Reversal Chart Patterns – January 2019 Tech Charts Webinar

/0 Comments/in Member Webinars, Premium/by Aksel Kibar- We will review some of those chart pattern breakdowns that were featured in the Global Equity Markets report.

- We will review some of the qualities we look for when identifying reversal chart patterns

- We will look at some of the developing top formations.

- We will continue to highlight Tech Charts members favorite chart pattern setups in different equity markets.

- Live questions from Members

- I wondered if you could discuss gold and silver in dollars please? They seem to have bottomed, but not clear on what formations they may be making. 48:25

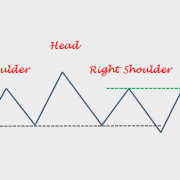

- Japan I have seen some folks draw non-horizontal boundary lines on potential H&S tops. Is this valid? 49:33 Link mentioned VEDANTA LTD (VDAN.NS)

- Italy would the buy signal come at a reversal to 15.8 or earlier? 51:16

- For the launching patterns you showed - where do you put your stop? Can you discuss trade management? 52:08

- Germany had a nice candle right where it should at the target low price, what do we need to see to be a buyer for a reversal upside? 53:44

- For PKG the right shoulder was higher than the left shoulder - What are your thoughts on this, do you prefer lower right shoulder? How much of a difference in shoulder height would you ignore? 56:06

- Can you talk about volume - how you use it? 57:25 - Link mentioned VOLUME AS A CONFIRMING INDICATOR

- Korea has an almost horizontal neck line, valid? 59:40

- On the breakdown of the H&S - Are you taking into consideration volume as a confirmation as well? 1:00:11

- What is the difference between consolidation, distribution, and continuation patterns? 1:00:44

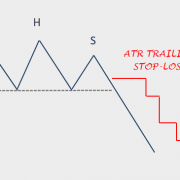

- You mention a price target on the charts, what about stop loss? Where would you set your stop loss? 1:03:00 Link mentioned ATR Trailing Stop-Loss – H&S Top

- If you are new to trading - How would you suggest starting? 1:03:43

- If a breakout signal is missed, would you try to enter at a rebound? 1:07:24

- If the price target is met do you take profit on the whole position? Or keep some on and use a trailing stop? 1:08:20

- When you draw your diagonal trend channels, do you start with the line on the top of the candles or the bottom? And are the charts linear or log? 1:09:06

- On the DAX why draw the neckline as horizontal? 1:10:23

- For ascending and descending triangles are there a minimum/ideal number of contact points you look for to define these? 1:11:45

- When you have 2 patterns e.g. H&S and rectangle, which price target should we use? 1:13:40

ATR Trailing Stop-Loss – H&S Top

/2 Comments/in H&S TOP, Premium, Video Series/by Aksel KibarRectangle – Bearish Reversal

/0 Comments/in Premium, RECTANGLE PATTERN, Video Series/by Aksel KibarSymmetrical Triangle Chart Patterns – September 2018 Tech Charts Webinar

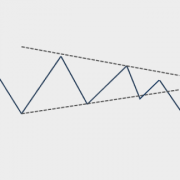

/0 Comments/in Member Webinars, Premium/by Aksel Kibar- The symmetrical triangle is a chart pattern with diagonal boundaries and it is a neutral chart pattern. It can form as a reversal as well as a continuation chart pattern.

- A symmetrical triangle forms due to the indecision between buyers and sellers.

- Review chart pattern breakouts that were featured in the Global Equity Markets report.

- Review some of the failed breakouts and try to analyze what differentiates a successful breakout from a failed breakout.

- Developing symmetrical triangle chart pattern setups.

- Highlight Tech Charts members favorite symmetrical triangle setups in different equity markets. Discuss and share some of the best classical chart patterns that members identified or those charts that members might have questions about.

- Recent chart pattern breakouts

- Q&A

- Live questions from Members

- Is there a way to distinguish better, stronger, higher probability chart patterns from the large number of those that get published on your watchlist/breakout lists. I am having a hard time choosing the few that I can afford to trade. I am giving priority to horizontal patterns where breakout will be new all time high? Is there another characteristic you would suggest using to screen for higher quality patterns? 54:35

- What’s your minimum W/L Ratio for entering a trade? 56:53

- What's the difference between symmetrical triangle reversal formation and a bullish or bearish pennant, before the breakout happens? (For example, Peter Brandt has been talking about USD/TRY pair, is that a pennant or a triangle?) 58:48

- In your Global Equity Market update you have charted "ACWI" as a symmetrical triangle on the weekly chart - what would need to happen for you to reclassify the chart as an ascending triangle? 1:00:26

- The 3% break out rule is it valid also for the futures market or only for stocks? 1:01:34

