GLOBAL EQUITY MARKETS – March 23, 2019

REVIEW

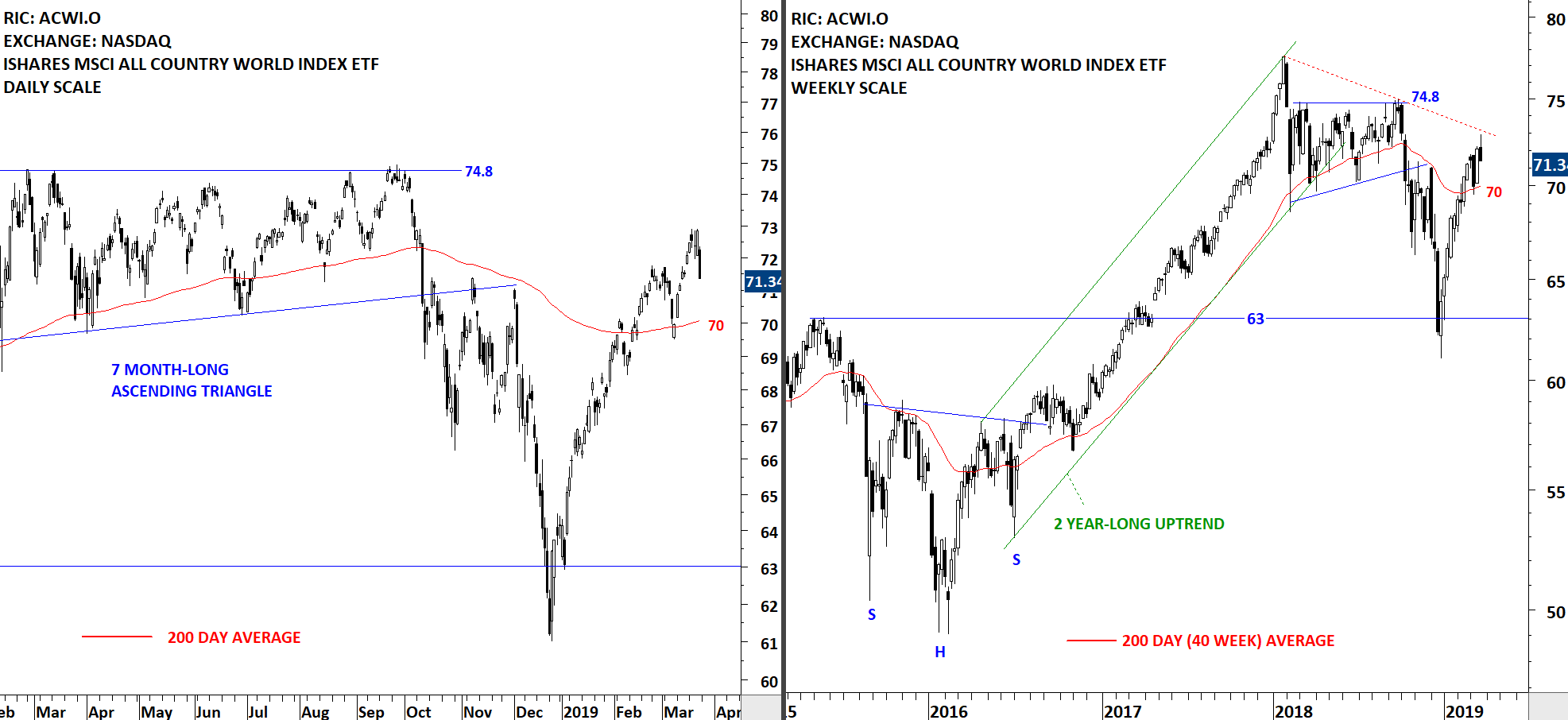

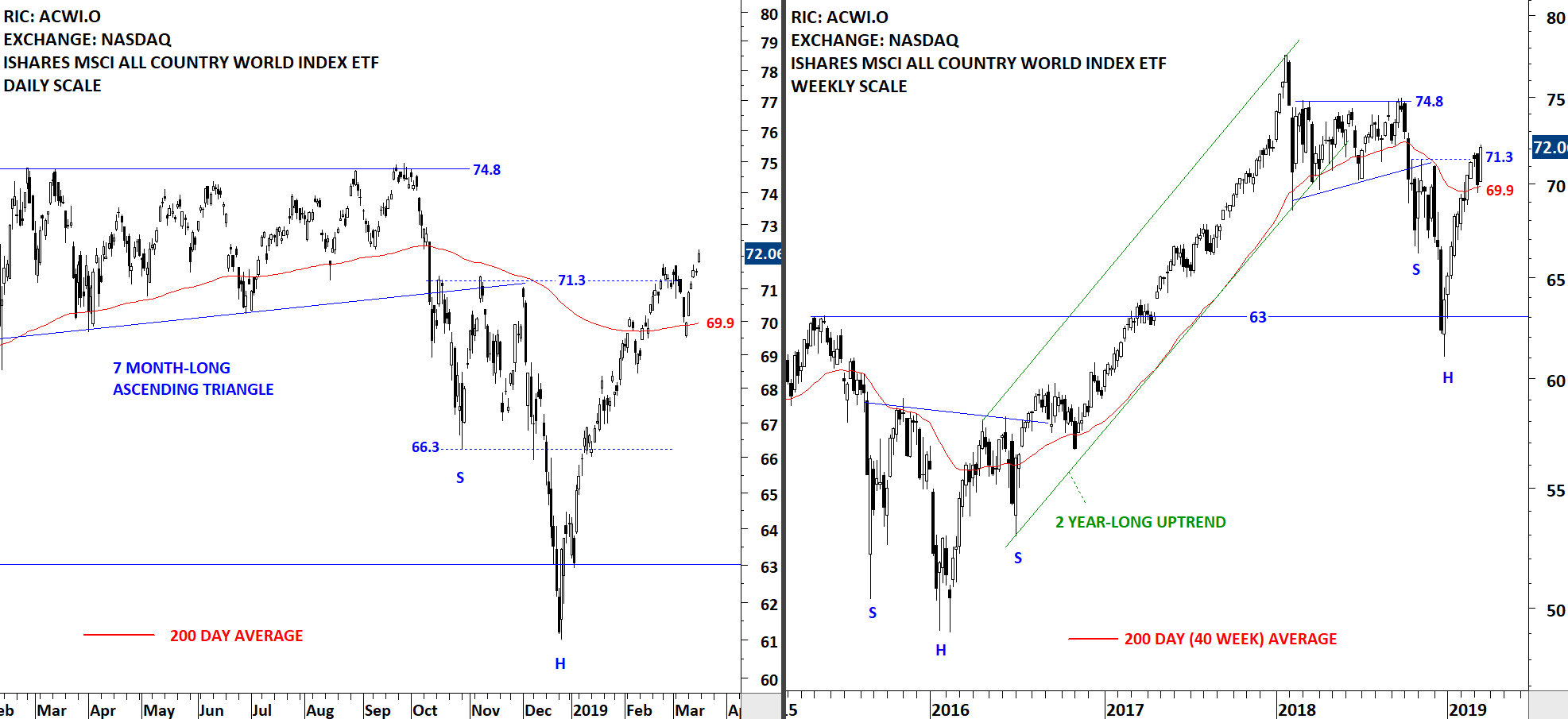

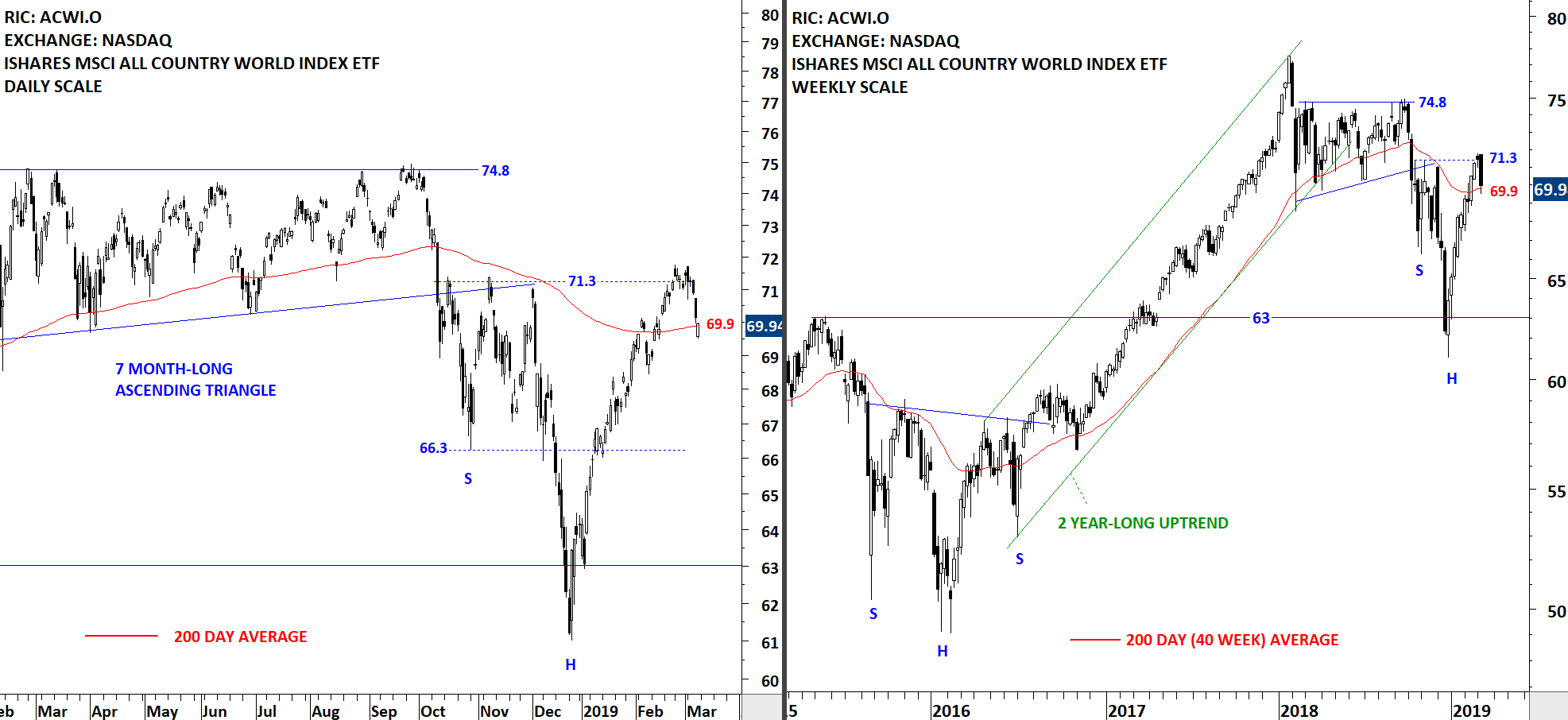

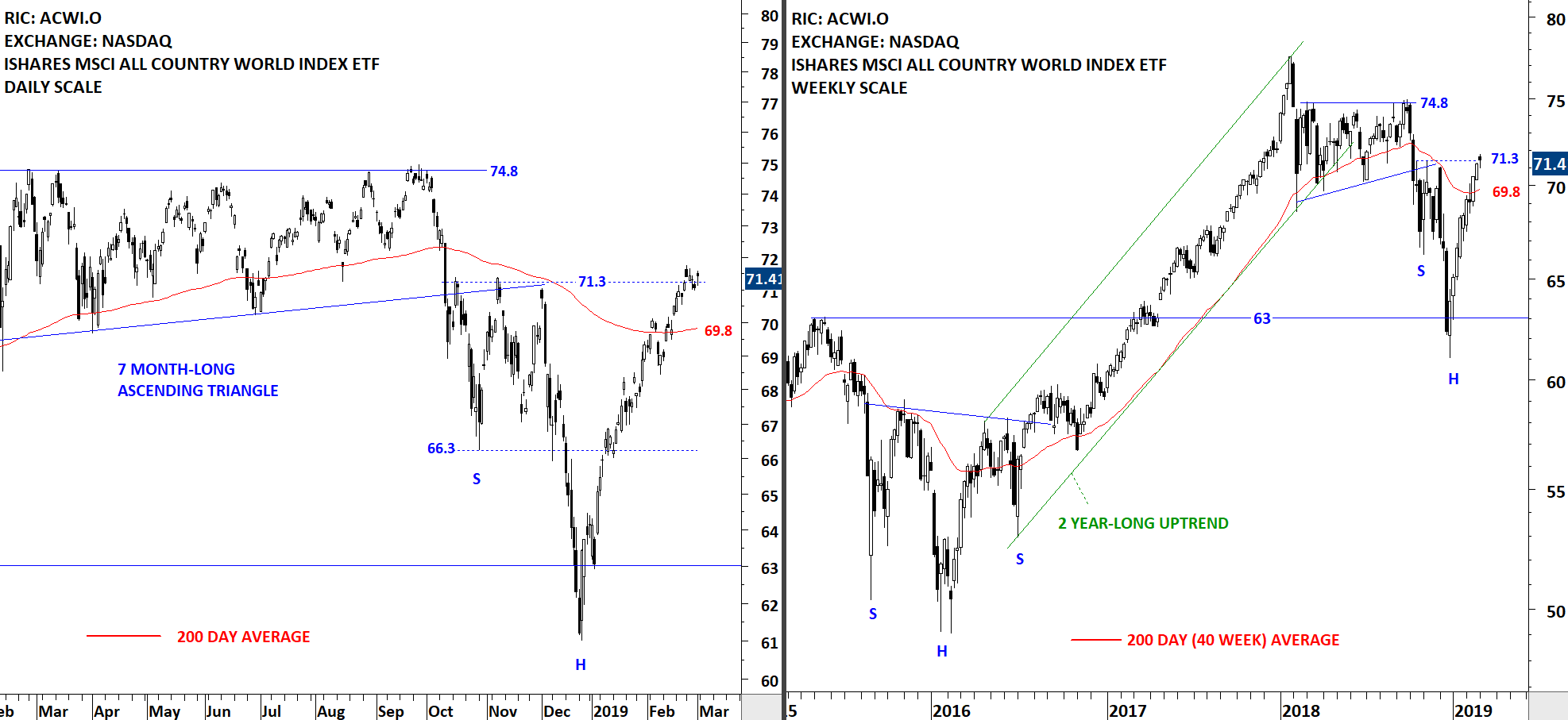

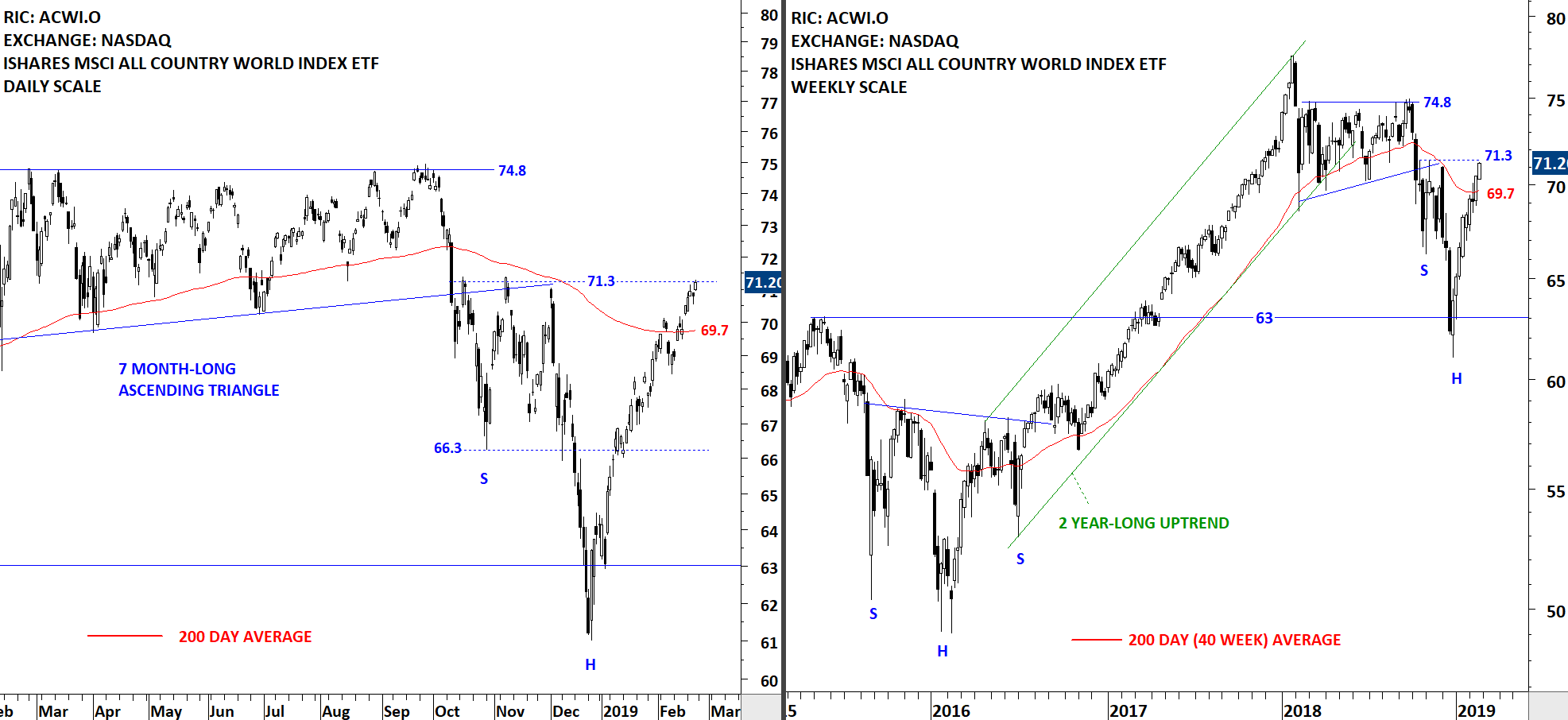

The benchmark for the Global equity markets performance the iShares MSCI All Country World Index ETF (ACWI.O) is trying to find direction above its long-term average. In March the index pulled back to the 200-day average and rebounded. Past few day’s trading once again pulled the index towards the long-term average that can act as support around 70 levels. We can see choppy price action around the 200-day average. More important is how the index will consolidate around the average. If it forms an orderly, recognizable short-term consolidation (in the form of a flag, pennant, rectangle, symmetrical triangle) I will conclude that the index is preparing for a new leg up. Price action in 2016 is a good explanation of what I would like to see around the 200-day average to call for a change in trend. (A sharp drop, followed by a strong rebound that breaches the 200-day average, followed by choppy price action in search of a new trend and eventually forming a recognizable chart pattern)