GLOBAL EQUITY MARKETS – August 25, 2018

REVIEW

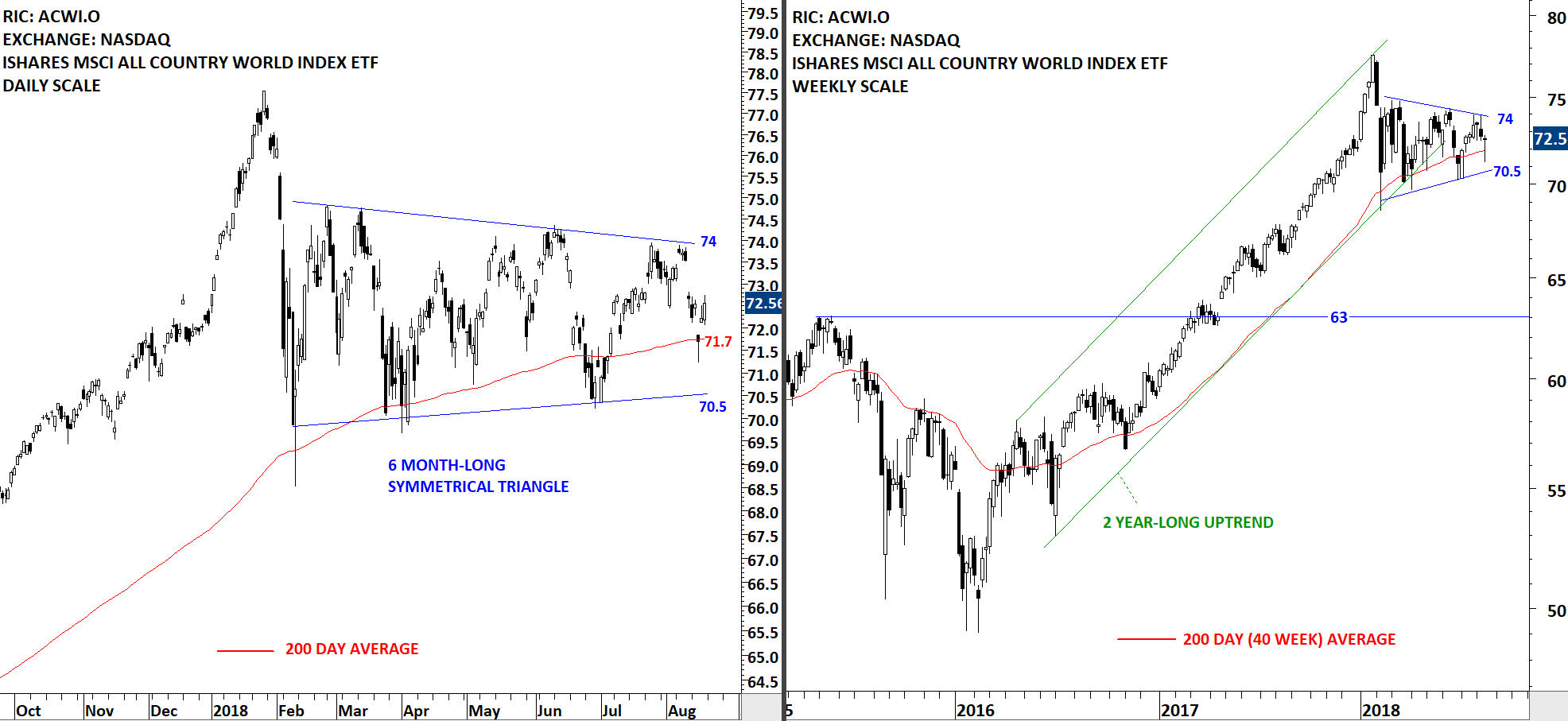

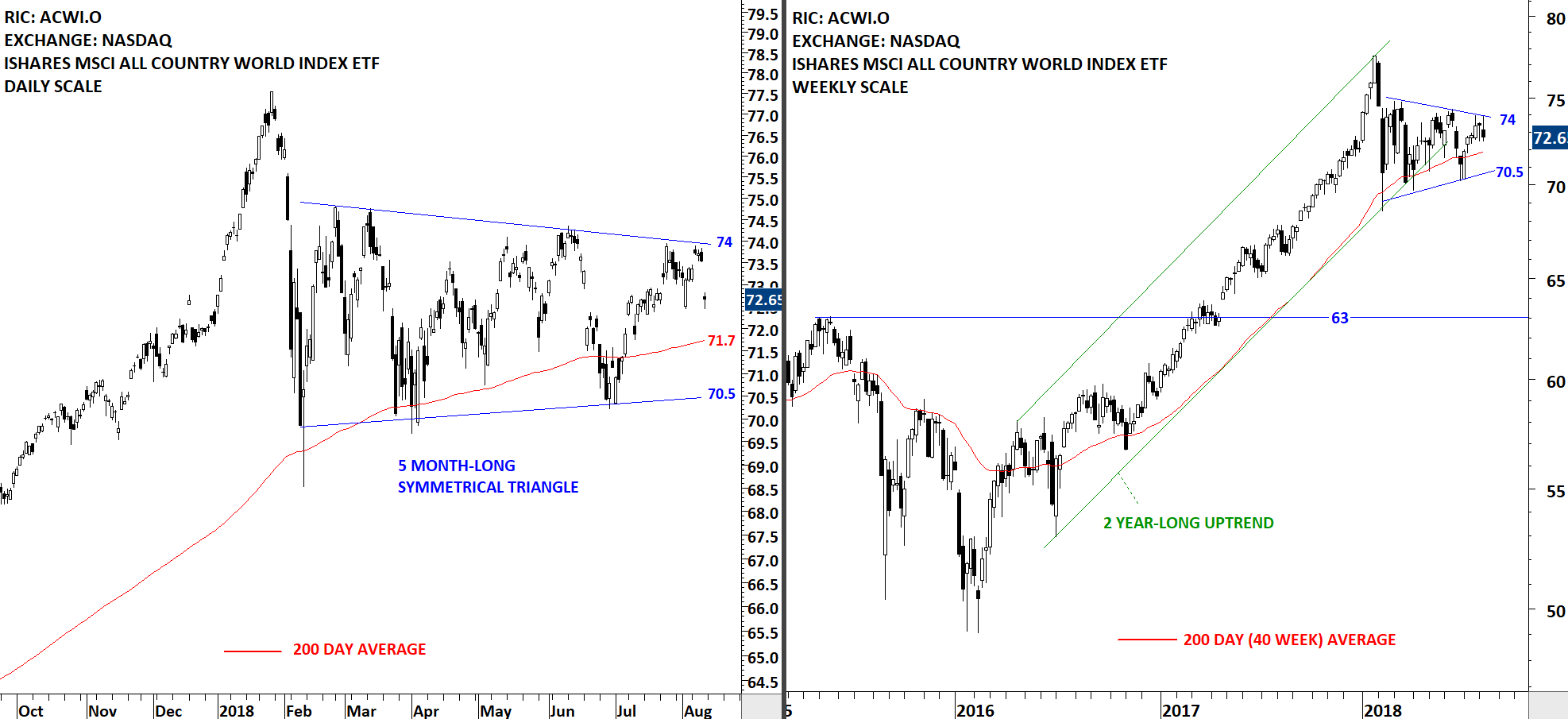

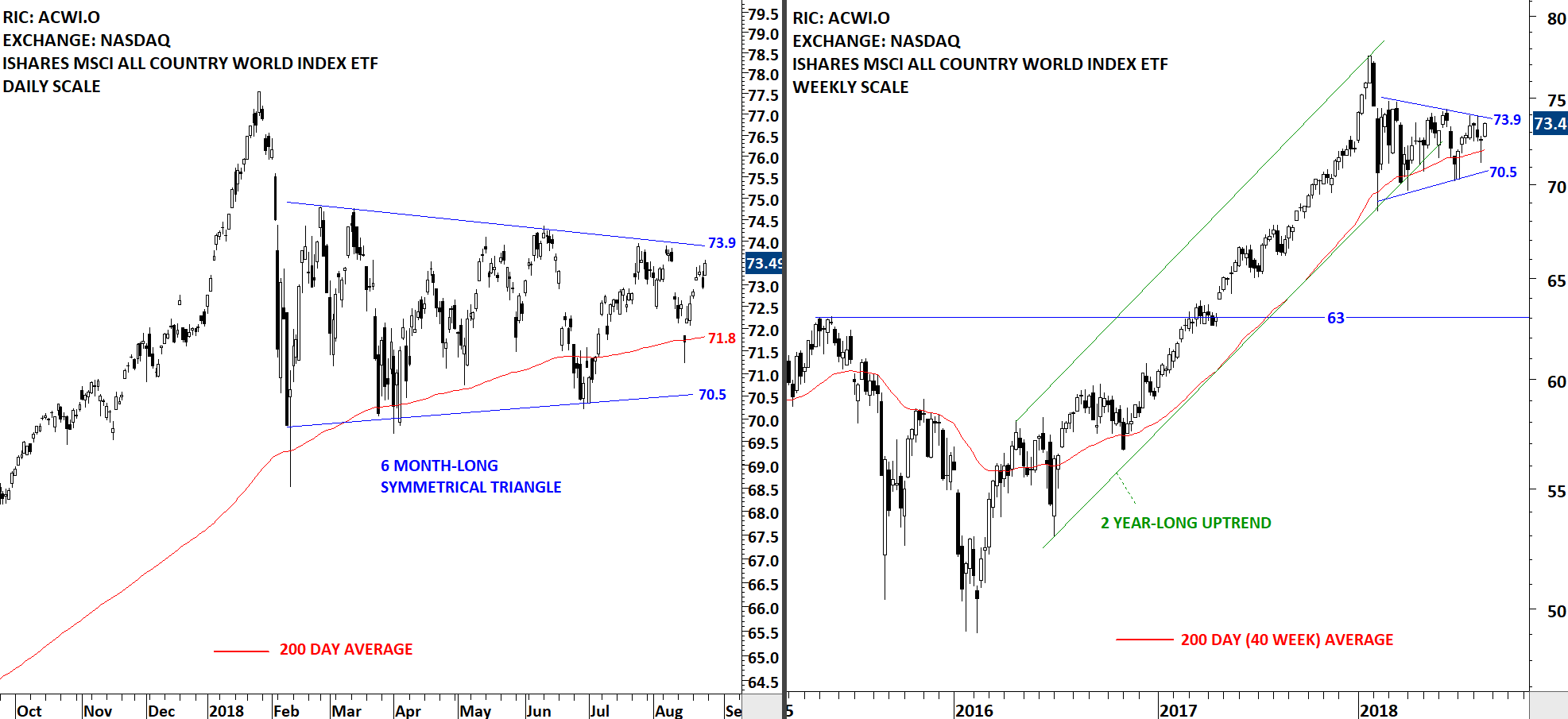

Once again the benchmark for Global Equity Markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) is challenging the upper boundary of its 6 month-long sideways consolidation. The upper boundary was tested several times over the past few months. Resistance stands at 73.9. The lower boundary of the possible symmetrical triangle is acting as support at 70.5 levels. The ACWI ETF is trading above its long-term (200-day) average. Breakout above the upper boundary can complete the multi-month sideways consolidation and result in a directional move. The ACWI ETF still remains in a trading range.

Read More

Read More