GLOBAL EQUITY MARKETS – July 27, 2019

/0 Comments/in Premium/by Aksel KibarREVIEW

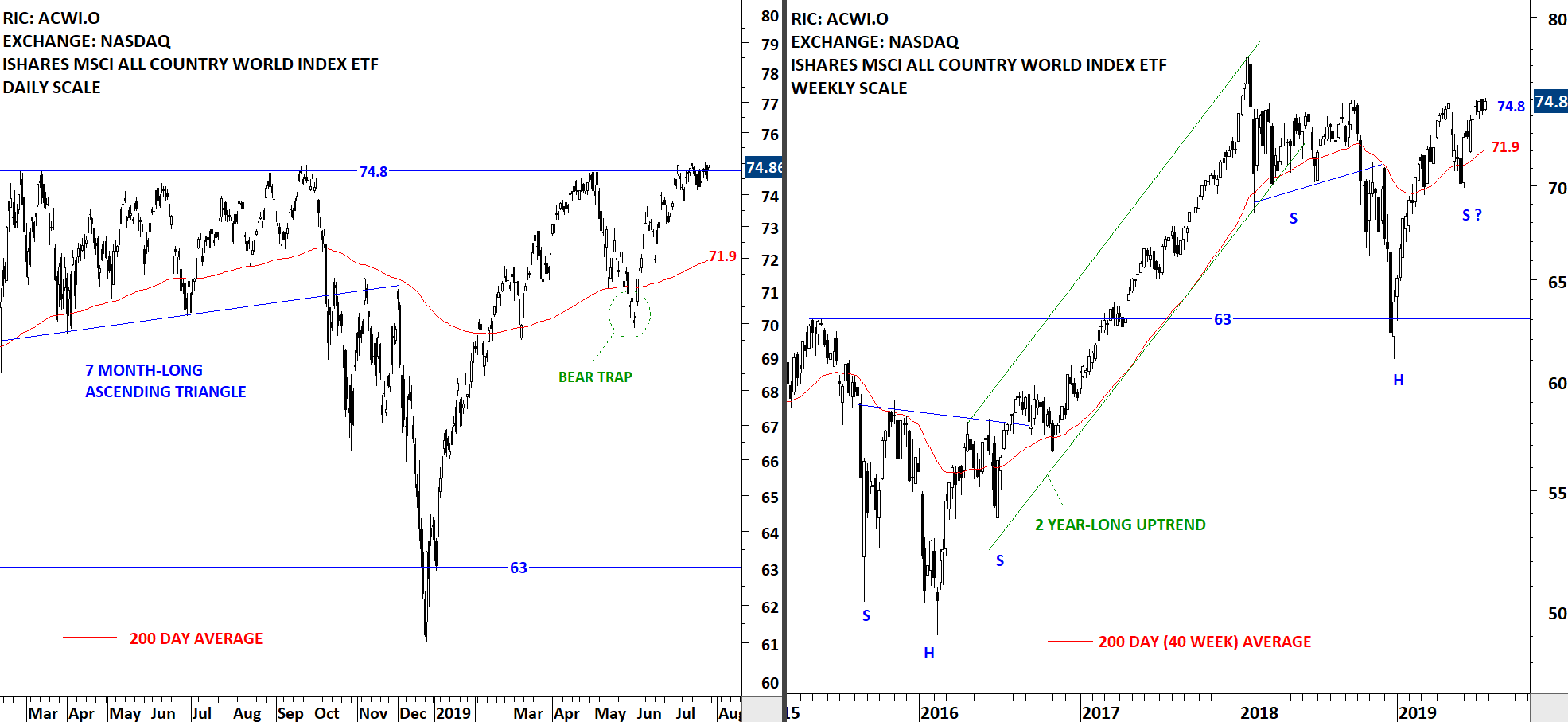

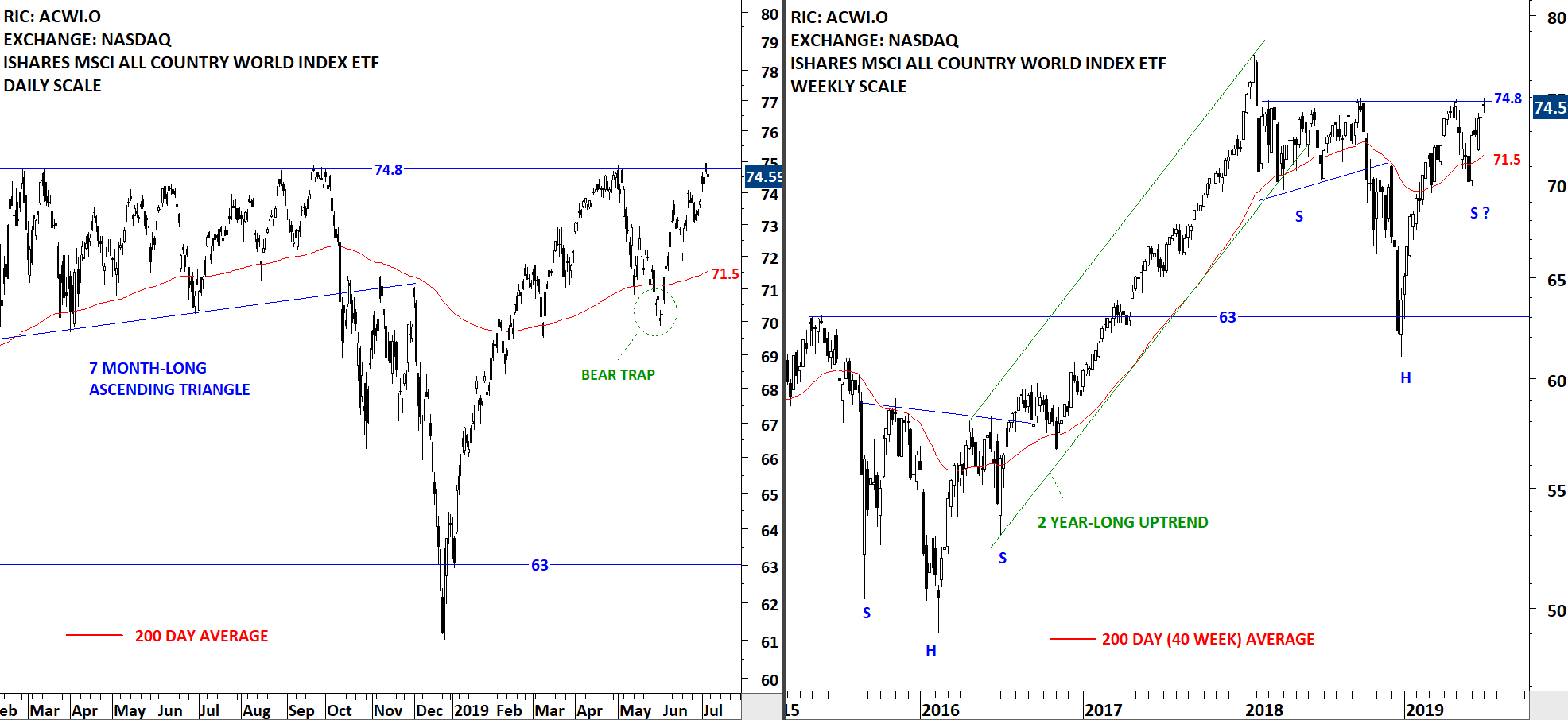

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) continues to challenge the strong horizontal resistance at 74.8 levels. A breakout can be very positive for Global equities. Failure at the strong resistance can result in a pullback towards the long-term average at 71.9 levels.

Read More

Read MoreGLOBAL EQUITY MARKETS – July 20, 2019

/0 Comments/in Premium/by Aksel KibarREVIEW

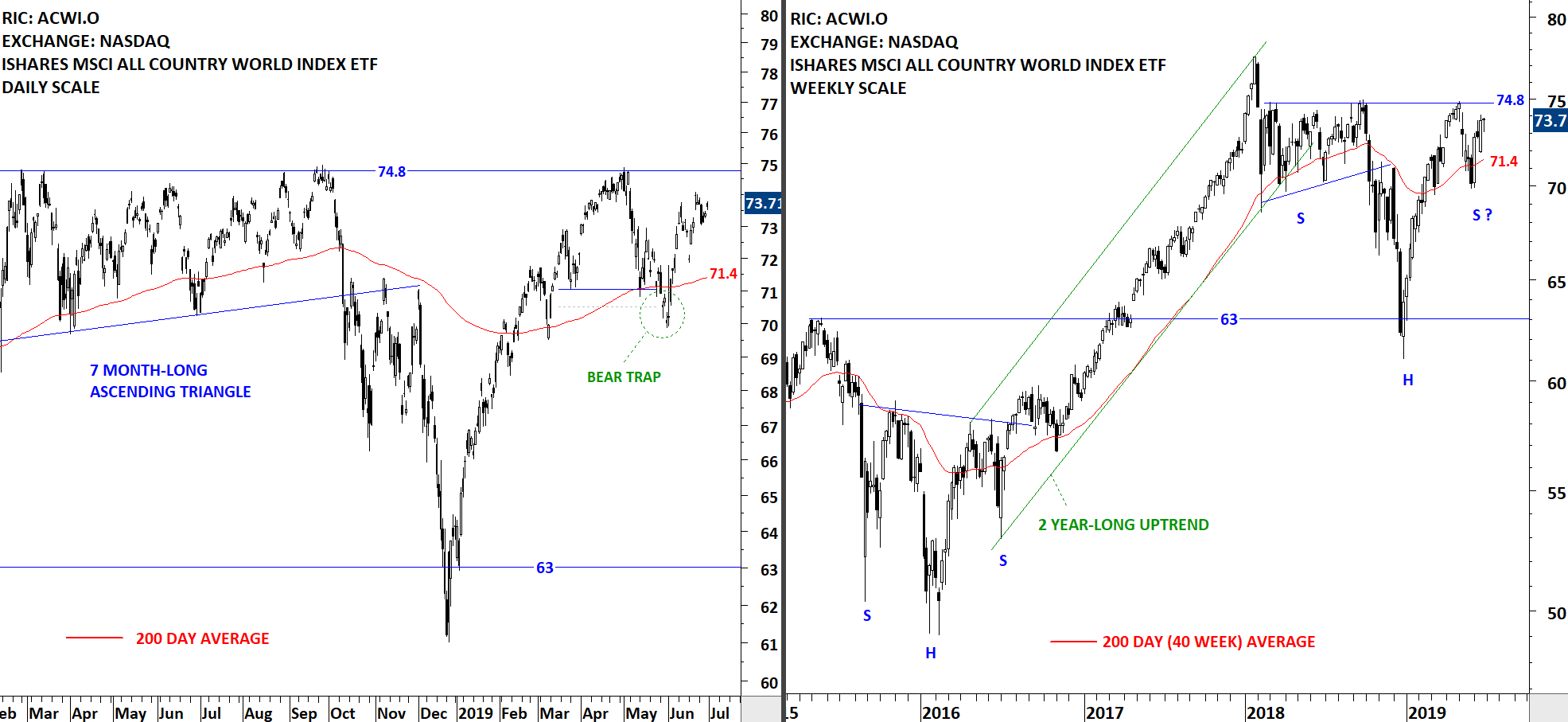

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) is testing the horizontal resistance at 74.8 levels. Breakout can be positive for Global equities. This week's price action once again challenged the horizontal resistance at 74.8 levels. I'm monitoring ACWI ETF for a possible breakout to all-time highs. The 200-day moving average at 71.9 levels will act as support during any pullback.

Read More

Read MoreGLOBAL EQUITY MARKETS – July 13, 2019

/2 Comments/in Premium/by Aksel KibarREVIEW

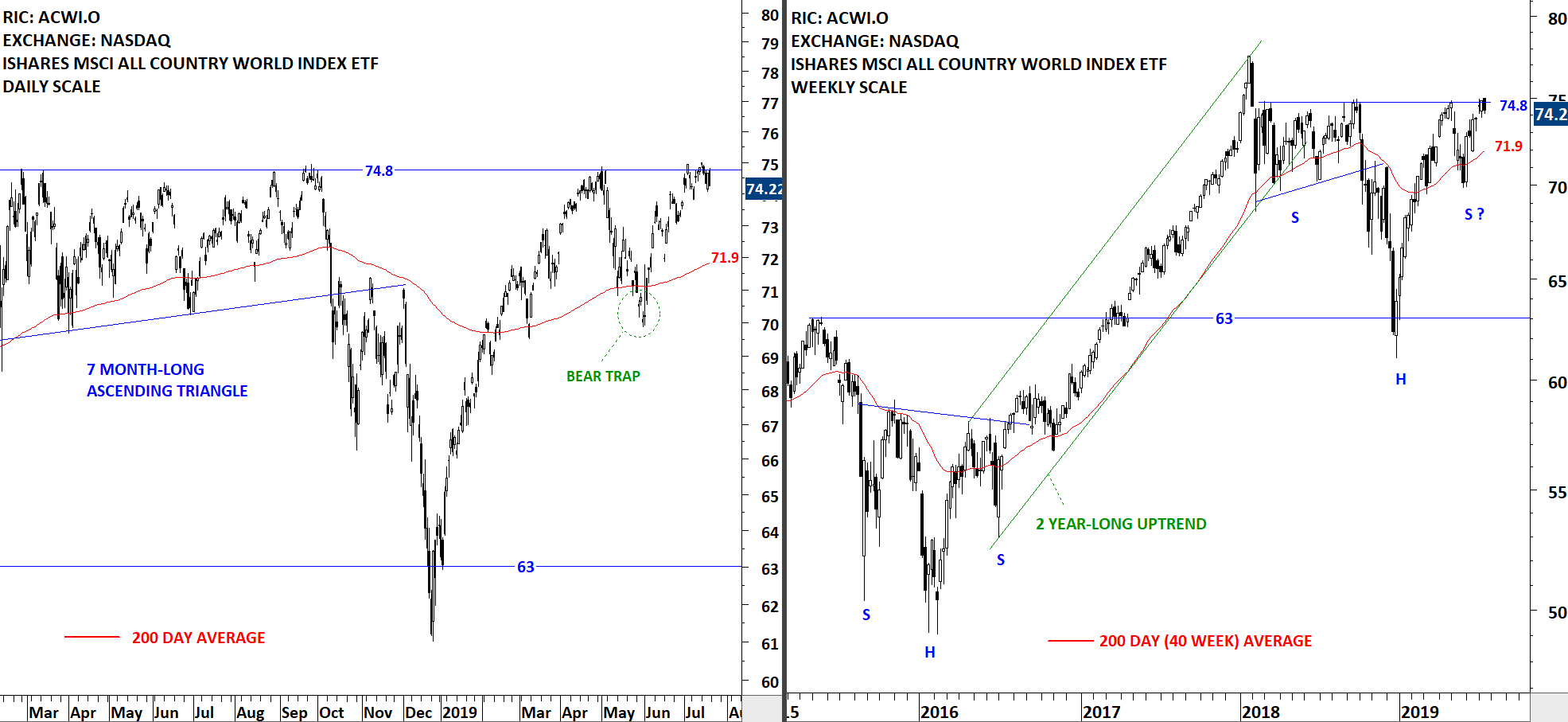

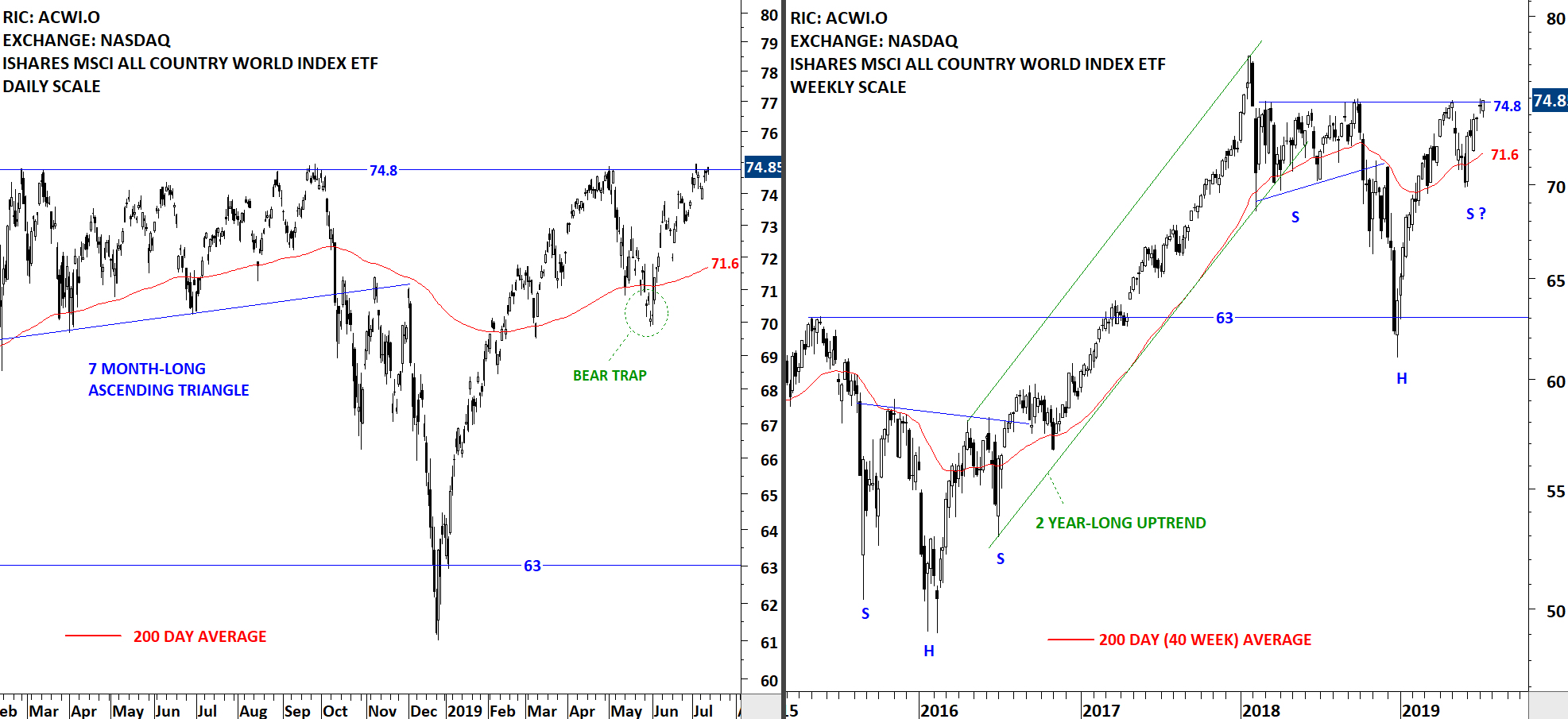

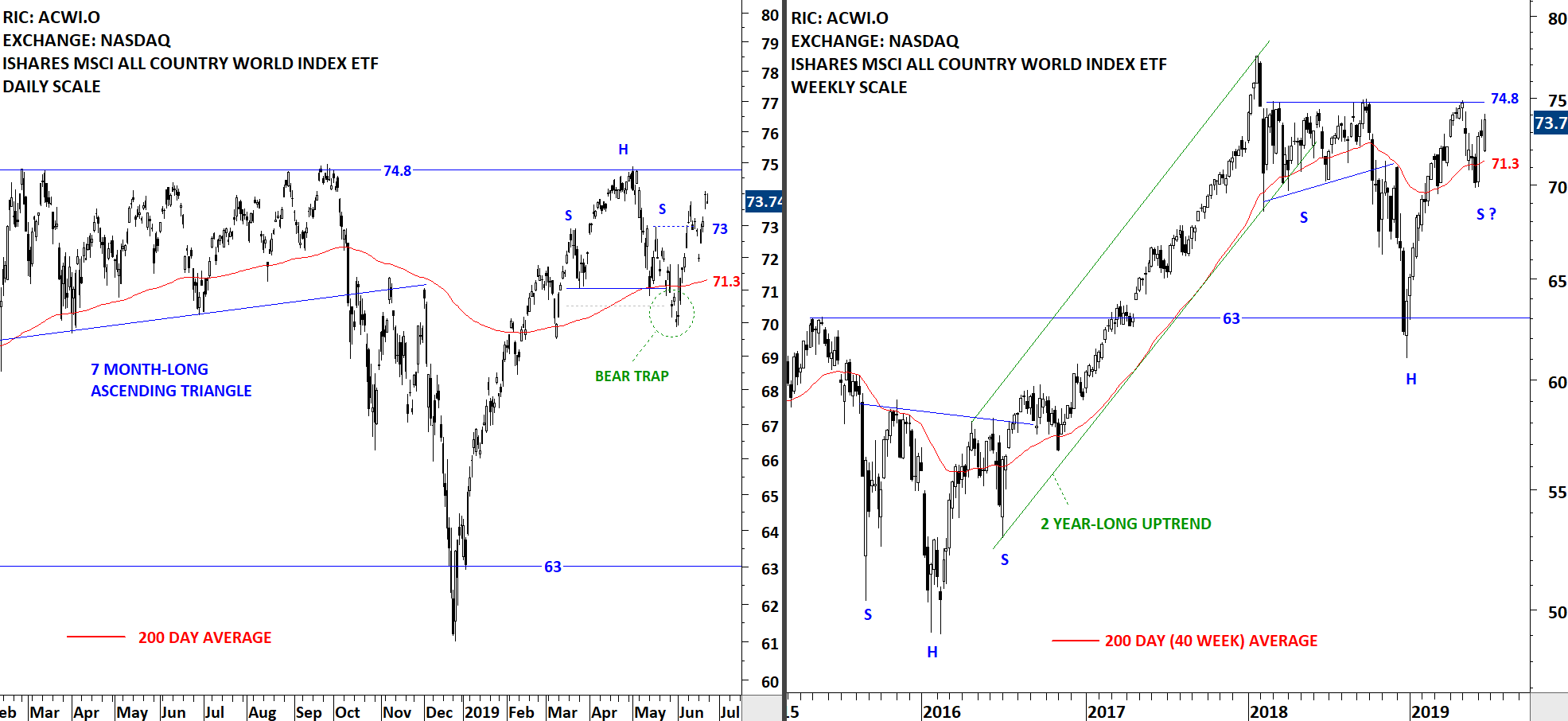

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) is testing the horizontal resistance at 74.8 levels. Breakout can be positive for Global equities. There are several major equity benchmarks that are testing long-term resistance levels. I'm weighing the possibility of a breakout to all-time highs. Usually top reversals do not take place after several tests of horizontal resistance. In this case, several tests of the horizontal boundary can be an indication of a breakout to all-time highs and the continuation of the existing uptrend. The 200-day moving average at 71.6 levels will act as support during any pullback.