- Is the 'red' line on the chart patterns a stop level or pattern negation level? If the latter, where does one place stops typically? 1:03:14

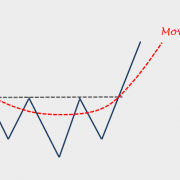

- I hear you say often that the best breakouts are those that ‘never look back’. In hindsight analysis I very much agree. But in realtime, without some sort of pullback, I find it very difficult to enter such breakouts with a good reward-to-risk ratio (the price runs away from Moving Averages and other stop-loss indicators and never allows them to catch up). How would you recommend trying to enter these ‘best’ breakouts? How to place stop loss if reversal? 1:05:59

- Confused about what to consider a breakout. Can you define at what point exactly a symmetrical triangle can be considered a pattern breakout? (Not the 3% confirmation point, but the actual level required to call it a breakout). Seems like you are using the actual chart boundary in some cases, but a prior high in other cases (for upward breakouts). 1:07:56

- It seems like most of the charts are around 10 months to 24 months or so; is that what you focus on as a time length for these patterns? Of the successful triangles; how long (as a %) of the pattern length does it take to meet the target (or 70% of target for those that don't make it all the way)? 1:09:22

- Most of the charts you show are generally 1:1 or 1:1.5 risk reward. That means my batting average should be more than 50% to be profitable. How to reduce the risk and increase 1:3 risk reward? 1:11:16

- Do you have any statistics on success rates of breakouts reaching targets vs. failure, etc.? 1:12:14

- Is it appropriate to have increased confidence in patterns with another launching pattern within it. For example, increased position size? 1:14:01

- Is there a point in the triangle where strength of the pattern diminishes (e.g., past 50% or 75% of the distance to the apex of the triangle? 1:14:30

- Just be clear on breakouts... So 3% confirmation point is calculated from the point that price first penetrates the triangle boundary? Am I right? 1:15:55

Symmetrical Triangle – Bearish Continuation

/2 Comments/in Premium, SYMMETRICAL TRIANGLE, Video Series/by Aksel KibarHead and Shoulders Top – Failure

/4 Comments/in H&S TOP, Premium, Video Series/by Aksel KibarTech Charts Year in Review – Year One

/0 Comments/in Member Webinars, Premium/by Aksel Kibar- A study on Chart Pattern Reliability with the available sample data over the past year

- Chart patterns with horizontal boundaries have been more reliable compared with breakouts from chart patterns with diagonal boundaries

- Long-term trends impact the number of bullish and bearish chart pattern setups and breakout opportunities

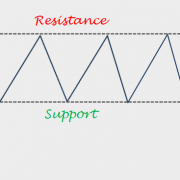

- Rectangles, H&S continuations, H&S bottoms and Ascending triangles have been reliable with breakouts from well-defined horizontal boundaries

- Developing breakout opportunities

- Live Q&A

DUBAI TRADERS SUMMIT – RECTANGLE

/2 Comments/in General, Premium, Video Series/by Aksel KibarIn April 2018, I was invited to share my experiences in charting the Middle East and Africa equity markets at the Dubai Traders Summit. The event was not recorded. I wanted to make this presentation available for our members so I recorded this educational video, featuring parts of the presentation I shared at the event. This section focuses on Rectangle examples. I hope you will find it valuable.

![]()

DUBAI TRADERS SUMMIT – H&S BOTTOM

/2 Comments/in General, Premium, Video Series/by Aksel KibarIn April 2018, I was invited to share my experiences in charting the Middle East and Africa equity markets at the Dubai Traders Summit. The event was not recorded. I wanted to make this presentation available for our members so I recorded this educational video, featuring parts of the presentation I shared at the event. This section focuses on H&S bottom examples. I hope you will find it valuable.

![]()

In Association with:

Latest Posts

CRYPTOCURRENCIES – December 8, 2025December 8, 2025 - 7:44 pm

CRYPTOCURRENCIES – December 8, 2025December 8, 2025 - 7:44 pm GLOBAL EQUITY MARKETS – December 6, 2025December 6, 2025 - 11:49 am

GLOBAL EQUITY MARKETS – December 6, 2025December 6, 2025 - 11:49 am GLOBAL EQUITY MARKETS – November 29, 2025November 29, 2025 - 11:53 am

GLOBAL EQUITY MARKETS – November 29, 2025November 29, 2025 - 11:53 am PINE SCRIPT CODE UPDATED ATR TRAILING STOP-LOSS (LONG/SHORT)November 27, 2025 - 7:14 pm

PINE SCRIPT CODE UPDATED ATR TRAILING STOP-LOSS (LONG/SHORT)November 27, 2025 - 7:14 pm

Search

As Seen On: