

- I know you previously mentioned about sending a report on Chinese stocks. Are you still planning to do so - thanks for all you do. 1:25:17

- Aren't Keltner channels more useful than Bollinger bands? After all, Keltner is based on ATRs -- actual price ranges, not just the moving average close which Bollinger uses? 1:25:42

- Do you think the volume of stocks is relevant for the pattern success ratio? 1:26:31

- Van Tharp’s Definitive Guide to Position Sizing – Van Tharp