Read More

Read MoreGLOBAL EQUITY MARKETS – July 6, 2019

/2 Comments/in Premium/by Aksel KibarREVIEW

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) is now testing the horizontal resistance at 74.8 levels. Breakout can be positive for Global equities. This week's candlestick shows that 74.8 levels remains a resistance. The 200-day moving average at 71.5 levels will act as support during any pullback.

Read More

Read MoreGLOBAL EQUITY MARKETS – June 29, 2019

/2 Comments/in Premium/by Aksel KibarREVIEW

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF continues to remain in a range between the horizontal resistance at 74.8 and the 200-day moving average at 71.4 levels. In the previous report I discussed the possibility of a H&S continuation chart pattern with the neckline standing at 74.8 levels. Price can continue to consolidate between the two important technical levels. A breakout above the horizontal resistance will be very positive for Global equities.

Read More

Read MoreGLOBAL EQUITY MARKETS – June 22, 2019

/2 Comments/in Premium/by Aksel KibarREVIEW

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) remains above its 200-day average. Strong resistance stands at 74.8 levels and the 200-day moving average as support at 71.3 levels. The weekly scale price chart can form a possible H&S continuation. So far the right shoulder formed symmetry in price but not in time. In other words the time it took for the left shoulder has been longer than the right shoulder. Perfect symmetry is rare. Breakout above 74.8 levels will be positive for Global equities.

