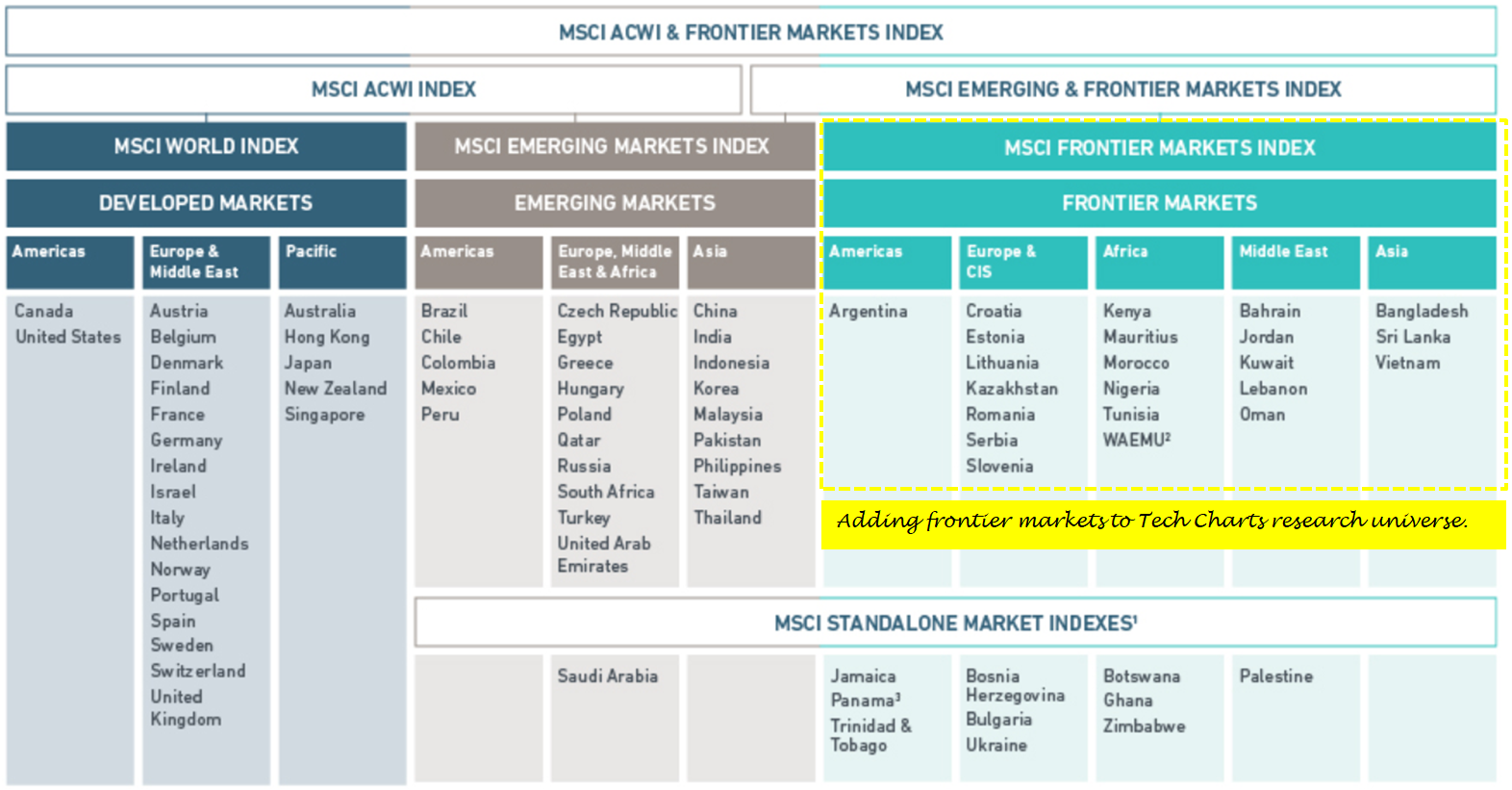

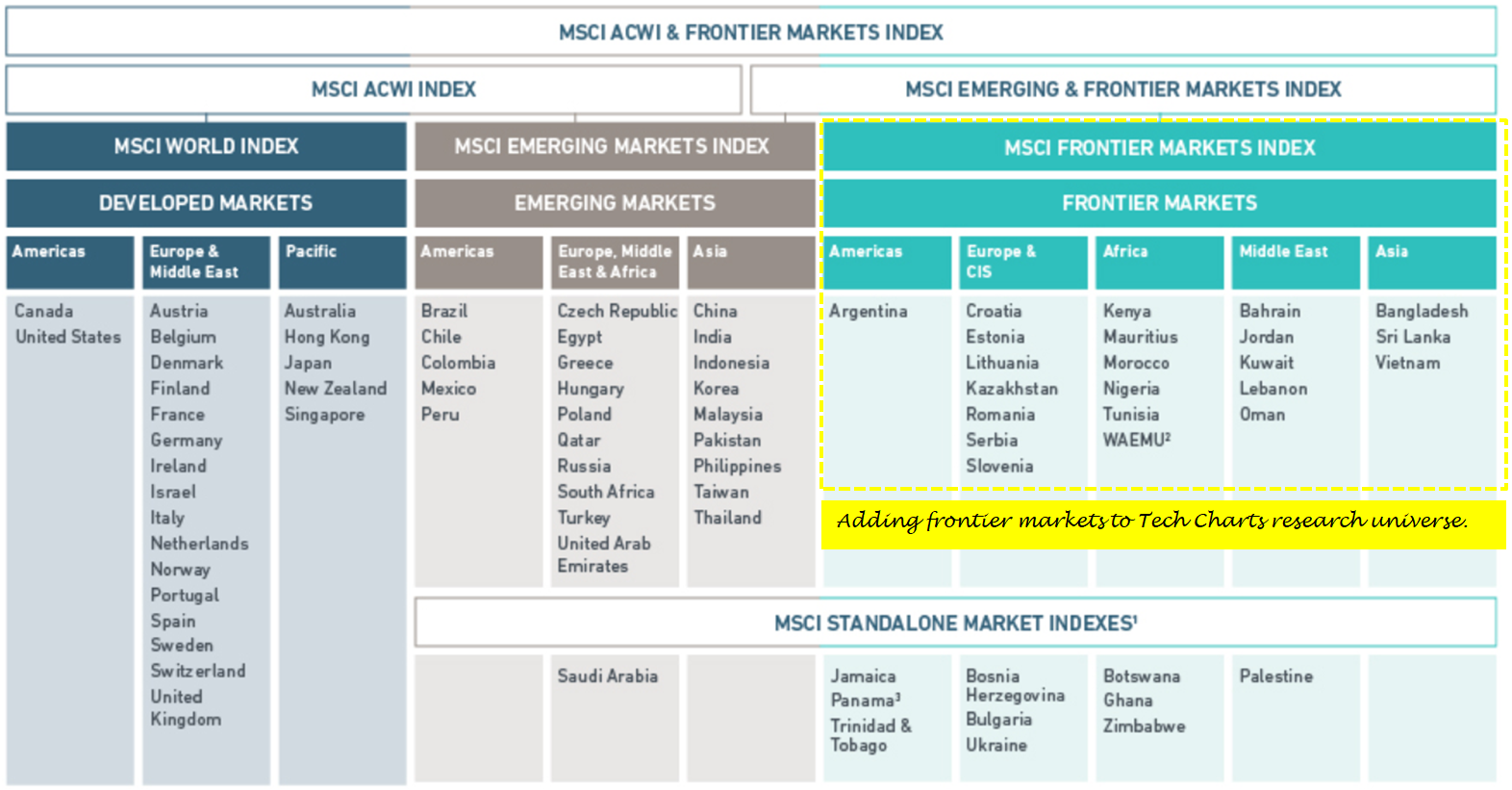

Tech Charts follows the MSCI classification for market research. Below is a table that shows MSCI classification for each market. Over the past year Global Equity Markets report have been covering developing breakout opportunities in Developed and Emerging Markets. In June 2018 we started adding Frontier Markets equities to our research universe and the weekly report. Please note that coverage of a specific market doesn’t mean you will find every equity available in that specific market. Global Equity Markets report features selective number of opportunities only if the price chart has a well-defined and mature classical chart pattern.

Every week Tech Charts Global Equity Markets report features some of the well-defined, mature classical chart patterns under a lengthy watchlist and the chart pattern breakout signals that took place during that week. Global Equity Markets report covers single stocks from developed, emerging and frontier markets, ETF’s and global equity indices. The report starts with a review section that highlights the important chart developments on global equity benchmarks. This blog post features two breakout opportunities in the Frontier Market Equities listed on the Kuwait Stock Exchange. Both equities were featured in the latest Global Equity Markets report.

Read more