Read More

Read MoreGLOBAL EQUITY MARKETS – June 15, 2019

/2 Comments/in Premium/by Aksel KibarREVIEW

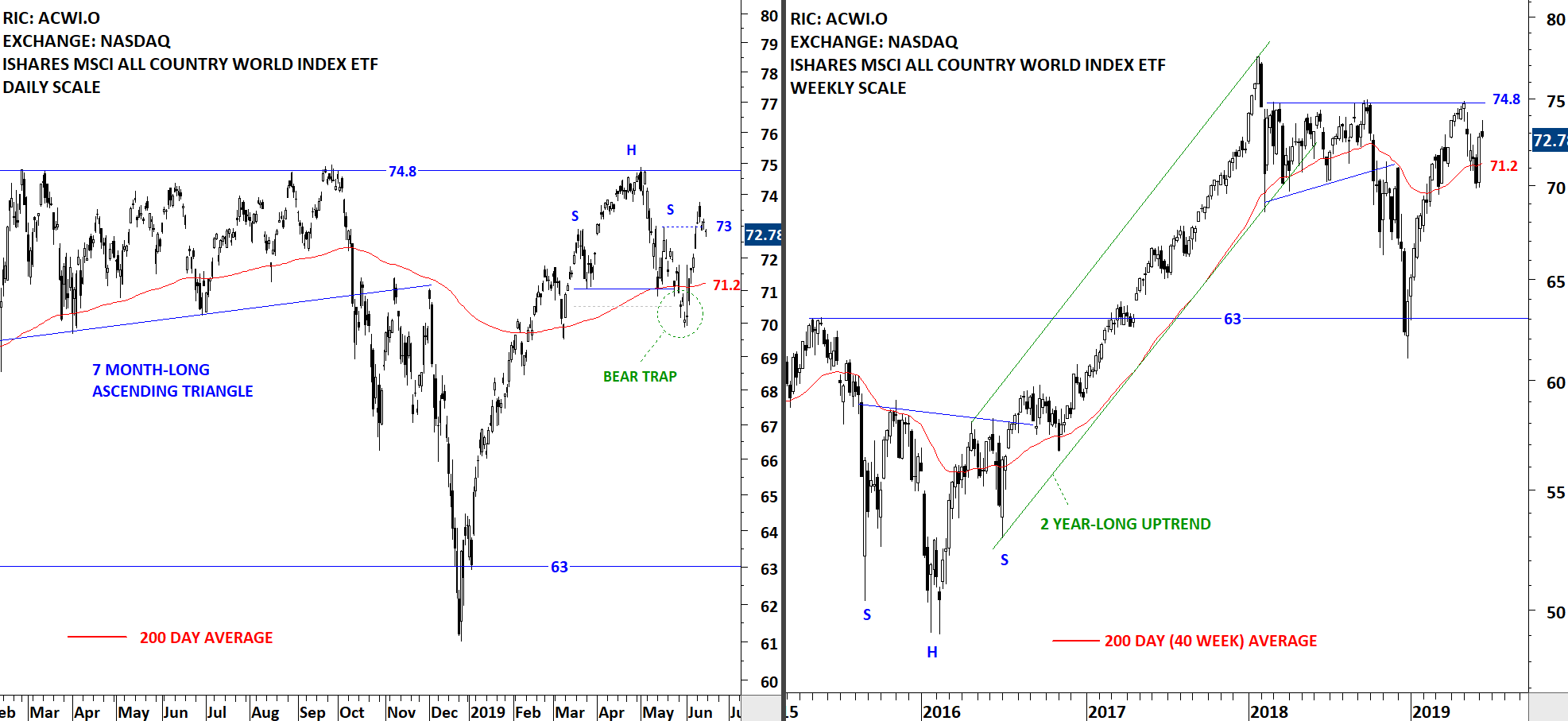

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) held onto its past week's gains. The ETF didn't move much and remained in a range between the 200-day moving average at 71.2 and the horizontal resistance at 74.8 levels. There is no clear trend or a recognizable chart pattern in the short-term. The ETF offers short-term trading opportunity between the boundaries at 71.2 and 74.8.

Read More

Read MoreGLOBAL EQUITY MARKETS – June 8, 2019

/0 Comments/in Premium/by Aksel KibarREVIEW

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) had a sharp reversal above its 200-day average and the horizontal resistance at 71 levels. Previous week's breakdown from the H&S top was possibly a bear trap. Global equities are going through a volatile, trend-less period. Read More

GLOBAL EQUITY MARKETS – June 1, 2019

/7 Comments/in Premium/by Aksel KibarREVIEW

The benchmark for the Global equity markets performance, the iShares MSCI All Country World Index ETF (ACWI.O) finsihed the week below the important support level at 71 levels. The head and shoulder chart pattern price target stands at 67.75 levels. Both the neckline and the 200-day moving average stands at 71 levels and will act as resistance. Read More

In Association with:

Latest Posts

GLOBAL EQUITY MARKETS – January 10, 2026January 10, 2026 - 10:14 am

GLOBAL EQUITY MARKETS – January 10, 2026January 10, 2026 - 10:14 am INTERIM UPDATE – January 8, 2026January 8, 2026 - 10:04 pm

INTERIM UPDATE – January 8, 2026January 8, 2026 - 10:04 pm CRYPTOCURRENCIES – January 5, 2026January 5, 2026 - 2:55 pm

CRYPTOCURRENCIES – January 5, 2026January 5, 2026 - 2:55 pm GLOBAL EQUITY MARKETS – January 3, 2026January 3, 2026 - 11:45 am

GLOBAL EQUITY MARKETS – January 3, 2026January 3, 2026 - 11:45 am

Search

As Seen On: